Gift Tax Rules

Lifetime gifts currently are subject to a gift tax imposed at the same tax rates that apply for the value of estates at the time a taxpayer dies, with some exceptions, as explained next.

Annual Exclusion

Gifts of up to the annual per donor per donee (recipient) per year limit amount may be made without tax consequences (Sec. 2503(b)). The gift must be a gift of a present interest. Direct gifts (including UGMA gifts) qualify, as do gifts to 2503(c) trusts and Crummey withdrawal trusts.

-

2503(c) trusts are those that meet the following requirements:

-

The property and the income may be expended by or for the benefit of the donee before age 21.

-

To the extent the property is not so expended, it will pass to the donee at age 21.

-

If the donee dies before age 21, the property will be payable to the donee’s estate or as the donee may appoint under a general power of appointment.

-

Note

Many clients hesitate to use 2503(c) trusts, because they do not want the child to receive the trust at age 21.

2. Crummey trusts take their name from the case of Crummey v. Comm, 397 F.2d 82 (9th Cir. 1968). In that case, a gift to a trust qualified as a present interest (and thus an annual exclusion), because the donee had a present (though short-term) right to withdraw the gift to the trust.

Tuition/Medical Exclusion

In addition to the annual exclusion, a donor may make gifts (with no specific dollar limitation) that are totally excluded from the gift tax in the following circumstances:

-

Payments made directly (Sec 529 plans are not direct) to an educational institution for tuition., This includes college and private primary education., It does not include books, supplies or room and board.

-

Payments made directly to any person or entity providing medical care for the donee.

In both cases, it is critical that the payments be made directly to the educational institution or health care provider. Reimbursement paid to the donee will not qualify. The tuition/medical exclusion is often overlooked, but these expenses can be quite significant. Parents and grandparents interested in estate reduction should strongly consider these gifts.

Gift Splitting

A husband and wife can each make annual exclusion gifts, thereby increasing the exclusion from $19,000 to $38,000 per year (based upon 2025 amounts). However, only one of the spouses may have available property to give. Code Section 2513 allows the spouses to elect (on a Form 709) to treat a gift made by one spouse as being made by both spouses. Gift splitting can be used for annual exclusion gifts, lifetime exclusion gifts, and gifts above the lifetime exclusions.

Example - Gift Splitting - John and Jane are married and have two children. In 2025 when the annual exclusion limit is $19,000, they would like to exclude $76,000 ($19,000 x 2 donors x 2 donees) in gifts. Jane received a large inheritance some years back; John has only a modest estate. Jane gives the children $38,000 each. Then the couple elects to gift split so that the $38,000 gift is treated as given one-half by Jane and one-half by John (or $19,000 each). The gifts all qualify for the annual exclusion.

-

Even if both spouses have sufficient resources to make gifts, gift splitting is useful when the husband and wife have different estate planning goals.

Example - Gift Splitting Where Spouses Have Different Estate Planning Goals - Steve has a large estate and a daughter, Ryan, from a prior marriage. He would like to make maximum annual exclusion gifts to her. Sharon, Steve’s wife, can afford to make annual exclusion gifts to Steve’s daughter, but is not inclined to do so, since she has other beneficiaries of her own to plan for. Steve gives $38,000 to Ryan in 2025 when the annual exclusion limit is $19,000. He and Sharon elect to gift split, so the gift is treated as given one-half by each. As long as the property given is properly valued and supportable on audit, the gift split helps Steve and Ryan, yet it costs Sharon nothing. Sharon’s financial and tax ability to make gifts to others is not reduced by the gift split.

-

For clients in community property states, if community property is given, gift splitting is not necessary. Regardless of who holds the record title, or who “makes” the gift, the property is owned one-half by each and is therefore given one-half by each.

Due Date for Gift Tax Returns (Form 709)

When required to be filed, gift tax returns generally are due by April 15 of the year following the gift. A calendar year taxpayer who requests an extension of time on Form 4868 for his or her income tax return also extends the due date of the gift tax return to the extended due date of the 1040.

However, if the taxpayer will owe a gift tax, payment voucher Form 8892-V should be completed and sent with payment to the IRS by the original due date, since the extension is only for the time to file and not for paying the tax. If the donor isn’t filing Form 4868, an automatic 6-month extension to file the gift tax return can be obtained by filing Form 8892 on or before the due date of the gift tax return.

No Tax Deduction

The value of gifts made, other than those to charitable organizations, is not deductible by the donor.

