Qualified Charitable Distribution (QCD)

Tax-Free IRA Distributions for Charitable Purposes

This provision (Code Sec 408(d)(8)) originated in 2006 and after multiple temporary extensions was made permanent by the Protecting Americans from Tax Hikes Act of 2015.

To constitute a qualified charitable distribution (QCD), the distribution must be made:

-

On or after the date the IRA owner attains age 70-1/2. A distribution from an IRA made to a charitable organization in the year that the IRA owner turns 70-1/2 but prior to the date the individual reaches age 70-1/2 is not a qualified charitable distribution.

-

Directly by the IRA trustee to a Code Sec. 170(b)(1)(A) charitable organization (other than an organization (private foundations) described in Code Sec. 509(a)(3)) or a donor-advised fund (as defined in Code Sec. 4966(d)(2));

-

Exception: Secure 2.0 Act Sec 307 allows a one-time $50,000 distribution to:

-

Charitable gift annuities,

-

Charitable remainder unitrusts, and

-

Charitable remainder annuity trusts.

-

-

Caution – Beginning For 2020 And Subsequent Years

The 2019 SECURE Act (Appropriations Act of 2020) and SECURE 2.0 Act (Appropriations Act of 2023) both increased the RMD age to 72 (73 as of 2023, 75 as of 2033) but still allow QCDs once the taxpayer reaches age 70½. The Act also repealed the age restriction for making traditional IRA contributions beginning in 2020, which means a taxpayer can make traditional IRA contributions and QCDs after reaching age 70½. As a result, Congress included a provision in the Act requiring a taxpayer who qualifies to make a QCD to reduce the QCD non-taxable portion by any traditional IRA contribution made after reaching 70½ that was deducted, even if they are not in the same year. (IRS Notice 2020-68) The worksheet in Appendix D of IRS Pub 590-B can be used to determine the QCD excludable amount.

Example #1 – Jack makes a traditional IRA contribution of $7,000 when he is age 71 and another $7,000 contribution at the age of 72. He claims an IRA deduction of $7,000 on his tax return for each year. Then later when he is 74, he makes a QCD in the amount $10,000 to his church’s building fund. Since Jack had made the IRA contributions after age 70½, his QCD must be reduced, by the post-70½ contributions that were deducted, and as a result the $10,000 is taxable ($10,000 – 14,000 = (4,000)). However, he can claim $10,000 to the church building fund as a charitable contribution on Schedule A if he itemizes his deductions. In the next year, Jack makes a $5,000 QCD to the university where he got his degree. The excludable amount of the QCD is $1,000 ($5,000 - $4,000 = $1,000). The $4,000 is the amount that remained from post-age 70½ IRA contributions that didn’t previously offset QCDs. Jack includes $4,000 as taxable IRA income and can deduct $4,000 as a charitable contribution if he itemizes. No amount of postage 70½ IRA contributions remains to reduce the excludable amount of QCDs for subsequent taxable years.

-

Example #2 – Bob makes a traditional IRA contribution of $7,000 when he is age 71 and another $7,000 contribution at the age of 72 and deducts the IRA contributions on his returns. Then later when he is 74, he makes a QCD in the amount $20,000 to his church’s building fund. Since Bob had made the deductible IRA contributions after age 70½, his QCD must be reduced by the $14,000. As a result, of the $20,000 QCD, $14,000 is a taxable distribution, $6,000 is nontaxable, and Bob can claim a $14,000 charitable contribution.

-

Substantiation

The taxpayer must have the same type of acknowledgment of their contribution that would be needed to claim a deduction for a charitable contribution. See Chapter 07.08.

