IRA Owner Required Minimum Distributions

To prevent an individual from investing in tax-deferred retirement plans, including Traditional IRAs, but never withdrawing from the plans, the account owner is REQUIRED to take a MINIMUM (as calculated per regulations) DISTRIBUTION (RMD) beginning in the year the IRA owner reaches the mandatory beginning age (unless he or she qualifies for the first-year exception explained below). (Code Sec 401(a)(9)) In the case of a qualified plan, the first distribution must be taken no later than April 1 of the year following the year the mandatory beginning age is reached (but see “Qualified Plan Required Beginning Date” below for exception). Failing to take the correct amount of minimum distribution (also known as excess accumulation) results in a penalty of 25% (10% if timely corrected) of the difference of what should have been withdrawn and what was withdrawn–but see later in this guide for how a waiver of the penalty may be obtained.

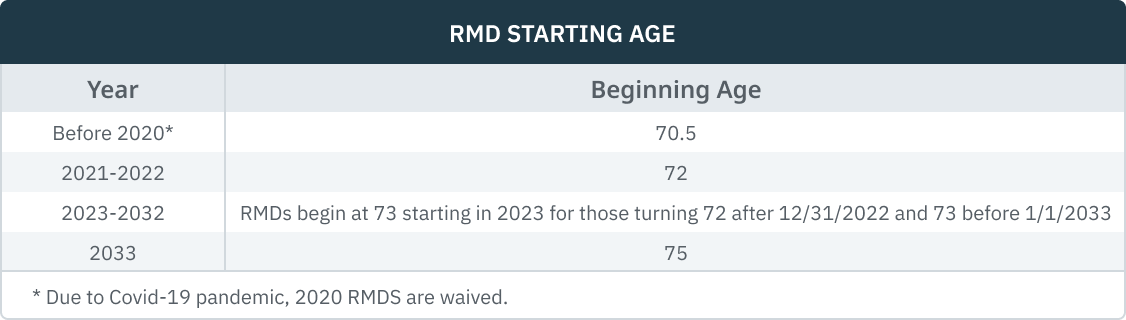

Age 70½ was first applied in the retirement plan context in the early 1960s and until recently has never been adjusted to take into account increases in life expectancy. The SECURE Act part of the Appropriations Act of 2020 increases the required beginning age for mandatory distributions from age 70½ to age 72 effective for distributions required to be made after December 31, 2019, with respect to individuals who attain age 72 after such date. The required beginning age was changed again by the SECURE 2.0 Act and the required beginning date is now April 1 following the calendar year in which the individual attains age 73 (age 75 effective in years beginning in 2033).

Example: An IRA owner born in 1951 will turn 73 in 2024 and has a required beginning date (RBD) of April 1, 2025. If this individual’s IRA distribution occurs in 2024, it will be taxed on the 2024 return, but if the distribution is made between January 1 and April 1 of 2025, the income is reported and taxed on the 2025 return, as will be the normal 2025 distribution. For an IRA owner born before 1951, their 2024 IRA distribution must be made by December 31, 2024.

-

The SECURE 2.0 Act further extended the RMD (the required beginning date, or RBD) age as shown in the table.

