User Fee

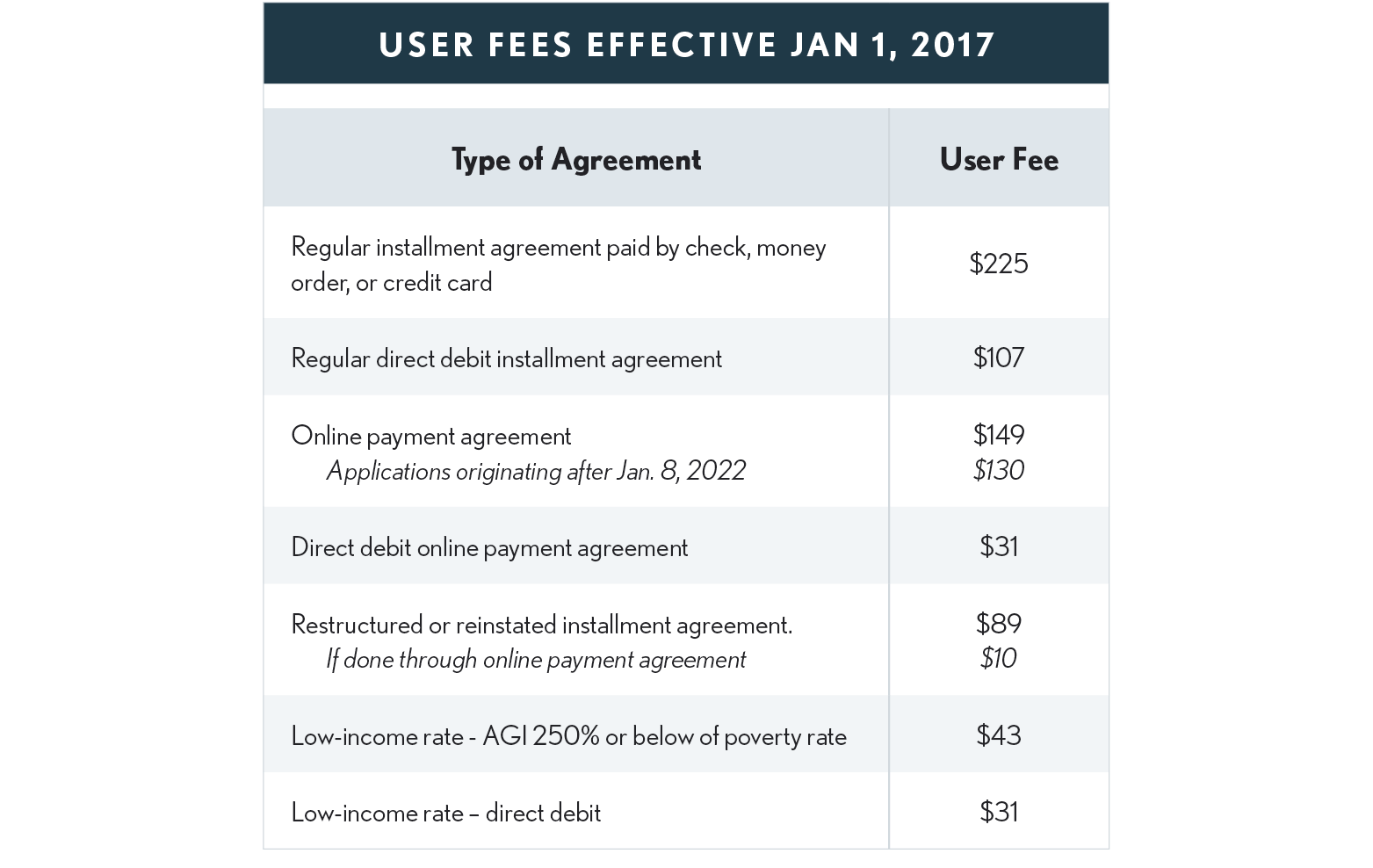

When setting up an instalment agreement there is a $31 to $225 fee, with the amount dependent on the method used to apply for the instalment plan and whether the taxpayer makes the payments by direct debit from a bank or other financial institution checking account (see table below). The fee is not to be included with the instalment agreement request. The IRS will bill the taxpayer for the fee with the first payment. The IRS will generally respond within 30 days.

