California Differences - Household Employees

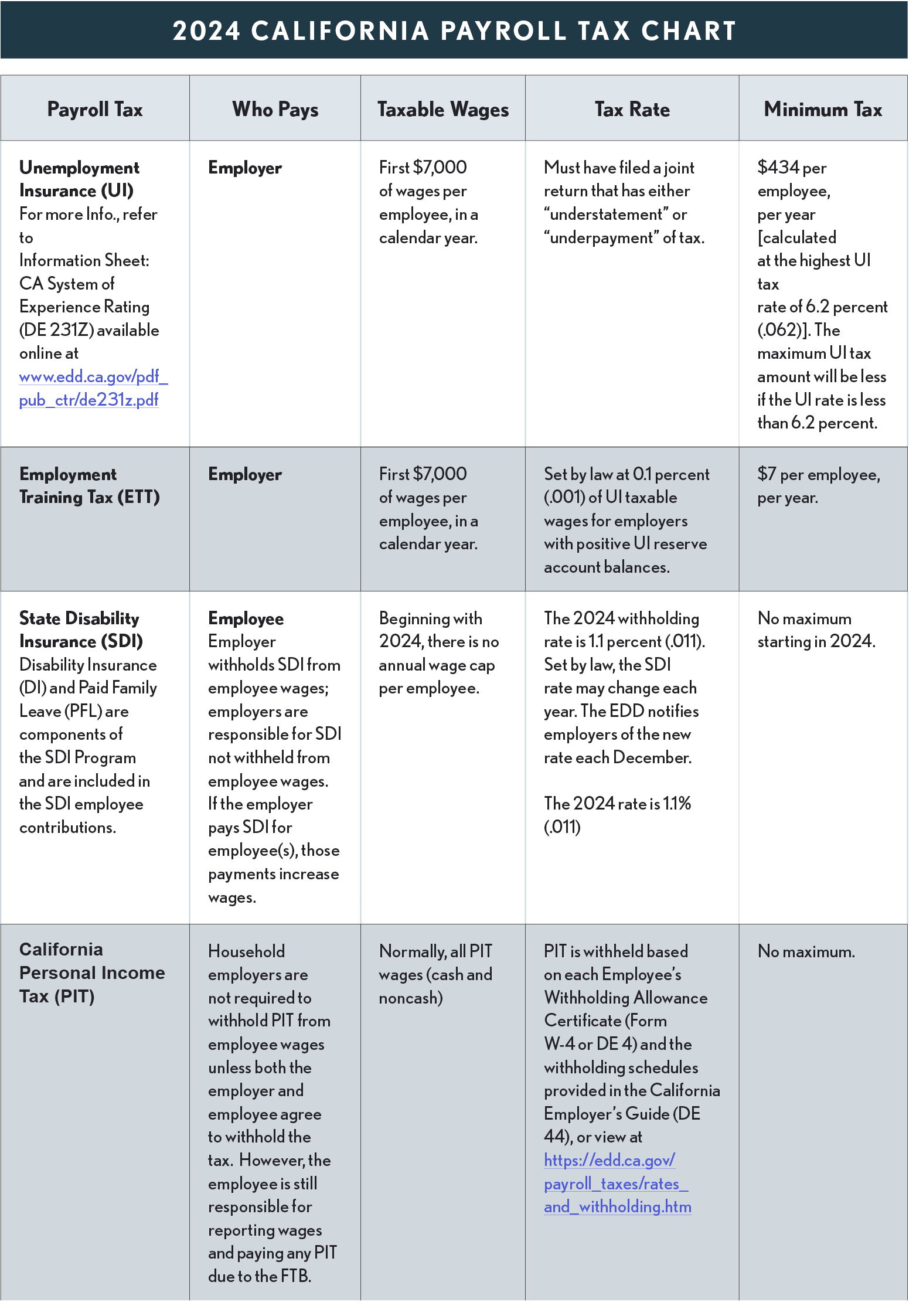

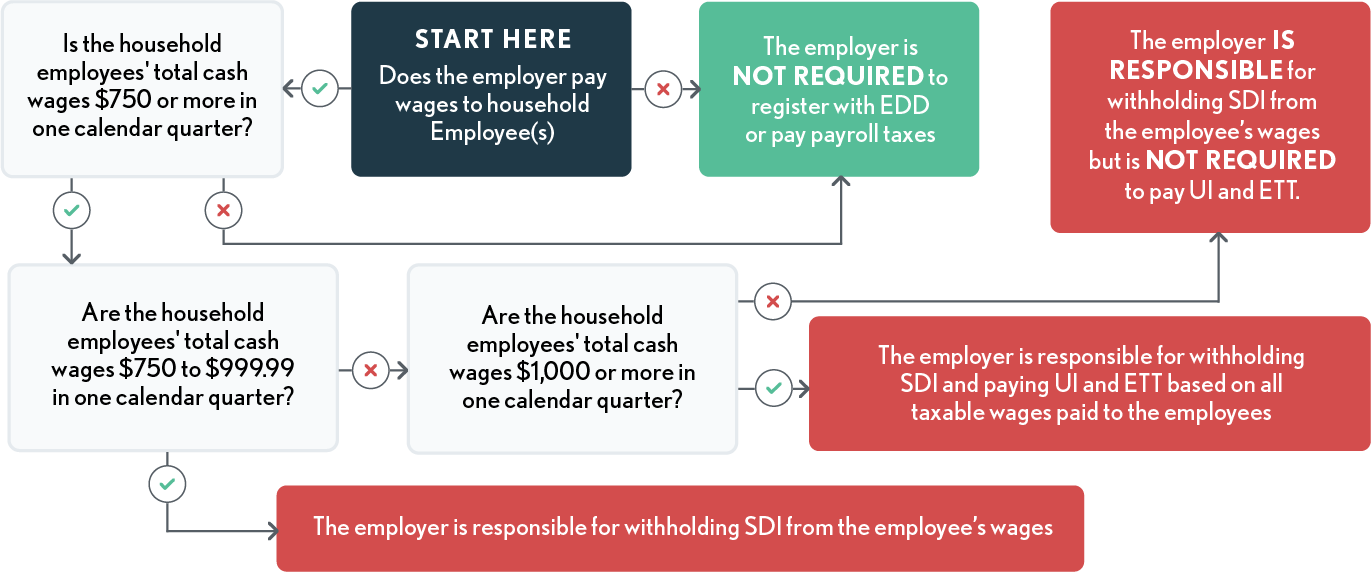

California’s employment taxes consist of unemployment insurance (UI) and employment training taxes (ETT) – paid by the employer – and state disability insurance (SDI) and state income taxes – paid by the employee through wage withholding. The California Employment Development Department (EDD) administers employment taxes. California does not allow household employers to pay their state employment taxes as part of their income tax filings. Instead, separate quarterly or annual employment tax returns and payments must be filed with the EDD. Household employers must register with the EDD when payments to one or more employees for household services reach $750 in cash wages in a calendar quarter.

Once $1,000 or more in cash is paid in a calendar quarter to household employees, the UI and EDD taxes apply to the current and following year. The threshold at which SDI withholding applies to domestic services in a private home is $750 of cash wages paid in a calendar quarter for household services. The SDI rate for 2023 is 0.09% and applies to wages up to $153,164, while the 2024 rate is 1.1% on all wages (no cap). California has the same rule as federal regarding income tax withholding (not required, but can be done if requested by the employee).

For information on the forms required to be filed, due dates and other details, please see EDD Pub. 8829 – 2023 Household Employer’s Guide (2024 version not available at publication date of this guide), available at: https://www.edd.ca.gov/pdf_pub_ctr/de8829.pdf

Meals and Lodging

Cash wages include both checks and cash. Noncash wages, such as meals and lodging, are not included when calculating whether the $750-in-cash-wages threshold is met. Meals and lodging are included once the cash limit of $750 is reached. See examples on page 5 of the DE 8829 - Household Employer’s Guide

California Assembly Bill (AB 1245) (Chapter 222, Statutes of 2015) requires all employers, including household employers, to electronically submit employment tax returns, wage reports, and payroll tax deposits to the EDD. The requirement was phased in, and as of January 1, 2018, all employers are required to electronically file and pay.

