Withdrawal Exceptions For All Qualified Plans

Some early withdrawal tax exceptions apply to all qualified plans, while some apply only to traditional IRAs. Those listed in this section apply to all qualified plans, unless otherwise noted.

60-Day Rollover to Another Qualified Plan

A taxpayer can avoid both the income tax and the penalty on an early distribution if the distribution is rolled over into an eligible retirement plan within 60-days of receipt (Code Sec. 402(c)(1)). The IRS may waive the 60-day rollover period for equitable reasons, including cases of casualty, disaster, or other events beyond an individual's control such as bank error, if certain conditions are met. (Code Sec. 402(c)(3)) Taxpayers may provide written certification to a plan administrator or an IRA trustee that he or she missed the 60-day deadline because of not being able to complete a rollover due to one or more of 12 situations provided for in Rev Proc 2020-46, modifying and superseding Rev Proc 2016-47. See page 04.04.07 for details.

Some taxpayers use the 60-day rollover provision as a source for a short-term loan. However, there are built-in hazards for the 60-day rule:

-

One rollover per 12 months rule - Code Sec 408(d)(3)(B) limits the number of IRA rollovers to one per one-year period., The IRS historically interpreted the one rollover per year to mean one rollover from each of the taxpayer’s IRAs, and this position had been published in IRS Publication 590 for 2013., However, the tax court in Bobrow v. Commissioner (TC Memo 2014-21) reached the conclusion that the once-per-year IRA rollover limitation applies on an aggregate basis, meaning that an individual could not make an IRA-to-IRA rollover if he or she had made such a rollover involving any of the individual’s IRAs in the preceding 1-year period.

The IRS has adopted the Tax Court position but provided transitional relief by not applying the court’s interpretation to IRA rollovers occurring before January 1, 2015. (Ann. 2014-15) See Chapter 4.04 for additional information.

-

Twenty percent withholding rule – Another barrier to completing a 60-day rollover is the mandatory 20% withholding of federal income tax requirement when a qualified plan distribution isn’t transferred trustee-to-trustee. Because 20% of the distribution went to withholding tax, the taxpayer only received 80% of the funds and cannot recoup the withholding until filing time. Thus, they would have to make up the 20% from other sources to complete a 100% rollover.

-

Direct transfers- A distribution from a qualified retirement plan or IRA that is transferred directly by the trustee of the plan to the trustee of another qualified plan or to another IRA does not count as a rollover and does not trigger the once-per-year rollover limitation; direct transfers are not subject to withholding.

Unreimbursed Medical Expenses Exception

Amounts withdrawn to pay unreimbursed medical expenses that would be deductible on Schedule A during the year and that exceed 7.5% of the taxpayer's AGI are exempt from penalty. This is true even if the taxpayer does not itemize.

Enter unreimbursed medical expense…………………………………....... ___________

Enter 7.5% of the taxpayer’s AGI for the year…................................................ <___________>

Penalty exempt amount……………………………………………………….. ___________

Disabled Exception

If

a taxpayer becomes disabled before reaching age 59-1/2, any amounts withdrawn

because of the disability are not subject to the 10% additional tax. A taxpayer is considered disabled if the

taxpayer can furnish proof that he/she cannot perform any substantial gainful

activity because of the physical or mental condition that causes the

disability. A physician must determine that the taxpayer's condition:

- Can be expected to result in death, or

- Is expected to be of a long, continued and indefinite duration.

In determining whether an individual's

impairment makes him unable to engage in any substantial gainful activity, the

regulations provide that the primary consideration is to be given to the nature

and severity of the impairment, but other factors, such as the individual's

education, training, and work experience, must also be considered. Substantial

gainful activity is the activity, or a comparable activity, in which the

individual customarily engaged prior to becoming disabled or prior to

retirement if the individual was retired at the time the disability arose.

Whether or not the impairment in a particular case constitutes a disability is

to be determined with reference to all the facts in the case. (Reg.

