Deductible Medical Expenses Considerations

The following presents infrequent or unusual medical expenses and how they are treated for the medical expense deduction:

Acupuncture - Medical expenses include the amounts paid for acupuncture.

Alcoholism - Amounts paid by an inpatient for treatment at a therapeutic center for alcoholism, and for meals and lodging furnished as a necessary incident to the treatment (Rev. Rul. 72-226), are eligible medical expenses. Cost of transportation to meetings of the Alcoholics Anonymous are expenses “primarily for and essential to medical care” in the case of an alcoholic who attends such meetings (Rev. Rul. 63-273).

Adoption Expenses Paid by Adopting Parent - Medical expense payments made by an adopting parent for medical services rendered to a child even before the child was placed in the parent's home are deductible if:

-

The child is a dependent of the adopting parent when services are rendered or paid; and

-

The expenses are paid by the parent, or agent, for the medical care of the child; and

-

They are not reimbursement for expenses by the adoption agency prior to adoption negotiations; and

-

The expenses are shown to be directly attributable to the medical care of the child.

The adoptive parents cannot deduct the natural mother's childbirth expenses. (Kilpatrick, Benny, (1977) 68 TC 469)

Birth Control Pills - A taxpayer caninclude in medical expenses the amount paid for birth control pills provided they were prescribed by a doctor.

Body Scan - The amount paid for a full-body scan was an allowed expense even though the taxpayer who underwent the test was not experiencing symptoms of illness and had not obtained a physician’s recommendation before undergoing the procedure. This procedure was for diagnosis, and since it did not have a non-medical function, it was allowed, despite its high cost or the possible existence of less expensive alternatives. (Rev. Proc. 2007-72)

Chiropractor - The amounts paid to chiropractors for medical care can be included in medical expenses.

Christian Science Practitioner - The amounts paid to Christian Science practitioners for medical care can be included in medical expenses.

Condoms – Per Notice 2024-71, the IRS announced that it will treat amounts paid for condoms as amounts paid for medical care and therefore deductible.

Cosmetic Surgery - This is defined as any procedure which is directed at improving the patient's appearance and does not meaningfully promote the proper function of the body or prevent or treat illness or disease. Cosmetic surgery or other similar procedures can't be taken into account as a medical expense deduction, unless the surgery or procedure is necessary to ameliorate a deformity arising from (or directlyrelated to) a (1) congenital abnormality, (2) personal injury resulting from an accident or trauma, or (3)disfiguring disease. (Code Sec. 213(d)(9)(A)) IRS specifically ruled that breast reconstruction surgery paid for by a breast cancer patient who had a mastectomy as part of her cancer treatment was a deductible medical expense. (Rev. Rul. 2003-57, 2003-22, IRB 959)

IRS allowed the cost of eye surgery to correct defective vision, including laser procedures such as LASIK and radial keratotomy, since these procedures are performed to correct a dysfunction of the body. (Rev. Rul. 2003-57, 2003-22, IRB 959)

Payments to a dentist to perform a teeth-whitening procedure on a patient whose teeth had discolored as a result of age were not deductible because the discoloration was not a deformity, was not caused by a disfiguring disease or treatment, and was done so as to improve appearance. (Rev. Rul. 2003-57, 2003-22, IRB 959)

Decedent’s Medical Expenses - Medical expenses of the decedent paid before death are claimed as an itemized deduction in the usual manner on the decedent’s final individual return. Medical expenses paid after the decedent’s death become the liability of the decedent’s estate, and they are claimed on the estate tax return (Form 706) when one is required to be filed. However, expenses that were paid out of estate funds within one year after the day of death can be treated as if paid by the decedent and claimed on the decedent’s final return instead. (IRC §213(c)(1); Reg §1.213-1(d)(1))

Strategy – Consult with the executor. Assuming (a) the decedent will itemize, (b) total medical expenses will exceed the 7.5% or 10%, as applicable, of AGI floor and (c) no Form 706 is required, it is clear that making the election, and deducting the medical expenses on the 1040 are appropriate. This also may require filing an extension or filing an original return and then later amending to take the additional medical expenses. If a 706 is being filed, but other expenses or allowed deductions reduce the gross estate to the point no tax is owed, it also makes sense to elect to claim the medical expenses on the decedent’s final 1040. To make the election, file a statement in duplicate with the decedent’s final return that the expenses are not being claimed on the estate tax return and that the estate waives the right to deduct the medical expenses at any time. The statement must be signed by the estate executor.

Diapers, Adult – See “Elderly Devices

Direct Primary Care Arrangements - Proposed regulations (NPRM REG-109755-19) released in June 2020 would define the costs for direct primary care arrangements as amounts paid for medical care and deductible as medical expenses. A direct primary care arrangement is a contract between an individual and one or more primary care physicians under which the physician or physicians agree to provide medical care for a fixed annual or periodic fee without billing a third party such as an insurance company. The IRS is also considering including in the definition a contract between an individual and a nurse practitioner, clinical nurse specialist, or physician assistant for this purpose. These regulations are proposed to apply for taxable years that begin on or after the date of publication of a Treasury decision adopting these rules as final regulations in the Federal Register.

Disabled Dependent Care Expenses - Some disabled dependent care expenses may qualify as either medical expenses, or work-related expenses for purposes of taking a credit for child and dependent care. The expenses can be applied either way if the same expenses are not used to claim both a credit and a medical expense deduction.

Drug Addiction - Amounts paid by a taxpayer to maintain a dependent in a therapeutic center for drug addicts, including the cost of the dependent's meals and lodging, are deductible medical expenses (Rev. Rul. 72-226).

Egg Donor Expenses - IRS has ruled privately (PLR 200318017) that a woman who can't conceive children using her own eggs may claim a medical expense deduction for the costs of obtaining an egg donor, including associated legal costs. IRS said that a procedure facilitating pregnancy by overcoming infertility similarly affects a structure or function of the body and also may be medical care. Expenses that prepare for and are directly related to a medical care procedure may also constitute medical care, IRS said. For example, Rev Rul 68-452, 1968-2 CB 111, holds that a kidney recipient who pays a kidney donor's surgical, hospital, and transportation expenses may deduct these costs as medical expenses. The ruling concludes that the costs of obtaining an egg donor, including the donor's expenses, are directly related and preparatory to her receiving the donated egg or embryo and may be deducted as medical expenses. IRS said that like other preparatory expenses, legal expenses may be deductible medical expenses if they bear a direct or proximate relationship to the provision of medical care to a taxpayer.

Elderly Devices - Questions frequently arise related to the deductibility of devices or supplies designed primarily for use by the elderly. Several devices, such as specialized phones with big buttons, pictures in place of the numbers, amplifiers for the hard of hearing, etc., are available without prescription. There are also medical alert devices that the elderly or infirm can wear and get medical help should they fall or have another medical emergency. To be deductible, these devices must meet the definition of a medical expense. In some cases, to meet the definition of a medical device requires the device to be prescribed by a medical professional and sometimes not. For instance, an individual who is deaf would be able to deduct the cost of a text (TTY) phone whether prescribed by a doctor or not, while one who is not deaf would not be able to deduct the cost. However, in an examination, the IRS might require proof the individual is deaf. Another example is the purchase of prescription eyeglasses, the cost of which would be deductible since they are prescribed, but the purchase of a magnifying glass at the drug store would not. However, where there is a question of whether the device is needed medically, a prescription from the doctor may be needed. Such would be the case for specialty phones, medical alert devices, adult diapers, etc.