Uniform Distribution Method for Lifetime Pay-Outs

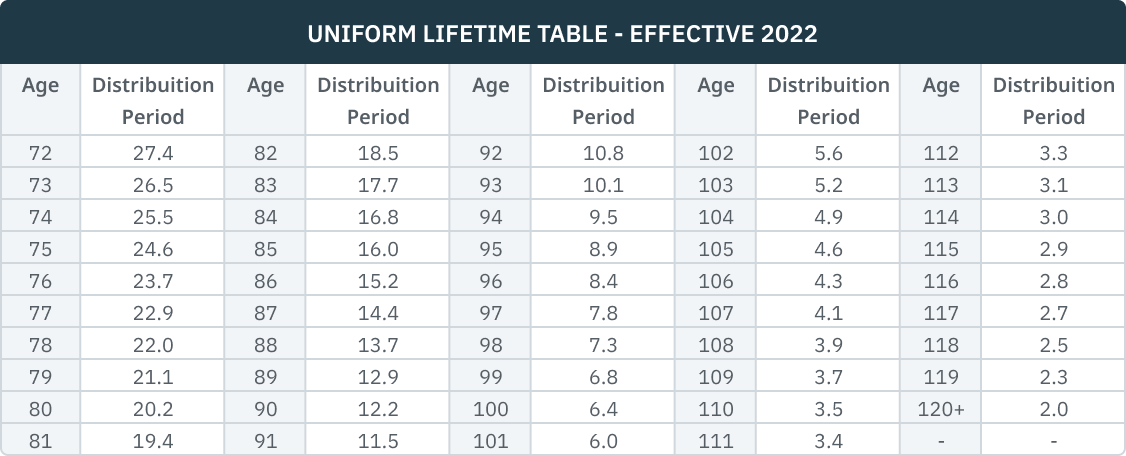

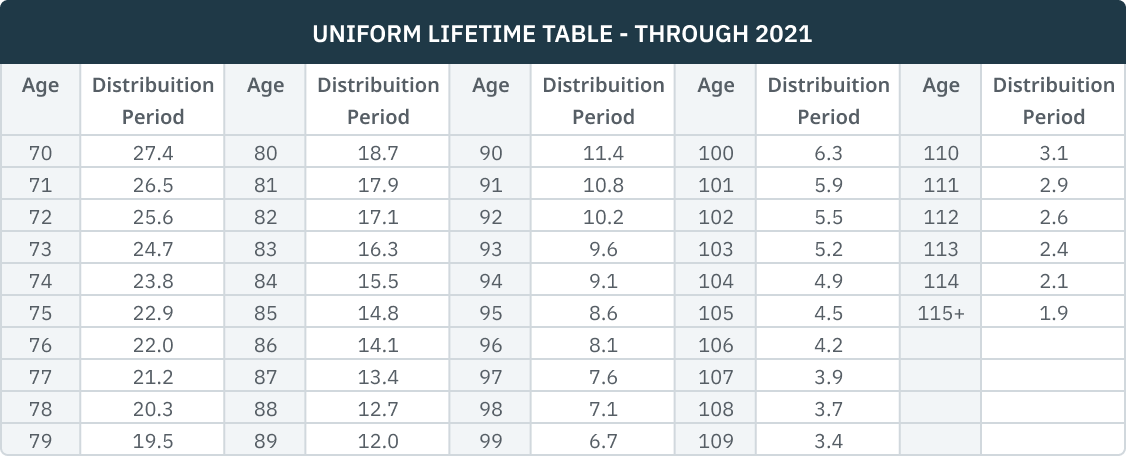

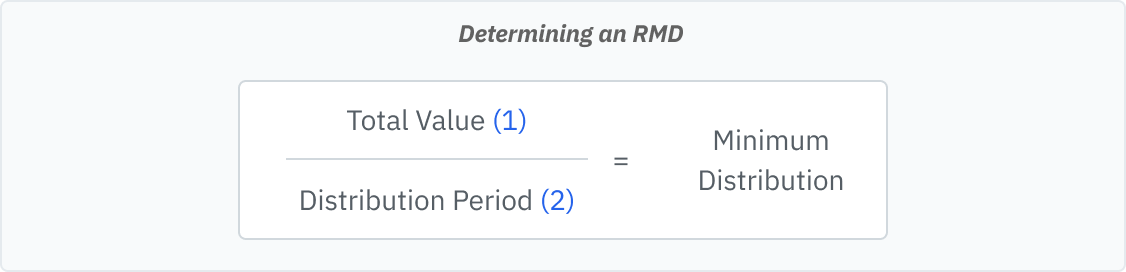

In general, the required minimum distribution for each year is determined by dividing the account balance as of the end of the preceding year by the age-based factor (distribution period) from the Uniform Lifetime Table (Reg § 1.401(a)(9)-5). This table is used regardless of the identity of the beneficiary or age differential between account owner and designated beneficiary, unless the account owner's spouse is the sole beneficiary and is more than 10 years younger than the account owner (see exception when spouse is more than 10 years younger than the owner later). The IRS has issued final regulations that alter the age-related distribution periods for the RMD Uniform Lifetime Table that had applied for many years, with this new table becoming effective for 2022. (T.D. 9930; Reg. 1.401(a)(9)-9) We have also retained the pre-2022 table for prior year tax issues,

(1) Determining Total Value: The total value is based on the employer-sponsored retirement plans or the IRA’s account value at the end of the business day on

December 31st of the PRIOR year. In the case of an IRA,

although the RMD for the year can

be taken from any one or a number of the taxpayer’s IRA accounts (Reg §1.408-8,

Q&A 9), the minimum

distribution amount must be figured separately for each account, and then

totaled to determine the RMD. The 12/31 value is not reduced by the

first-time RMD taken between January 1 and April 1 in the year following the

end of the year the taxpayer reaches the mandatory distribution age.

