Tier 2 Expenses

Note

All Tier 2 Miscellaneous Itemized Deductions are suspended (not deductible on individuals’ federal returns) for the tax years 2018 through 2025 but may be deductible for certain states.

Tier 2 expenses must be reduced by 2% of AGI before they are deducted on Schedule A and they are not allowed at all for AMT computation purposes. They include such expenses as professional dues, qualified job-related educational expenses, malpractice insurance premiums, job-seeking expenses, employee office-in-home expenses, professional periodical subscriptions, uniforms, union dues, the deductible portion of unreimbursed business meals, expenses related to the production of income, tax preparation fees, and appraisal fees related to property given to charity or involved in a casualty loss.

Tax Preparation Fees

For years before 2018 and after 2025, generally tax preparation fees, including the costs of electronic filing, paid by the taxpayer are deductible as Tier 2 expenses. This would also include the purchase of tax preparation software, guides, and instructions. If the taxpayer is self-employed or has rental income property an allocated amount of the tax preparation fees may be deductible on those schedules in lieu of Schedule A. Such allocation continues to be allowed during the 2018-2025 suspension period.

Caution (1)

If allocated amounts of tax preparation fees are deducted on Schedule C, E, or F, and those amounts are $600 or more, the taxpayer may need to issue a Form 1099-MISC to the individual or firm who provided those services.

Caution (2)

If your return preparation software transfers the fee you charged the client for the prior year return as a pro forma amount for Schedule A miscellaneous deductions, be sure to adjust that amount for the preparation fees allocated to other schedules.

Credit and Debit Card Fees Related to Tax Payment are Deductible

Credit or debit card convenience fees charged for paying federal individual income taxes electronically are deductible as a Tier 2 itemized deduction for years before 2018 and after 2025. (IR-2009-37)

Legal Expenses

(Also see Chapter 7.9 – Legal Expenses) – Other than for years 2018-2025, an individual can usually deduct legal expenses incurred in attempting to produce or collect taxable income or paid in connection with the determination, collection, or refund of any tax. The following legal expenses are also deductible:

-

Related to either doing or keeping the taxpayer’s job, including expenses paid to defend the taxpayer against criminal charges arising out of his/her trade or business

-

For tax advice related to a divorce, if the bill specifies how much is for tax advice and it is determined in a reasonable way, or

-

To collect taxable alimony.

Work Clothes and Uniforms

For years other than 2018-2025, the cost and upkeep of work clothing is deductible if the following two requirements are met.

-

They are worn as a condition of employment

-

The clothing is not suitable for everyday wear. It is not enough that the clothing be distinctive, it must be specifically required by the taxpayer’s employer. Nor is it enough that the taxpayer does not, in fact, wear the work clothes away from work. The clothing must not be suitable for taking the place of the taxpayer’s regular clothing.

Examples of workers who may be able to deduct the cost and upkeep of work clothes are: delivery workers, firefighters, health care workers, law enforcement officers, letter carriers, professional athletes, and transportation workers (air, rail, bus, etc.). Musicians and entertainers can deduct the cost of theatrical clothing and accessories if they are not suitable for everyday wear. IRS contends that white bib overalls and standard shoes, such as a painter might wear, are not distinctive in character or in the nature of a uniform.

-

Tax Court Case - The Tax Court has held that a salesman for Ralph Lauren who was required to purchase and wear the designer's apparel while representing the company couldn't deduct the cost of such clothing as unreimbursed employee expenses., The Court found that the clothing was clearly suitable for regular wear and upheld IRS's imposition of an accuracy-related penalty with respect to the related portion of the underpayment. (Barnes, TC Memo 2016-79)

The costs of protective clothing required for work, such as safety shoes or boots, safety glasses, hard hats and work gloves, are deductible. Examples of workers who may require safety items include carpenters, chemical workers, machinists, oil field workers, pipe fitters, and truck drivers.