Equipment and Supplies - IRS has ruled that the Sec. 213(b) prohibition against deductibility of nonprescription medicine or drugs does not apply to such items as crutches, bandages, and diagnostic devices (e.g., blood sugar kits used by diabetics). The costs of such equipment and supplies are deductible if they otherwise meet the general requirement of being paid for the diagnosis, cure, mitigation, treatment, or prevention of disease. (Rev. Rul. 2003-58, 2003-22, IRB 959)

Fertility Enhancement - Medical expenses include the cost of the following procedures to overcome an inability to have children (2022 IRS Pub 502, page 8).

-

Procedures such as in vitro fertilization (including temporary storage of eggs or sperm).

-

Surgery, including an operation to reverse prior surgery that prevented the person operated on from having children.

Gender Identity Disorder - IRS acquiesced to the U S Tax Court decision in O’Donnabhain v Commissioner (134 T.C. 34 (2010)) and no longer takes the position reflected in Letter Ruling 200603025. Thus, the costs of gender reassignment surgery and hormone replacement will be considered qualified medical expenses for persons with gender identity disorder. (Action on Decision 2011-03)

Genetic Testing - May funds from a flexible spending account (FSA) be used to purchase genetic testing services that include both reports on an individual's ancestry and health, including genetic health risks, carrier status and wellness traits? FSA funds are allowed to be used for medical purposes.

Code Sec. 213(d)(1)(A) provides that "medical care" is for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body. The term "diagnosis" encompasses the determination that a disease may or may not be present and includes testing of changes to the function of the body that are unrelated to disease.

Amounts paid by individuals for diagnostic and similar procedures performed without a physician's recommendation and on an individual not experiencing symptoms of an illness or disease, and a pregnancy test that tests the healthy functioning of the body, qualify as medical care. (Rev. Rul. 2007-72)

In a private letter ruling (PLR 201933005) the IRS indicated the taxpayer must allocate the price paid for the DNA collection kit and health services between the medical and non-medical items and services to determine what is deductible medical care. There are two steps to making this allocation.

-

The price of the DNA collection kit must be allocated between the ancestry services and the health services using a percentage (cost of the health services/total cost of ancestry plus health services).

-

As to the health services, the taxpayer may use a reasonable method to value and allocate the cost of the health services between services that are medical care (such as the testing at the laboratory) and non-medical services or items (such as the reports that provide general information on a test result).

Based on the IRS’s thinking in this matter, the same formula would apply for claiming the cost of the health portion of the testing as an HSA-eligible expense or an itemized deduction medical expense.

Guide Dog or Other Service Animal - The cost of a guide dog or other service animal to be used by a visually impaired or hearing-impaired person, or a person with other physical disabilities, can be included in medical expenses. The amounts paid for the care of these specially trained animals are also medical expenses. (Rev Rul 57-461; Rev Rul 68-295; IRS Pub 502) Based on these citations, expenses related to “emotional support animals” would not qualify as a medical deduction.

Health Care Sharing Ministry - Proposed regulations (NPRM REG-109755-19) released by the IRS in June 2020 would define expenditures for health care sharing ministry memberships as amounts paid for medical care that would be deductible as medical insurance. For the purposes of Sec 213, the proposed regulations define a health care sharing ministry as an organization:

-

Which is described in section 501(c)(3) and is exempt from taxation under section 501(a);

-

Whose members share a common set of ethical or religious beliefs and share medical expenses among themselves in accordance with those beliefs and without regard to the State in which a member resides or is employed;

-

Whose members retain membership even after they develop a medical condition;

-

Which (or a predecessor of which) has been in existence at all times since December 31, 1999, and medical expenses of its members have been shared continuously and without interruption since at least December 31, 1999; and

-

Which conducts an annual audit performed by an independent certified public accounting firm in accordance with generally accepted accounting principles and which is made available to the public upon request.

These regulations are proposed to apply for taxable years that begin on or after the date of publication of a Treasury decision adopting these rules as final regulations in the Federal Register.

Note: Membership in a health care sharing ministry would prevent an individual from contributing to an HSA.

Health Reimbursement Arrangements (HRA) Payments -Medical expenses paid by an HRA are not deductible since an HRA is a pre-tax plan funded by an employer.

Home Modifications - See “Impairment-Related Expenses.”

Household Help as a Medical Expense - The cost of household help cannot be included in medical expenses, even if such help is recommended by a doctor. This is a personal expense that is not deductible. However, certain expenses paid to a person providing nursing-type services may be included. See “Nursing Services” below. Also, certain maintenance or personal care services provided for qualified long-term care can be included in medical expenses.

Insurance Premiums - Amounts paid for insurance including medical, hospital, dental, long-term care (limited), lost or damaged contact lenses, prescription drugs and insulin, and Medicare-B and Medicare-D insurance premiums (see Medicare premiums) are allowed. Premiums paid through an employer’s flexible spending arrangement are not deductible because they are paid with pre-tax dollars. The deduction for insurance premiums for coverage acquired through a health exchange (Marketplace) is allowed net of the premium assistance credit. See also “Premium Tax Credit & Marketplace Insurance,” later in this text.

Self-Employed Health Insurance Deduction - A self-employed individual (or a partner or a more-than2%-shareholder of an S corporation) can deduct as an above-the-line expense 100% of the amount paid during the tax year for medical insurance on behalf of taxpayer, spouse, dependents, and children under age 27 even if the child is not a dependent (Code Sec. 162(l)(1)(D)). For the taxpayer to be eligible for the deduction, one of the following statements must be true:

-

Schedule C or F - The taxpayer was self-employed and had a net profit for the year reported on Schedule C (Form 1040) or Schedule F (Form 1040). The deduction cannot exceed the individual’s net earnings from self-employment derived from the trade or business for which the plan providing the coverage is established. Net earnings is the net profit from Schedule C or F reduced by the 50% of SE tax deduction (1040 Schedule 1, line 15) and/or the contributions to the taxpayer’s qualified retirement plan, SEP or SIMPLE plan (1040 Schedule 1, line 16) (Form 1040, Schedule 1, instructions worksheet). Schedule 1 line references are for the 2021 form. The health care policy can be either in the name of the business or in the name of the taxpayer.

-

S-Corporation Shareholder

-

Must be a more-than-2% S corporation shareholder.

-

The shareholder's Medicare wages (i.e., the amount from box 5 of Form W-2) from the S corporation are treated as the shareholder’s earned income (Form 7206 Line 11), and

-

The premiums paid or reimbursed by the S corporation are shown as wages on Form W-2 (Box 1).

-

The premiums are not subject to FICA or Medicare tax.

