California Penalties Overview

-

Late Filing: 25% of the tax due if filed after the Oct 15 due date

-

Late Filing Minimum: Lesser of $135 or 100% of the refund.

-

Late Paying: 5% of the tax due plus 1/2% per month

-

Underpayment of Estimated Taxes: See Chapter 10.3

-

Mandatory E-File E-Pay Penalty: See Chapter 10.3

Late Filing of Return

The maximum total penalty is 25% of the tax not paid if the tax return is filed after October 15. The minimum penalty for filing a tax return more than 60 days late is $135 or 100% of the balance due, whichever is less.

Late Payment of Tax

If the total tax liability is not paid by the original due date, generally April 15 of the year following the tax year, a taxpayer will incur a late payment penalty plus interest. If at least 90% of the tax shown on the return is paid by the original due date of the tax return, the FTB will waive the penalty based on reasonable cause. However, the imposition of interest is mandatory. The penalty is 5% of the tax not paid when due plus 1/2% for each month, or part of a month, the tax remains unpaid.

Minimum Late Payment Penalty

California amount is $135. (FTB Website last updated 4/11/2023)

Interest

Interest will be charged on any late filing or late payment penalty from the original due date of the return to the date paid. In addition, if other penalties are not paid within 15 days, interest will be charged from the date of the billing notice until the date of payment. Interest compounds daily and the interest rate is adjusted twice a year. The FTB website has a chart of interest rates in effect since 1976. For the current and historical interest rates go to: https://www.ftb.ca.gov/pay/penalties-and-interest/interest-and-estimate-penalty-rates.html.

