Contributions

Contributions to a Coverdell Education Savings Account are limited per year and per beneficiary. The contributions can be made by anyone, including the beneficiary, providing the modified AGI of the contributor is less than the phase out limit. Maximum contribution is $2,000. Contributions can be made to a qualified state tuition program and a Coverdell Education Savings Account in the same year.

Coverdell or Section 529 Plan?

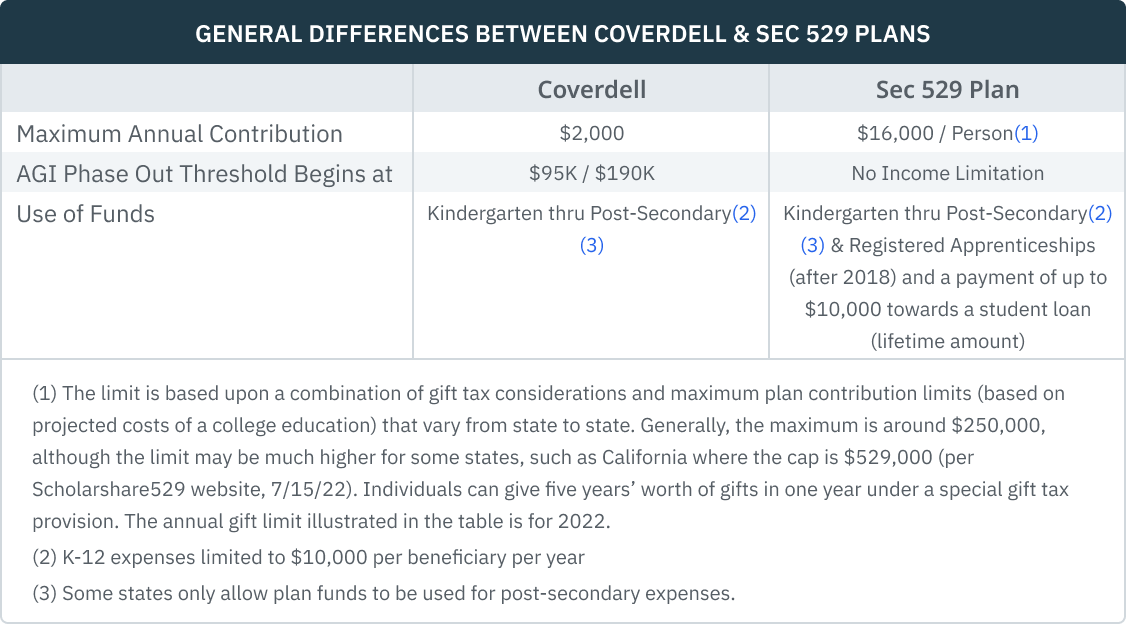

Frequently, taxpayers will ask if it is better to contribute to a Coverdell Account or to a Section 529 Plan. Until the TCJA of 2017, Coverdell funds could be used for kindergarten and up, while Section 529 plans only applied to post-secondary education. This difference in the two arrangements was diminished for federal purposes as of 2018, when distributions from Section 529 plans of up to $10,000 per year per beneficiary became available to be used for grades K-12 also. However, since then the SECURE Act added distributions for costs of registered apprenticeships and up to $10,000 toward student loans as eligible expenses for Section 529 plans.

Caution: some states may not have expanded the definition of eligible expenses for their Section 529 plans to include expenses incurred for schooling below college level or the SECURE Act additions.

The advantages of a Section 529 plan are control, larger contributions, and no AGI phase-out for contributors.

Who Can Contribute?

In addition to individuals, including the child, corporations and other entities (including tax-exempt organizations) are permitted to make contributions to Coverdell accounts.

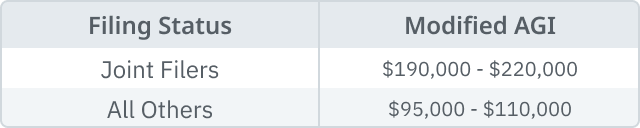

Magi Phase Out

The annual contribution per beneficiary is available in full only to an individual contributor with modified AGI below the phase out limits. These amounts are shown in the table:

Magi Phase Out Does Not Apply to Corporations or Other Entities

Corporations and other entities (including tax-exempt organizations) are permitted to make contributions to Coverdell Education Savings Accounts, regardless of the amount of the income of the corporation or entity during the year of the contribution. (Com Rept. ¶ 5015)

Modified AGI

The contribution limit is phased out ratably for individual contributors with “modified AGI” between the initial and top modified AGI levels. “Modified AGI” is AGI increased by non-U.S. income excluded under the foreign provisions (§ 911, 931, or 933). The obvious solution to a contributor being limited by their AGI is for the contributor to gift the funds for the contribution to either the beneficiary or someone else whose modified AGI is low enough to allow the contribution on behalf of the beneficiary, or see paragraph immediately above.

Contributions

Contributions CANNOT be made that:

-

Aren’t made in cash;

-

Are made after the accountholder reaches age 18 (special needs students discussed later), or

-

Exceed the annual contribution limit (except for rollovers).

Timing of Contributions

Contributions to a Coverdell account must be made by the due date (without extensions) of the contributor’s tax return, i.e., April 15 most years for most individual taxpayers. (Code Sec. 530(b)(4))

Excess Contribution Penalty

A 6% excise tax applies to excess contributions to these accounts--i.e., any contribution over the annual limit. However, the excise tax won’t apply:

-

If excess contributions made during the year are distributed before the first day of the 6 month of the following tax year – generally June 1 for most individuals. (Code Sec. 530(d)(4)(C)) The distribution must include any earnings attributable to the excess contribution.

-

To rollover contributions. (Code Sec. 4973(e)(2)(B))

The 6% tax is imposed on the individual whose Coverdell ESA(s) received the excess contributions, i.e., the beneficiary. It is computed on Form 5329.

Excess Contribution

An “excess contribution” to Coverdell ESAs maintained for any beneficiary for a year is the sum of:

-

The amount by which the contributions to all Coverdell ESAs for the beneficiary in a year exceeds:

-

$2,000, or

-

if less, the maximum amount allowed under Code Sec. 530(c) (the contribution limit for each contributor). (Code Sec. 4973(e)(1)(A))

-

-

The excess contribution for the preceding year, reduced by the sum of:

-

Distributions from the Coverdell ESA during the current year (other than rollover distributions) (Code Sec. 4973(e)(1)(B)(i)),and

-

The excess of: (i) the maximum amount which may be contributed to Coverdell ESAs for the current year, over (ii) the actual contribution for the current year. (Code Sec. 4973(e)(1)(B)(ii))

-

Example - Excess Contribution - Truman is five years old. Coverdell accounts were established for Truman by three of this relatives.

| Contributed | AGI Allowable | |

| Relative #1 | $1,000 | -0- |

| Relative #2 | $1,500 | $500 |

| Relative #3 | $2,000 | $1,000 |

| Total | $4,500 | $1,500 |

Since AGI limited contributions are less than the $2,000 annual limit, the amount of the excess contributions to Truman's Coverdell account for the year is $3,000 ($4,500 - $1,500). Therefore, Truman is liable for a $180 penalty (6% x $3,000).

The 6% tax can be paid with funds withdrawn from one or more of the beneficiary's Coverdell accounts. However, if the withdrawal of contributions, plus earnings on these contributions, is not made by the due date (including extensions) of the beneficiary's return for the tax year in which the contributions were made, then the withdrawal would be subject to an additional 10% tax.