-

The policy can be either in the name of the S corporation or in the name of the shareholder.

-

If the S corporation pays the premiums, the premium amounts are included on Form W-2 as wages.

-

If the shareholder pays the premiums, and the policy is in the shareholder's name, the S corporation must reimburse the shareholder and report the premium amounts on the W-2 as wages. Otherwise, the insurance plan won't be considered established under the business.

-

-

Partner - The taxpayer is a partner with net earnings from self-employment for the year reported on Schedule K-1 (2023 Form 1065), box 14, code A. The policy can be in the name of the partnership or in the name of the partner.

-

If the partnership pays the premiums, the premium amounts must be reported on Schedule K-1, Form 1065, as guaranteed payments included in the partner's gross income.

-

If a taxpayer/partner pays the premiums, and the policy is in the taxpayer/partner's name, the partnership must reimburse the taxpayer and the premium amounts will be included in gross income as guaranteed payments on Schedule K-1. Otherwise, the insurance plan won't be considered established under the business.

-

“Subsidized” Health Plan - No deduction is available for any month in which the self-employed individual is eligible to participate in a “subsidized” health plan maintained by an employer of the taxpayer, the taxpayer's spouse, or any dependent, or any child of the taxpayer who hasn't attained age 27 as of the end of the tax year. This rule is applied separately to:

-

plans that provide coverage for qualified long-term care services, or are qualified long-term care insurance contracts and,

-

plans which don't include such coverage and aren't such contracts (Code Sec. 162(l)(2)(B)).

Thus, an individual eligible for employer-subsidized health insurance may still be able to deduct long-term care insurance premiums, so long as he isn't eligible for employer-subsidized long-term care insurance. Important Definition - The term “subsidized” means at least 50% of the cost of the coverage is paid by the employer (Sec 35(f)(1)).

No Double Dipping - The health insurance premiums claimed as an above-the-line SE health insurance expense cannot also be claimed as a Schedule A medical expense.

Impairment-Related Expenses - Capital Expenses - Amounts paid for special equipment installed in the home, or for improvements may be included in medical expenses, if their main purpose is medical care for the taxpayer, the spouse, or a dependent. The cost of permanent improvements that increase the value of the property may be partly included as a medical expense. The cost of the improvement is reduced by the increase in the value of the property. The difference is a medical expense. If the value of the property is not increased by the improvement, the entire cost is included as a medical expense.

Example - A doctor recommends that a taxpayer with severe arthritis have daily hydrotherapy. The taxpayer has a hot tub installed at a cost of $21,000. A certified home appraiser determined the hot tub addition increased the home’s value by $15,000. The taxpayer’s medical deduction for installing the hot tub will only be $6,000. The other $15,000 of expenses will increase the home’s basis, meaning that it will add to the home’s cost and will offset the sales price when the home is sold.

-

While the tax rules don’t require a prescription from a doctor for most medically related home modifications, the taxpayer, if questioned by the IRS, needs to be able to demonstrate how the expenditure is related to his or her medical care or that of a spouse or dependent. And having a letter from the individual’s doctor that explains the type of modifications that would be medically beneficial would help to prove a medical need.

Only reasonable costs to accommodate a home to a disabled condition are considered medical care. Additional costs for personal motives, such as for architectural or aesthetic reasons, are not medical expenses.

Not all improvements result in an increased home value (see list below). In fact, some, such as lowering cabinets for an occupant confined to a wheelchair, could actually decrease the home’s resale value.

On the flip side, there are circumstances where certain home modifications may actually increase the home’s value for buyers with disabilities.

Certain improvements made to accommodate a home to a taxpayer’s disabled condition, or that of the spouse or dependents who live with the taxpayer, do not usually increase the value of the home and the cost can be included in full as medical expenses. These improvements include, but are not limited to, the following items:

-

Constructing entrance or exit ramps for the home,

-

Widening doorways at entrances or exits to the home,

-

Widening or otherwise modifying hallways and interior doorways,

-

Installing railings, support bars, or other modifications,

-

Lowering or modifying kitchen cabinets and equipment,

-

Moving or modifying electrical outlets and fixtures,

-

Installing porch lifts and other forms of lifts but generally not elevators,

-

Modifying fire alarms, smoke detectors, and other warning systems,

-

Modifying stairways,

-

Adding handrails or grab bars anywhere (whether or not in bathrooms),

-

Modifying hardware on doors,

-

Modifying areas in front of entrance and exit doorways, and

-

Grading the ground to provide access to the residence.

In Vitro Fertilization - Although not specifically addressed in the Code, Regs, etc., it would appear that this procedure would be deductible if performed on the taxpayer claiming the expense., The code specifically allows procedures that affect the structure or function of the body. (Code Sec 213(d)(1)(A)) It also would be allowed under discretionary surgery performed on the taxpayer., Discretionary medical costs are generally deductible where they are not illegal under Federal law. For example, abortions, vasectomies, and procedures to render the taxpayer incapable of getting pregnant have been held deductible. (Rev Rul 97-9, 73-201 & 73-603) According to IRS Pub. 502 (2021, page 7), the cost of procedures to overcome an inability to have children are qualified medical expenses. Such procedures include in vitro fertilization (including temporary storage of sperm or eggs) and surgery, including surgery to reverse a prior operation performed to prevent the person from having children.

In Vitro Fertilization Expenses Denied in Absence of Medical Condition - A taxpayer was denied a medical expense deduction for in vitro fertilization (IVF) expenses. He was a fertile man who used IVF for nonmedical reasons. He had no physical or mental condition that prevented him from procreating without the use of IVF technologies. (W. Magdalin, TC Memo. 2008-293, Dec. 57,629(M)) Subsequently confirmed in appeals.

A married, male same-sex couple (the taxpayers) asked the IRS for a ruling as to which expenses would be deductible if Spouse 1 donated the sperm, Spouse 2’s sister donated the egg and a third-party (unrelated) was the gestational surrogate. The taxpayers wanted to have a child who had as much representative DNA from the couple as possible. The IRS said only the medical costs and fees directly attributable to the taxpayers are deductible within the limitations of IRC Sec 213, including sperm donation and sperm freezing. Referencing Magdalin and other cases, the IRS said that payments the taxpayers may make related to the following products and services are not deductible under IRC Sec 213: egg retrieval, IVF medical costs, childbirth costs and fees for the surrogate, surrogate medical insurance related to the pregnancy, legal and agency fees for the surrogacy, and other medical costs and fees arising from the surrogacy. (IRS Letter Ruling 202114001 (Jan. 12, 2021))

Lactation -The IRS in Announcement 2011-14 says that breast pumps and supplies that assist lactation are medical care under Code Sec. 213(d) because, like obstetric care, they are for the purpose of affecting a structure or function of the body of the lactating woman.