Military Uniforms

Taxpayers generally cannot deduct the cost of uniforms if they are on full-time active duty in the armed forces. However, armed forces reservists can deduct the unreimbursed cost of uniforms if military regulations restrict the taxpayers from wearing it except while on duty as a reservist. A student at an armed forces academy cannot deduct the cost of uniforms if they replace regular clothing. However, the cost of insignia, shoulder boards, and related items are deductible. Civilian faculty and staff members of a military school can deduct the cost of uniforms. Deductions related to military uniforms are suspended for 2018-2025.

Gift Expenses

Only gifts given during a trade or business are deductible and then they are generally limited to $25 per year per person (recipient). (IRC Sec 274(b); Reg. 1.274-3) These expenses would be deducted on Schedule C, E or F, as appropriate. For employees, these are Tier 2 deductions that are suspended for 2018-2025.

-

Married Taxpayers - If the taxpayer and spouse both give gifts, both are treated as one taxpayer. It does not matter whether they have separate businesses, are separately employed, or whether each has an independent connection with the recipient. If a partnership gives gifts, the partnership and the partners are treated as one taxpayer.

-

Incidental Costs - Incidental costs, such as engraving on jewelry, or packaging, insuring, and mailing, are generally not included in determining the cost of a gift for purposes of the $25 limit. A cost is incidental only if it does not add substantial value to the gift.

-

Exceptions - The following items are not considered gifts for purposes of the $25 limit.

-

An item that costs $4 or less, and

-

Has the taxpayer’s name clearly and permanently imprinted on the gift, and

-

Is one of a number of identical items that the taxpayer widely distributes, such as pens, desk sets, and plastic bags and cases.

-

-

Signs, display racks, or other promotional material to be used on the business premises of the recipient.

-

Gift vs Entertainment - Any item that might be considered either a gift or entertainment generally will be considered entertainment. However, if the taxpayer gives a customer packaged food or beverages that he intends the customer to use at a later date, treat it as a gift. Entertainment expenses are not deductible after December 31, 2017, per the TCJA. An employee expense of a job-related gift is not deductible for years 2018-2025. See Chapter 3.11 Meals and Entertainment.

Car Expenses

If an employee uses his car for business purposes in years other than 2018-2025, he may be able to deduct car expenses as a Tier 2 itemized deduction. Generally, one of the two following methods is used to figure deductible auto expenses.

-

Actual Car Expenses

-

Standard Mileage Rate

Details and options relating to the deduction for the business use of the taxpayer’s vehicle is complicated and covered separately in Chapter 3.12.

-

Employee Vehicle Deductions - the AMT & 2% Rule - In years other than 2018-2025, the unreimbursed business expenses of an employee can only be deducted as miscellaneous itemized deductions subject to the 2% of AGI reduction., Thus, those who take the standard deduction receive no tax benefit for those expenses. Even when itemizing, taxpayers encounter two additional limitations:

-

For regular tax purposes, the employee business expenses when combined with other expenses in the same category are first reduced by 2% of a taxpayer’s income (AGI) and then only the excess is deductible.

-

If the employee is taxed by the AMT, then none of the business expenses are allowed at all.

-

As a result, many taxpayers are unable to deduct their employee business expenses. However, there are two possible strategies that may help an employee recover some or all of these expenses.

The simplest way is for the employee to negotiate an accountable reimbursement plan with his or her employer. This will allow the employer to provide the employee with nontaxable reimbursement for the expenses. Depending upon the employer’s attitude, the employee might need to accept a pay reduction approximately equal to the expense reimbursement.

Another possible strategy involves business assets that must be depreciated. By minimizing the depreciation deductions each year, when the business assets are sold or scrapped, the business basis will be higher than it would be if accelerated depreciation or Sec. 179 deductions were claimed. As a result, a potential deductible business loss has been created. Since the gain or loss from the sale of business assets is treated as income or loss on the face of the tax return, there is no need to itemize to benefit from a loss from the sale of the business asset.

