Gift Recipients

Gifts can, of course, be given to individuals. However, for various reasons, a donor may not want the donee to own the gifted property outright. The donee may be a minor. The donee may be a young adult, legally competent but immature and not responsible. The donor may be reluctant to give up full control. The donor may want some of the protections afforded by other gift vehicles even for a mature and responsible donee.

UGMA/UTMA

All states have adopted some form of the Uniform Gifts to Minors Act or the Uniform Transfer to Minors Act. In general, these statutes allow for a simple method to create an informal trust-type arrangement with a custodian holding property for the minor.

Advantages:

The chief advantage is that the transaction and set up is very simple and usually does not require an attorney. The transfer constitutes a completed present interest gift that qualifies for the annual exclusion. Income on the property is taxed to the minor (subject to the “kiddie tax”).

Disadvantages:

-

The property must be distributed to the child when the child reaches the age provided for in the UGMA/UTMA statute, typically 18 in most states although some states are 18 or graduation from high school or 21. The property will be includible in the donor’s gross estate if the donor is acting as custodian at the time of the donor’s death.

-

Depending on the state’s law, some types of property may not be owned in UGMA/UTMA form.

Sec. 2503(c) Trusts

The advantage of these trusts is easy qualification for the annual exclusion. The disadvantage is that the property in trust passes to the donee at age 21.

Crummey Trusts

Advantages:

-

Qualifies for annual exclusion, though in a convoluted manner.

-

Trust does not have to end at age 21; it can last for the entire lifetime of the beneficiary and beyond.

-

Allows for generation-skipping.

-

Can probably qualify as a spendthrift trust and be exempt from the reach of some or all of the beneficiary’s creditors.

Disadvantages:

-

Complexity.

-

Beneficiary has a right to withdraw trust property for some specified period of time.

-

The lapse of a withdrawal right has tax consequences to the beneficiary, e.g., income tax, Sec. 678(a), Sec. 2541(e) and estate tax, Sec. 2041(b)(2).

Non-Crummey Trusts

Though not often used, a client could also draft a trust for adult beneficiaries that does not grant Crummey withdrawal rights. Gifts to the trust would not be eligible for the annual exclusion. Possible situations when such a trust might be appropriate:

-

Gifts of the lifetime exemption., (Of course, a Crummey withdrawal right could be granted and the gift made in the amount of the exemption amount plus the annual exclusion amount.), Similarly, gifts in excess of the lifetime exclusion might also be given to a non-Crummey trust.

-

The donor’s annual exclusions are already being used up under some other portion of the estate plan (other trusts, family limited partnerships (FLPs), etc.)

-

The donor desires to avoid the tax consequences to the beneficiary arising from a lapse of a withdrawal right.

Generation-Skipping Trusts

If a client is forward-looking enough, he/she can achieve impressive results by structuring a trust through at least the next generation’s lifetime (and often to the end of the third or fourth generation’s lifetime).

Under a traditional plan, the parents would provide in the will or trust for assets not to be distributed to a child while the child is young. At some designated age, say 30 or 35, the trust would terminate, and the trust assets would be distributed to the child. As an alternative, the trust might provide for staggered distributions, say one-third at each of ages 25, 30 and 35, with total termination and distribution occurring at age 35.

Under a generation-skipping plan, the trust would not terminate at any given age. Instead, the trust will last for the entire lifetime of the beneficiary, and often beyond. The child (and often his or her children) will be the trust beneficiaries, usually with an objective distribution standard relating to health, education, maintenance and support in accordance with the beneficiaries’ accustomed standard of living.

If the parents so desire, the child can be given the right to appoint himself or herself as the trustee after attaining a pre-set age or some other objective benchmark.

If a child is both the primary beneficiary and the trustee, and if the distribution standard is health, education, maintenance and support, the child is basically in the same position as a surviving spouse in a typical bypass trust.

The trust has the following advantages over an outright distribution to an adult beneficiary:

Transfer Tax Savings

-

Unless a prior lapsed withdrawal right causes a portion of the trust to be included in the beneficiary’s gross estate, the trust will probably not be subject to estate taxes on the beneficiary’s death.

-

If sufficient GST exemption is allocated to the trust by the donor/decedent, the trust will also be exempt from the generation-skipping tax on the beneficiary’s death.