Lead-Based Paint Removal - The cost of removing lead-based paints from surfaces in a taxpayer’s home to prevent a child who has or has had lead poisoning from eating the paint can be included in medical expenses. These surfaces must be in poor repair (peeling or cracking) or within the child’s reach. The cost of repainting the scraped area is not a medical expense. If, instead of removing the paint, the area is covered with wallboard or paneling, treat these items as capital expenses. Do not include the cost of painting the wallboard as a medical expense. (2021 IRS Publication 502, page 10)

Learning Disability (Special Education) - Tuition fees paid to a special school for a child who has severe learning disabilities caused by mental or physical impairments, including nervous system disorders can be included in medical expenses. A doctor must recommend that the child attend the school. See “Schools and Education – Special” (discussed later). Tutoring fees recommended by a doctor for the child’s tutoring by a teacher who is specially trained and qualified to work with children who have severe learning disabilities may also be included. (2022 IRS Publication 502, page 13, Special Education)

Medical care includes the cost of attending a special school designed to compensate for or overcome a physical handicap, to qualify the individual for future normal education or for normal living. This includes a school for the teaching of Braille or lip reading. The principal reason for attending must be the special resources for alleviating the handicap. The cost of tuition for ordinary education that is incidental to the special services provided at the school, and the cost of meals and lodging supplied by the school also is included as a medical expense. The distinguishing characteristic of a special school is the substantive content of its curriculum, which may include some ordinary education, but only if the ordinary education is incidental to the school's primary purpose of enabling students to compensate for or overcome a handicap. (PLR 20052103)

The Tax Court has also held, and IRS has privately ruled that, where a school attended by a student with a medical problem doesn't qualify as a special school because the ordinary education isn't incidental to the special services provided, the costs of the special program or special treatment (but not the entire tuition) may still be a deductible medical expense

Legal Fees - A taxpayercan include in medical expenses legal fees paid that are necessary to authorize treatment for mental illness. However, do not include in medical expenses fees for the management of a guardianship estate, fees for conducting the affairs of the person being treated, or other fees that are not necessary for medical care. (2022 IRS Publication 502, page 10, Legal Fees)

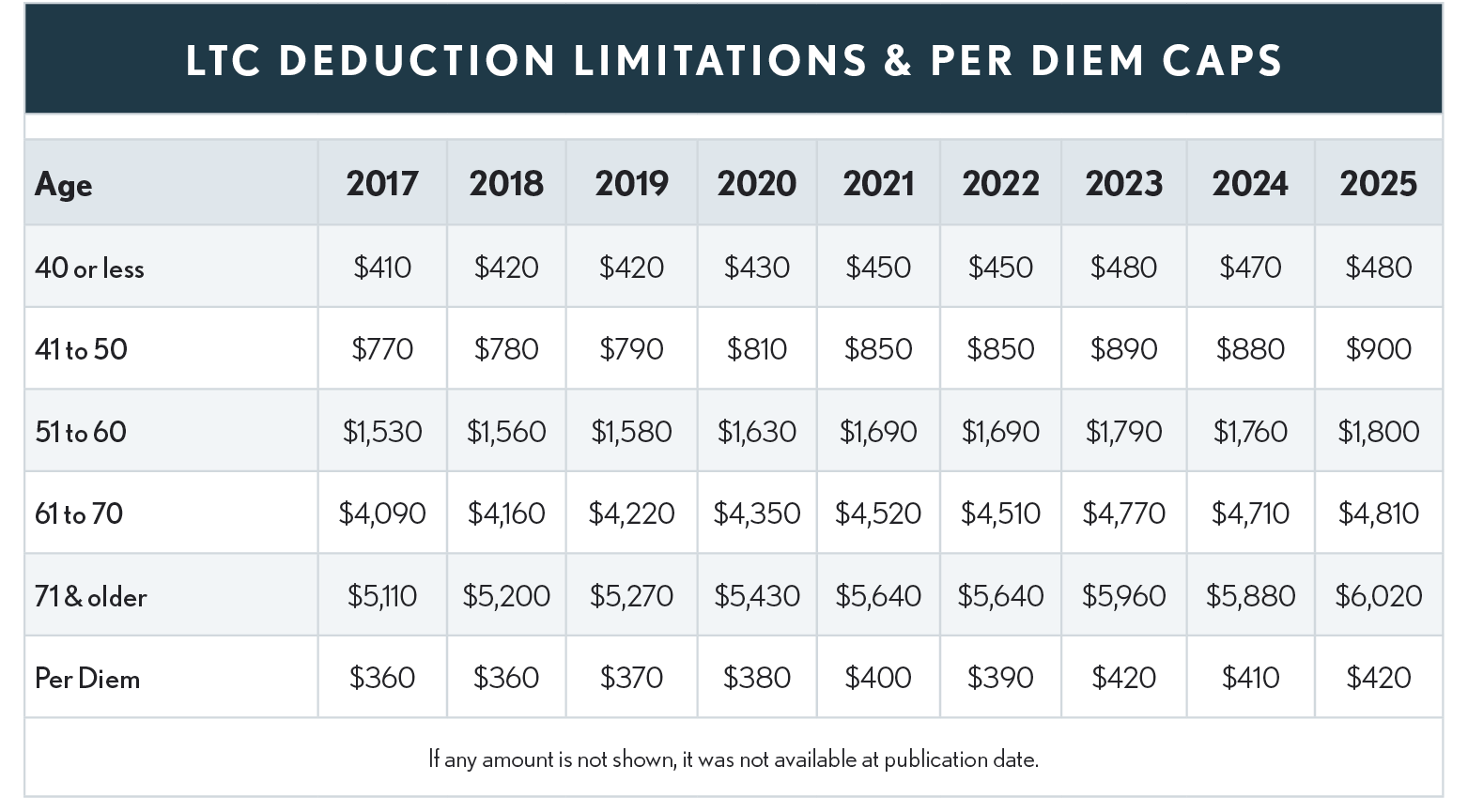

Long-Term Care Insurance - Amounts paid for long-term care services and certain premiums paid on long-term care insurance will be includible as medical expenses on Schedule A. Costs of care provided by a relative who is not a licensed professional or by a related corporation or partnership don’t qualify. The maximum amount of long-term care premiums treated as medical expenses depends on the insured’s age and is inflation-indexed annually. (IRC Sec 213(d)(10))

Employees generally won’t be taxed on the value of coverage under employer-provided long-term care plans. However, the exclusion doesn’t apply if coverage is provided through a cafeteria plan. In addition, long-term care services can’t be reimbursed tax-free under a flexible spending account.

Long-term contract - "Long-term contract" is an insurance contract that provides only coverage of long-term care and meets certain other requirements. Some long-term care riders to life insurance will also qualify. Benefits under a long-term care policy (other than dividends or premium refunds) are generally tax-free. With per diem contracts that pay a flat-rate benefit without regard to actual long-term care expenses incurred, the exclusion is limited to $175 a day indexed for medical cost inflation (amount for 2022 is $390) except when long-term care costs incurred are more than the flat rate and are not otherwise compensated by some other means.

A contract isn’t treated as a long-term care contract unless determination of chronically ill takes into account at least five activities of daily living--eating, toileting, transferring, bathing, dressing and continence. Although the contract must take into consideration at least five, the definition of chronically ill (below) only requires the individual to meet two of the five.

