Travel

Auto Travel

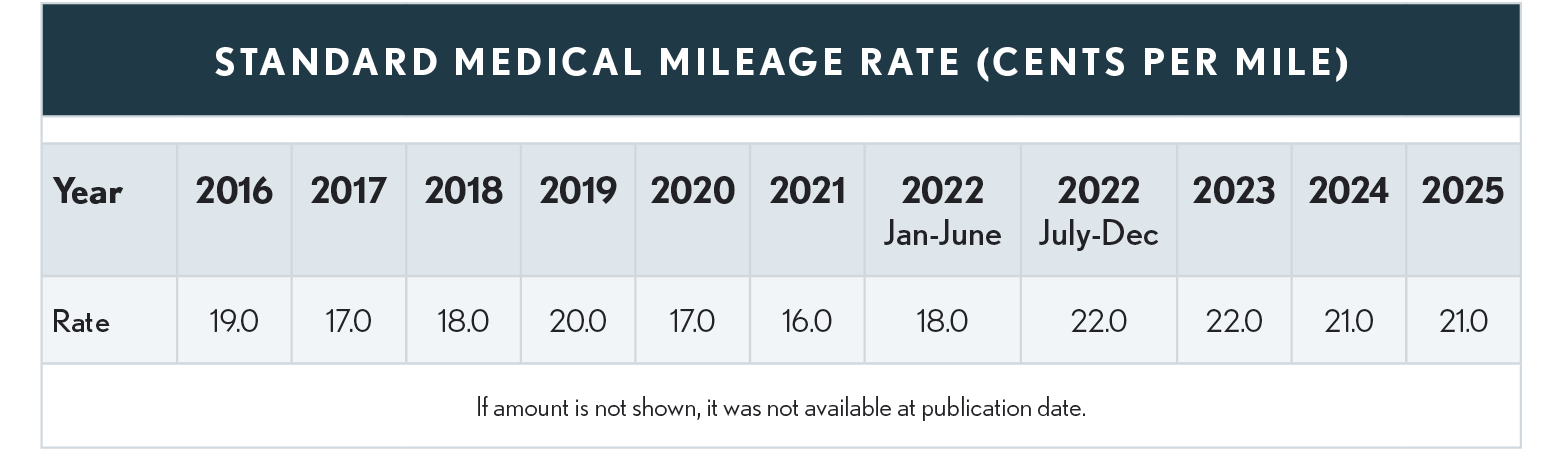

When using a vehicle for medical reasons, deduction is allowed at a specified rate (cents) per mile (see table) or for actual cost of gas and oil (not repairs, maintenance, depreciation, lease fees, etc.).

Trips

Amounts paid for transportation to another city may be included in medical expenses, if the trip is primarily for, and essential to, receiving medical services. Up to $50 per night for lodging may be included. A trip or vacation taken merely for a change in environment, improvement of morale, or general improvement of health cannot be included in medical expenses, even if the trip is made on the advice of a doctor.

Lodging

The cost of meals and lodging at a hospital or similar institution may be included if the main reason for being there is to receive medical care. Medical expenses may also include the cost of lodging not provided in a hospital or similar institution. The cost of such lodging while away from home may be included if all the following requirements are met:

-

The lodging is primarily for and essential to medical care.

-

The medical care is provided by a doctor in a licensed hospital or in a medical care facility related to, or the equivalent of, a licensed hospital.

-

The lodging is not lavish or extravagant under the circumstances.

-

There is no significant element of personal pleasure, recreation, or vacation in the travel away from home.

The amount included in medical expenses for lodging cannot be more than $50 for each night for each person. Lodging is included for a person for whom transportation expenses are a medical expense because that person is traveling with the person receiving the medical care. For example, if a parent is traveling with a sick child, up to $100 per night is included as a medical expense for lodging. Meals are not deductible.

Moving

Where a taxpayer is required to permanently relocate for medical reasons, only transportation costs related to the taxpayer are deductible, and the travel costs for the taxpayer’s family are not deductible. Other typical moving expenses such as van and storage are not deductible.

Vehicles and Vehicle Modification

Medical expenses include the cost of special hand controls and other special equipment installed in a car for the use of a person with a disability. Medical expenses also include the difference between the cost of a regular car and a car specially designed to hold a wheelchair.

In addition, the traditional moving expenses for a job-related move are suspended for years 2018 through 2025.