Back-Door Conversions to Roth IRA Accounts

Often high earners can’t contribute to a Roth IRA. If their modified adjusted gross income (MAGI) exceeds certain inflation adjusted phaseout limits. See Table 2 on page 4.06.02 for those limits.

However, there is a way to circumvent those income limitations by using a strategy referred to as “backdoor conversions” which allows individuals to convert their existing retirement accounts to Roth accounts.

The tax code does not use the terminology “backdoor” or “mega backdoor” conversions. That terminology was coined by tax bloggers and others followed suit. A “backdoor” conversion relates to converting a traditional IRA to a Roth IRA while a “mega backdoor” conversion refers to converting an employer qualified plan to a Roth IRA. The “mega” term was added because larger sums of money can be contributed to a qualified employer plan, which may then be converted to a Roth IRA. The following retirement plans are eligible for “backdoor” conversions:

-

Backdoor Conversions:

-

Individual Retirement or Annuity Account (except RMD),

-

-

Mega Backdoor Conversions:

-

Employer’s qualified pension, profit-sharing or stock bonus plan (including a 401(k) plan),

-

Annuity plan,

-

Tax-sheltered annuity plan (section 403(b) plan), or

-

Governmental deferred compensation plan (Section 457 plan).

-

The conversions are separated into two categories, the “backdoor” or “mega backdoor” because “mega backdoor” conversions must abide by the provisions of the employee’s plan and may or may not be conducive to or even permit backdoor conversions.

Tax Issues of Backdoor Conversions (including Mega)

A rollover can include both untaxed and after-tax funds. Since only taxed funds can be rolled into a Roth IRA, any untaxed funds rolled into a Roth are taxable.

Issues Related to “Backdoor” Conversions

1. All IRAs Are Treated as One - When doing an IRA conversion, all the taxpayer’s traditional IRAs, SEP-IRAs and SIMPLE IRAs are aggregated when determining the amount taxable at conversion, i.e., all IRAs are treated as one.

Example – Taxable Amount at Conversion of Mixed IRAs: In earlier years, Irene had made deductible SEP-IRA contributions of $25,000. In 2018 through 2024 she only made nondeductible contributions to a regular IRA of $14,000. In 2024, the SEP’s value is $32,000 and the IRA’s value is $16,000. Irene converts the regular IRA to a Roth IRA in 2024. Although Irene’s basis in her IRAs is $14,000, she can only use $4,084 of the basis in the conversion ($14,000/$48,000 = 29.17% x $14,000 = $4,084), leaving $11,916 of the $16,000 she converted as taxable.

2. Non-deductible Contributions – Non-deductible IRA contributions are converted to a Roth tax-free. So, for higher income people a strategy is to make a designated non-deductible Traditional IRA contribution and then convert it into a Roth IRA. Caution: This strategy may not work or work as well if the taxpayer already has other IRA accounts.Remember when a taxpayer has made both deductible and nondeductible IRA contributions all Traditional IRAs are treated as one, and for the taxpayer who has other IRA accounts a conversion will be treated as coming ratably from all of them, which may include taxable conversions.

3. Segregating Deductible & Non-deductible Traditional IRA Contributions – Generally, rollovers are thought of as transfers from a qualified plan to an IRA or from one IRA to another IRA.However, a taxpayer may roll assets from a Traditional IRA to other qualified plans including 401(k) plans, 403(a) and 403(b) annuities and 457 governmental retirement plans, assuming the plan will accept the IRA funds.

Only the taxable portion of the IRA can be moved to qualified plans (Code Sec. 408(d)(3)(A)(ii)). For taxpayers who have mixed IRAs (including both deductible and nondeductible contributions), this provides a means to segregate the taxable and nontaxable amounts and then later convert the nontaxable portion without paying any conversion tax (except on any interim earnings). Thus, the taxable portion can be rolled into a qualified plan, leaving the nontaxable portion in the IRA where it can be converted to the Roth IRA.

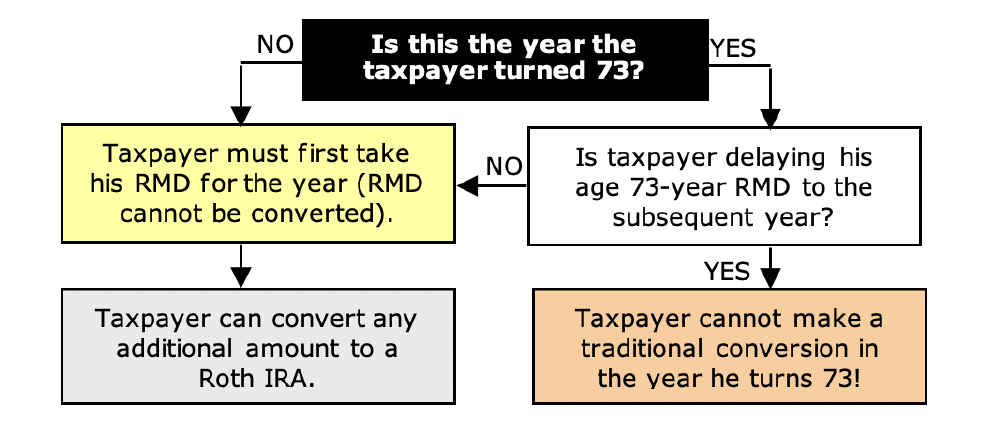

4. Conversions After Reaching RMD Age - IRA owners are permitted to make Traditional to Roth conversions after reaching 73, provided that they first take the RMD for the year; the RMD amount cannot be converted (Code Sec. 408(d)(3)). Thus, if the taxpayer, in the year he turns 73, wishes to delay the RMD until the subsequent year, he would not be able to also make a conversion in that year (Preamble to TD 8816, 2/3/1999).