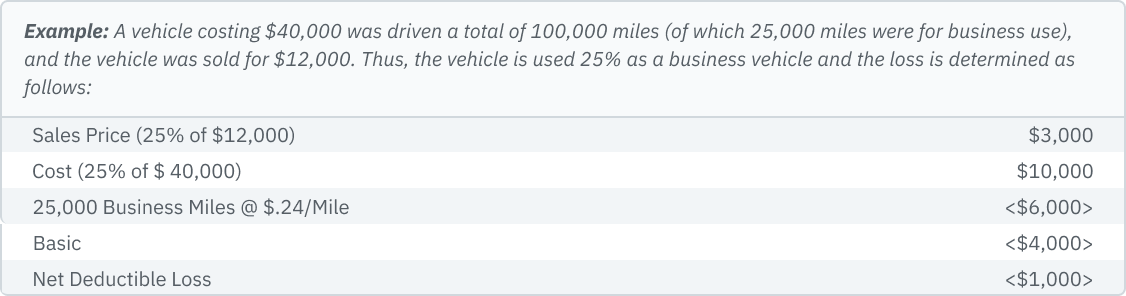

The business asset most likely to fall into this category is the business-use portion of the employee’s vehicle. To gain any benefit, the sale must result in a loss. The benefit will vary depending on three variables unique to each situation: the cost of the vehicle, how much depreciation was allowed or allowable for its business use, and the vehicle’s sale price.

In the example, the standard mileage rate was used with an imputed depreciation rate of 24 cents per mile (see Chapter 3.11 for a table of actual recent-year rates). Using the standard mileage rate minimizes the taxpayer’s recordkeeping and produces a low depreciation component. The taxpayer must account for depreciation when selling the vehicle, even though no benefit was derived. The tax benefit rule does not apply to depreciation. (Reg § 1.111-1(a))

Hobby Expenses

Other than for years 2018-2025 - If a taxpayer does not carry on an activity for profit (in other words, it is a hobby), the taxpayer may deduct their hobby expenses, up to the amount of any hobby income, as a Tier 2 itemized deduction. Thus, hobby income is reported on their 1040 (via Schedule 1, line 8i on the 2021 version), and, except for years 2018-2025, any expenses, not exceeding the hobby income, are deductible as miscellaneous itemized deductions on Schedule A, assuming the taxpayer is not claiming the standard deduction, in which case they would be reporting income but not deducting the expenses. For 2018-2025, none of the hobby expenses are deductible, so all of the hobby income will be taxable. See Chapter 3.3 for information on “Profit Motive.”

Job-Search Expenses

Expenses looking for a new job in the taxpayer’s current occupation are deductible (other than for years 2018-2025), even if a new job is not obtained. To be deductible, the expenses cannot be to look for a job in a new occupation or for a first job. If there is a substantial time gap between the taxpayer’s last job and when the search for a new job occurs, the expenses are not allowed.

The types of expenses that are deductible if looking for a new job in the same occupation include:

-

Fees paid by the taxpayer to employment and outplacement agencies and for career counseling.

-

Resume preparation costs, such as typing, printing and mailing.

-

Travel and transportation expenses if the trip is primarily to look for a new job. Even if the travel expenses to an area aren’t deductible because job search wasn’t the taxpayer’s primary reason for the trip, the expenses looking for work in the area are allowed.

Investment Fees and Expenses

Investment fees, custodial fees, trust administration fees (for revocable trusts), and other expenses paid for managing investments that produce taxable income are deductible in years other than 2018-2025. However, the fees are only deductible for the production of taxable income and are not deductible for the production of non-taxable investment income. Where the expenses are for the production of both taxable and nontaxable income, an allocation must be made.