Example - Gift Tax Computations - Neil Moneybags, a single father, gave $5,507,000 to his daughter in 2024. Neil has not made previous taxable gifts. The gift tax is computed as follows:

| Value of gift | $5,507,000 |

| Annual exclusion | <18,000> |

| Taxable gift | $5,489,000 |

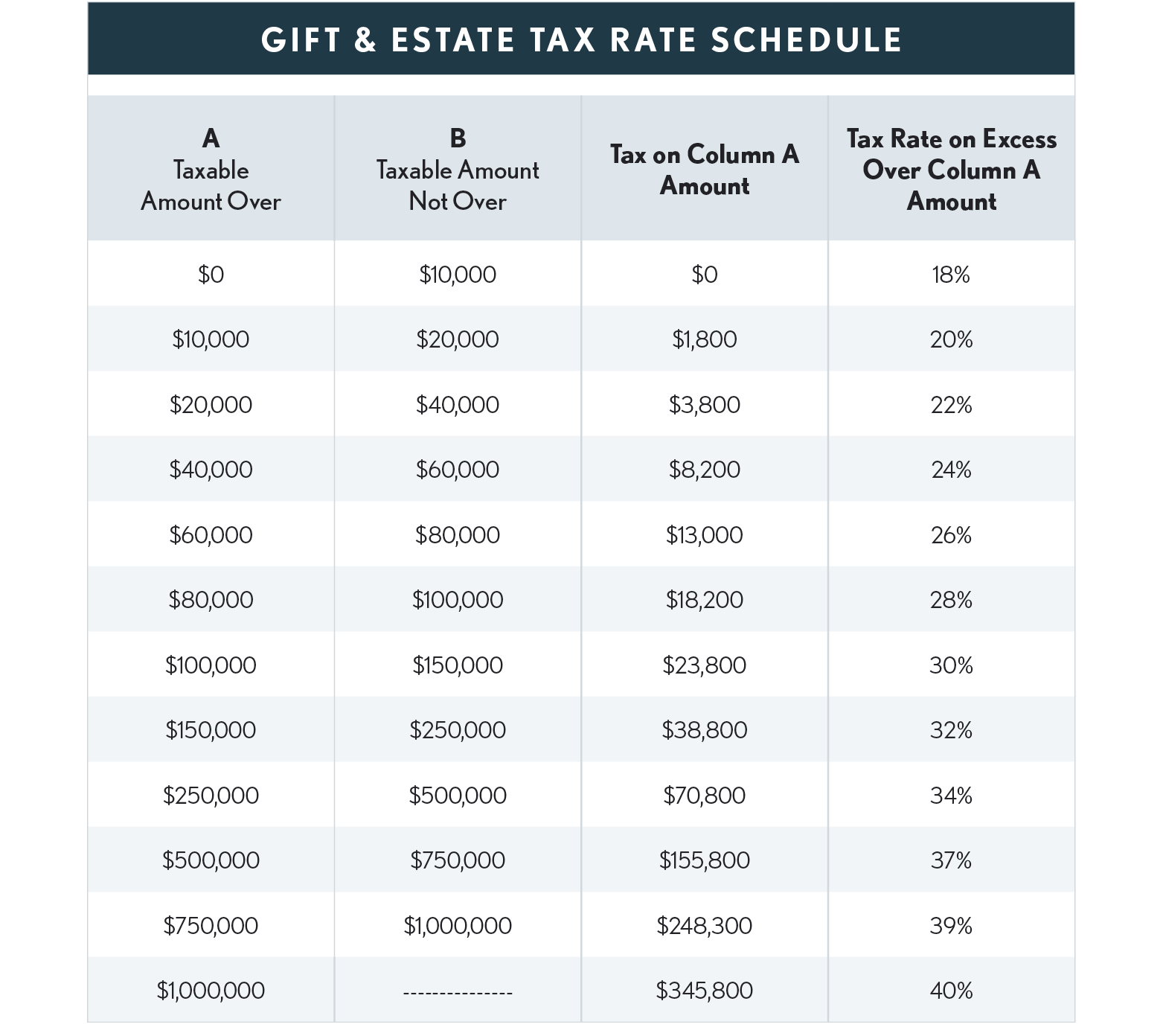

| Tax per rate schedule | $2,141,400 |

| Unified credit used | <2,141,400> |

| Tax due | $ 0 |

| Of course, this gift may cause an increase in estate taxes upon Neil’s death or a later gift. Neil’s 2024 unified credit of $5,113,800* has been reduced to $2,972,400 ($5,113,800 - $2,141,400), which remains to be used against future taxable gifts and/or his estate tax when he dies. The available future unified credit amount may be more or less at his date of death depending on whether he’s made additional gifts more than the annual exclusion amount that used up more of the lifetime amount and what the lifetime exclusion (and unified credit) is for the year of his death. * The unified credit is determined by computing the tax on the $13.61 million exclusion for 2024. |

Gifts in Excess of Lifetime Exclusion

Once the annual exclusion and the lifetime

exclusion are used up, any further gifts generate a gift tax.