Distribution

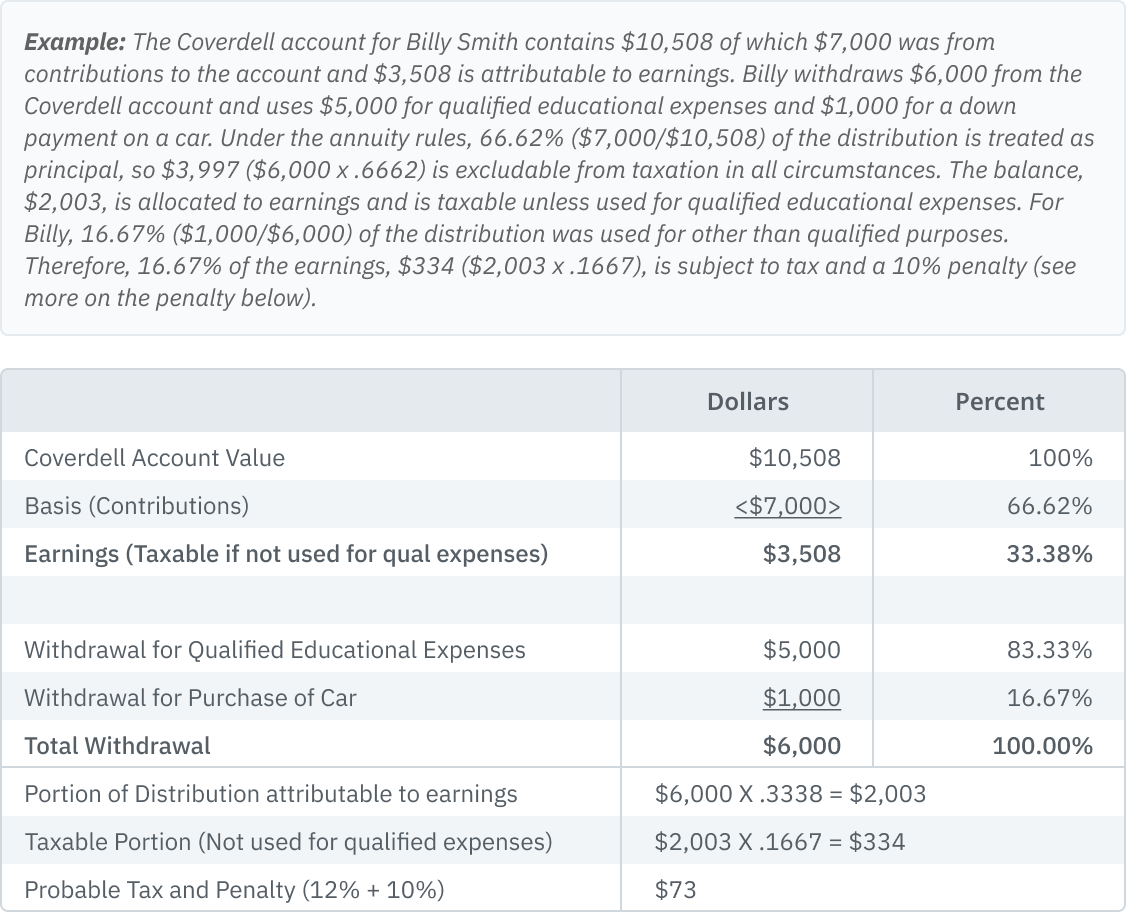

Distributions are generally taxed under rules similar to those for annuities. Distributions will be considered made up of principal (under all circumstances excludable from gross income) and earnings (which may or may not be excludable from income).

Distributions Used Entirely to Pay Qualified Expenses

The entire distribution is tax-exempt.

Distributions Used Partially (or not at all) to Pay Qualified Expenses

When all or part of the distribution is used for other than qualified expenses, then all or a portion of the earnings are taxable as computed under the annuity rules.

Distributions Due to the Death of the Beneficiary

At the death of the designated beneficiary, the account balance must be distributed within 30 days after the beneficiary’s death to his/her estate.

Mandatory Distributions Prior to Age 30

The funds must be withdrawn or rolled over to another qualified Coverdell account (see rollovers) prior to the beneficiary attaining the age of 30. Distributions that are not rolled over are taxable and subject to penalties under the same annuity rules that apply for distributions used partially to pay qualified expenses. We assume that if the funds are not distributed, they will be subject to an annual 6% (excise tax) excess contributions penalty.

Special Needs Students

Age limitations don’t apply to “special needs beneficiaries.” The definition of a “special needs student” will be determined under regulations issued by the IRS (no regs have been issued on this topic as of July 15, 2022). Congress wants IRS regulations to define a "special needs beneficiary" as including an individual who because of a physical, mental, or emotional condition (including learning disability) requires additional time to complete his or her education. (Com Rept)

Thus, contributions may continue to be made to a Coverdell account for a special needs beneficiary after the beneficiary reaches age 18. In addition, in the case of a special needs beneficiary, a deemed distribution of any balance in a Coverdell account will not occur when the beneficiary reaches age 30. (Com Rept)

Beneficiaries Attending Military Academies

Coverdell education savings accounts and qualified tuition programs are allowed, without an additional penalty on the earnings portion of the withdrawals, for beneficiaries attending specified military academies.

Paid to Another Coverdell Account

Distributions aren’t taxable to the extent the amount is paid to another Coverdell account for the beneficiary, or member of the beneficiary’s family(defined in§2032A(e)(2)) within 60 days of the distribution. In addition, just one distribution from a Coverdell account can be rolled over to another Coverdell account in a 12-month period.