Example – Allocating expenses in years other than 2018-2025 – Joe Lewis has ABC Financial manage his investment portfolio and ABC charges Joe an annual management fee of one half of one percent of his portfolio value. For the tax year that management fee was $3,700. Joe’s portfolio produced a total of $35,000 of taxable and non-taxable income for the year. Of that $35,000, $15,000 was from interest on tax free municipal bonds and the balance, $20,000, was from taxable interest and dividends. Therefore only $2,114 ($3,700 x ($20,000/35,000)) of the management fee is deductible.

-

Caution

When investment expenses are allowed as a Tier 2 itemized deduction (i.e., in years other than 2018-2025), they must also be taken into account when computing the net investment income for purposes of determining how much investment interest is deductible. Most tax software includes a single entry point for the total of all investment expenses. Attempting to itemize those expenses on a separate line of the return will defeat the software computation.

Strategy (Only for years other than 2018-2025)

Where the 2% of AGI will reduce or eliminate an investment expense and the taxpayer has investment interest carryover, consider not deducting the investment expenses so as to maximize the investment interest expense deduction. However, utilizing this strategy will prevent deduction of the investment expenses when determining the net investment income for purposes of the 3.8% net investment income surtax, so the effect on the surtax must also be considered. The state return may also be affected if state law allows deduction of Tier 2 expenses.

Special Rules for Performing Artists

Some performing artists are allowed to deduct their employment-related expenses as an adjustment to gross income, thus avoiding the 2%-of-AGI reduction on these expenses. This abovethe-line deduction is unchanged by the TCJA. In order for these taxpayers to qualify for this special rule, all of the following must be met:

-

They must have two or more employers in the performing arts field during the tax year (don’t count nominal employers who pay less than $200);

-

Their business expenses must be more than 10% of the gross income earned as a performing artist;

-

AGI (before performance-related expenses) can’t be more than $16,000. Married performers must file joint returns (unless they lived apart all year)., The two-employer requirement and 10%-of-gross-income requirement are applied to each spouse separately. However, the $16,000-AGI requirement applies to married performers’ joint income.

Performing arts related expenses are not deducted on Schedule A; they are transferred from Form 2106 to Form 1040, Schedule 1, line 12 (2021).

State and Local Government Officials Get “Above-The-Line” Deduction(unchanged by TCJA)

Employee business expenses of an official of a state or local government are deductible in computing AGI, if the official is compensated in whole or in part on a fee basis. The officials for whom this provision is intended are those who provide certain services to the government, and who hire employees and incur expenses in connection with their official duties. Since these expenses are deductions “above-the-line,” they are also deductible for AMT purposes.

Firefighter Meals

See Chapter 3.11 – Meals & Entertainment

Home Office

(Also see Chapter 3.16 – Home Office) – If an employee uses a part of his home regularly and exclusively for business purposes, in years other than 2018-2025, he may be able to deduct a part of the operating expenses and depreciation of the home, or $5 per business-use square foot, up to 300 square feet, if using the simplified method. He can claim this deduction for the business use of a part of the home only if that part of the home is used regularly and exclusively:

-

As the taxpayer’s principal place of business for any trade or business,

-

As a place to meet or deal with patients, clients, or customers in the normal course of a trade or business, or

-

In the case of a separate structure not attached to the taxpayer’s home, in connection with the taxpayer’s trade or business.

The regular and exclusive business use must be for the convenience of the taxpayer’s employer and not just appropriate and helpful in the taxpayer’s job.

Caution

The home office deduction can produce some negative effects when and if the home containing the office is sold. Unless the simplified method was used for all years when a home office deduction was claimed, there will be a certain amount of depreciation recapture that cannot be excluded under the home sale rules. If the home office is a separate structure the entire gain from the office portion of the home will not qualify for the exclusion of home gain.

Education Expenses

Job-related educational expenditures are deductible by an employee as Tier 2 miscellaneous deductions (in years other than 2018-2025) or on Schedule C for a self-employed individual. Some job-related education expenses may qualify for the American Opportunity Credit or Lifetime Learning credits. The same expense, however, cannot be used for more than one tax benefit.

