Delayed Distributions

Even though contributions to the Coverdell account are not permitted past the age of 18, the funds can remain in the Coverdell account and continue to accrue investment earnings up to the mandatory distribution age (prior to age 30). The longer the income accrues tax-free in the account the greater the benefit derived by the recipient. To maximize the tax-free income, one would want to delay the distribution as long as possible and still be able to utilize all of the funds for qualified purposes. Interplay with the American Opportunity Credit must also be considered because this credit applies only to the first four years of post-secondary education and the same expenses cannot be utilized for both tax benefits.

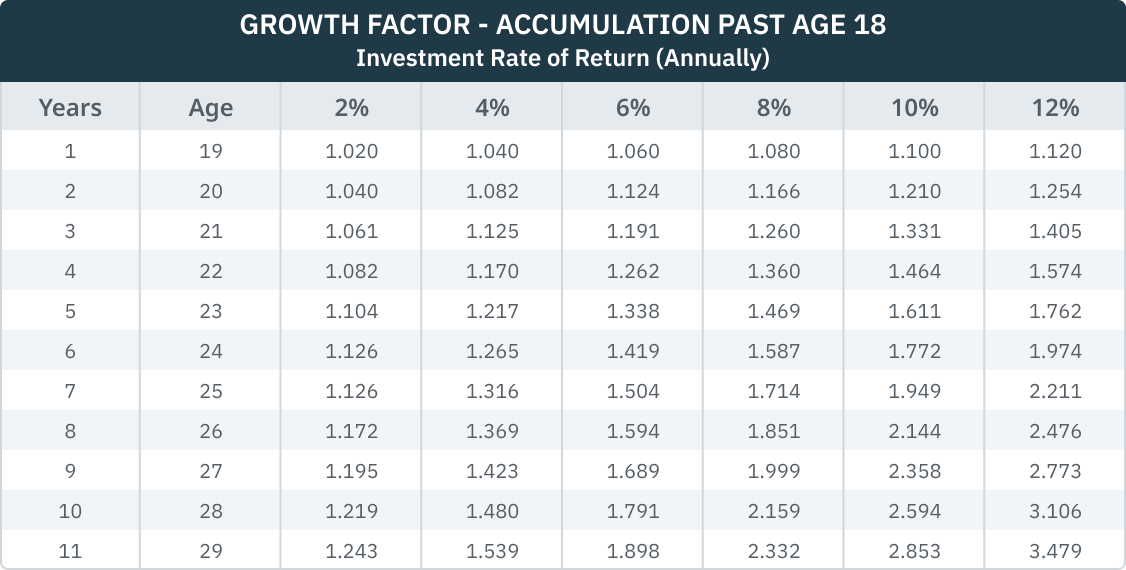

The table above assumes the Coverdell account is not immediately utilized and allowed to continue to accumulate during the period in which no contributions are allowed and up to the age at which mandatory distribution or qualified rollover is required.

California Differences - Coverdell Accounts

California conforms to Federal with respect to the Coverdell accounts, but California has no state education credits. Taxable distributions are subject to a 2-1/2% penalty, computed on FTB Form 3805-P.