Contributions To HSAs

Any eligible individual, whether employed, unemployed or self-employed, may contribute to an HSA. Unlike IRAs, there is no requirement that the individual have compensation and there are no phase-out rules for high-income taxpayers. For an HSA established by an employer, the employee, the employer or both may contribute to the HSA. Family members or any other person may also make contributions to an HSA on behalf of an eligible individual. (Notice 2004-23; Notice 2004-50) If an individual has more than one HSA, the aggregate annual contributions to all the HSAs are subject to the limit.

Contributions to an HSA must be made in cash (no stock or other property). Payments to the HDHP and contributions to the HSA can be made through an employer’s cafeteria plan, and these are treated as employer contributions that are excludable from the employee’s wages, so the employee would not then take a deduction for these contributions.

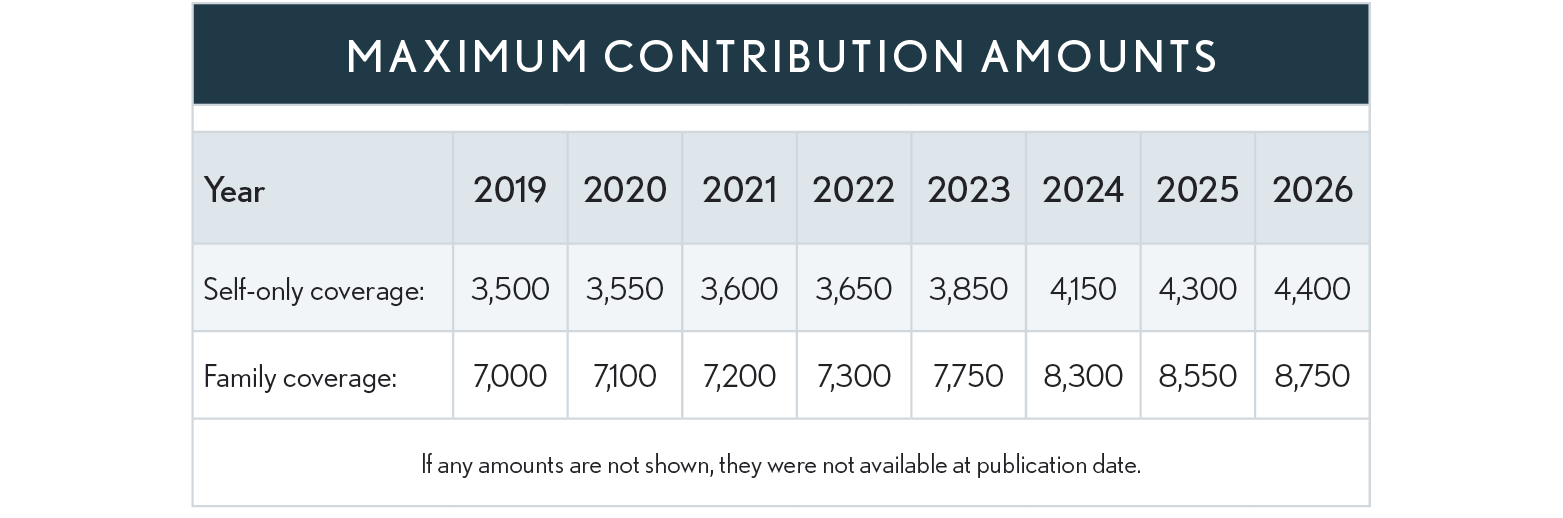

Maximum Contribution – General Limitation

The maximum annual contribution to an HSA is the sum of the limits determined separately for each month, based on status, eligibility and health plan coverage as of the first day of the month.

The maximum annual monthly contribution is determined as follows:

-

Self-only coverage (monthly) = 1/12 of the self-only dollar limit for the year.

-

Family coverage (monthly) = 1/12 of the family coverage dollar limit for the year.

Additional Catch-up Contribution

Individuals (and their spouses covered under the HDHP), age 55 and older, who are not enrolled in Medicare are allowed to increase their HSA contribution. The catch-up contribution, like the annual contribution limit, is computed on a monthly basis. The annual amount has been $1,000 since 2009.