Long-term care services - “Long-term care services” include necessary diagnostic, preventive, therapeutic, curing, treating, mitigating, and rehabilitative services, maintenance or personal care services prescribed by a licensed practitioner for the chronically ill. (IRC Sec 7702B(c)(1))

Chronically ill person - "Chronically ill person" is one who has been certified by a licensed health care practitioner within the previous 12 months as: (1) unable to perform at least two activities of daily living (eating, toileting, transferring, bathing, dressing, continence) without substantial assistance for a period of 90 days due to loss of functional capacity, (2) having a similar level of disability as determined in regulations, or (3) requiring substantial supervision to protect from threats to health and safety due to severe cognitive impairment.(IRC Sec 7702B(c)(2))

The requirement that a qualified long-term care insurance contract must base determination of whether an individual is chronically ill by taking into account five activities of daily living applies only to (1) above (being unable to perform at least two activities of daily living).

Payments made as a charge against the cash surrender value of a life insurance contract - No medical expense deduction is allowed for payment of long-term care coverage under a qualified long-term care insurance contract if the payment is made as a charge against the cash surrender value of a life insurance contract or the cash value of an annuity contract. (Code Sec 7702B(e)(2))

Reporting requirements - A taxpayer who receives long-term care benefit payments will receive a Form 1099-LTC from the payer. Refer to the flow chart included in the instructions for Form 8853 for whether or not there are reporting requirements and if there are, which sections of the Form 8853 must be completed.

Medical Reimbursement - Amounts (other than policyholder dividends or premium refunds) received under a qualified long-term care insurance contract are treated as amounts received for personal injuries and sickness and are treated as reimbursement for expenses actually incurred for medical care. (Sec 7702B(a)(2))

Registered Domestic Partners - In states that recognize RDP relationships, the long-term care insurance premiums paid for the domestic partner may also be deductible for state but not federal purposes.

Refunded LTC Premiums Upon Death - Normally, any refund for long-term care insurance premiums applied to future premiums would generally not be taxable (Sec 7702B(b)(1)(E)). However, Sec 7702B(b)(2)(C) says that section does not apply when a taxpayer dies. The logic being there are no future premiums to pay. Thus, any refund received would be taxable income to the extent the taxpayer received a tax benefit for deducting the premiums as a medical deduction.

However, when the taxpayer is deceased when the refund is received it becomes income in respect of a decedent (IRD) to the extent it would have been taxable to the decedent if he or she had received the refund while still living.

Meals - Medical expenses may include 100% of the cost of meals at a hospital or similar institution if the main purpose for being there is to get medical care. The cost of meals that are not part of inpatient care may not be included.

Medical Alert - See “Elderly Devices”

Medical Conferences - IRS has ruled that a taxpayer may deduct the cost of attending a conference relating to a dependent’s disease. (Rev Rul 2000-24, 2000-19 IRB) In this ruling, the taxpayer was allowed to deduct the cost of the conference registration fee and travel to the conference, because those costs were primarily for a dependent's medical care and the taxpayer's attendance was essential for that care. The costs of meals and lodging were not deductible, because the dependent did not receive medical care at a licensed facility (a prerequisite for medical deduction of meals and lodging).

Medical Marijuana (Controlled Substance) - As a controlled substance that is not recognized as legal by the federal government, the cost of marijuana, even if (1) prescribed by a physician to alleviate pain or other symptoms of an illness or (2) legal under state law, is not deductible for federal purposes. (2021 IRS Publication 502, page 15)

Medicare Premiums

Medicare Part A - Medicare Part A is generally paid through payroll taxes and is sometimes referred to as the hospital insurance (HI) portion of FICA and SE taxes. This amount is not a medical expense. However, a taxpayer not covered under Social Security (or who was not a government employee who paid Medicare tax) can voluntarily enroll in Medicare A. In that case, the Medicare A premiums paid are included as a medical expense. The 2023 Part A premium for these individuals is up to $506/month, an increase from $499/month in 2022.