Additional Considerations

If the taxpayer(s) meet certain requirements, some or all of the education expenses discussed here may qualify for a more beneficial tax treatment such as a credit, AGI adjustment (for years available before 2021) or, in the case of a self-employed individual, a Schedule C deduction.

-

Qualifying Education Expenses - To be deductible on Schedule A (for years other than 2018 through 2025), educational expenses must be closely related to the taxpayer’s present job., Temporary absence from work, however, will not automatically cause a problem if that absence is a year or less and the taxpayer returns to the same type of work., The specific requirements state that the education must either:

-

(a) Maintain or improve skills required in the taxpayer’s present job, OR

-

(b) Be required by the employer to retain the taxpayer’s position.

Note: Educators are allowed to deduct expenses for classes on a new subject they will teach or for training for a school counseling or administrative job. For teachers, this is all considered one line of work.

-

Non-qualifying Education Expenses - No deduction is allowed for education that:

-

Is being completed as part of meeting a minimum requirement for getting a job,

-

Is of a general or personal nature, or

-

Leads to qualification for a new trade.

-

-

New Trade or Business Cases:

-

A software engineer worked as a project manager. The Tax Court ruled she was not entitled to deduct education expenses related to obtaining her executive masters of business administration (EMBA) degree because the education qualified her for a new trade or business. Her employment was largely unrelated to her EMBA coursework, and although she continued to be qualified to manage people as a project manager, she also became qualified to perform many other tasks of business, management, finance and marketing that she was not qualified to perform before enrolling in the EMBA program. (M.Z. Creigh, TC Summary Opinion 2017-26)

-

This case is also about EMBA program expenses. Here the taxpayer was a finance and accounting professional. Among the issues raised by the IRS when they denied the education expenses were that the EMBA degree was a general degree that did not maintain or improve specific skills required for his employment and that the degree qualified him for a new trade or business. The taxpayer was a well established finance and accounting business manager at an airport hotel before beginning his EMBA program, and he took courses that improved his managerial and leadership skills in his position as a business manager. Although hired by another company soon after graduating, the taxpayer performed duties that were substantially similar to those of his former job, the degree was not a prerequisite for the job, and considering the courses he took, the taxpayer was not qualified to perform new tasks or activities with the conferral of his degree. Therefore, the expenses qualified. (A. Kopaigora, TC Summary Opinion 2016-35)

-

-

Deductible Educational Costs Include - Transportation, travel, tuition, books, fees, supplies, etc., For qualified transportation, actual expenses of a car may be deducted, or the taxpayer may use the standard mileage rate., Education expenses of a regularly employed individual who goes from work to school on a strictly “temporary basis” can also include the costs of returning from school to home., Roundtrip mileage is also deductible for those who travel from home to school on a temporary basis, regardless of distance or whether the taxpayer attends school on nonworking days. If attendance at school:

-

Is realistically expected to last (and does in fact last) for one year or less, and facts and circumstances don’t indicate otherwise, the temporary basis standard is met.

-

Is realistically expected to last for more than 1 year or if there is no realistic expectation that the attendance will last for 1 year or less, the attendance is not temporary, regardless of whether it actually lasts for more than 1 year.

-

Initially is realistically expected to last for 1 year or less, but at some later date the attendance is realistically expected to last more than 1 year, that attendance will be treated as temporary, absent facts and circumstances to indicate otherwise, until the taxpayer’s expectation changes. It will not be treated as temporary after the date the taxpayer determines it will last more than 1 year. If the “temporary basis” test is not met, transportation costs from home to school do not count, but if the employee goes directly from work to school, the one-way costs of transportation qualify. If a taxpayer in this situation goes home before attending school, and the distance from home to school is greater than the mileage from work to school, only the work-to-school distance is deductible.