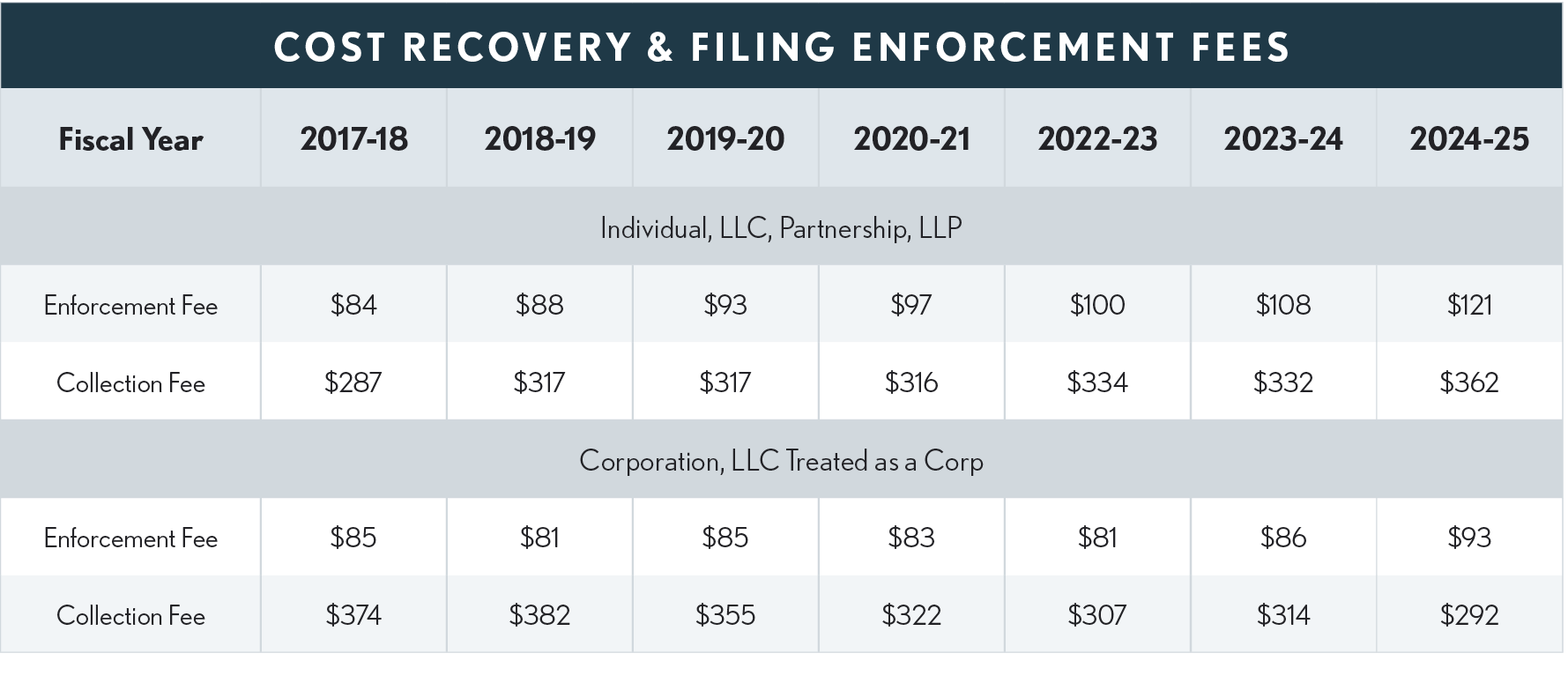

Cost Recovery & Filing Enforcement Fees

The FTB charges cost recovery fees if they must take collection action to resolve a taxpayer’s filing and payment delinquencies. Cost recovery fees may include a filing enforcement fee, a collection fee, a lien fee, and fees to cover the cost of seizing and selling property. The FTB charges a filing enforcement fee for any individual or business that fails to file a required tax return in response to a legal demand to file. Fees vary from year to year based on legislation and are set for a fiscal year July 1 through the following June 30. (R&TC Sections 19254, 19209, 19221, 19233, and 19234) The current fees and those for recent past years are shown in the table below.

Bad Check Penalty

If the taxpayer’s financial institution does not honor a payment to the Franchise Tax board that the taxpayer made by check, money order, or electronic funds transfer, a penalty of 2% of the payment amount is assessed. However, if the payment is less than $1,250 the penalty is $25 or the payment amount, whichever is less.

Demand to File Penalty

If the Franchise Tax Board issues a demand to file an income tax return or to provide information, and the taxpayer does not comply, the FTB will impose a penalty of 25% of the tax on the assessment, without reduction of payments and credits. This may result in a taxpayer owing penalties and interest even if the return shows a refund due.

If the taxpayer is required to make payments electronically and fails to do so, the penalties are:

-

Individuals: 1% of the amount not electronically paid

-

Businesses: 10% of the amount not electronically paid

Penalty For Underpayment Of Estimated LLC Fee

10% of the underpaid fee.

Failure to File Secretary of State (SOS) Statement

Failure to file an entity’s annual or biennial Statement of Information on time is subject to a penalty. Only the SOS can waive the penalty. To request a waiver: SOS email Penalty Waivers for Failing to File Statement of Information. The penalties are:

-

Exempt organizations: $50

-

All other businesses: $250

Nest Penalty

California's non-economic substance transaction understatement penalty (NEST), imposes a 20 percent penalty for understatements attributable to non-economic substance transactions (Revenue and Taxation Code (R&TC) Section 19774). The penalty increases to 40 percent for transactions that are not adequately disclosed.

A transaction lacks economic substance either because:

-

It lacks an economic benefit or,

-

There is no bona fide, non-tax California business purpose for entering into the transaction.

In cases where the taxpayer has received a final federal audit report, the FTB may assess the NEST penalty in lieu of the accuracy-related penalty assessed on the audit report if both of these criteria are met:

-

The federal adjustment was from a transaction lacking economic substance.

-

Tax benefits from this same transaction were reported on the California tax return.

This penalty is imposed on a Notice of Proposed Assessment. To dispute the NEST penalty, the taxpayer should file a protest of the penalty within the required 60-day time period (R&TC Section 19041), and also file a request for Chief Counsel to Relieve Penalties (Form FTB 626).

The factors relating to whether the penalty was properly imposed will be developed during the protest process. The Chief Counsel relief process (R&TC Section 19774(d)) is the mechanism for determining whether to withdraw or reduce the NEST penalty.

The Chief Counsel's determination will consider all grounds raised in the dispute of the penalty, including substantive arguments concerning economic substance and business purpose. The Chief Counsel will issue a determination on the Request for Penalty Relief. The taxpayer cannot appeal or challenge the Chief Counsel's refusal to compromise the penalty before the Office of Tax Appeals or in court. A Notice of Action will be issued on the remaining issues which are the subject of the protest. The taxpayer may also contest the penalty after paying the full amount and filing a claim for refund with FTB, and may appeal to the Office of Tax Appeals or file an action in court after the refund claim is denied or deemed denied.

Frivolous Submission Penalty

The Franchise Tax Board (FTB) may impose a penalty of $5,000 for specified frivolous submissions as provided for in R&TC Section 19179. The penalty will not apply if the person withdraws the submission in writing within 30 days of FTB's notice that states the submission is a “specified frivolous submission.” The FTB has adopted the list of frivolous positions in IRS Notice 2008-14. A “specified frivolous submission” is a submission that includes material that meets either of the following definitions:

-

Is based on a position FTB identifies as frivolous.

