Partial Payments Required with Offer Submissions

Taxpayers submitting offers must make a non-refundable, up-front payment to IRS while the service considers the merits of the offer. According to the instructions in the Form 656-B (April 2024) booklet, the payment options are:

-

For Lump-Sum Offers – 20% paid with the offer and the balance paid in five or fewer installments within 5 or fewer months of the offer’s acceptance.

-

For Periodic Payment Offers – Requires the first payment with the offer and the remaining balance paid, within 6 to 24 months, in accordance with the proposed offer terms. Under this option, the taxpayer must continue to make monthly payments while the IRS is evaluating the offer. If these payments aren’t made, the IRS will return the offer. There is no appeal. Total payments must equal the total offer amount.

Individuals meeting the Low-Income Certification guidelines will not be required to send the initial payment or make the required monthly payments while their offer is being considered.

Failure to Submit Up-Front Payments

Will produce the following actions:

-

For lump-sum offers – where no up-front payment is submitted the offer will be returned to the taxpayer as being un-processable., If less than the 20% up-front payment is submitted, the IRS will ask the taxpayer to pay the remaining balance in order to avoid having the offer returned. If it isn't paid, IRS will return the offer and retain the application fee.

-

For periodic payment offers – failure to submit the first proposed instalment with the offer will result in the offer being returned to the taxpayer as being un-processable.

Application of the Up-Front Payments

The up-front payments are not refundable and are considered payments on tax. Thus, if the offer is rejected the up-front payments will be applied to the taxpayer’s liability. A taxpayer can specify the application of any payment made under the above rules to the assessed tax or to other amounts at the submission of the offer. If a taxpayer fails to specify then the IRS will apply the payments in the best interest of the government. However, the applicant may make a deposit (see Form 656, Section 5), which may be returned. If the offer is accepted, the payments made during the offer process, including any money designated as a deposit, will be applied to the offer amount.

The application of any partial payment won't matter if the offer is accepted, but it might if the offer is rejected. To prepare for that possibility, if the offer is being made with respect to more than one tax year, the taxpayer should consider applying any payments made under the offer to more recent years, rather than to those nearing the expiration of the limitation period for collection. This will avoid having the payments credited to a tax liability that might be rendered uncollectible by the running of the statute of limitations.

Up-Front Payment Waivers Possible

Taxpayers qualifying as low-income or filing an offer based solely on doubt as to liability can receive a waiver of the partial payment requirements.