-

Example 1 – Educational Transportation to Temporary Location – Going Home Before Class - Ron works regularly in a nearby town and goes directly from work to home. He also attends school every work night for 3 months to take a course improving his job skills. Since Ron is attending school on a temporary basis, he can deduct the daily roundtrip transportation expenses in going between his home and school, regardless of the distance traveled.

-

Example 2 - Educational Transportation to Temporary Location – Classes on Non-work Days - Jean attended job-related classes for six consecutive Saturdays; she does not normally work on Saturdays. Since Jean is going to school on a temporary basis, she will be able to deduct the costs of her roundtrip mileage between home and school.

-

Example 3 - Educational Transportation to Non-temporary Location - Assume that Jean attended job-related classes twice a week for an 18-month period. When Jean began the course of instruction, she knew it was to be for 18 months. On school nights, she drove from work to school and from school to home. Because Jean’s school attendance is not temporary, she may deduct only the transportation costs of travel between work and school. If she went home before attending school, and the distance from home to school was greater than the mileage from work to school, only the work-to-school distance is deductible.

-

Example 4 – Educational Transportation Outside Area – Tim, a stockbroker, works in Washington, D. C. and enrolls in an investment class in Baltimore, Maryland that he realistically expects to last for 1 year or less. He actually attended three nights a week for 3 months. He may deduct his roundtrip transportation expenses between Washington and Baltimore, because he meets the temporary basis test. The distance Tim travels is not relevant.

-

The recordkeeping requirements are the same for education as for other employee business expenses. The kind of records necessary depends on the nature of the expense (local, away-fromhome, etc.).

To the extent a VA (Veterans Affairs) allowance represents “subsistence” payments, it is not taxable AND does not reduce expenses. Any VA allowance intended to offset actual educational expenses reduces the expense deduction. Rev Rul 83-3states that VA benefits paid under 38 USC Section 1677 (1976) are direct reimbursements of education expenses, and benefits under 38 USC Section 1681 (1979) are half for subsistence and half to reimburse expenses.

Example - Educational VA Benefits - Sean, a veteran, paid deductible education expenses in the amount of $1,200 in 2022. He received payments of $810 from the Dept. of Veterans Affairs under 38 USC Section 1681 as reimbursement for his expense. One-half of the reimbursement is for living expense and one-half for education. If it weren’t that the TCJA effectively disallows employee business expenses, Sean would have been able to deduct $795 ($1,200 less 1/2 of $810) for his educational expenses before considering the 2% of AGI reduction.

-

Travel as a Form of Education

Generally, the IRS has taken the position that “Travel as a Form of Education” for teachers and educators is not an allowable education expense. However, in the court case Jorgenson, TC Memo 2000138, a high school English teacher was allowed foreign travel as an educational expense when that travel was part of a structured course offered by an education institution. In this particular case, the taxpayer enrolled in courses offered by UC Berkeley and UC Extension. One course entitled “Legendary Greece” involved extensive travel in Greece and another entitled “Southeast Asia, Sacred Places” involved travel to Thailand, Cambodia and Indonesia. The IRS took the position the education was travel as a form of education and therefore not deductible. The court disagreed and determined the courses were academic courses that:

-

Maintained or improved her skills, and

-

Were ordinary and necessary.

Thus, a distinction must be made between travel itself being a form of education (expenses not deductible) and when an individual travels away from home primarily to obtain education (education expenses are deductible). In the latter case the individual's expenditures for travel, meals, and lodging while away from home are deductible.

Variable Annuity Losses

Variable annuities typically invest in a variety of stock funds, money market accounts, etc. After the original investment, the annuity may have declined in value and will be worth less today than its original cost.

If the annuity is a non-qualified annuity and is surrendered in a cash-out transaction in a year other than 2018-2025, the loss from the annuity can be claimed as a miscellaneous deduction subject to the 2%-of-adjusted-gross-income limit. (2017 IRS Pub 575, pg. 22)