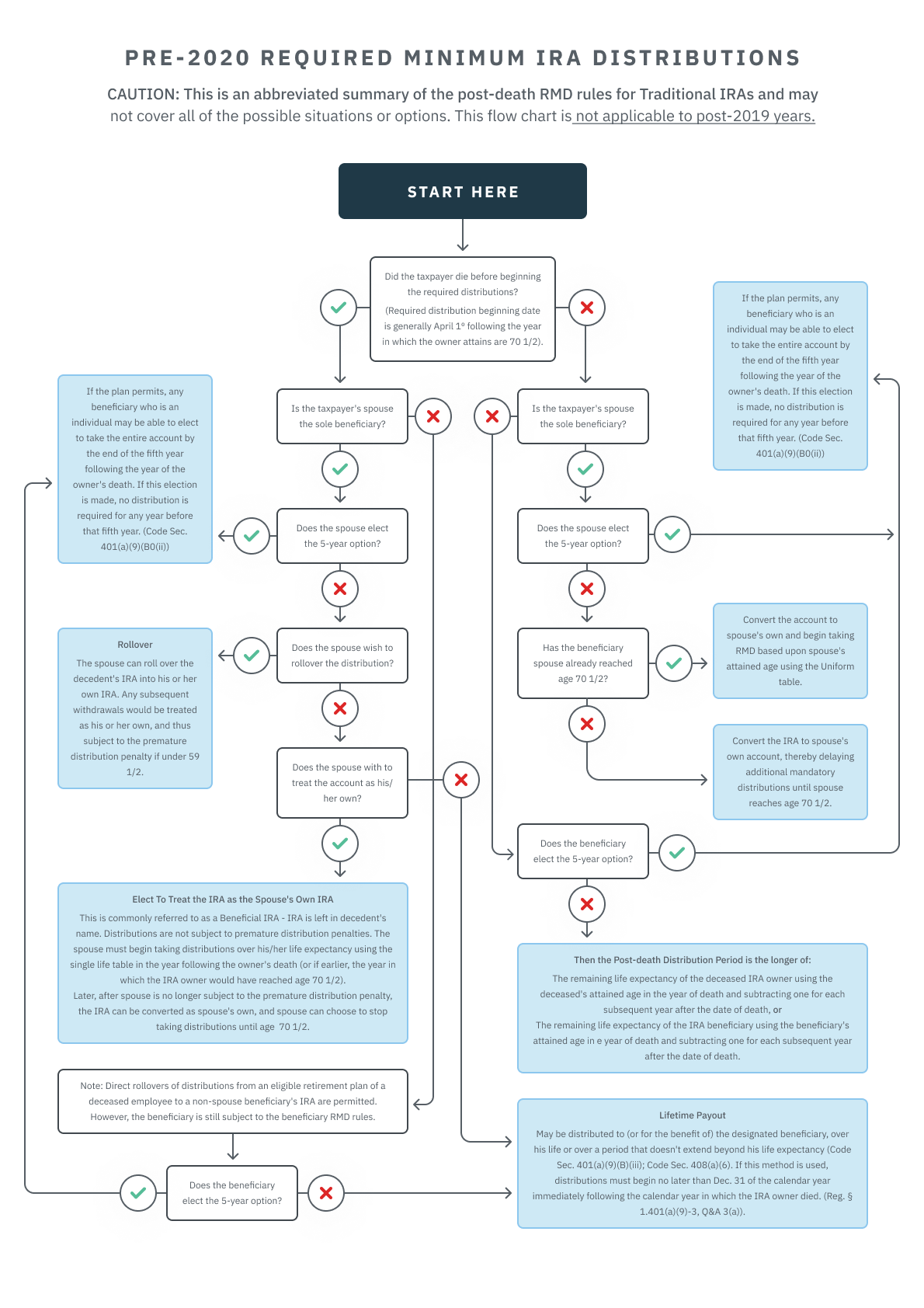

Pre-2020 Beneficiary Distributions

Note: When dealing with pre-2020 distributions the mandatory distribution age would always be 70½ since age 72 only applies in 2020 and subsequent years.

Beneficiary Distributions After RMDs Have Begun

When an employer-sponsored retirement plan participant or the IRA owner dies after beginning the required distributions and the beneficiary is an individual, the beneficiary must begin taking distributions the year after the plan or IRA owner’s death as follows:

Spouse as Sole Beneficiary

The IRS permits a sole beneficiary spouse far more options than it does other beneficiates. When the spouse is the sole beneficiary, the spouse has the options listed below. Caution: The sole beneficiary requirement is not met if the beneficiary is a trust, even if the spouse is the sole beneficiary of the trust.

-

Spouse Under 70-1/2 - Convert the account to his or her own account, thereby delaying additional mandatory distributions until he or she reaches age 70-1/2., Caution, if spouse is under the age of 59½, after the conversion the distributions would be subject to the premature distribution penalty until the spouse turns 59½.

-

Spouse 70-1/2 or Older - Convert the account to his or her own account and begin taking RMD based on the surviving spouse’s attained age using the Uniform Lifetime Table (also referred to as the Uniform Distribution Table).,

-

Leave in Decedent’s Name (regardless of surviving spouse’s age) - (Commonly referred to as a Beneficial IRA,) the IRA is left in the decedent’s name and distributions are not subject to premature distribution penalties. The spouse must begin taking distributions over his or her life expectancy using the Single Life Table in the year following the owner’s death (or if earlier, the year in which the IRA owner would have reached age 70-1/2)., Later, after the spouse is no longer subject to the premature distribution penalty, the IRA can be converted to his or her own, and the choice can be made to stop taking distributions until age 70-1/2.