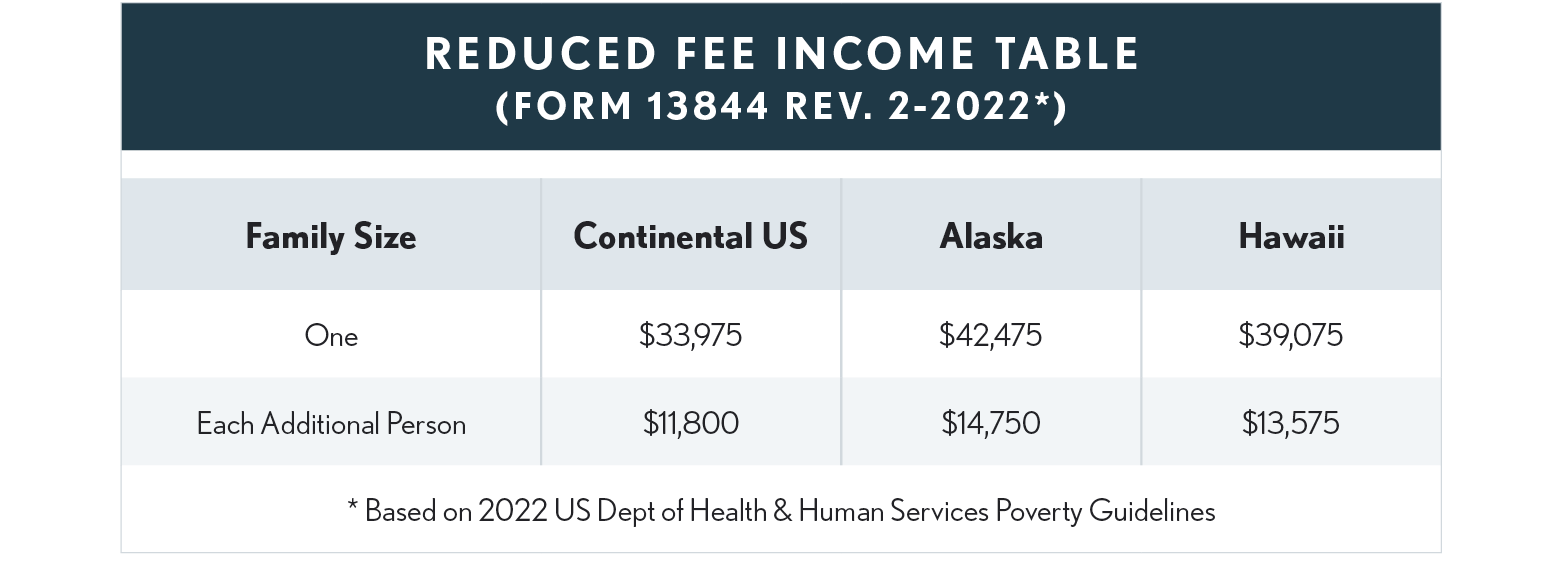

A taxpayer may be qualified for a fee at the low end of the range if their income is below a certain level, as shown in the accompanying table. If a taxpayer receives an instalment agreement acceptance notice from the IRS but not a reduced user fee, even though they believe they should qualify for one, request a reduced fee by completing Form 13844.The qualifications depend upon family size and whether they reside in the continental US, Hawaii or Alaska.

User Fee Waivers and Reimbursements

For instalment agreements entered into on or after April 10, 2018, by taxpayers whose AGI for the most recent year for which such information is available is at or below 250% of the federal poverty rate (low-income taxpayers), the IRS will waive the user fee if the low-income taxpayer agrees to make electronic payments through a debit instrument by entering into a direct debit instalment agreement. For a low-income taxpayer who is unable to make electronic payments through a debit instrument by entering into a direct debit instalment agreement, the IRS will reimburse the user fee that the taxpayer paid for the instalment agreement upon completion of the instalment agreement. (Form 9465 instructions, rev. Oct. 2020)