1.72-17A(f))

The following are examples of impairments that would ordinarily be considered as preventing substantial gainful activity:

-

Loss of use of two limbs;

-

Certain progressive diseases which have resulted in the physical loss or atrophy of a limb, such as diabetes, multiple sclerosis, or Buerger's disease;

-

Diseases of the heart, lungs, or blood vessels which have resulted in major loss of heart or lung reserve as evidenced by X-ray, electrocardiogram, or other objective findings, so that despite medical treatment breathlessness, pain, or fatigue is produced on slight exertion, such as walking several blocks, using public transportation, or doing small chores;

-

Cancer which is inoperable and progressive;

-

Damage to the brain or brain abnormality which has resulted in severe loss of judgment, intellect, orientation, or memory;

-

Mental diseases (e.g. psychosis or severe psychoneurosis) requiring continued institutionalization or constant supervision of the individual;

-

Loss or diminution of vision to the extent that the affected individual has a central visual acuity of no better than 20/200 in the better eye after best correction, or has a limitation in the fields of vision such that the widest diameter of the visual fields subtends an angle no greater than 20 degrees;

-

Permanent and total loss of speech;

-

Total deafness uncorrectable by a hearing aid.

The existence of one or more of the impairments described above will not, in and of itself always permit a finding that an individual is disabled as defined in Sec 72(m)(7). Any impairment, whether of lesser or greater severity, must be evaluated in terms of whether it does in fact prevent the individual from engaging in his customary or any comparable substantial gainful activity.

-

AIDS did not constitute disability - The Tax Court noted that the taxpayer did not qualify as disabled, because he had been able to engage in substantial gainful activity during the year at issue.(West, TCS)

-

Depression constituted disability - Tax Court has held that a former postal employee's depression qualified her for the disability exception to the 10% premature withdrawal penalty tax on qualified plans. Her psychologist's conclusion that there was a fair prospect of her eventual return to work in some capacity didn't mean that her condition was not indefinite. (Mary L. Coleman-Stephens, TC Summary Opinion 2003-91)

In contrast, and more typical of the outcome of cases involving mental illness, in an earlier 2003 case (Keeley v. Commissioner, TC Summary Opinion 2003-53), the Tax Court held that the taxpayer’s depression was not a qualified disability for the 10% penalty exception. In the Court’s opinion the taxpayer’s condition was remediable, and it did not require him to be institutionalized or put under constant supervision, conditions noted in the regulations for a mental illness to be a disability.

Beneficiary Exception

If a taxpayer dies, the benefits distributed to a taxpayer’s beneficiary or estate are exempt from the early withdrawal penalty. Caution: If a decedent’s spouse chooses to treat the distribution as his/her own and later receives a distribution before reaching age 59-1/2, it may be subject to the penalty.

Annuity or "Substantially Equal Payments" Exception

Note

The IRS issued notice 2022-6 on 1/18/2022 which slightly modified this material for years 2022 and beyond. When viewing the various criteria please note that both the old and new rates are included.

This exception essentially allows a taxpayer to retire early and take withdrawals before reaching age 59-1/2 without penalty. For qualified plans, this exception applies only for distributions that begin after the taxpayer separates from service. To qualify for this exception, the payments:

-

Must be part of a series of substantially equal payments over the taxpayer’s life, or the joint life expectancies of the taxpayer and the taxpayer’s beneficiary, and

-

Payments under this exception must continue for at least 5 years, or until the taxpayer reaches age 59-1/2, whichever is the longer period. This 5-year rule does not apply if a change from an approved distribution method is made because of the death or disability of the IRA owner.

Code Section 72(t) does not include a specific method of computing the payments. In Notice 89-25, 1989-1 CB 662, modified by Rev. Rul. 2002-62 (which itself is modified and superseded by Notice 2022-06), the IRS suggests three methods that might be used in computing the payments. Several letter rulings have also been issued approving other methods.

The following summarizes the methods outlined in Rev. Rul. 2002-62. Methods 1 through 3, explained below, are applicable for any series of payments starting on or after January 1, 2003, but could have been used for distributions starting in 2002. As the examples for Methods 1 through 3 shows, the amount of the annual payment varies significantly with the method chosen.

CAUTION: The following examples use the pre-2022 life expectancy and distribution tables. In T.D. 9930

(Nov. 5, 2020), which provides updated tables, the IRS stated that they anticipate issuing guidance that would update Rev. Rul. 2002-62. This update would apply the life expectancy, distribution period, and mortality tables set forth in the revised regulations for purposes of determining substantially equal periodic payments once these regulations become effective, which is Jan. 1, 2022. That IRS guidance is included in Notice 2022-06.