-

5-Year Option - May elect to take the entire account by the end of the fifth year following the year of the owner’s death. If this election is made, no distribution is required for any year before that fifth year. A distribution under the 5-year option is not subject to early withdrawal penalties.

Other Individual Beneficiaries

If the beneficiary or beneficiaries (including the spouse) include individuals other than the spouse, then the first required distribution is in the calendar year following the year of the IRA owner’s death.

These distributions are not subject to the premature distribution penalty. Using the Single Life Table, the post death distribution period used to determine the RMD is the longer of:

-

The remaining life expectancy of the deceased IRA owner using the deceased’s attained age in the year of death and subtracting one for each subsequent year after the date of death.

-

The remaining life expectancy of the IRA beneficiary using the beneficiary’s attained age in the year of death and subtracting one for each subsequent year after the date of death.

However, in lieu of the two options above, any beneficiary who is an individual may elect to take the entire account at any time before the end of the fifth year, following the year of the owner’s death. If this election is made, no distribution is required for any year before that fifth year.

Distributions Where Owner Dies Before RMDs Have Begun

When an IRA owner dies before the required distributions beginning date (generally, April 1 following the year in which the owner attains age 70-1/2), the beneficiary has the following choices:

If the Sole Beneficiary is the Owner’s Spouse

The spouse may choose one of the following options, or if not used, the rules for non-spouse beneficiaries apply.

-

Rollover - The spouse can roll over the decedent's employer-sponsored retirement plan or the IRA into his or her own IRA., Once rolled into the spouse’s IRA, any future withdrawals would be treated as his or her own, and if the spouse is under 59-1/2 at the time of the distribution, the premature distribution penalty will apply.

-

Leave in Decedent’s Name (regardless of surviving spouse’s age)- Commonly referred to as a Beneficial IRA or employer sponsored retirement plan (rolled into an IRA) the IRA is left in the decedent’s name and distributions are not subject to premature distribution penalties. The spouse must begin taking distributions over his or her life expectancy using the Single Life Table in the year following the owner’s death (or if earlier, the year in which the IRA owner would have reached age 70-1/2).

Later, after the spouse is no longer subject to the premature distribution penalty, the IRA can be converted to his or her own, and if desired, distributions may cease until age 70-1/2.

If a Non-Spouse Beneficiary is Designated

A non-spouse beneficiary may roll over an inherited IRA if the plan allows it, and the distribution is made directly from one trustee to another. The account balance will be distributed by one of the methods described below. The determination of whether the five-year or lifetime pay-out rule applies depends on the provisions of the IRA. It may be silent as to which rule (5-year or lifetime pay-out) applies (see “IRA Silent” below), specify which rule applies, or it may allow the owner (or beneficiary) to elect which rule applies. (Reg. § 1.401(a)(9)3, Q&A 4)

-

For the Five-Year Pay-out - May be entirely distributed at any time before five years after the IRA owner's death and the total can be taken in multiple distributions during the five-year period (Code Sec. 401(a)(9)(B)(ii)). A non-spouse beneficiary is permitted to directly roll over the beneficiary’s entire benefit until the end of the fourth year, but as of January 1 of the fifth year following the year the plan owner died, no amount payable to the beneficiary is eligible for rollover (IRS Notice 2007-7, Q&A 17). If the 5-year rule applied to the non-spouse beneficiary under the plan making the direct rollover, the 5year rule also applies for the purpose of determining RMDs under the IRA to which the rollover contribution is made (IRS Notice 2007-7, Q&A 19).

-

For the Lifetime Pay-out - May be distributed to (or for the benefit of) the designated beneficiary, over his life or over a period that doesn't extend beyond his life expectancy (Code Sec. 401(a)(9)(B)(iii); Code Sec. 408(a)(6)). If this method is used, distributions must begin no later than Dec. 31 of the calendar year immediately following the calendar year in which the IRA owner died (Reg. § 1.401(a)(9)-3, Q&A 3(a)).

IRA is Silent as to the Distribution Method

-

The lifetime payout rule applies if the beneficiary is the decedent's spouse, and the IRA:

-

Does not contain provisions specifying the methods of distribution after an IRA owner's death, or allowing the choice to be made by an IRA owner or beneficiary, or

-

Allows a choice to be made, but the choice is not exercised and the IRA doesn't specify the payout method, or

-

Allows a choice to be made and the lifetime payout method is chosen, or

-

Specifies that the lifetime payout method is to be used.

-

-

The five-year payout rule applies if the IRA provides for only this method, or it provides a choice between five-year and lifetime payouts, and the IRA owner chose, or the surviving-spouse beneficiary chooses the five-year method. (Reg. § 1.401(a)(9)-3, Q&A 4)

Determining Beneficiaries’ Distribution Period – Multiple Beneficiaries

If more than one beneficiary is designated on the date on which the designated beneficiary is determined (generally, as of Sept. 30 of the year following the year of the IRA owner's death), then the IRA is paid out over the oldest beneficiary's life expectancy.

The beneficiaries’ remaining life expectancy is determined using the:

-

Oldest beneficiary’s age as of his or her birthday in the calendar year immediately following the IRA owner’s death, or

-

For those accounts that were separated by the end of the year after the year after death, the age of each beneficiary.

-

Where the beneficiaries include the spouse, account separation must be completed by September 30th instead of year-end to take advantage of the spouse sole beneficiary provisions.

Sub-IRAs OK'd Where Estate Was Named IRA Beneficiary

A Private Ruling (PLR 201128036) permitted an IRA with an estate named as the beneficiary to be divided up into sub-IRAs set up for the beneficiaries of the estate. Although the move allowed each beneficiary to separately invest his or her share of the IRA, they were still locked into a short pay-out period (based on the decedent’s age at death). With better tax planning on the IRA owner's part, however, they could have qualified for a much longer tax-deferred pay-out period.