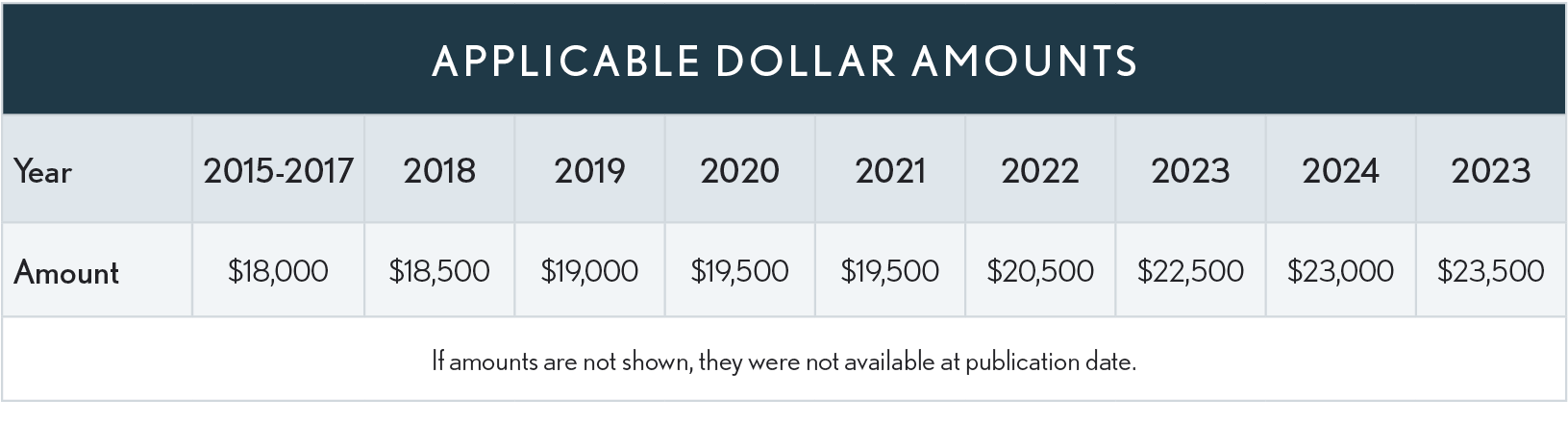

Annual Compensation Limit

The maximum

amount which may be deferred under the plan for a tax year may not exceed the

lesser of:

(1) Applicable dollar amount, or

(2) 100% of annual compensation.

Inflation Adjustments

The applicable dollar amount is adjusted for cost-of-living increases. Any cost-of living increase that is not a multiple of $500 will be rounded to the next lowest multiple of $500.

Special Catch-Up Rule

Under a special catch-up rule, the limit will be twice the otherwise applicable dollar amount limits in the three years before retirement.

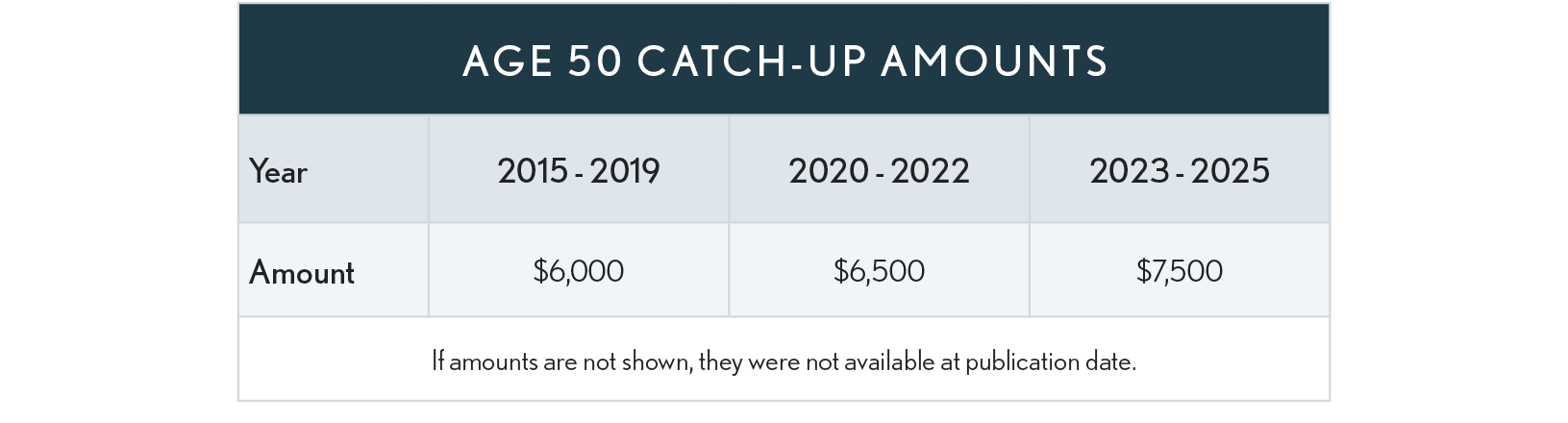

Age-50 Catch-Up Contributions

An individual who will reach age 50 by the end of the year, and who has contributed the maximum amount to the Sec. 457 plan for the year, may contribute an additional amount. This amount is the lesser of the excess of that year’s compensation over any other elective deferrals made by the participant, or the amount shown in the table. CAUTION: The age 50 catch-up rule and the final 3-year catch-up rule may not both be used in the same years.

Catch-Up Contributions Required to Be Roth Contributions

SECURE 2.0 Act Section 603 (amending IRC Sec 414) provides that effective January 1, 2026*, all catch-up contributions, if the if the participant’s Social Security wages for the prior year exceeded $145,000 must be designated Roth contributions. In addition, if catch-up contributions are provided under a plan as designated Roth contributions for participants whose wages exceed $145,000, the plan must also permit catch-up contributions made by other eligible participants to be designated Roth contributions.

*These changes were originally scheduled to take effect January 1, 2024, but to help taxpayers make a smooth transition, the IRS extended the effective date to January 1, 2026 (IR-2023-62 and IR-2023-155 released August 25, 2023).