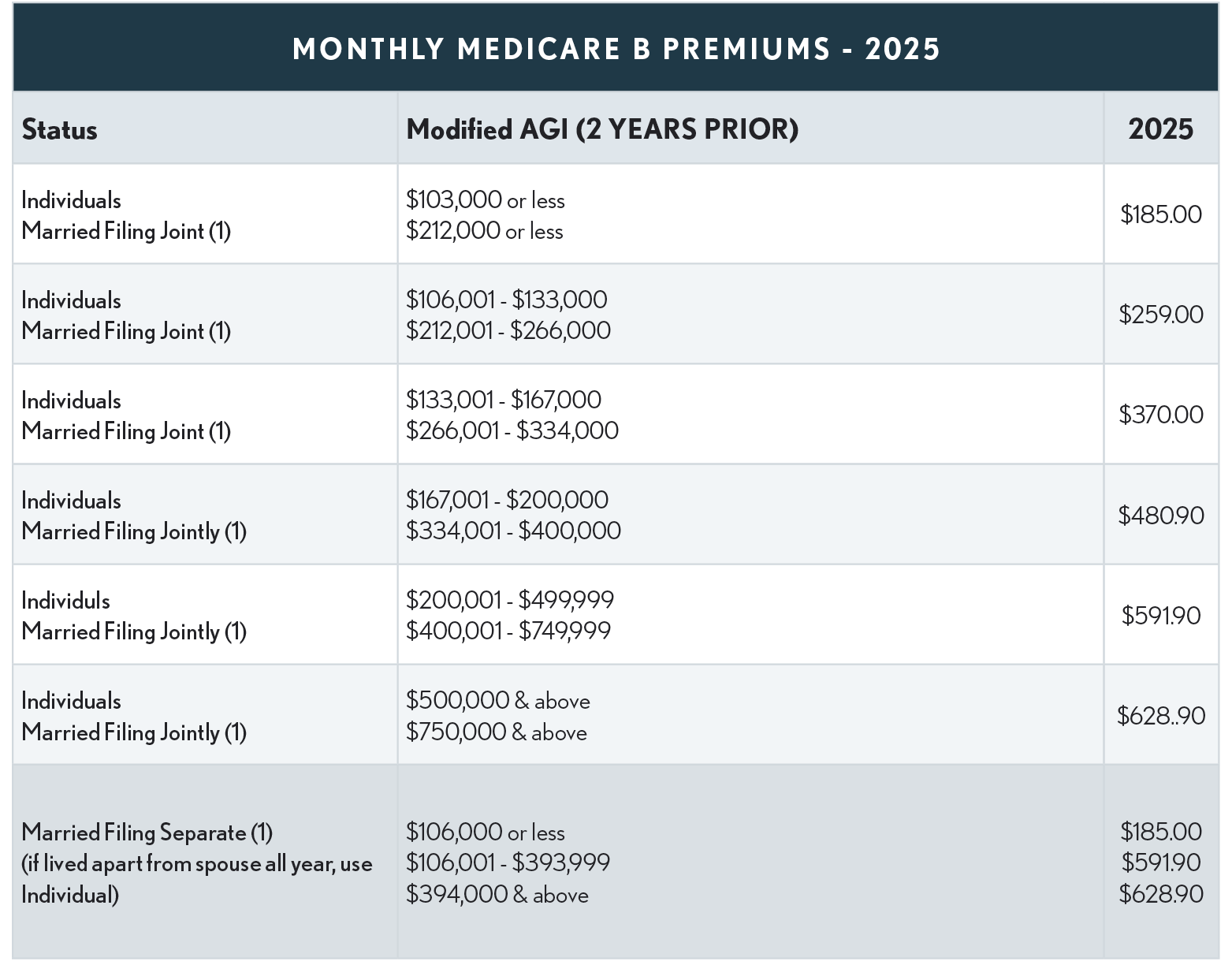

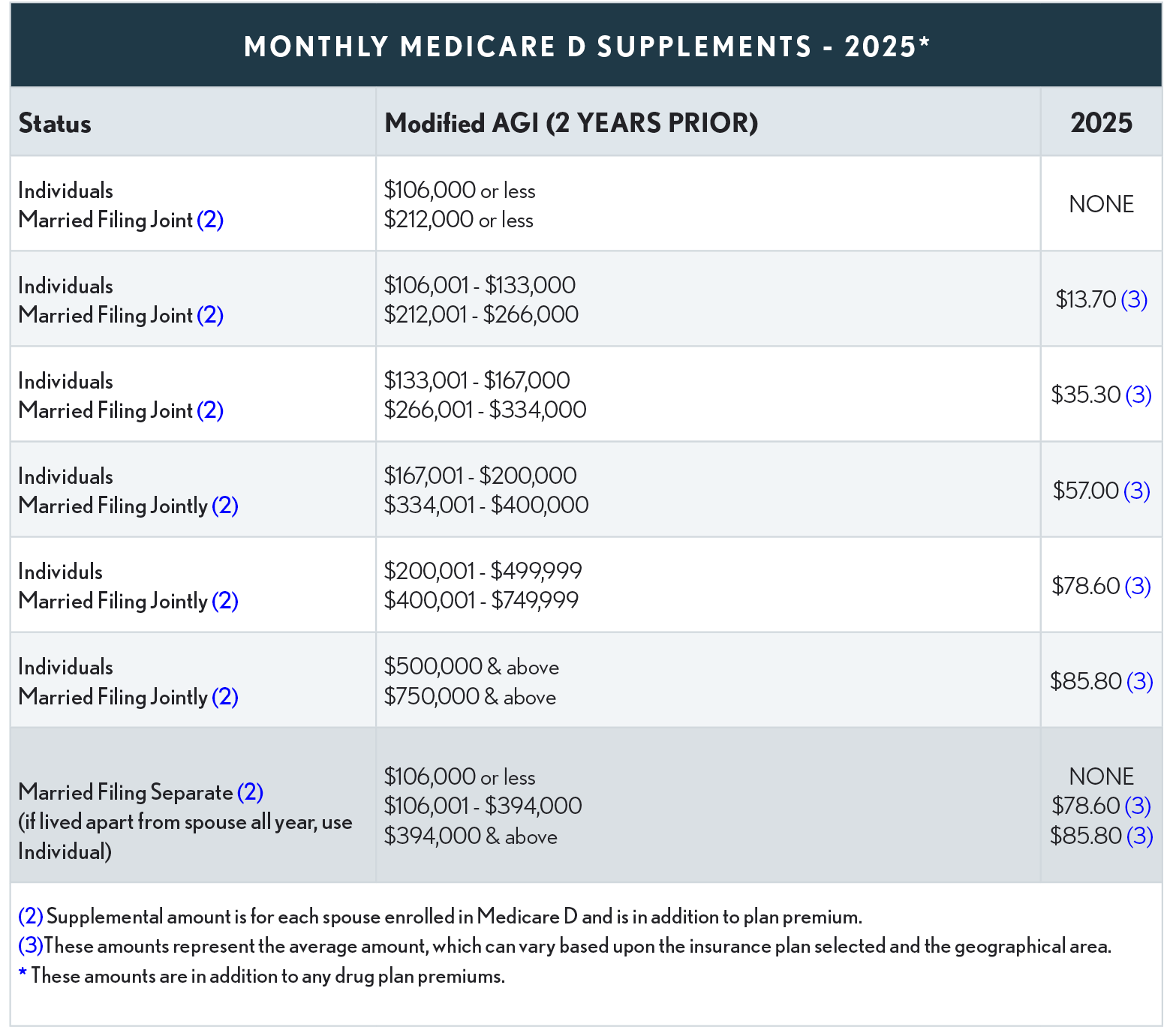

Medicare B and D - Both Medicare B (Medicare premiums) and Medicare D (Medicare prescription drug coverage) are treated and deducted as medical insurance premiums. The amounts paid or withheld from the individual’s Social Security income is based on the taxpayer’s MAGI two years previously. The following tables reflect the Medicare Part B monthly premiums and the Medicare Part D monthly supplement based upon a taxpayer’s MAGI. To determine the amount paid, add together both the Part B and D amounts.

Modified AGI - The modified AGI for making the adjustment is the Federal AGI plus the following:

-

Tax-exempt interest income;

-

United States savings bonds interest used to pay higher education tuition and fees if the interest was excluded from income on Form 8815;

-

Excluded foreign earned income and housing costs;

-

Income derived from sources within Guam, American Samoa, or the Northern Mariana Islands; and o , Income from sources within Puerto Rico.

Medicare Part C - Under this coverage, also known as Medicare Advantage, the participant pays the monthly Medicare B premium and also pays an additional monthly premium to the insurance company providing the coverage, although in some cases there is no extra premium. Both the cost of Medicare B premiums and any additional Part C premiums qualify as medical insurance premiums.

Married Filing Separate - For those taxpayers who qualify for Medicare, the premiums are based upon their modified adjusted gross income (MAGI) and filing status from the tax return two years prior. As the Medicare chart for 2025 above illustrates, the rates for individuals filing MFS are substantially higher than for other Medicare participants.

Example - For a married couple, living together in 2023 with a joint MAGI of $220,000, we can compare the results with them as Married Filing Separate and Married Filing Joint to see what the difference in Medicare premiums will be for 2025.

-

Married Filing Separate - Assume they evenly divide their joint MAGI, so each as a MAGI of $110,000. Using the MFS (lived together) table above, their individual premiums would be $591.90 per month or $7,102.80 per year. Their combined 2025 premiums would be: $14,205.60

Married Filing Joint - If they had filed MFJ their MAGI would have been $220,000. Using the Married Filing Joint tables their individual premiums would be $259.00 per month or $3,108.00 per year. Their combined 2025 premiums would be: $6,216.00. Thus, because they filed as MFS in 2023, their 2025 Medicare premiums increased by ($14,205.60 - $6,216.00): $7,989.60

Amended AGI - If the taxpayer subsequently amends the tax return for the year on which the AGI adjustment is based and there is a significant reduction in AGI for that year, the taxpayer can submit a copy of the amended return and the premium will be retroactively adjusted.