-

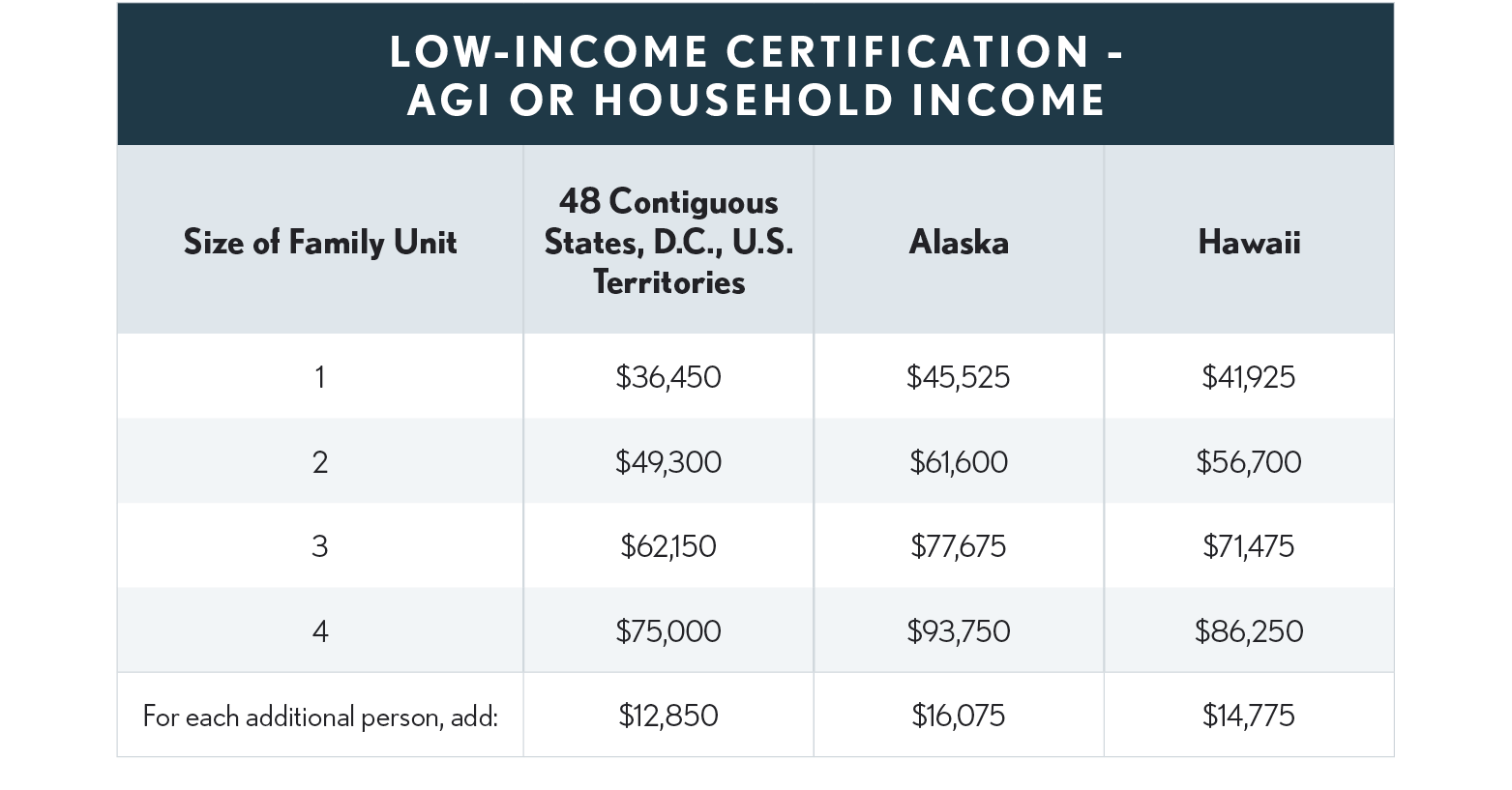

Low-Income Taxpayer Offers - A low-income taxpayer is an individual whose income falls below poverty levels based on guidelines established by the U.S. Department of Health and Human Services. Taxpayers claiming the low-income exception should use the worksheet and low-income guidelines in the Form 656-B booklet to determine if they qualify. The testing amount is the applicant’s AGI from their most recently filed tax return or the household’s gross monthly income from Form 433-A(OIC) x 12. The amounts from the April 2024 revision of Form 656 are as follows:

-

Doubt as to Liability Offers - An offer is considered to be submitted solely on the basis of doubt as to liability if the taxpayer submits the offer on Form 656-L, Offer in Compromise (Doubt as to Liability), or if the offer is submitted on Form 656, Offer in Compromise, it is clear on the face of the form that the only basis on which the taxpayer relies in making the offer is doubt as to liability.

Offers are submitted using Form 656, Offers in Compromise. Form 656-B, Offer in Compromise Booklet, provides detailed instructions for completing the offer and includes all of the necessary financial forms and worksheets. When submitting Form 656, taxpayers must include an application fee unless they qualify for the low-income exemption or are filing a doubt-as-to liability offer. The application fee will be applied to the assessed tax or other amounts due.

Deemed Acceptance

If an offer is not withdrawn, returned or rejected within 24 months of the date received by IRS, it is deemed to be accepted. Time periods during which a liability included in the offer is the subject of a dispute in court proceedings will be disregarded by the IRS when calculating the 24-month time frame. (Code Sec 7122(f))