-

Method 1, Required Minimum Distribution (RMD) Method (RR 2002-62) – The annual payment for each year is determined by dividing the account balance for that year by the number from the chosen life expectancy table for that year. Under this method, the account balance, the number from the chosen life expectancy table and the resulting annual payments are redetermined for each year. If this method is chosen, no modification in the series of substantially equal periodic payments will be deemed made, even if the amount of payments changes from year to year, provided there isn’t a change to another method of determining the payments.

Example: Taxpayer is age 55, spouse is age 50; qualified retirement plan account balance is $303.00; taxpayer's first distribution is in 2021. Generally, the Uniform Lifetime Table would be used, unless (1) there is no designated beneficiary, in which case the Single Life Expectancy Table is used, or (2) the distribution is from a Joint and Last Survivor annuity for which the Joint and Last Survivor Table is used.

| Factor | Annual Distribution | |

| Single Life | 29.6 | $10,236 |

| Uniform Lifetime | 41.6 | $ 7,284 |

| Joint and Last Survivor | 38.3 | $ 7,911 |

CAUTION

The RMD Method may not allow an affected taxpayer to withdraw enough from their IRA to meet their current financial obligations while they wait for their Social Security or other retirement plan payments to kick in.

-

Method No. 2, Fixed Amortization Method (RR 2002-62) – The annual payment for each year is determined by amortizing in level amounts the account balance over a specified number of years determined using the chosen life expectancy table and the chosen interest rate (defined below). Once calculated, theannual payment would not change, and the same amount would be distributed in later years.

Example: Same facts as above, plus the chosen interest rate is 3.5% (for the purpose of these examples, assume that this is an eligible rate). The annual distribution would be as follows depending on the Life Expectancy Table used:

| Factor | Annual Distribution | |

| Single Life | 29.6 | $16,602 |

| Uniform Lifetime | 41.6 | $13,936 |

| Joint and Last Survivor | 38.3 | $14,483 |

-

Method No. 3, Fixed Annuitization Method (RR 2002-62) – Divide the account balance by an annuity factor that is the present value of an annuity of $1 per year beginning at the taxpayer’s age and continuing for the life of the taxpayer (or the joint lives of the individual and beneficiary). The annuity factor is derived using the mortality table in Appendix B of Rev. Rul. 2002-62 and using the chosen interest rate (defined below). Under this method, the annual payment determined for the first distribution year remains the same amount in each succeeding year.

Example: Under the fixed annuitization method, using the facts as in the example just above, the single life annuity factor would be 18.336 and the annual distribution $16,525 ($303,000/18.336). For a joint life expectancy, the annuity factor is 21.485 and the distribution would be $14,103 ($303,000/21.485).

-

Rules and definitions for Methods 1 – 3:

-

Life Expectancy Tables – that can be used are :

-

Uniform Lifetime Tables. – Illustrated on page 4.02.01. There is one for pre-2022 years (starting at age 70) and another for post-2021 years (starting at age 72). See Appendix A to Notice 2022-06 for the life expectancy factor for ages 10 through 71.

-

The Single Life Expectancy Tables – Illustrated on page 4.02.03 for pre-2022 years and page 4.02.02 for post-2021 years

-

Joint and Last Survivor Tables – Pre-2022 table illustrated starting at 4.02.7 and the post-2021 table illustrated starting at 4.02.4. Use the number from the chosen table for the distribution year that is for the employee’s (or IRA owner’s) age on his or her birthday in that year. If the Joint and Last Survivor Table is used, the age of the beneficiary on the beneficiary’s birthday in the year is also used. For Method 1, the same life expectancy table used for the first distribution year must be used in each following year. If the Joint and Last Survivor table is used, the survivor must be the actual beneficiary of the account for the year of the distribution, determined for the year on January 1, and without regard to changes in the beneficiary during that or prior years. If there is more than one beneficiary, the identity and age of the beneficiary used for Methods 1 – 3 is determined as explained in chapter 4.17 at “Determine Beneficiaries’ Life – Multiple Beneficiaries.” Essentially use the oldest beneficiary’s life expectancy. If, in any year there is no beneficiary, use the Single Life Table for that year.

-

-

Interest Rates - The interest rate that may be used is any rate that is not more than:

-

For years before 2020: Not more than 120% of the federal mid-term rate for either of the two months immediately preceding the month in which the distributions begin.

-

For years after 2021: Not more than the greater of (i) 5% or (ii) 120% of the federal mid-term rate for either of the two months immediately preceding the month in which the distributions begin.

