California Differences - Sec 529

As of the publication of this guide, CA has not conformed to the provisions of OBBBA.

California’s version of a Section 529 college savings plan, which was established in 1999, was renamed in 2017 to ScholarShare 529. The URL is www.scholarshare529.com.

-

This savings plan program invests in special investment portfolios.

-

For the taxpayer’s beneficiaries, allocations are weighted more heavily towards equities, and as beneficiaries become older, allocations are weighted more heavily towards bonds and money market instruments.

-

Other state’s programs may be used by California residents & vice versa.

-

Education is NOT LIMITED to California educational institutions.

-

Account maximum is $529,000 per Scholar Share website (last verified 7/21/25).

Conformity with Federal Changes

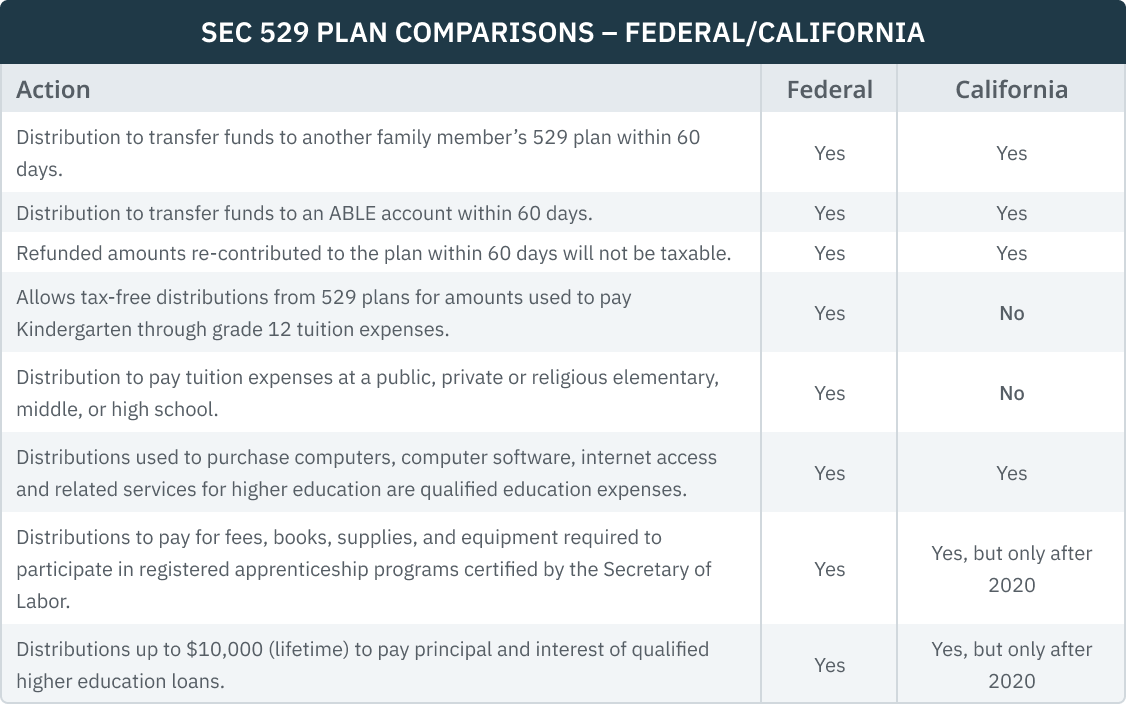

AB 91 (signed by the governor 6/27/2019) and other more recent legislation generally conform California law with federal law for the following:

-

A distribution is not taxable, if, within 60 days of distribution, it is transferred to the credit of another beneficiary who is a “member of the family” as defined in IRC Sec 529(e)(2) or is rolled into an ABLE account for the same beneficiary or a family member.

-

Refunded amounts re-contributed to the plan within 60 days will not be taxable.

-

Distributions used to purchase computers, computer software, internet access and related services are qualified education expenses and thus not taxable.

-

Apprenticeship expenses are eligible expenses for tax-free distributions from 529 plans after 2020.

-

Distributions, up to a lifetime limit of $10,000, made after 2020 to pay principal and interest of qualified higher education loans are eligible education expenses and therefore not taxable.

Nonconformity with Federal Changes

California does not conform to the TCJA provision allowing tax-free distributions from 529 plans for amounts used to pay tuition expenses at a public, private or religious elementary, middle, or high school.

529 Plan to Roth Rollover

California does not conform to the SECURE 2.0 Act provision that allows tax-free rollovers from a 529 plan to a Roth IRA when the plan was maintained for at least 15 years. Rollover distribution from an IRC Section 529 plan to a Roth IRA is includible in California taxable income and subject to an additional tax of 2½ percent. (FTB Tax News, March 2025)

Direct Deposit of Refunds to Scholar Share Savings Plan

Income tax refunds can be directly deposited into the taxpayer’s Scholar Share 529 College Savings Plan account. See Form 540 or 540-2EZ instructions.

Matching Grant

New Scholar Share accounts may be eligible to receive dollar-for-dollar matching contributions up to $225 into the account from Scholar Share 529. See the plan’s website for additional information.