Definitions & Other Issues

Ten-Year Rule

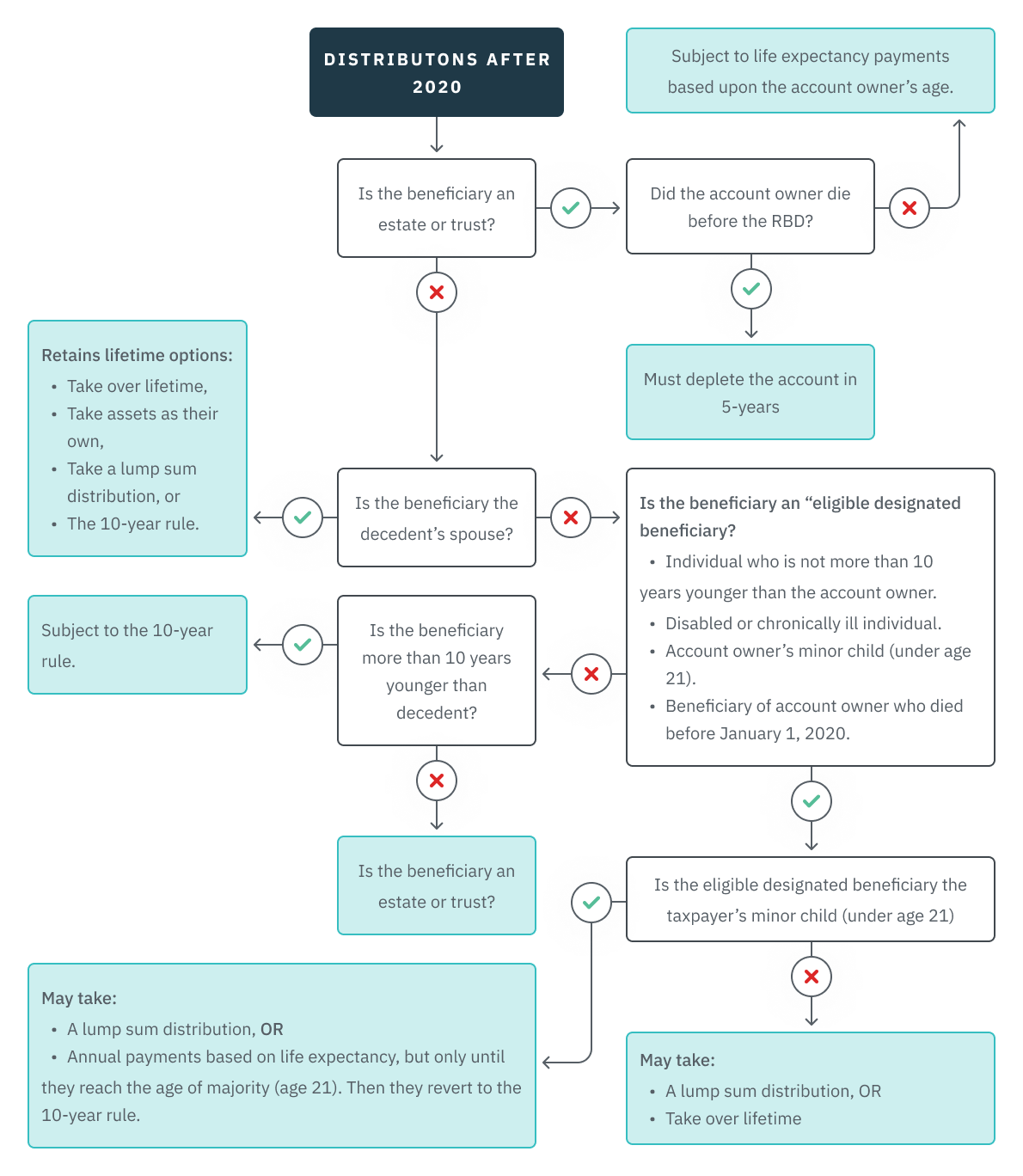

The account must be depleted by the end of the year that includes the 10th anniversary of the account owner’s death, if the account owner died on or after their required beginning date (RBD), then the beneficiary must ALSO take annual distributions based their life expectancy and then distribute the balance in the 10th year.

-

Separate Accounting Applies – The SECURE Act’s individual accounting for beneficiaries remains intact under the proposed regs. Beneficiaries’ status is determined September 30 of the year after the account owner’s death.

To the extent that separate accounts are created and maintained for multiple beneficiaries by December 31 of the year following the account owner’s death, each beneficiary will be treated as the sole beneficiary of that account.

Thus, if there are different beneficiary categories with different payout options, separate accounting will preserve the available options for each category provided separate accounts are created and maintained by December 31 of the year following the account owner’s death.

Example: IRA owner dies before his RBD. He has three beneficiaries – his spouse, his son, and his daughter – all receiving equal shares. Under the old rules, the distribution period for all three beneficiaries would be based on the shortest life expectancy of the three. Under the proposed regs the distribution period would depend on the category of each beneficiary as long as the separate account rules are followed.

-

Deadline for Spousal Election to Treat IRA as Own

A spouse beneficiary may treat an inherited IRA as his or her own by making an election (e.g., transferring the assets to his or her own IRA) or by making a “deemed election” (i.e., failing to take an RMD from the account or making a contribution to the account).

The deadline for a spouse beneficiary to elect to treat the inherited IRA as their own is the later of:

-

The year following the IRA owner’s death or

-

The year in which the spouse beneficiary reaches RBD age (73 for 2023-2032).

If the spouse beneficiary fails to meet this requirement, the spouse beneficiary cannot treat the IRA as their own. However, the spouse can distribute and roll over the inherited assets to their own IRA.

Hypothetical RMDs

If the IRA account owner dies before the RBD and the spouse beneficiary elects the 10year rule, the spouse can still roll the undistributed IRA balance into the spouse’s own IRA before the last year of the 10-year period. However, in the year the spouse reaches the RBD age the regulations require the spouse beneficiary to calculate a “hypothetical” RMD. The hypothetical RMD is the amount that would have been required to be distributed had the life expectancy rule applied to the spouse beneficiary and exclude that amount from any rollover contribution.

RMD Aggregation for Rollover Purposes

Where an individual has multiple IRA accounts, and desires to roll over an IRA distribution in any year in which RMDs are required, RMDs must be taken from all IRAs before determining the portion of a distribution that is ineligible for rollover treatment.

50% Penalty

Often an IRA owner who is required to take an RMD dies before the distribution for the year of death has occurred. The beneficiary (or beneficiaries) becomes responsible for taking the RMD for that year but may not realize until after the end of the year that no distribution had been made. As a result, the 50% penalty for failing to take the required amount has applied. The proposed regs offer some relief:

-

If a beneficiary fails to take an RMD for the year in which the account owner dies, the IRS will automatically waive the penalty if:

-

The beneficiary removes the year-of-death RMD by the beneficiary’s tax filing deadline, including extensions.

If an account owner dies before the RBD, and an eligible beneficiary fails to take a life expectancy payment, the IRS will automatically waive the penalty if:

-

The beneficiary did not make an affirmative election to take life expectancy payments, and

• The beneficiary elects the 10-year rule by the end of the ninth calendar year following the account owner’s death.

NOTE: A public hearing is slated for June 15, 2022, to address the comments on the proposed regs that have been submitted to the IRS. After that, it will take several months for the IRS to release final regulations.