-

The revenue rulings that contain the applicable federal mid-term rates are available on the IRS web site by searching for “applicable federal rate”.

-

Account Balance – The account balance used to determine payments under the RMD method is generally the account balance on the last valuation day of the preceding year. For the fixed amortization and fixed annuitization methods, the account balance must be determined in a reasonable manner based on the facts and circumstances. The account balance will be treated as determined in a reasonable manner if it is the account balance on any date within the period that begins on December 31 of the year prior to the date of the first distribution and ends on the date of the first distribution. (Notice 2022-06)

Example: An IRA with daily valuations made its first distribution on 07/15/22. According to Notice 2022-06, when using Method 2, it would be reasonable to determine the yearly account balance based on the value of the IRA from 12/31/21 to 07/15/22. In subsequent years, using the same method, it would be reasonable to use the value either on 12/31 of the prior year or on a date within a reasonable period before that year’s distribution.

-

-

Modifications to Payments - Under all three methods, IRS will consider that there is a modification to the series of payments if, after the first valuation date, there is:

-

Any addition to the account balance other than gains or losses,

-

Any nontaxable transfer of a portion of the account balance to another retirement plan, or

-

A rollover by the taxpayer of the amount received resulting in such amount not being taxable.

-

CAUTION

Payers of qualified “substantially equal” payments will prepare Form 1099-R with a code 2 (early distribution, known exception) in Box 7. However, the Form 1099-R instructions tell payers to use code “1” (early distribution, no known exception) if they don’t know if the taxpayer meets the requirements for the “substantially equal” exception. This could happen if the taxpayer transfers his IRA or qualified plan account from the custodian who was originally involved when the payment plan was set up to a different custodian or trustee (for example, from one brokerage to another), even if the payments have not been modified. In this event, Form 5329 (Part I) will need to be prepared and included with the taxpayer’s income tax return to justify why no penalty has been included in the return. Any transfer of accounts should be done trustee-to-trustee to avoid the possibility that the taxpayer would be considered to have received an additional payment (even if it is rolled over timely) and then be disqualified from the “substantially equal” exception.

-

Rollovers & Exchanges – The SECURE 2.0 Act Section 323 provides that the exception continues to apply in the case of a rollover of the account, an exchange of an annuity providing the payments, or an annuity that satisfies the required minimum distribution rules. Effective for transfers, rollovers, and exchanges after December 31, 2023, and effective for annuity distributions on or after the date of enactment of this Act.

IRS Q&A from IRS.gov:

Q7. Can I change from one method to another in calculating substantially equal periodic payments?

Yes. Rev. Rul. 2002-62 permits a one-time change from either the amortization method or the annuitization method to the required minimum distribution method. (Notice 2022-06, section 3.03(b), confirms this rule.)

Q8. What is the effect of an account being completely depleted?

If

there are no assets remaining in the individual account plan or IRA, the

taxpayer will not be subject to the Code §72(t) tax because of not receiving substantially equal periodic payments. In addition, the recapture tax will not apply.

Q9. Are the three methods the only acceptable ways of determining substantially equal periodic payments?

No. Another method may be used in a private letter ruling request, but, of course, it would be subject to individual analysis.

Q10. Can I take the substantially equal payments on a monthly basis?

Yes. Monthly payments under the required minimum distribution method would be the calculated annual amount divided by 12. Under the amortization and annuity methods, the choice of having the payment made monthly should be part of the original calculation.

Distribution as Result of an IRS Levy

The 10% penalty tax on early withdrawals (under Code Sec. 72(t)) does not apply to withdrawals from a qualified plan or IRA made on account of a levy under Code Sec. 6331 on the plan or IRA. (§ 72(t)(2)(A)(vii))

This exception applies to distributions only if the qualified plan or IRA is actually levied on. The 10% penalty tax still applies if the taxpayer withdraws amounts from a qualified plan or IRA to pay taxes in the absence of a levy, or even if the taxpayer makes a plan or IRA withdrawal in order to cause the IRS to release a levy on a separate property interest of the taxpayer.