-

The GST exemption for 2025 is $13.99 million ($27.98 million for a couple). Certain lifetime gifts may also be eligible for a $19,000 (2025) GST annual exclusion (under rules that are far more restrictive than the gift tax annual exclusion).

Therefore, if a family plans properly, it is possible to exempt over $28 million of property (plus income and appreciation) from the U.S. transfer tax system (gift, estate and generation skipping taxes) on the death of the second generation.

If the trust extends through the lifetime of the third generation, the same result occurs at that generation’s death.

Contrast that result with an outright gift to a mature adult child. The child will own the property outright and will be able to transfer it to his or her children only by subjecting it to the estate and gift tax system. The likely result is that the property (which was already taxed at Mom and Dad’s deaths) will be subject to estate tax all over again.

-

If generation-skipping is to be attempted, it is best to segregate GST exempt property and GST non-exempt property., This usually requires 2 sets of trusts., While being cumbersome, it structures the family wealth so that the trustees can maximize the benefit of the GST exemption., The trustee can simply make all distributions to the second generation out of non-exempt trusts and let the exempt trust grow in value.

-

Over 2 or 3 decades of managing the trusts in that manner, the growth of the exempt assets versus the non-exempt assets can be quite dramatic.

-

It is also a good idea to build a mechanism into the non-exempt trust to make sure that on the child’s death, the trusts are subject to estate taxes if the estate tax rates are lower than the GST rate. An easy approach is to provide for generation-skipping trusts only up to the amount of the GST exemption. More sophisticated formula provisions are possible and are commonly used. Currently the top estate tax rate and the GST rate are the same, so this provision may no longer be appropriate.

Creditor Protection

The trust would usually include “spendthrift” provisions that would prevent most of the beneficiary’s creditors from reaching the trust’s assets. If the assets are distributed to the beneficiary outright they would be far more likely to be reached by a creditor. Many of our clients have a great concern over runaway damages and excessive lawsuits. Many of them take great pains to structure their own affairs to limit the reach of creditors. With the generation-skipping trust, they can easily do the same for their children and grandchildren.

Divorces

The spendthrift provisions and the general lack of the beneficiary’s ownership of the trust assets will probably greatly reduce the chance of losing the property in a divorce. If the child owned the assets outright, the assets would be more reachable by the child’s spouse.

Family Limited Partnership (FLP)

A family limited partnership (or LLC, or LLP) can be a means of giving property to children (limited partnership interest) in order to shift future appreciation to children, with the parent (as general partner) retaining control indefinitely. This type of arrangement can be viewed as a substitute for a transfer of property to an irrevocable trust for the benefit of the children. This technique’s details are not included in this material.

Gifting Encumbered Property

When an individual makes a gift of encumbered property, the amount of the gift reported on Form 709, U.S. Gift Tax Return, is the FMV of the property less the amount of the encumbrance. The recipient of the gift assumes the giver’s adjusted basis. When a mortgage on property exceeds the giver’s basis, the giver recognizes a capital gain in an amount equal to the excess of the mortgage over basis.

Example: Parents wish to gift an investment property to their son. The FMV of the property is $500,000, the mortgage on the property, which the son will be assuming, is $230,000. The parents’ adjusted basis in the property is $200,000. Thus, the parents’ gift amount is $270,000 ($500,000 - $230,000), the son assumes his parents’ basis in the property of $200,000 and the parents have long-term capital gain equal to the excess of the mortgage over basis, which in this example is $30,000 ($230,000 - $200,000).

-

Compensation Distinguished from a Gift

Although gifts are generally excluded from the recipient's gross income, transfer by or for an employer to or for the benefit of an employee can't be excluded as a gift (Code Sec. 102(c)(1)).

Extraordinary transfers to the natural objects of an employer's gift (e.g., an employee who is the employer's son) aren't transfers to or for the benefit of the employee if the transfer wasn't made in recognition of employment.

De minimis fringe benefits are not treated as a gift and are excluded from the recipient's gross income (Code Sec. 132(a)(4)). A de minimis fringe is any property or service whose value is so small that accounting for it is unreasonable or administratively impracticable, considering the frequency with which similar fringe benefits are provided by the employer to its employees (Code Sec. 132(e)(1)).

If, as a means of promoting goodwill, an employer makes a general distribution to employees of hams, turkeys, or other merchandise of nominal value at Christmas or a comparable holiday, the value of the gifts isn't included in the employees' income (Rev. Rul. 59-58).

