Gift & Estate Tax Considerations

Normally, gift tax doesn’t apply to amounts paid by one individual on behalf of another individual directly to a qualifying educational organization as tuition for that other individual. (Code Sec. 2503(e)). However, since contributions to qualified tuition programs are not paid directly, that exclusion does not apply.

Section 529 plans are often promoted as an estate-planning device for wealthy grandparents, since making a large contribution to a 529 plan reduces their taxable estate much quicker than the annual gift exclusion. But while the assets leave their estate, they don't leave their control.

Completed Gifts

Contributions to Section 529 plans are considered completed gifts and are subject to the gift tax rules. Under these rules, individuals can annually give away (gift) up to the annual exclusion amount to another individual (twice that amount for a married couple) without triggering gift taxes or reducing their lifetime gift and estate tax exclusion.

Five-Year Option

Where contributions exceed the annual exclusion amount, a donor may elect to take certain contributions to a QTP into account ratably over a five-year period in determining the gift amount made during the calendar year. The provision is applicable only with respect to contributions not in excess of five times the annual exclusion amount available in the calendar year of the contribution. Any excess may not be considered ratably and is treated as a taxable gift in the calendar year of the contribution. Thus, an individual could contribute five times the annual exclusion and a couple twice that amount. The gift would reduce the donor’s estate by the full amount of the gift by the end of the five-year period. Should the donor die before the five-year period elapses, any amount more than the allowable annual exclusions would revert back to the donor’s estate. No additional gift could be given to the beneficiary of the Section 529 plan for that entire five-year period without triggering a gift tax return filing requirement, and potentially gift tax, unless there is an increase in the annual exclusion amount.

Annual Exemption Increases During Five-Year Period

If, in any year after the first year of the five-year period, the amount of the annual exclusion is increased, the donor may make an additional contribution in any one or more of the four remaining years up to the difference between the exclusion amount as increased and the original exclusion amount for the year or years in which the original contribution was made (Prop. Reg. 1.529-5(b)(2)(iv)).

Example - In Year 1, when the annual gift exclusion is $15,000, Paul, who is divorced, makes a contribution of $90,000 to a QTP for the benefit of his child, Chris. Paul elects under section 529(c)(2)(B) to account for the gift ratably over a five-year period beginning with the calendar year of contribution. Paul is treated as making an excludable gift of $15,000 in each of Years 1 through 5 and a taxable gift of $15,000 ($90,000 – (5 x $15,000)) in Year 1. In Year 3, when the annual exclusion is increased to $16,000, Paul makes an additional contribution for the benefit of Chris in the amount of $8,000. Paul is treated as making an excludable gift of $1,000; the remaining $7,000 is a taxable gift in Year 3.

-

Multiple Five-Year Options

Although overlapping five-year periods are not allowed according to the provisions of Prop. Reg. 1.529-5(b)(2)(v), it would appear that additional five-year periods can be elected once the initial five-year period has been completed.

Gift Tax Return

A gift tax return, Form 709, must be filed for the year of the contribution, if the gift exceeds the annual gift tax exclusion amount. The 709 includes a special box in Schedule A (line B) providing the election. The following is the text of that election:

o Check here if you elect under Section 529(c)(2)(B) to treat any transfers made this year to a qualified state tuition program as made ratably over a five-year period beginning this year. See instructions. Attach explanation.

The explanation must include the total amount contributed per individual beneficiary, the amount for which the election is being made, and the name of the individual for whom the contribution was made. Please see the instructions for Form 709 for additional information.

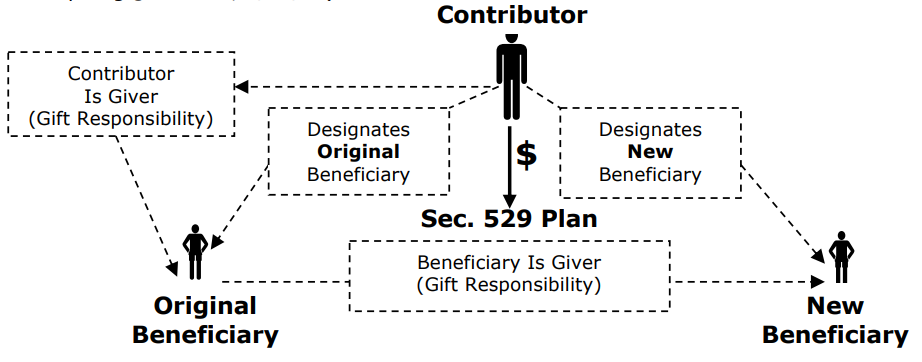

Change of Beneficiary

Contribution to a QTP is a completed gift from the contributor to the designated beneficiary. Therefore, any subsequent transfer occurring by reason of a change in the designated beneficiary or a rollover from the account of the original designated beneficiary to the account of another beneficiary is treated as a transfer from the original designated beneficiary to the new beneficiary. This is the result even though the change in beneficiary or the rollover is made at the direction of the contributor under the terms of the contract. (Preamble to Prop Reg § 1.529-5, 8/24/98)

Taxable Transfer?

Such a transfer is not a taxable gift if the new beneficiary: (Prop Reg § 1.529-5(b)(3)(ii) ["Taxpayers may rely," Prop Regs, 8/24/98]

(1) Is

a member of the family of the old beneficiary, and

(2) Is

assigned to the same generation as the old beneficiary.

Generation-Skipping Tax

Under proposed regs, the portion of a contribution to a qualified tuition program that is excludible from taxable gifts under the gift tax annual exclusion also satisfies the requirements of Code Sec. 2642(c)(2), and therefore, is also excludible for purposes of the generation-skipping transfer (GST) tax. Prop Reg § 1.529-5(b)(1) ["Taxpayers may rely,” Prop Regs, 8/24/98].

Death of a Beneficiary

No interest in a qualified tuition program is included in the estate of any person for estate tax purposes. However, amounts distributed on account of the beneficiary’s death are included in the beneficiary’s estate. Thus, if the beneficiary’s interest is rolled over to another beneficiary, there are no transfer tax consequences if the beneficiaries are in the same generation. If the new beneficiary is in a lower generation than the deceased beneficiary, the five-year rule may be applied to exempt from the gift tax a transfer of up to five times the amount of the annual gift exclusion.