E-File and E-Pay Requirement

California Assembly Bill (AB 1245) (Chapter 222, Statutes of 2015) requires all employers, including household employers, to electronically submit employment tax returns, wage reports, and payroll tax deposits to the EDD.

Penalties - Filing paper returns instead of electronically filing when required will result in the following penalties for household employers:

-

Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW) - $50 per return

-

Employer of Household Worker(s) Quarterly Report of Wages and Withholdings DE (3BHW) - $20 per wage item

-

Payroll Tax Deposit (DE 88) – 15% of the amount due.

Waiver - Employers may request a waiver from the electronic filing mandate due to:

-

Lack of automation

-

Severe economic hardship

-

Current exemption from the federal government, or

-

Other good cause.

The E-file and E-pay Mandate Waiver Request (DE 1245W) can be downloaded at: www.edd.ca.gov/pdf_pub_ctr/de1245w.pdf

Waiver requests, which cannot be filed retroactively, must be received by the final filing date of the quarter for which the taxpayer is requesting that the waiver begin. Requests received after the due date for the quarter requested will be processed for the subsequent quarter. An approved waiver will be valid for four consecutive quarters beginning with the effective quarter, and to avoid a non-compliance penalty when the waiver expires, an employer must start to electronically file and pay, or submit a new waiver request

Comment

The EDD makes CA household employers basically jump through the same hoops as business employers. No consideration is given to the difficulty of complying. These rules are extremely complex and confusing for elderly taxpayers, who want to remain in their home and hire home nursing care, gardeners, pool maintenance, housekeepers, etc. (see list below). That is why so many pay cash to their gardener, housekeeper, pool person, and other home help. The state’s overcomplicated rules are costing the government more tax revenue than is being collected from the ones that comply.

