Carryover (Substituted) Basis

Under the carryover basis rules, the BASIS OF THE OLD PROPERTY (with certain adjustments) is used for:

-

Property acquired in a TAX-DEFERRED” EXCHANGE (Sec 1031).

-

Vehicles acquired in a TRADE-IN transaction. Before 2018 (Sec 1031 before TCJA amendment)., Basis is the adjusted basis of the trade-in plus unrecognized loss or minus unrecognized gain, plus cash given., This can be complicated when accounting for part personal, part business use. Note: Effective with exchanges completed after 2017, only exchanges of real property will qualify for Sec 1031 treatment.

-

Replacement property in an INVOLUNTARY CONVERSION (Sec. 1033).

-

REPLACEMENT RESIDENCE (Sec. 1034)., Code Sec 1034 was repealed, effective for sales and exchanges after 5/6/1997. Prior to repeal, it allowed the seller to postpone gain on the sale of a principal residence if a replacement residence was acquired within a specified time, and the new residence’s cost was at least as much as the adjusted sales price of the old residence. The basis in the new residence was reduced by the amount of the postponed gain.

-

PROPERTY ACQUIRED FROM A DECEDENT DYING IN 2010 (where the estate opts for the “no tax” method) that is not increased to FMV by the $1.3 million general adjustment or the $3 million spousal adjustment.

-

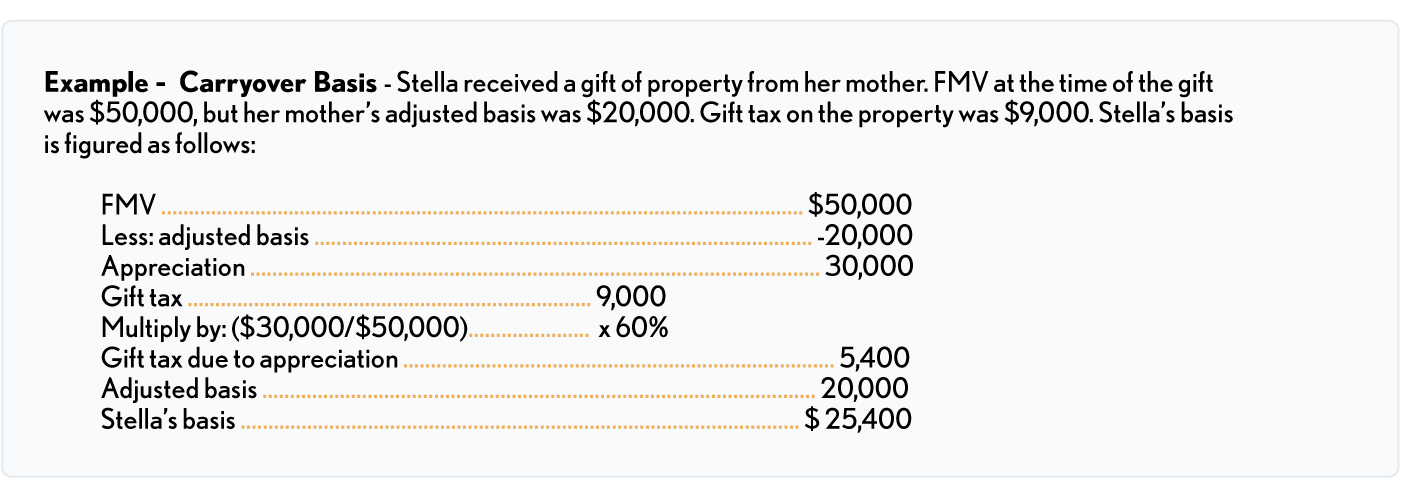

GIFTS: The previous owner’s adjusted basis (plus all or some of the gift tax paid – see #7 next) is generally used for gifts., BASIS FOR GAIN equals the donor’s basis., BASIS FOR LOSS equals the smaller of the donor’s basis or the FMV at the date of the gift., Notice, though, that the BASIS WILL BE THE FMV AT DATE OF DEATH if the gift was required to be included in the decedent’s estate (may not be so for deaths in 2010).

-

For gifts after 1976, only the gift tax attributable to the appreciation is added to basis. For gifts before 1977, the whole Federal gift tax is added. In either case, adding the gift tax cannot increase the total basis to more than the FMV.

Holding Period

Where there is carryover of basis, there is generally a carryover of holding period as well.