5. Converting SIMPLE IRAs – Although a SIMPLE IRA can also be converted to a Roth IRA under the same rules described above, a taxpayer can’t convert any amount distributed from the SIMPLE during the 2-year period that begins with the date of first participation in the SIMPLE.

6. Paying the Tax on a Conversion - Where does the money come from to pay this income tax liability on a conversion to a Roth?The taxpayer can pay the liability from other funds or from IRA funds.However, if the tax is paid from IRA funds, those funds are not part of the rollover (conversion) and therefore are subject to early withdrawal penalties if the taxpayer is under 59½ at the time of the withdrawal.

7. Impact on Social Security Taxability and Medicare Premiums - During retirement years, some taxpayers will find that distributions from their IRA accounts will impact the taxability of their Social Security benefits and impact other AGI limited issues. If this is a planning consideration, the conversion to a Roth IRA before retirement will produce tax-free distributions during retirement and could reduce or eliminate the taxability of the Social Security benefits. Individuals participating in Medicare who have modified AGI over a specified amount for the return filed in the second preceding year pay higher Medicare B and D premiums. For example, if 2022’s MAGI was over $91,000 ($182,000 if filing jointly), a surcharge applies to the 2024 premiums. See chapter 7.02 for the Medicare rates for other years. Qualified distributions from Roth IRAs are not included in MAGI, so converting a Traditional IRA to a Roth for these individuals before they enroll in Medicare may be beneficial.

Additional Issues Related to “Mega Backdoor” Conversions:

8. What makes the "Mega" strategy more complicated is based upon whether a particular qualified plan provisions permit:

-

After-tax contributions, and

-

In-service (meaning still working for the employer) distributions of those after-tax contributions.

Pro-Rata Rule

IRS Notice 2014-54 offers insight regarding the tax treatment when distributing after-tax funds from a 401(k) plan, whether it's an in-service distribution or one that occurs after separation from service.

An in-service distribution of employee after-tax contributions is subject to the pro-rata rule, which determines the taxable amount of the distribution. A majority of 401(k) plans separately account for after-tax contributions and their earnings. Here, the pro-rata distribution rule applies only to that account. Therefore, the taxable portion of each distribution is the amount of (pre-tax) earnings on after-tax contributions There is no need to include the value of other separately tracked funds (i.e., pre-tax deferral, Roth, and employer contributions, if any). That amount is taxable if converted to a Roth IRA whereas the distribution is tax-free if the pre-tax funds are rolled over to a traditional IRA.

Therefore, you can't distribute only after-tax contributions to make a Roth conversion.

Instead, per Notice 2014-54, distributions are done pro-rata. Thus, taking a distribution leads you to withdrawing (only) a portion of your after-tax contributions. In other words, distributions must be done on a pro-rata basis as the funds leave the plan if a Roth conversion is occurring, which means if you try to take just some of the account balance, you only get some of the after-tax contributions! However, it's possible to receive favorable tax treatment for an in-service distribution of after-tax contributions and earnings to Roth IRA conversions.

On an ongoing (annual) basis, like the Backdoor Roth IRA, you could make employee after-tax contributions (into your 401(k)) and subsequently do a Mega Backdoor Roth conversion each year.

Examples of Backdoor Conversions

Example #1 Traditional IRA Conversion: Assume we are converting a Traditional IRA that includes $20,000 of deductible contributions, $10,000 of non-deductible contributions and $1,000 of earnings for a total amount of $31,000. The IRA owner decides to convert $15,000 of the Traditional IRA to a Roth IRA. Thus 32.26% ($10,000/$31,000) of the $15,000 or $4,839 converts tax free and the balance, $10,161 is taxable.

Example #2 Mega Conversion: Assume we are converting a 401(k) to a Roth the includes $20,000 of after tax contributions and $11,000 earnings which are pre-tax and separately tracked, for a total amount of $31,000. The taxpayer decides to convert $20,000 but cannot cherry pick the $20,000 from the $20,000 of after tax contributions. Instead, the taxable amount must be determined using the “Pro Rata” rule. Thus 35.48% ($11,000/$31,000) of the $20,000, or $7,096 of the conversion is taxable and $12,904 balance converts tax free.

Alternate Example #2 Mega Conversion: IRS guidance (Notice 2014-54) offers a tax-free alternative. Here, the taxpayer "splits" the proceeds, sending (converting) $20,000 to a Roth account tax-free, while $11,000 can be rolled over tax-free to a traditional IRA!

Conversion Impact on Other Tax Consequences

When considering whether or not to convert to a Roth IRA, the impact on various tax benefits due to increasing AGI by the taxable conversion amount must be carefully considered. For instance, a conversion may cause the taxpayer to lose part or all of certain tax benefits for the conversion year, like:

-

American Oppty/Lifetime Learning Credits

-

Earned Income Tax Credit (EIC)

-

Child Tax Credit

-

Saver’s Credit

-

Adoption Credit

-

Higher Education Interest Deduction

-

Medicare B & D Premiums – 2 Years Later

-

Medical Itemized Deductions

-

Miscellaneous Itemized Deductions thru 2025

-

Nontaxable Social Security

-

Favorable Tax Brackets

-

Capital Gains Rates

-

Special Loss Allowance for Rental Real Estate

Impact On Estate Taxes and Beneficiaries

Both Traditional and Roth IRAs will be includible in a decedent’s estate and taxed if the estate is large enough. Traditional IRAs are included in an estate and are also taxable to the beneficiary. Roth IRAs will be includible in the estate, but qualified distributions are not taxable to the beneficiary. This can be a significant benefit to taxpayers with large estates and may be reason enough to convert.