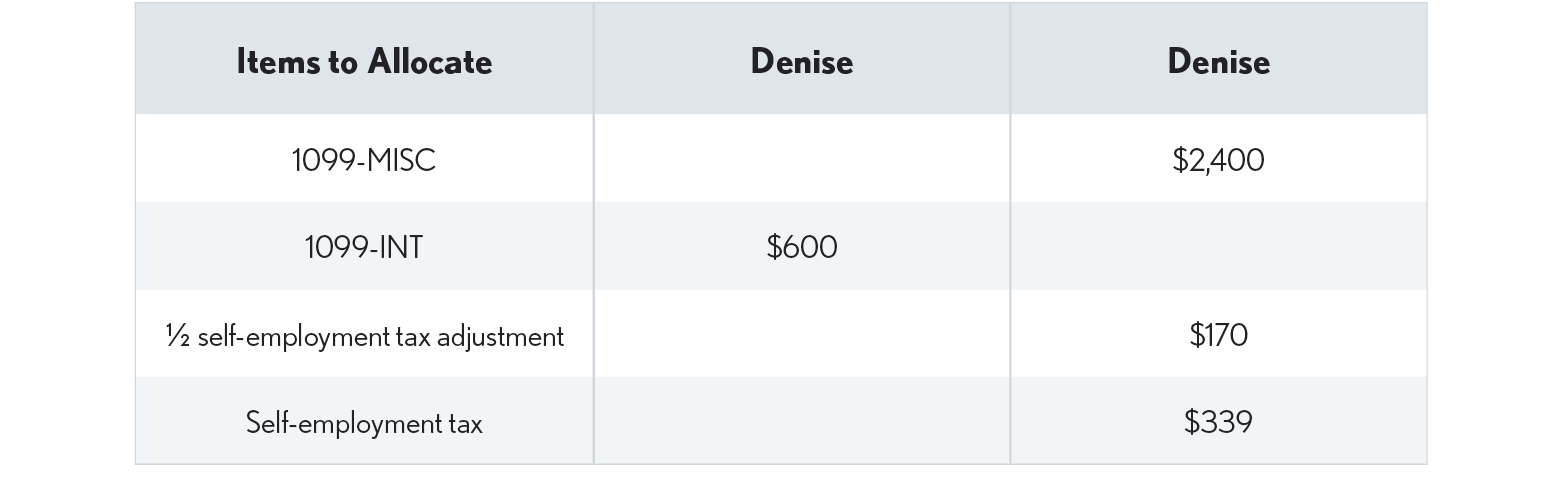

Filled In Allocation Worksheet Example

Facts - Denise and William filed jointly in 2019, but they were divorced in 2029. On April 30, 2029, the IRS issued a collection notice to the couple in regard to their 2019 tax return. The notice cited four adjustment items:

-

An unreported 1099-MISC for William showing $2,400 non-employee compensation from Showtime Consulting;

-

$339 assessed for self-employment tax on the $2,400 1099-MISC;

-

An adjustment to income of $170 for half of the $339 self-employment tax;

-

An unreported 1099-INT from Bank of New York for Denise in the amount of $600.

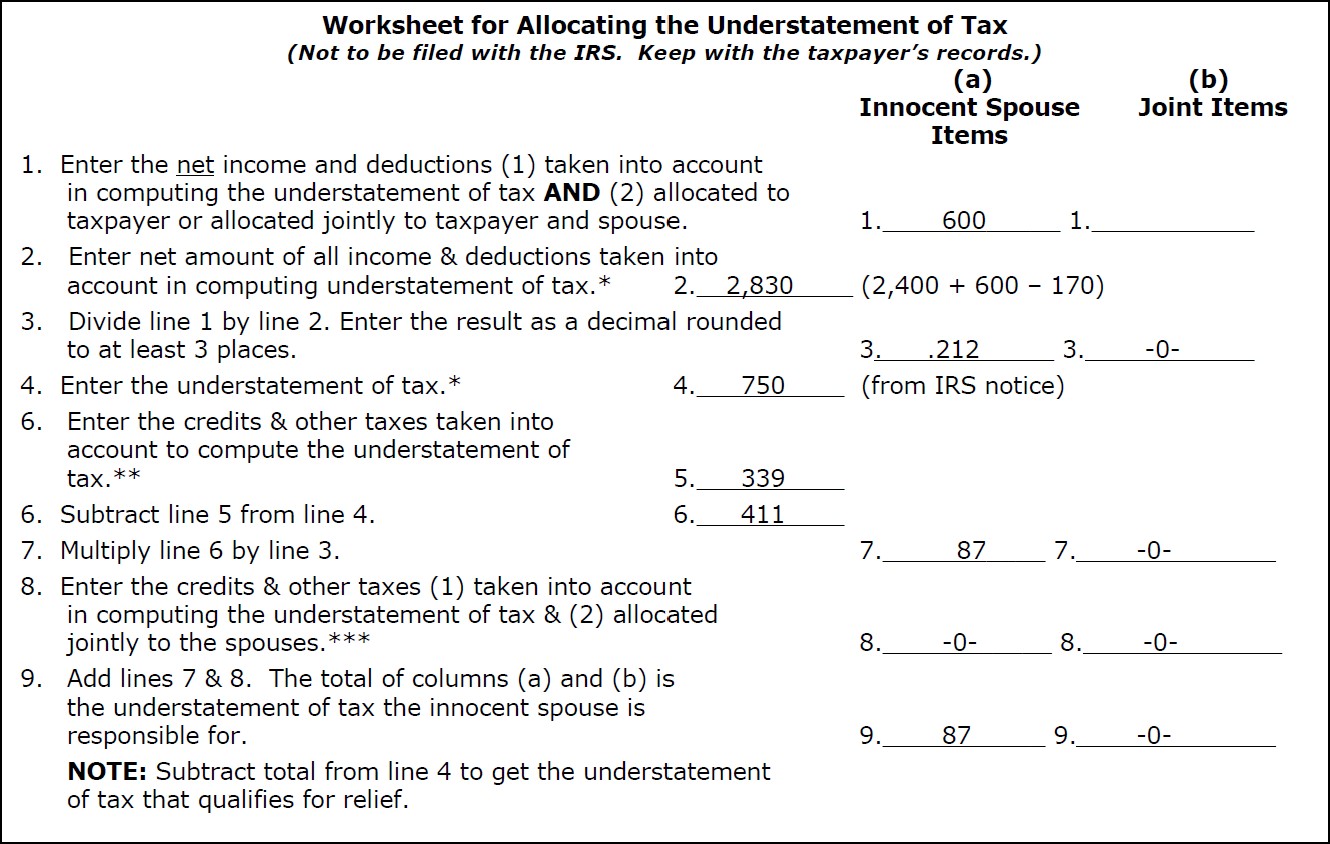

After consulting with her accountant, Denise decided to file Form 8857 to request relief under separation of liability provisions. With her accountant’s help, she fills out an allocation worksheet. The following table shows the allocated items: