401(K) Plan Contribution Limits

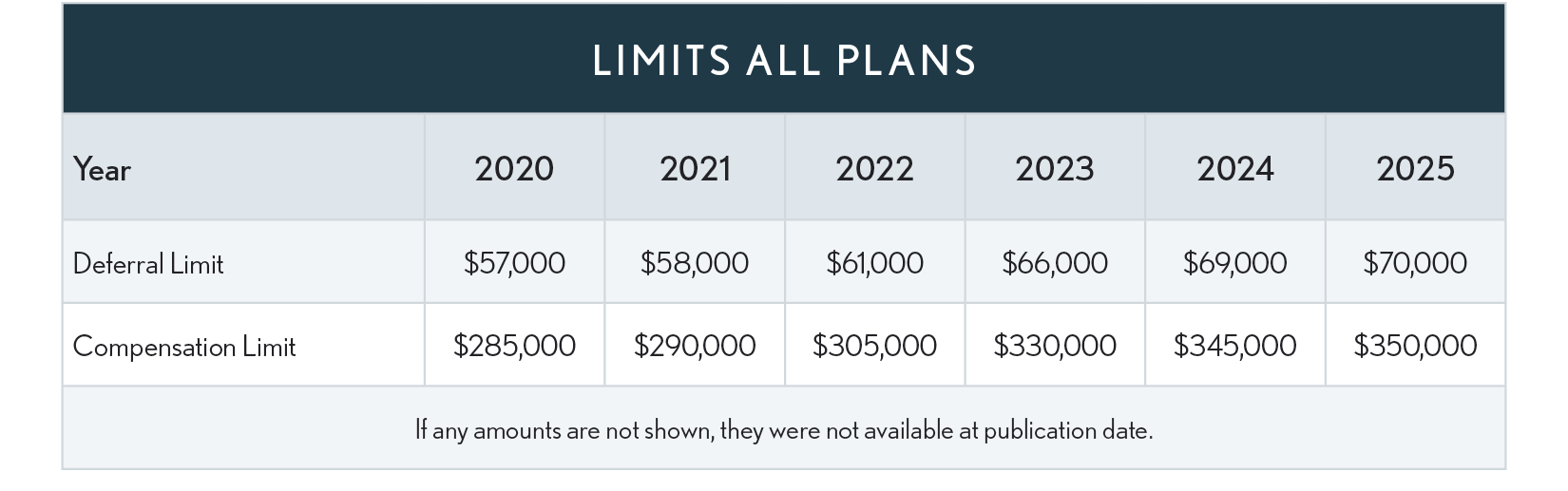

The annual limit to the amount of deferred compensation that each employee may contribute to the 401(k) plan for recent years is shown in the table below.

Catch-Up Contributions

Individuals age 50 and over can make additional annual “catch-up” contributions to salary reduction plans including 401(k) plans, provided the plan permits catch-up contributions. The allowable “catch-up” amount is indexed for inflation in $500 increments. The catch-up amount for 2020 through 2022 is $6,500 ($7,500 for 2023 through 2025).

Catch-Up Contributions Exempt from Regular Limits

Catch-up contributions are exempt from the regular dollar limits on deferrals. Provided that all 401(k) plan participants are permitted to make catch-up contributions, they are exempt from non-discrimination rules.

Age 60 through 63 Higher Catch-Up Limits

SECURE 2.0 Act, Section 109 increases the catch-up contribution limits to the greater of $10,000 or 50% more than the regular catch-up amount beginning in 2025 for individuals who have attained ages 60, 61, 62 and 63. The increased amounts are indexed for inflation after 2025. Thus, beginning in 2025 the 401(k) plan catch-up amount for individuals aged 60 through 63 will be $11,250 (1.5 x $7,500).