Maximum Distribution

-

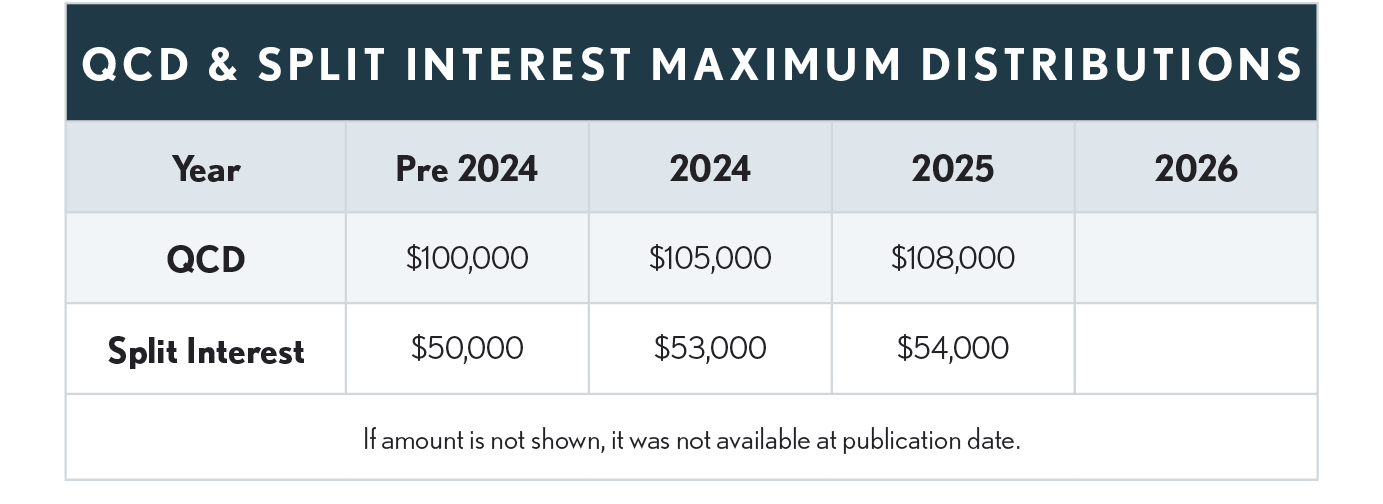

2006 and Subsequent Years - No more than $100,000 per year of IRA distributions made directly to Code Sec. 170(b)(1)(A) charitable organizations can be excluded from the IRA owner's gross income. If filing a joint return and both spouses have an IRA, each spouse can have a qualified charitable distribution, and each can exclude up to $100,000 from income per year. The $100,000 is inflation adjusted starting in 2025 (see table below).

-

2023 and Subsequent Years – In addition to that described in the above paragraph, the SECURE 2.0 Act expands the IRA charitable distribution provision to allow for a one-time, $50,000 distribution to Split Interest Entity charities. The $50,000 is inflation-adjusted (see table below).

The term “Split-Interest Entity” means:

-

A Charitable Remainder Annuity Trust (Sec 664(d)(1))

-

A Charitable Remainder Unitrust (Sec 664(d)(2))

-

A Charitable Gift Annuity (Sec 501(m)(5))

No Charitable Contribution Deduction

Amounts excluded as a QCD cannot be used as charitable contributions on Schedule A.

Charitable AGI Limitations

QCDs are not subject to the charitable contribution percentage limits since they are not included in gross income and are not claimed as a charitable contribution.

Medicare Premiums

Medicare premiums are based upon the taxpayer’s MAGI two years previously. Utilizing the QCD for charitable contributions reduces MAGI and thus may reduce Medicare premiums.

Excess Contributions

Amounts in excess of the annual $100,000 limit (inflation-adjusted) cannot be carried over. The excess would be treated as (1) an IRA distribution and (2) a charitable contribution subject to the usual percentage-ofAGI limits.

Required Minimum Distribution (RMD)

The amount of a QCD is treated as being part of the taxpayer’s RMD for the tax year.

Regular IRAs (Traditional or Roth) Only

The exclusion does not apply to distributions made from “ongoing” simplified employee pensions (SEPs), or “ongoing” SIMPLE IRAs. The term “ongoing” means the plan is maintained under an employer arrangement under which an employer contribution is made for the plan year in which the QCD is made. However, the exclusion would apply to SEPs and SIMPLEs where the taxpayer is retired and the employer will not contribute to the account during the year. (Notice 2007-7, Q&A 36).

Caution - Direct Transfer Requirement

A QCD must be made directly by the IRA trustee to a charitable organization. Thus, a distribution made to an individual, and then rolled over to a charitable organization, would not be excludible from gross income. The result would be a separate IRA distribution and charitable contribution, both subject to the normal rules. A check from the IRA made payable to an eligible charitable organization that is delivered to the organization by the IRA owner will be considered to be made directly by the IRA trustee to the organization. (Notice 2007-7, Q&A 41)

Some IRA trustees provide the IRA owners with check writing privileges on their IRA accounts. If a taxpayer over age 70½ writes a check from his IRA account and delivers it to a qualified charitable organization, will that count as a direct transfer to charity? The IRS provides no specific guidance on the issue, other than Notice 2007-7, Q&A 41 cited above. However, it would appear that a check written by the taxpayer from the IRA account to a qualified charity MAY meet the requirements of Q&A 41, since the funds are transferred directly to the charity through normal banking channels and the taxpayer has no access to the funds during the transfer process.

Distribution Allocation for Non-Deductible Contribution Amounts

The distribution is treated as consisting of income first, up to the aggregate amount that would be includible in gross income (but for the provision) if the aggregate balance of all IRAs having the same owner were distributed during the same year. Proper adjustments must be made in applying the Code Sec. 72 annuity rules to other distributions made in that and later tax years to reflect the amount treated as a qualified charitable distribution under this special rule.

Example: Ira Owner is over age 70½ and has a traditional IRA with a balance of $100,000 consisting of $20,000 of non-deductible contributions and the balance attributable to deductible contributions and earnings. All of the IRA contributions were made before he turned 70½. He has no other IRA accounts. He makes a direct distribution of $80,000 to a qualified charitable organization. By the special rule, the contribution is treated as coming from the income first. The remaining $20,000 consists only of non-deductible contributions and will not be taxable on distribution.

-

Reporting QCDs

The total of all IRA distributions is included on line 4a of Form 1040 (2023). Then subtract the amount of the QCD and any Form 8606 adjustments from the line 4a amount and enter the result on line 4b. Also enter “QCD” in the margin for line 4b. See IRS Pub 590-B and the instructions for 1040 Lines 4a and 4b.