But if an employer distributes cash, gift certificates or similar items of readily convertible cash value, the value of the gifts is additional wages or salary, regardless of the value.

But Christmas gift certificates, redeemable only in the employer's merchandise up to $25 in value, were exempt from withholding and so not compensation income because the certificates weren't readily convertible to cash and were of relatively small value (Hallmark Cards v. U.S., (1961, DC MO)).

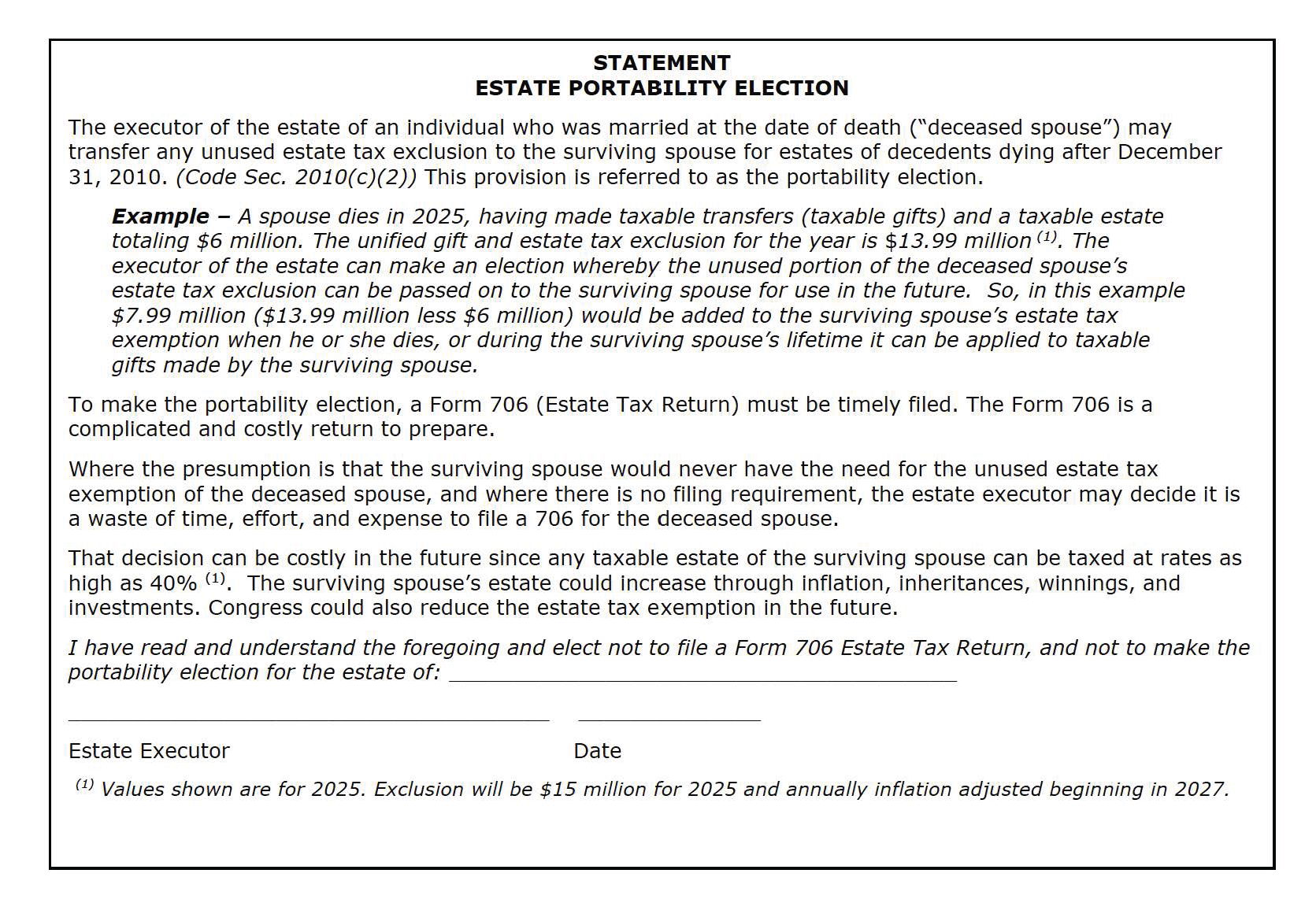

Client Portability Notice

This has had no legal review, use at your own discretion.