Tier 1 Expenses

Tier 1 expenses are fully deductible on Schedule A (not subject to the 2% of AGI limitation) and are deductible against the AMT. These include impairment-related work expenses for handicapped individuals, Federal estate tax on income in respect of a decedent, repayments of more than $3,000 under claim of right, amortizable premium on taxable bonds, gambling losses to extent of winnings, and unrecovered investment in the contract of the pension of a decedent.

Amortizable Bond Premium

Bond premium is the amount paid for a bond that exceeds its face value. A taxpayer can elect to amortize the premium on taxable bonds acquired prior to 10/23/86 and deduct the amortization as a Tier 1 itemized deduction. For bonds purchased after 10/22/86 and before 01/01/88, amortization of the premium is investment interest expense, unless a taxpayer elects to offset the interest income on the bond with the amortized portion of the premium. For bonds acquired after 1987, the amortization of the premium can only offset the interest income on the bond--no Schedule A deduction is available.

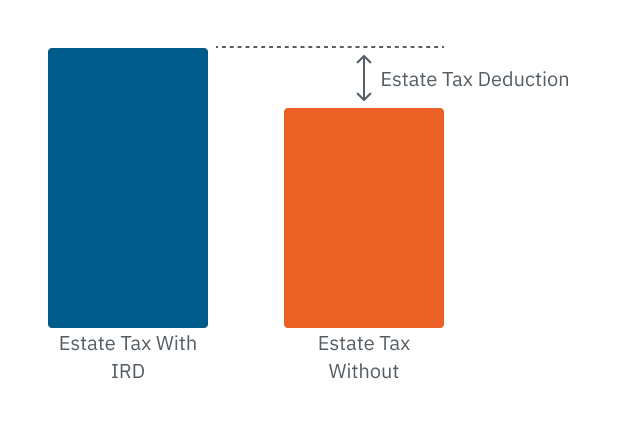

Federal Estate Tax on Income in Respect of a Decedent

A taxpayer can deduct the Federal estate tax attributable to income in respect of a decedent that the taxpayer as beneficiary must include in gross income. This is a frequently overlooked deduction, since it is generally up to a beneficiary's preparer to recognize that the deduction exists and calculate the deduction.

When a client comes in with a 1099R or K-1 with income from an inherited IRA, do you ask two very important questions?

-

Was there a 706 filed for the estate?

-

If so, was there a tax liability on the 706?

If the answer to both questions is yes, then your client is eligible for a Tier 1 miscellaneous (not subject to the 2% of AGI reduction) itemized deduction. However, with the TCJA’s increase in the estate tax exclusion amount to $10 million – adjusted for inflation to $12,060,000 for 2022 – fewer estates will be subject to an estate tax so it is more likely than ever that the answers to these questions will be no. Even so, you should be on the lookout for this situation.

-

Background - Income in Respect of a Decedent (IRD) is included in the decedent’s gross estate AND is subject to income tax. To make up for this inequity, a deduction for estate tax is allowed to the ultimate recipient of the income., If the recipient is an individual, it is claimed as a miscellaneous itemized deduction, not subject to the 2% limitation. If the estate receives the income, the deduction is claimed on Form 1041. (IRC § 691(c)(1)(A); Reg § 1.691(c)-1(a))

-

Amount Deductible - The amount of estate tax that is deductible is the part representing the net value of all items in the estate, which are IRD. The deductible amount is included on 1040 Schedule A, line 16 (2021).

Example A: Sergei, a lawyer, was a cash-basis taxpayer when he died two years ago. At the time he was entitled to $12,000 from clients in payment for services. He had also accrued $8,000 in bond interest at the time of his death. He owed $5,000 in expenses for which his estate became liable. These income and expense items, as well as non-IRD income and expenses, were reported on Sergei’s estate tax return. After credits, the estate owed $9,460 in tax. The net value of items included as IRD is $15,000 ($20,000 income less $5,000 expense). The estate tax determined without including the $15,000 is $4,840. The estate tax that qualifies for the deduction is $4,620 ($9,460 minus $4,840).

