Periodic Pension or Annuity Payments

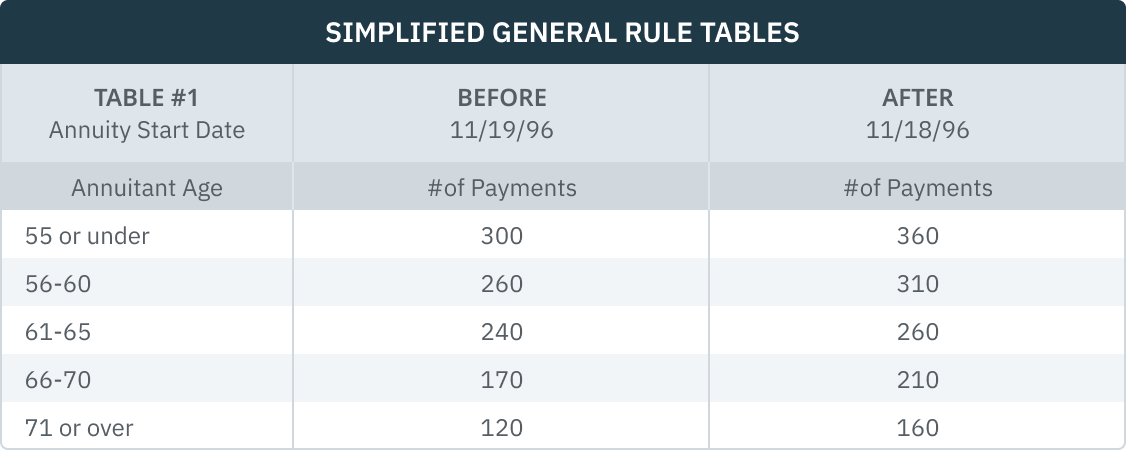

Discover the tax implications of periodic pension or annuity payments below. You will also find a table explaining the simplified general rule.

Generally, distributions from pensions and annuities are made in regular, periodic payments. Distributions are tax-free to the extent the participant has after-tax dollars in a plan (“investment in the contract”) and the balance is taxable.

Information Needed to Figure Annuity Taxability

When determining the taxability of pensions, the following data should be available:

-

Amount of both employer AND employee contributions to the plan.

-

Amount of each annuity payment AND how often it is paid (e.g., monthly).

-

“Starting date” of the annuity. This is the later of the first day of the first period for which a payment is received under the contract or the date when the obligation under the contract becomes certain.

-

Length of time the annuity payments will continue (e.g., for a set number of years, over the lifetime of the taxpayer only, over the lives of the taxpayer and spouse or other beneficiary).

-

Guarantees of a specific minimum return (i.e., “refund feature”).

-

Age of the annuitant, spouse and other beneficiary.

A taxpayer’s “Investment in the Contract” (cost) consists of:

-

The taxpayer’s own after-tax contribution to the plan, and

-

Funds contributed by an employer and included in the taxpayer’s taxable income.

However, certain items may have to be subtracted from the cost:

-

Premium refunds, rebates, “dividends”

-

Premiums paid for disability or health benefits

-

Value of the refund feature, but only if the taxable part of the annuity is computed under the General Rule, as described below. Regs describe how to compute the refund feature.