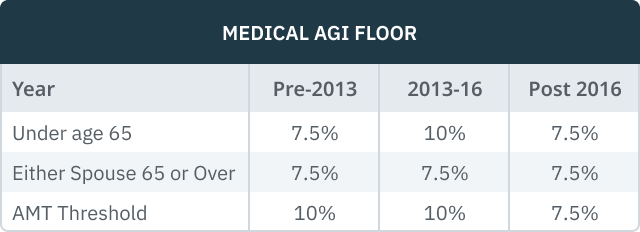

Medical AGI Floor

Medical

deductions are only allowed to the extent total medical expenses exceed a

percent of AGI. There have been numerous

changes with the passage of the ACA, TCJA

and other legislation. The AGI limit was 7.5% for years 2019 and 2020, and was

scheduled to increase to 10% beginning in 2021.

However, the Taxpayer Certainty and Disaster Tax Relief Act of 2020 makes the 7.5% threshold permanent. (IRC Sec 213(a) as amended by Act Sec 101) The 7.5% rate applies for all taxpayers for both regular tax and the AMT.