Qualified Longevity Annuity Contracts

A longevity annuity is a deferred annuity that is scheduled to commence at an advanced age. Longevity annuities make it easier for retirees to use a limited portion of their savings to purchase guaranteed income for life starting at an advanced age, such as 80 or 85, to address the risk of outliving their assets. Once that risk is addressed, a retiree's task of generating income from his remaining assets would be more manageable because it would be limited to a fixed period of time.

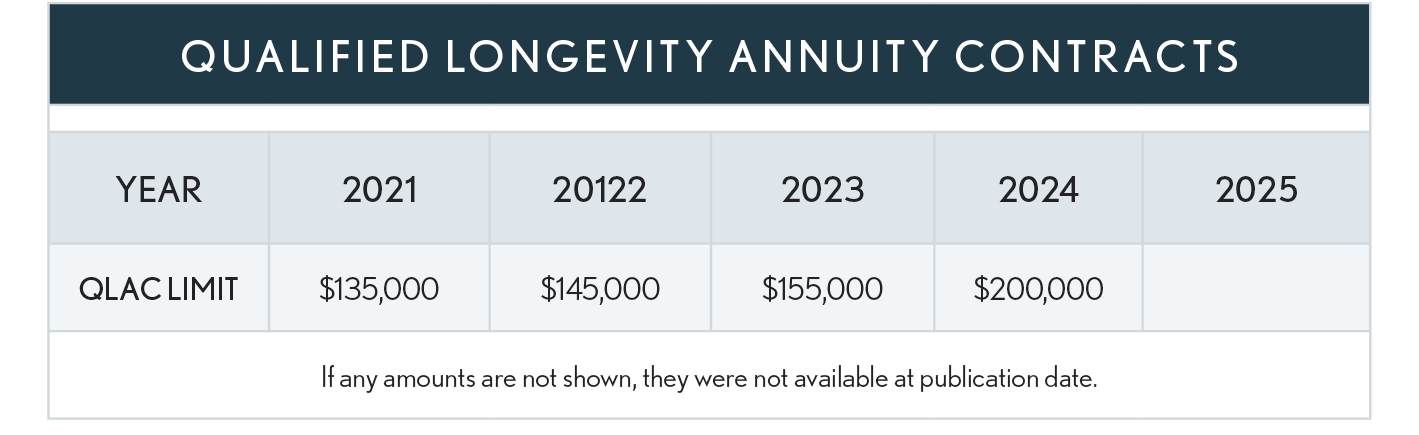

IRS Regulations 1.401(a)(9)-6, finalized in 2014, require distributions to begin no later than at age 85 and provide some relief for individuals who want to stretch out their retirement funds by generally allowing taxpayers to use up to the lesser of 25% or $125,000 (adjusted for inflation) of their retirement account to purchase a qualified longevity annuity contract (QLAC) within the account. See below for SECURE 2.0 Act changes.

The amount used to purchase the QLAC is subtracted from the account balance and would thus reduce the RMD from the retirement account each year until a specified time in the future when distributions must begin from the annuity.

Although not a perfect solution to not taking distributions, a QLAC can in effect delay the distributions associated with funds used to purchase the QLAC until as late as the pre-determined date for the start of the annuity payments, but no later than age 85.

Example: Dan, who is age 73, has a traditional IRA account with a balance of $700,000. From the IRS annuity table (used beginning in 2022), for age 73, Dan has an expected distribution period (life expectancy) of 26.5 years, and his RMD for the year would be $26,415 ($700,000/26.5). However, in 2024 Dan could have purchased a QLAC in the amount of $175,000 (the lesser of 25% of $700,000, which is $175,000, or $200,000) with IRA funds prior to the end of the year, thus reducing his IRA account balance currently subject to mandatory distribution to $525,000. As a result, his RMD for the year would be $19,811. In addition, his QLAC would begin distributions at whatever date Dan selected for the start date, but at least by age 85.

-

Since Social Security (SS) income becomes taxable when one-half the taxpayer’s SS benefits plus the taxpayer’s other income, including non-taxable interest income, exceeds $25,000 ($32,000 for married taxpayers filing jointly), using a QLAC to reduce a taxpayer’s RMD income could actually reduce the tax on the taxpayer’s SS income. QLACs do not apply to Roth IRAs since there are no RMD requirements and the income is generally tax-free.

Other QLAC rules:

-

The regulations permit a QLAC to be offered under a defined contribution plan but not a defined benefit plan.

-

A QLAC may not include a variable contract, an equity-indexed contract, or a similar contract.

-

If on or after July 2, 2014, an existing contract is exchanged for a contract that satisfies the requirements to be a QLAC, the new contract will be treated as purchased on the date of the exchange and therefore may qualify as a QLAC. In such a case the fair market value of the contract that is exchanged for a QLAC is treated as a premium that counts toward the QLAC limit.If an annuity contract fails to be a QLAC solely because premiums for the contract exceed the premium limits, then the contract will not fail to be a QLAC if the excess premium is returned to the non-QLAC portion of the employee's account by the end of the calendar year following the calendar year in which the excess premium was paid.

-

A QLAC may provide for a single-sum death benefit paid to a beneficiary in an amount equal to the excess of the premium payments made with respect to the QLAC over the payments made to the employee under the QLAC. If a QLAC is providing a life annuity to a surviving spouse (or will provide a life annuity to a surviving spouse), it may also provide a similar return of premium (ROP) benefit after the death of both the employee and the spouse.

The 2014 regulations (T.D. 9763) generally exempted QLACs from the minimum distribution rules until payments commence. However, due to a lack of statutory authority to provide a full exemption, the regulations imposed certain limits on the exemption that have prevented QLACs from achieving their intended purpose in providing longevity protection.

SECURE 2.0 Act, Section 202 addresses these limitations by:

-

Repealing the 25% limit,

-

Allowing up to $200,000 (indexed, but no change for 2024) to be used from an account balance to purchase a QLAC, and

-

Facilitating the sales of QLACs with spousal survival rights – and clarifies that free-look periods are permitted up to 90 days with respect to contracts purchased or received in an exchange on or after July 2, 2014.

-

Effective Date: Effective for contracts purchased or received in an exchange on or after December 29, 2022.

Form 1098-Q

The IRS created Form 1098-Q, Qualifying Longevity Annuity Contract Information, to be used to report the status of longevity annuity contracts held by defined contribution plans, IRAs, and eligible governmental plans, to participants and the IRS.