Effect of Major Life-Changing Events - The Social Security Administration will use a more recent tax year’s modified AGI, rather than the one of the second prior year, if the taxpayer experiences a major-life changing event, defined as:

-

Death of a spouse,

-

Taxpayer’s marriage or divorce,

-

Taxpayer or spouse stopping work or reducing the number of hours worked,

-

Reduction in income from income-producing property due to certain casualties or disasters, and

-

Reduction in income or loss of income from certain pensions, such as when a pension plan is terminated.

Married Couples - The monthly adjustment applies to each premium, so if both spouses are enrolled in Medicare, the couple will pay double the premium adjustment.

Moving - See the guide "Travel"

Non-Hospital Institutions - The following are examples of when expenses for nonhospital institutions are deductible:

-

All amounts paid by the taxpayer to maintain his mentally disabled son in a specially selected private home (which qualified as an “institution”) in accordance with the recommendation of the psychiatrist in charge of the son's case, to help the son adjust to life in the community after living in a mental hospital. (Rev Rul 69-499, 1969-2 CB 39),

-

Hotel meals and lodging, where taxpayer stayed in and received nursing service in the hotel, after getting appendicitis, having surgery in a hospital and being discharged from the hospital because it needed his hospital room. All these events took place in New York, while taxpayer lived in Milwaukee. At the time of his discharge, the attending physician said taxpayer was too weak to travel home., (Kelly, Daniel v. Com. (1971, CA7))

-

Amounts paid to maintain a child at a halfway house, including room and board. Admission to the halfway house required the recommendation of a psychiatrist and continued psychiatric supervision during the stay. The house staff included a psychiatrist and mental health counselor. (IRS Letter Ruling 7714016)

Nursing Home - Medical expenses include amounts paid for the cost of inpatient care at a hospital or similar institution if the main reason for being there is to receive medical care. This includes amounts paid for meals and lodging.

Allocation of retirement residence fees to resident's medical expenses (Delbert L. Baker, (2004) 122 TC) - The Tax Court has approved the use of the percentage method for determining what portion of monthly fees paid by a taxpayer to a continuing care retirement community qualified as deductible medical expenses. In doing so, the Tax Court rejected IRS's contention that the deductible amount had to be determined based on an actuarial analysis considering life expectancy and health care level expectancy. But no deduction was allowed for costs related to use of the pool and spa at the facility.

Nursing Services - Wages and other amounts paid for nursing services can be included in medical expenses. Services need not be performed by a nurse if the services are of a kind generally performed by a nurse. This includes services connected with caring for the patient's condition, such as giving medication or changing dressings, as well as bathing and grooming the patient. These services can be provided in the home or another care facility.

Generally, only the amount spent for nursing services is a medical expense. If the attendant also provides personal and household services, these amounts must be divided between the time spent performing household and personal services and the time spent for nursing services. However, certain maintenance or personal care services provided for qualified long-term care can be included in medical expenses.

Part of the amounts paid for that attendant's meals are also included in medical expenses. Divide the food expense among the household members to find the cost of the attendant's food. If additional amounts for household upkeep were paid because of the attendant, include the extra amounts with the medical expenses. This includes extra rent or utilities paid, because a larger apartment was needed to provide space for the attendant.

Additionally, certain expenses for household services or for the care of a qualifying individual incurred to allow the taxpayer to work may qualify for the child and dependent care credit. However, the same expense cannot be used for both the credit and the Schedule A medical deduction.

Over-the-Counter Drugs - The costs of over-the-counter drugs are not allowed as a medical deduction unless specifically prescribed by a health care professional; an exception applies for insulin. Over the counter drugs cannot be paid for from health care flexible spending accounts (FSAs) and health reimbursement arrangements (HRAs) unless they are purchased with a prescription. (Rev Rul 2010-23).

Organ Donor - The costs of medical expenses incurred as an organ donor or possible organ donor, including medical care in connection with donating a kidney or other organ and transportation, are deductible medical expenses of the donor. In addition, the organ recipient can deduct the cost of medical care he or she pays in connection with the donating of the organ, including the donor’s transportation. (2021 Publication 502, page 13, Transplants)

Phones - See “Telephone”

Physical Exam - The amount a taxpayer paid for an annual physical exam, even though the taxpayer was not experiencing any symptoms of illness, was allowed. It qualified because it was for diagnosis. (Rev. Proc. 2007-72)

Personal Protective Equipment (PPE) - In an announcement, the IRS has said that amounts paid for personal protective equipment, such as masks, hand sanitizer, and sanitizing wipes, for the primary purpose of preventing the spread of the coronavirus, are treated as amounts paid for medical care under Code Sec. 213(d). (Ann. 2021-7)

Pregnancy Test - The cost of a self-administered pregnancy test was deductible even though its purpose was to test the healthy functioning of the body rather than to detect disease. (Rev. Proc. 2007-72)

Premium Tax Credit & Marketplace Insurance - The amount of health insurance paid through the marketplace that is a medical deduction on Schedule A or treated as self-employed health insurance is the cost of the insurance net of the PTC allowed. Use the following worksheet to determine the deductible amount. (2022 IRS Pub 502, Page 12).

Insurance Premiums $_______

Advance Premium Tax Credit(APTC) <_______ >

PTC Repaid _______

Additional PTC Received <_______ >

Medical Insurance Deduction $_______

Premium Tax Credit Repayments - Where a taxpayer repays the PTC, that repayment could increase their medical itemized deduction or their above-the-line self-employed health insurance deduction, depending upon the circumstances. However, contrary to the general rules for cash basis taxpayers, and based on the example in Pub 502, the deduction will go to the year of the credit and not the year in which the credit is repaid.

Example 1 - Amy is under age 65 and unmarried. The cost of her health insurance premiums in 2023 is $8,700. Advance payments of the premium tax credit of $4,200 are made to the insurance company and Amy pays premiums of $4,500. On her 2023 tax return, Amy is allowed a premium tax credit of $3,600 and must repay the $600 excess advance credit payments (which is less than the repayment limitation). Amy is treated as paying $5,100 ($8,700 less the allowed premium tax credit of $3,600) for health insurance premiums in 2023.

-

| Insurance Premiums | $8,700 |

| Advance Premium Tax Credit (APTC) | <4,200> |

| PTC Repaid | 600 |

| Additional PTC Received | <0> |

| Medical Insurance Deduction | $5,100 |

Public Safety Officers (Retired) - Eligible retired public safety officers (police officers, firefighters, chaplains, or members of a rescue squad or ambulance crew) may elect to exclude governmental retirement plan distributions that don't exceed the amount the employee paid for qualified health or long-term care premiums, if the distributions are paid directly to insurers. SECURE 2.0 Act Section 328 repeals the direct payment requirement effective December 29, 2022.