-

Reflects a desire to delay or impede the administration of federal income tax laws determined by the IRS, or California income or franchise tax laws determined by FTB.

Relief Available - Either or both of the following methods may be used to contest the frivolous submission penalty:

• Request relief from the penalty by submitting form FTB 626, Request for Chief Counsel to Relieve Penalties.

• After paying the penalty in full, the taxpayer can also file a claim for refund within the statute of limitations (R&TC Section 19306).

Frivolous Return Penalty

A penalty applies for filing a frivolous return and is determined in accordance with Section 6702 of the Internal Revenue Code, except as otherwise provided. (R&TC Section 19179) The frivolous return penalty is $5,000 for California and is imposed if all of the following apply:

• The taxpayer submits what is purported to be a required return.

• The purported return does not contain sufficient information to judge the substantial correctness of the self-assessment or contains information that, on its face, indicates that the self-assessment is substantially incorrect.

• The purported return is based on a frivolous position or reflects an attempt to delay or impede administration of the tax laws.

Relief from Frivolous Return Penalty - The same methods apply as those for relief from the frivolous submission penalty. FTB’s penalty reference chart: http://www.ftb.ca.gov/forms/misc/1024.pdf or https://www.ftb.ca.gov/forms/misc/1024.html

First Time Abatement (FTA) Penalty Relief

For Tax Years Before 2022 - California DOES NOT have a first-time abatement penalty relief provision similar to that of the IRS because the FTB maintains that it does not have administrative authority to abate penalties but may abate certain penalties if reasonable cause is proven. The fact that the IRS abated a penalty under the FTA policy, or that the taxpayer has a good compliance history with the state, is not by itself sufficient to establish reasonable cause.

For Tax Years Beginning on or After 2021 - AB 194 (signed into law 6/30/2021) adds new R&TC Sec 19132.5 that provides an individual may request, and the FTB would be required to grant, a onetime abatement of a failure-to-file or failure-to pay timeliness penalty. Taxpayers may choose to pursue one-time abatement as an alternative to reasonable cause abatement, or they may pursue one-time abatement after a request for reasonable cause abatement has been rejected. (FTB Tax News August 2023

To be eligible for this one-time abatement relief, an individual either must not have been required to file a California return or must have filed all required returns and paid all taxes, penalties, fees, and interest currently due other than the timiliness penalty for which abatement is requested, or have an installment agreement in place with the FTB for paying those taxes, penalties, fees, etc. A taxpayer would be able to claim this relief only once in their lifetime and for only one taxable year. The FTB began accepting one-time timeliness penalty abatement requests on April 17, 2023.

The abatement request can be made using Form FTB 2918, One-Time Penalty Abatement – Individual (see the form instructions for where to mail the form), or can be made verbally by calling the FTB at 800.689.4776 within the United States.

To claim a refund, FTB 2918 must be filed within the statute of limitations, which is the latest of:

-

Four years after the original tax return due date.

-

Four years after the date of a timely filed tax return.

-

One year from the date of overpayment.

Penalties and Reasonable Cause Relief

Some penalties may be abated if a taxpayer can demonstrate reasonable cause. "Reasonable cause" in the context of penalties means that the taxpayers exercised ordinary business care and prudence in meeting their tax obligations but nevertheless failed to comply. Taxpayers may go to ftb.ca.gov and search for “reasonable cause” for law summaries which describe the circumstances that generally constitute reasonable cause.

Penalties imposed on taxpayers that can be abated for "reasonable cause" include:

-

Delinquent/Late Filing Penalty - R&TC Section 19131.

-

Late Payment Penalty - R&TC Section 19132.

-

Notice and Demand/Failure to Furnish Information Penalty - R&TC Section 19133.

-

Accuracy-Related Penalty - R&TC Section 19164.

-

Electronic Fund Transfer (EFT) Penalty - R&TC Section 19011.

-

Dishonored Payment Penalty - R&TC Section 19134.

-

Withholding Liability for Tax and Withholding Penalties - R&TC Section 18668.

-

Partnership/S-Corporation late filing penalties - R&TC Sections 19172 and 19172.5.

Reasonable Cause Abatement Request Forms

The FTB has two forms with instructions regarding reasonable cause and statute of limitations:

-

FTB 2917, Reasonable Cause – Individual and Fiduciary Claim for Refund

-

FTB 2924, Reasonable Cause – Business Entity Claim for Refund

The FTB recommends using these two forms for a quicker response but will continue to accept and process handwritten reasonable cause abatement requests.

If the taxpayer has already paid in full all outstanding liabilities, including the penalty for which abatement is being requested, the form will serve as a Claim for Refund.