OIC Procedures and Required Forms

IRS’ authority to compromise a tax liability is established by Code Section 7122. The IRS’ authority to enter a valid agreement exists only when the statute is carefully and strictly administered. A very old case states that without such administration a compromise agreement is not binding on either the IRS or the taxpayer (Botany Worsted Mills v. U.S., 278 U.S. 282 (1929)). However, just because an Offer is made doesn’t mean the IRS will accept it. For example, during 2021 only 30.9 percent of the offers submitted were accepted.

The procedures for submitting an offer in compromise are outlined in Rev. Proc. 2003-71. This procedure applies to all offers to compromise a civil or criminal liability submitted to the IRS, except for those offers going directly to Appeals. In addition, it doesn’t apply to offers that have been referred to the Department of Justice.

Submit offers (based on other than doubt as to liability) on Form 656, Offer in Compromise. NOTE: The latest version of the form available MUST ALWAYS be used and none of the standard language of the form may be stricken or altered. The form needs to be signed under penalty of perjury.

The offer should include:

-

All tax liabilities to be covered by the compromise.

-

The legal grounds for the compromise.

-

The amount the taxpayer is proposing to pay and

-

The payment terms (including amounts and due dates of payments).

The taxpayer needs to submit Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, or Form 433-B, Collection Information Statement for Businesses, along with any other backup information as required by the IRS. The information sent to the IRS must be current, reflecting the taxpayer’s financial situation for the 3 months just before the date of submitting the offer. Forms 433-A and 433-B must be filled out COMPLETELY. This means that items that don’t apply to the taxpayer should be notated with N/A (not applicable).

If the basis of an offer is doubt as to liability, the taxpayer should submit Form 656-L (latest version when this material was updated is dated May 2024), which includes a detailed description of why the taxpayer believes he/she doesn’t owe the tax liability.

Taxpayers submitting offers on Form 656 must make a non-refundable, up-front payment to IRS (in addition to the application fee) while the service considers the merits of the offer, unless waived because the taxpayer meets the low-income exception noted above. (See “Partial Payments Required with Offer Submissions” above for amounts.) The up-front payments are not refundable and are considered payments of tax. Thus, if the offer is rejected the upfront payments will be applied to the taxpayer’s liability. A taxpayer can specify the application of any payment made under the above rules to the assessed tax or to other amounts at the submission of the offer. If a taxpayer fails to specify, then the IRS will apply the payments in the best interest of the government.

If an offer is accepted under the “effective tax administration” or “doubt as to collectability” categories and collection of an amount more than that offered would create economic hardship, then the taxpayer may ask for the user fee to either be refunded or applied against the offer amount. The IRS won’t refund the fee to the taxpayer if the offer is accepted, rejected, withdrawn, or returned as non-processable after acceptance for processing. However, they won’t charge an additional fee if a taxpayer resubmits an offer the IRS determines it has rejected in error or returned in error after acceptance for processing (Reg. Section 300.3(b)). Other limitations on submitting the fee include:

-

If making an offer on a liability owed jointly with another person, only one Form 656 is needed and one application fee.

-

If making an offer individually (e.g., for employment tax liability) and for other liabilities with another person (e.g., income tax), but only one of the individuals is submitting an offer, all liabilities are listed on Form 656 and one application fee is submitted.

-

If a taxpayer makes an offer individually and another jointly, then the taxpayer shows all tax liabilities on Form 656 and submits one application fee., The other joint filer files Form 656 showing only the joint tax liability but must also submit an application fee.

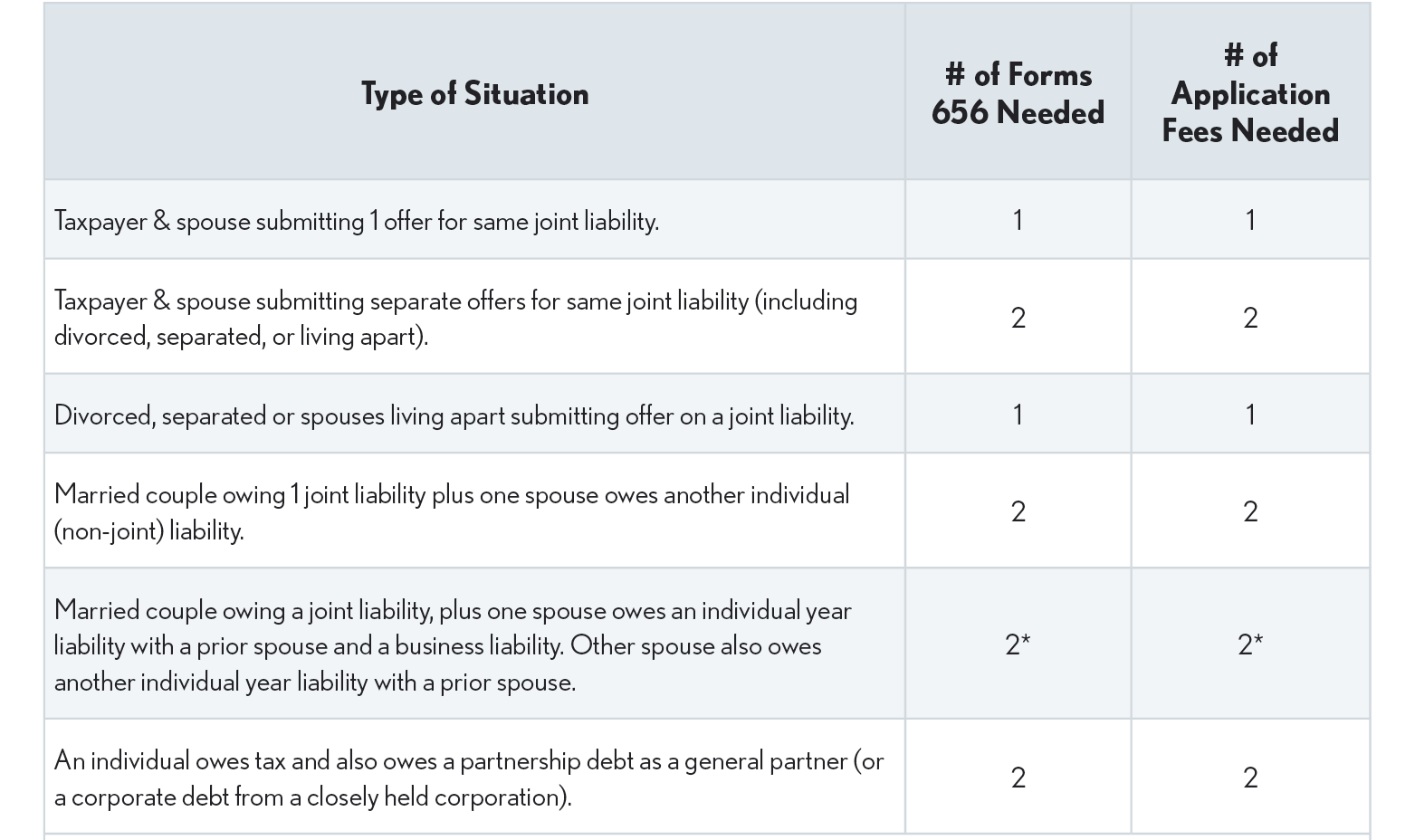

The following table shows the number of Forms 656 and application fees needed in specific OIC filing situations:

*One spouse will file one offer listing the joint income tax, the individual year tax and the business liability. The other spouse will file an offer listing the joint income tax liability and the individual year liability. Each will attach a single application fee with their offer. Note: It does not matter that the joint liability appears on both offers.