-

Example B: Assume Diane inherited Sergei’s estate (Example A). She collected the $12,000 from the clients this year and will include that amount in income on her current year return. She itemizes deductions and will claim a miscellaneous deduction of $2,772, figured as follows: $12,000/$20,000 x $4,620 = $2,772.

-

-

Caution - This has been an often-overlooked tax deduction. The primary reason? There is no IRS form associated with the 706 providing the beneficiaries with the information needed to determine the deduction., Therefore, it is the responsibility of the practitioner to recognize the potential for this deduction when a taxpayer has inherited taxable income.

Gambling Losses to Extent of Winnings

(Also see Chapter 7.11 – Gambling Losses) – A taxpayer may deduct gambling losses on Schedule A, line 16 (2021) to the extent of winnings included in total income on Form 1040. To verify the losses, a taxpayer should have a record, which includes the following information:

-

The date and specific type of wager;

-

The name and address or location of the gambling establishment;

-

The names of other people present with the taxpayer at the establishment; and

-

The amount won or lost. In addition, documentation like wagering tickets, canceled checks, credit card records, bank withdrawals, etc., should also be available.

Impairment-Related Work Expenses

Taxpayers having a physical or mental disability that limits their activities can deduct impairment-related work expenses on Schedule A, line 16 (2021). For example, an allowable expense would be for the cost of attendant care at the place of the taxpayer’s work.

Unrecovered Investment in Pensions

If a retired person dies before recovering the entire basis in a pension or annuity (that started after 1986), the unrecovered portion is allowed as a deduction on the retiree’s final return on Schedule A, line 16 (2021). If the annuity is for the joint lives of a retiree and a designated beneficiary, the deduction would apply to the final return of the last to die. Otherwise, it would be allowed on the final return of the retiree decedent. (Code Sec. 67(b)(10); Code Sec. 72(b)(3)(A))

-

Strategy – If a decedent was drawing a pension and that pension was only partially taxable, then there will be some remaining unrecovered basis., See the example below that shows how to determine the amount of the unrecovered basis.

Example - Bill Smith, age 65, began receiving retirement benefits in 2018 under a joint and survivor annuity. Bill’s annuity starting date is January 1, 2018. The benefits are to be paid for the joint lives of Bill and his wife Kathy, age 65. Bill had contributed $31,000 to a qualified plan and had received no distributions before the annuity starting date. Bill is to receive a retirement benefit of $1,200 a month, and Kathy is to receive a monthly survivor benefit of $600 upon Bill’s death.Under the simplified method, Bill’s tax-free monthly amount is $100 ($31,000 ÷ 310). Upon Bill’s death, if Bill has not recovered the full $31,000 investment, Kathy will also exclude $100 from her $600 monthly payment. If Bill and Kathy die before 310 payments are made, a miscellaneous itemized deduction will be allowed for the un-recovered cost on the final income tax return of the last to die.

-

Claim of Right Doctrine

(Also see Chapter 9.5 – Claim of Right) – Code Section 1341 describes the Claim of Right doctrine which offers benefits to taxpayers who have included an amount in income in one tax year but have had to repay all or part of it in a later year.

-

For Repayments over $3,000 - Taxpayers can choose between a Tier 1 miscellaneous itemized deduction on Schedule A, line 16 (2022) OR a tax credit based on the difference in tax with or without the repaid income in the year the income was originally reported., Make both computations and select the one that provides the greater benefit.

-

Repayments of $3,000 or less - Are claimed as Tier 2 miscellaneous itemized deductions, and therefore aren’t deductible in years 2018 through 2025.

Excess Deductions on Trust or Estate Termination

There has been some confusion related to the deductibility of excess deductions flowing through to beneficiaries from a non-grantor trust or estate on Form 1041 K-1 upon termination of the trust or estate. Prior to the passage of the TCJA, excess deductions on the termination of a trust were included as part of the beneficiary’s tier 2 (subject to the 2% of AGI limitation) miscellaneous itemized deductions. However, TCJA suspended the deduction for tier 2 deductions for years 2018 through 2025, leading many to believe (1) that the pass-through expenses at termination were no longer deductible by the beneficiary and (2) they were no longer deductible on the 1041.