Example – IRS Levy – Taxpayer, age 40, has $15,000 in his IRA, including $5,000 in nondeductible (after-tax) contributions. IRS issues a notice of levy to the IRA custodian for the collection of taxes owed by the taxpayer, and levies on the entire $15,000 in his IRA in Year 1. On his Year 1 income tax return, the taxpayer must report taxable income of $10,000 ($15,000 withdrawal less $5,000 nondeductible contributions). However, under Code Sec. 72(t)(2)(A)(vii), the taxpayer is not subject to the 10% early withdrawal tax on the distribution. But if the taxpayer had withdrawn the money to pay taxes in the absence of a levy, the 10% penalty would apply, and the additional tax would be $1,000.

-

-

Pension Plan Garnishment - IRS has privately ruled that qualified retirement plans won't be disqualified for paying some participants' and beneficiaries' benefits to satisfy their criminal fines under garnishment orders relating to federal criminal statutes. IRS also concluded that the distributions would not be subject to the 10% early withdrawal penalty tax, mandatory withholding or written notice requirements. (PLR 200426027)

In another ruling, IRS privately held that a federal court seeking to collect a fine in an individual's criminal case would not violate the anti-alienation rule by garnishing the individual's Code Sec. 401(k) plan account balance. However, that ruling did not address the 10% additional tax, or whether the payments would be subject to mandatory withholding. See PLR 200342007.

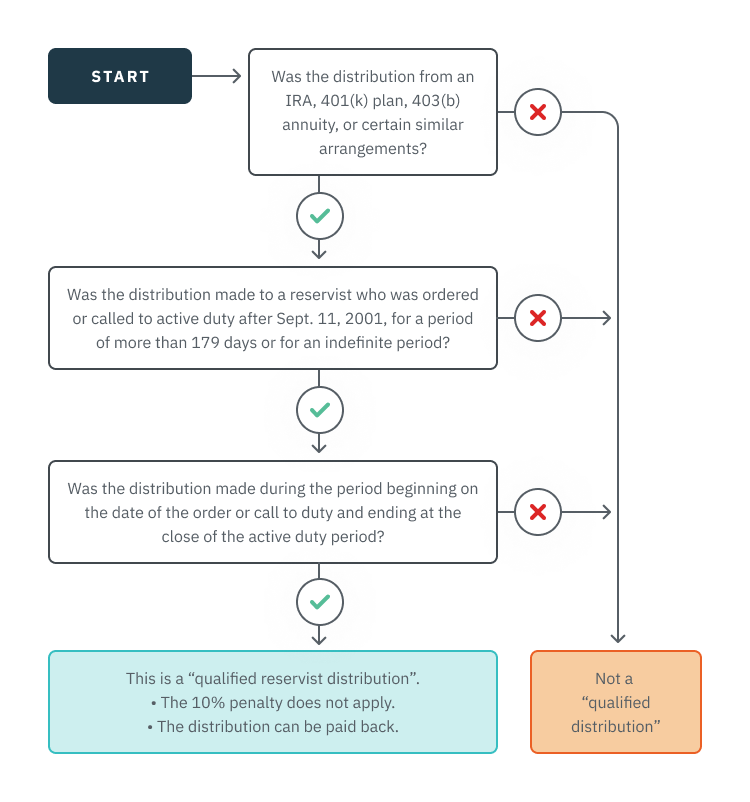

Qualified Reservist Distributions

The 10% early withdrawal penalty tax does not apply (retroactively) to a

“qualified reservist distribution.” A

qualified distribution is:

(1) From an IRA or attributable to elective deferrals under a 401(k) plan, 403(b) annuity, or certain similar arrangements;

(2) Made to individuals who (because of their being members of a reserve component) are ordered or called to active duty after Sept. 11, 2001, for a period of more than 179 days or for an indefinite period; and

(3) Made during the period beginning on the date of the order or call to duty and ending at the close of the active-duty period.

-

Pay-Back Option - Those who receive a qualified reservist distribution may, at any time during the two-year period beginning on the day after the end of the active duty period, make one or more contributions to their IRAs in an aggregate amount not to exceed the amount of the distribution (i.e., they may make “pay back” contributions).

-

Original Distribution Taxability - No provision is made to allow the taxpayer to amend the return on which the original distribution was reported to recover the regular tax that was paid on the amount that is paid back. Since the amount that is paid back is not deductible, it may be appropriate for the taxpayer to contribute the pay-back to a Roth IRA; there the earnings on the repayment will grow tax-free and distributions will be tax-free (if the age and holding period requirements are satisfied). If the nondeductible pay-back is made into a Traditional IRA, when the funds are distributed at retirement, they will be partially tax-exempt based on the ratio of nondeductible contributions to total contributions. In the year the distribution is paid back, the taxpayer is required to file Form 8606 to report the nondeductible contribution.