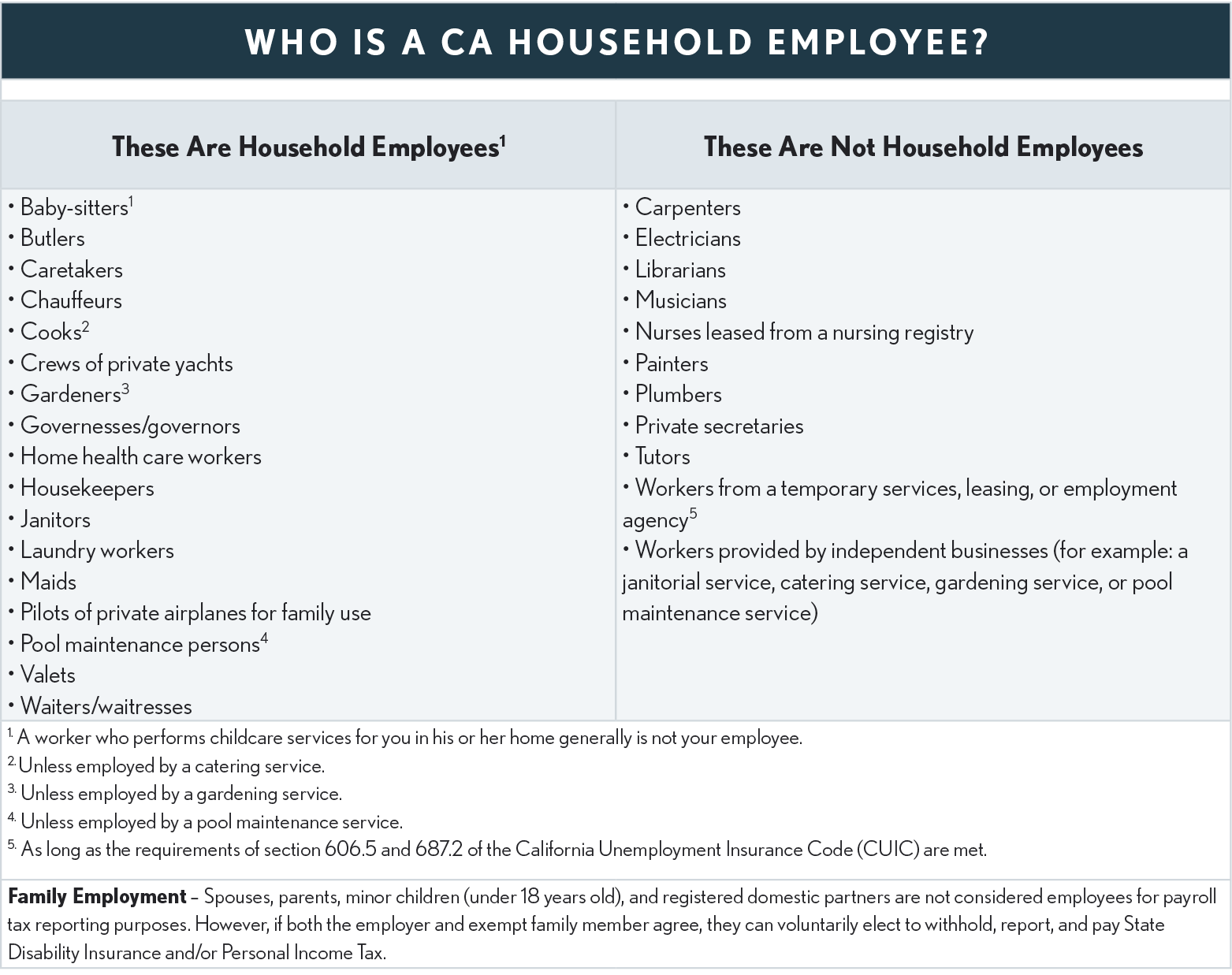

Who is a CA Household Employee?

The worker is the taxpayer’s employee if the taxpayer controls what work is done and how it is done. If the worker is an employee, it does not matter whether the work is temporary, full-time, or part-time, or that the worker was hired through an agency. The worker is an independent contractor, and not the taxpayer’s employee, if only the worker controls how the work is done. An independent contractor usually provides his or her own tools and offers services to the general public in an independent business. Refer to the table below for a list of workers that the EDD says are or are not household employees. This list is not intended to be a complete list of household employees.