Catch-Up Contributions Required to Be Roth Contributions

SECURE 2.0 Act Section 603 (amending IRC Sec 414) provides that effective January 1, 2026*, for employees with wages of more than $145,000 in the prior year from the employer sponsoring the plan, catch-up contributions must be designated as Roth contributions. Other employees who are eligible to make catch-up contributions may designate their catch-up contributions as a Roth contribution. However, if the employer doesn’t have a designated Roth plan, then catch-up contributions cannot be made. Prior to 2026, matching and nonelective contributions had to be made on a pre-tax basis.

*These changes were originally scheduled to take effect January 1, 2024, but to help taxpayers make a smooth transition, the IRS extended the effective date to January 1, 2026(IR 2023-62 and IR-2023-155 released August 25, 2023

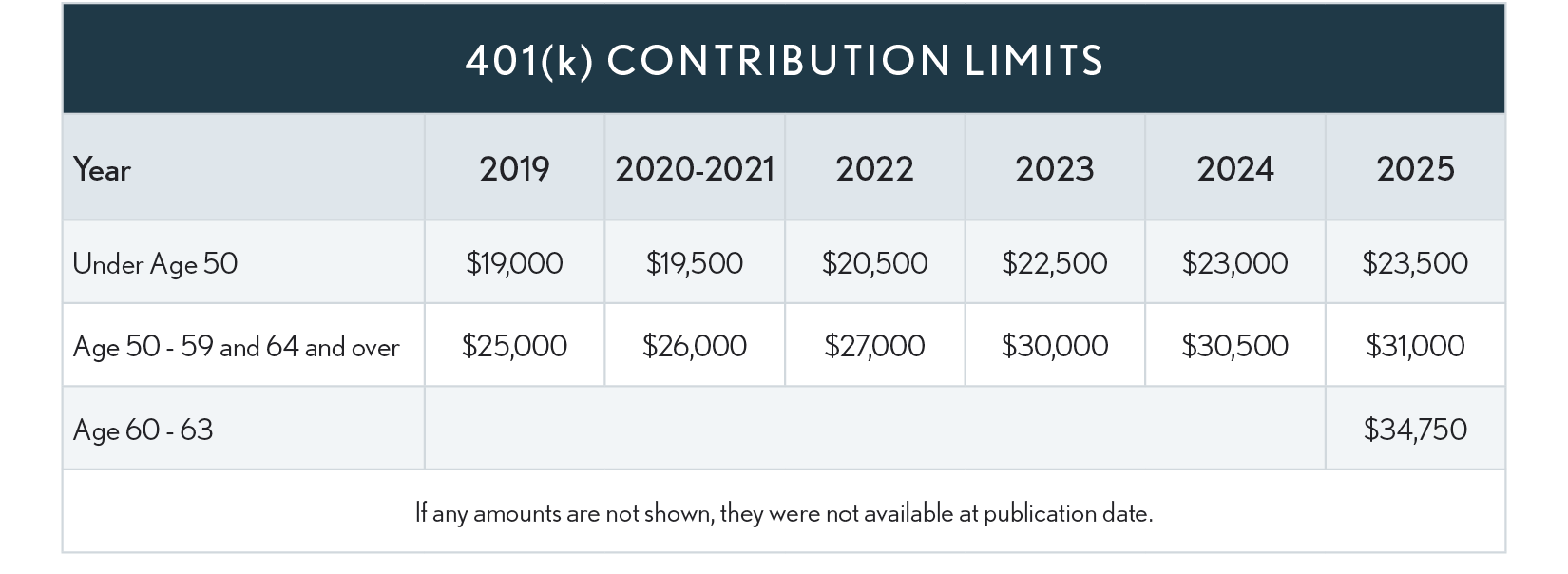

Limits All Plans

In addition to the limit on elective deferrals, annual contributions to all an employee’s retirement accounts – including elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures to the accounts - may not exceed the lesser of 100% of the employee’s compensation or the amounts shown in the table below. Also, the amount of compensation that can be considered when determining employer and employee contributions is limited to the amounts indicated in the table.