Penalty-Free Plan Withdrawals for Births or Adoptions

For distributions made after Dec. 31, 2019, the SECURE Act provides that withdrawals from retirement plans for a "qualified birth or adoption distribution" are not subject to the 10% early withdrawal penalty. This is a distribution to an individual made during the one-year period beginning on the date on which a child of the individual is born or on which the legal adoption by the individual of an eligible adoptee is finalized. An eligible adoptee means any individual (other than a child of the taxpayer's spouse) who has not attained age 18 or is physically or mentally incapable of self-support. The maximum aggregate amount of a qualified birth or adoption distribution by any individual with respect to any birth or adoption is $5,000, applied on an individual basis (so each spouse separately may receive up to $5,000 of qualified birth or adoption distributions). Taxpayers must include the name, age, and taxpayer identification number (TIN) of the child or eligible adoptee on their tax return. In addition, such qualified birth or adoption distributions may be recontributed to an individual's applicable eligible retirement plans, subject to certain requirements. (Code Sec 72(t)(2)(H), as amended by SECURE Act Sec. 113)

-

Qualified Coronavirus-related Distributions - The 10% penalty on early withdrawals is waived for up to $100,000 of coronavirus-related retirement plan distributions (including IRAs) made January 1, 2020 through December 30, 2020, to an individual:

o Who

is diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019

(Covid-19) by a test approved by the Centers for Disease Control and

Prevention,

o Whose spouse or dependent is so diagnosed, or

o Who experiences adverse financial consequences as a result of the coronavirus. (CARES Act Sec. 2202(a))

See Chapter 04.05 for additional details on coronavirus-related retirement plan distributions.

Penalty Exception for Terminal Illness

SECURE 2.0 Act Section 326 provides an exception to the additional 10% tax in the case of a distribution to an individual who is terminally ill on or after the date on which such employee has been certified by a physician as having a terminal illness.

-

Definition - For purposes of this provision, the term ‘terminally ill individual’ means an individual who has been certified by a physician as having an illness or physical condition which can reasonably be expected to result in death in 84 months or less after the date of the certification.

-

Documentation — An employee shall not be considered to be a terminally ill individual unless such employee furnishes sufficient evidence to the plan administrator in such form and manner as the Secretary may require.

Penalty Exception for Domestic Abuse

A domestic abuse survivor may need to access his or her money in their retirement account for various reasons, such as escaping an unsafe situation. SECURE 2.0 Act Section 314 allows retirement plans to permit participants that self-certify that they experienced domestic abuse to withdraw a small amount of money not subject to the 10% early withdrawal penalty and not to exceed the lesser of:

-

$10,000, or

-

50% of the present value of the nonforfeitable accrued benefit of the employee under the plan.

A distribution is an eligible distribution if it is made during the 1-year period beginning on any date on which the individual is a victim of domestic abuse by a spouse or domestic partner.

Domestic abuse means physical, psychological, sexual, emotional, or economic abuse, including efforts to control, isolate, humiliate, or intimidate the victim, or to undermine the victim’s ability to reason independently including by means of abuse of the victim’s child or another family member living in the household.

Distribution may be repaid at any time during the 3-year period beginning on the day after the date on which such distribution was received.

Withdrawals for Certain Emergency Expenses

SECURE 2.0 Act Sec 115 adds new IRC Sec 72(t)(2)(I) that provides a penalty exception for certain distributions used for emergency expenses, which are unforeseeable, or immediate financial needs relating to personal or family emergency expenses.

Only one distribution is permissible per year of up to $1,000, and a taxpayer has the option to repay the distribution within 3 years. No further emergency distributions are permissible during the 3-year repayment period unless repayment occurs.

The term “emergency personal expense distribution” means any distribution from an applicable eligible retirement plan (as defined in IRC Sec 402(c)(8)(B) other than a defined benefit plan) to an individual for purposes of meeting unforeseeable or immediate financial needs relating to necessary personal or family emergency expenses. The administrator of an applicable eligible retirement plan may rely on an employee's written certification that the employee satisfies the conditions of the preceding sentence in determining whether any distribution is an emergency personal expense distribution. (Sec 72(t)(2)(I)(iv))

Applies to distributions made after December 31, 2023.