The IRS subsequently issued Notice 2018-61 notifying taxpayers that the IRS intended to issue regulations dealing with this Sec 642(h) issue and in the meantime the taxpayers could rely on guidance included in Notice 2018-61, which provides the following:

-

Excess deductions on termination of a 1041 flowing through to beneficiaries from a trust 1041-K1 are deductible on Schedule A. Enter the amount on line 16 – Other Deductions.

Proposed regulations (NPR 113295-18) were published in May 2020, and finalized (T.D. 9918) in September 2020, that clarified this issue. Taxpayers may rely on the proposed regulations for taxable years of beneficiaries beginning after 2017 and before the final regulations are published. Under Reg. 1.642(h)-2(b) the excess deductions are categorized and reported as:

-

An adjustment to income on Form 1040/1040-SR (such as an NOL, capital loss carryover, Sec 67(e) deductions*),

-

Non-miscellaneous itemized deductions reported on Schedule A of the 1040/1040-SR (such as nonbusiness state income tax and real estate tax), and

-

Miscellaneous deductions that aren’t deductible in years 2018 through 2025 (such as investment management fees).

It will be the responsibility of the fiduciary to break out the excess deduction amounts on the 1041 K-1 or accompanying statement issued to beneficiaries, and to identify those that may be limited when claimed by the beneficiary. For previously issued 2018 and 2019 K-1s, beneficiaries may need to contact the fiduciary to determine the allocation to be able to determine the correct excess termination deduction. Amended returns may be needed since the reporting instructions in Notice 2018-61 are changed by the proposed regulations. However, keep in mind the statutory period for requesting a refund (generally 3 years from the due date of the return).

*Under Sec 67(e) an estate or trust computes its AGI the same way as does an individual, except that certain deductions are allowed in arriving at adjusted gross income on the 1041 that aren’t treated that way on a 1040. These include costs which are paid or incurred in connection with the administration of the estate or trust and which would not have been incurred if the property were not held in the estate or trust – typically fiduciary fees, legal fees, and the estate or trust’s tax preparation fees.

IRS Updates Reporting Instructions - On its web site the IRS updated the instructions for reporting Sec 67(e) excess deductions on termination to account for the proposed regulations as discussed above:

-

For tax year 2019, an excess deduction for IRC Sec 67(e) expenses is reported as a write-in on Schedule 1 (Form 1040/1040-SR), Part II, line 22. On the dotted line next to line 22, enter the amount of the adjustment and identify it using the code “ED67(e)”. Include the amount of the adjustment in the total amount reported on line 22.

-

For tax year 2018, report an excess deduction of Sec 67(e) expenses as a write-in on Schedule 1 (Form 1040), line 36. On the dotted line next to line 36, enter the adjustment amount and identify it using code “ED67(e)”. Include the amount of the adjustment in the total reported on line 36.

Of course, if these expenses were previously included on Schedule A, they will need to be removed from Schedule A.

Net Qualified Disaster Loss

Normally taxpayers who aren’t itemizing deductions don’t include Schedule A in their return. However, taxpayers who are not itemizing and who have a net qualified disaster loss are eligible to claim both the qualified disaster loss and the standard deduction. Line 16 of Schedule A, “Other Itemized Deductions” is used to accomplish this, by doing the following (duplicated from the 2021 Form 4684 instructions, page 3):

-

Enter the amount from Form 4684, line 15, on the dotted line next to line 16 on Schedule A (Form 1040), or line 7 of Schedule A (Form 1040-NR), and the description, “Net Qualified Disaster Loss.”

-

Also, enter on the dotted line next to line 16 of Schedule A (Form 1040) or line 7 of Schedule A (Form 1040NR), your standard deduction amount and the description, “Standard Deduction Claimed With Qualified Disaster Loss.”

-

Combine these two amounts and enter the total in the entry space on line 16 of Schedule A (Form 1040), or line 7 of Schedule A (Form 1040-NR), and on Form 1040, 1040-SR, or 1040-NR, line 12a.