(2) Determining the Distribution Period: The IRS provides tables for use in determining the retirement plan or the IRA owner’s life

expectancy (referred to as “distribution period” by the IRS). Generally, IRA owners will use the “Uniform

Lifetime Table”, illustrated above, to determine their “distribution period.”

If the employer-sponsored retirement plan participant’s or the IRA owner’s spouse is the sole beneficiary, the Joint and Last Survivor Table may be used (available in IRS Publication 590-B). However, the Uniform Lifetime Table will always produce the smallest minimum distribution, unless the spouse is more than 10 years younger than the IRA account owner. The Preamble to the 2002 final regulations provides that for lifetime distributions, the marital status of the plan owner (or employee, if RMDs are made from a qualified plan account) is determined on January 1 each year (Reg. § 1.401(a)(9)-9, Q&A 3, PLR 200250037).

Example: Don’s oldest age during 2024 is 75 and he has a single IRA account with a value of $150,000 at the close of the last business day in December 2023. Using the Uniform Lifetime Table effective for year 2022 or later, we find that the distribution period for age 75 is 24.6 years. Thus, Don’s RMD for 2024 is $6,098 ($150,000/24.6). As a matter of information, if the table for years prior to 2021 had still been in effect, Don’s RMD would have been $452 more ($6,550 - $6,098).

-

Determining Age

Use the owner’s oldest attained age for the year of the distribution.

RMD in Year of Owner’s Death

Often the question arises related to the need for a required minimum distribution (RMD) in the year of the plan owner’s death. The following has been gleaned from the regulations and IRS Publication 590-B.

-

Dies before required beginning date – If the IRA owner passed away before his or her distribution required beginning date, then there is no RMD for the year of death., Where an IRA owner dies after reaching the mandatory distribution age, but before April 1 of the next year, no minimum distribution is required because death occurred before the required beginning date. (Pub 590-B)

-

Dies after required beginning date – An RMD is required in the year of the owner’s death if the owner died on or after the required beginning date (Reg § 1.401(a)(9)-5, Q&A 4(a)). The IRA beneficiaries are responsible for figuring and distributing the owner's required minimum distribution in the year of death. (2023 Pub 590-B, Pg. 8).

Where a retirement plans or the IRA’s owner dies before receiving his or her entire RMD in the year of death, the unpaid amount must be distributed to the named beneficiaries or, if none, the decedent’s estate (Reg. § 1.401(a)(9)-5, Q&A 4(a)). Presumably, the amounts received before death would be taxed on the decedent's final return and the remaining amount paid after death would be taxed to the beneficiary or estate. The RMD amounts not distributed in the year of death would be subject to the 25%(50% for years beginning on or before December 29, 2022) excess accumulation penalty. However, under the regulations proposed in February 2022, if an eligible beneficiary fails to take a life expectancy payment, the IRS will automatically waive the penalty if (Prop. Regs. Sec 1.402(c)-2):

o The beneficiary did not make an affirmative election to take life expectancy payments, and

o The beneficiary elects the 10-year rule by the end of the ninth calendar year following the account owner’s death.

Where the spouse of the deceased owner becomes the owner of the retirement plan or the IRA in the year of death, the spouse is required to take a distribution based upon the decedent’s age and thereby satisfy the decedent’s RMD requirements (2023 Pub 590-B, Pg. 8). It is assumed that if the spouse fails to do so, the spouse will be subject to the excess accumulation penalty but see the penalty waiver above.

First Year IRA RMD Exception

If a taxpayer so chooses, he or she can delay an RMD for the first year until the second year, thus making the distribution includible in the second year’s tax return. This is sometimes desirable if the taxpayer has substantial wages or other income in the year the mandatory distribution age is reached and expects less income the next year. In this situation, by delaying the distribution to the second year the tax bracket could be substantially lower. If the taxpayer chooses that option, then:

-

The first year RMD must be taken by April 1 of the following year, and

-

The taxpayer must also take the second year RMD distribution by December 31 of year two, thus doubling up the distributions in year two.

Qualified Plan Required Beginning Date

In general, distributions from a qualified plan must begin no later than April 1 of the year following the year in which the employee attains the mandatory distribution age or (except in the case of a 5-percent owner), if later, retires. This date is called the required beginning date. (Code Section 401(a)(9)) This “retirement, if later” exception does not apply to IRAs.