The exclusion is limited to $3,000 per year. Any amount excluded isn't deductible as a medical expense for itemized deductions and isn’t includible as health insurance for the self-employed health insurance deduction (PPA § 845). The retired employee will need to include an attestation in their return that the distribution does not exceed the amount the employee paid for qualified health insurance premiums for the year of the payment (Sec 402(l)(5)(A)(ii)). IRS Notice 2007-7 explains the exclusion for qualifying payouts to public safety officers:

-

A public safety officer is an individual serving a public agency in an official capacity, with or without compensation, as a law enforcement officer, a firefighter, a chaplain, or as a member of a rescue squad or ambulance crew.

-

The exclusion is available only to public safety officers who separate from service:

-

After attaining normal retirement age or

-

Due to disability. It is not available to surviving spouses or dependents after the public safety officer dies.

-

-

The exclusion applies only if an eligible retired public safety officer elects to have an amount subtracted from his distributions from an eligible government plan (one described in Code Sec. 414(d) that is either a Code Sec. 403(a) or Code Sec. 403(b) plan, or an eligible governmental plan under Code Sec. 457(b)) and uses that amount to pay qualified health insurance premiums. The employer sponsoring the eligible government plan is not required to offer such an election.

-

Prior to December 30, 2022 the distribution had to be paid directly to an accident or health insurance plan that provides insurance issued by an insurance company regulated by a State (including a managed care organization that is treated as issuing insurance). The direct-payment by the payer requirement was repealed by the SECURE 2.0 Act.

-

Benefits attributable to service other than as a public safety officer are eligible for favorable tax treatment under Code Sec. 402(l), as long as the individual separates from service as a public safety officer, because of disability or after attaining normal retirement age, with the employer maintaining the eligible government plan.

Tax Law Inconsistency - When deducting long-term care (LTC) insurance premiums as a medical deduction, the deduction is limited based on the taxpayer’s age to an annually inflation-adjusted amount. However, when justifying the $3,000 pension exclusion for retired public service officers (PSOs) the full amount of the premiums is used in the computation. (IRC Sec 402(l)(4)(D) In addition, there is no double dipping so the insurance premiums used to compute the exclusion cannot also be used as a medical deduction. Where there are both qualifying health insurance premiums and LTC premiums, it is more beneficial to use the LTC premiums for the exclusion computation since they generally would be limited as a medical deduction. The code does not specify which should be used first.

Form 1040 Instructions - The amount shown in box 2a (taxable amount) of Form 1099-R doesn't reflect the exclusion. Therefore, enter the total distributions on line 5a and the taxable amount (after subtracting the excludable amount) on line 5b and enter “PSO” next to line 5b. (2021 1040 Instructions, Pg. 27)

If the taxpayer is retired on disability and reporting his or her disability pension on Form 1040, line 1, include only the taxable amount on that line and enter “PSO” and the amount excluded on the dotted line next to line 1.

Schools and Education – Special - A taxpayercan include in medical expenses payments to a special school for a mentally impaired or physically disabled person if the main reason for using the school is its resources for relieving the disability. A taxpayer can include, for example, the cost of:

-

Teaching Braille to a visually impaired child,

-

Teaching lip reading to a hearing-impaired child, or

-

Giving remedial language training to correct a condition caused by a birth defect. The cost of meals, lodging, and ordinary education supplied by a special school can be included in medical expenses only if the main reason for the child’s being there is for the resources the school has to relieve the mental or physical disability.

Do not include in medical expenses the cost of sending a problem child to a special school for benefits the child may get from the course of study and the disciplinary methods.

Smoking-Cessation Programs - IRS has ruled that uncompensated amounts paid by taxpayers for participation in smoking-cessation programs and for prescribed drugs designed to alleviate nicotine withdrawal are eligible medical expenses. (Rev Rul 99-28, 1999-25 IRB; IR-1999-55) However, because of the Code Sec. 213(b) prohibition of deductions for most nonprescription drugs, no deductions are permitted for the costs of nonprescription nicotine gum and certain nicotine patches.

Social Security Taxes for Household Employees - If a domestic employee, such as a nurse, is paid cash wages of $2,600 or more in 2023, there will generally be withholding and social security and Medicare taxes that must be paid.

Spouse - Prior or Current - A taxpayer can include medical expenses paid for a prior or current spouse provided the taxpayer was married to the spouse either at:

-

The time the spouse received the medical services or

-

At the time the taxpayer paid the medical expenses. (2022 Pub 502, page 3)

Stem Cell Therapy and Storage - Medical expenses are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and the costs for treatments affecting any part or function of the body including dental expenses (IRC Sec. 213). Thus, treatment of an ailment with stem cell therapy would qualify as a medical deduction.

Cord blood contains stem cells that doctors may use to treat disease. Thus, expenses for banking cord blood to treat an existing or imminently probable disease may qualify as deductible medical expenses. However, banking cord blood as a precaution to treat a disease that might possibly develop in the future does not satisfy the existing legal standard that at a minimum a disease must be imminently probable. (IRS Information Letter 2010-0017)

Sterilization - The cost of a legal sterilization (a legally performed operation to make a person unable to have children) can be included in medical expenses.

Surrogacy Fees - You won’t run across it very often, because the number of surrogacies compared with conventional births is very small. Generally, surrogacy arrangements are made through surrogacy agencies. Surrogacy is a legal arrangement – the surrogate mother, the parents and the agency all have entered into a binding contract and in the event of a breach of that contract, can be held to the terms of the agreement.

Tax Treatment for the Surrogate - The Internet contains a wide variety of opinions related to the taxability of the surrogacy fee to the surrogate mother. Some authors classify this fee as a gift; however, a U.S. Supreme Court decision (Commissioner vs. LoBue, Philip (1956, S Ct)) stated that, for tax purposes, gifts must be made out of detached or disinterested generosity. Any payment that parents make to a surrogate mother cannot reasonably be considered detached or disinterested, so surrogate fees are not gifts.

On the other hand, many surrogacy agencies advise their clients that surrogacy payments are for pain and suffering and thus are exempt under IRC Sec 104. This section is about “compensation for injury or sickness”; however, the term “pain and suffering” does not appear anywhere in that section. Surrogacy does not meet the definition of an excludable physical injury under IRC Sec 104 such as an injury associated with a car accident, bungled surgery or other accident. Thus, surrogacy fees do not fall under the compensation exclusion for injury or sickness.

Sec 61 states, “Except as otherwise provided, gross income means all income from whatever source derived.” There is no exception in the code for surrogacy fees, so such fees are considered taxable income for the surrogate mother. To complicate matters, the surrogate mother is providing a personal service and thus may be subject to self-employment tax in addition to income tax if such a fee is received in the course of a business.

To be subject to Social Security (SE) tax, the surrogacy arrangement would have to rise to the level of a trade or business. The determination of whether that is the case is dependent on the facts and circumstances of the individual surrogacy. For instance, if a surrogate has entered into such an arrangement previously or intends to do so again, the fee will likely be considered self-employment income. However, if the surrogacy is a one-time activity, an argument could be made that this act is not a business—in which case the surrogacy fee would not be subject to SE tax.

If the fee is considered self-employment income, it may be offset with benefits that are available to any selfemployed taxpayer, including the ability to deduct health insurance above the line rather than as an itemized deduction and the ability to make deductible contributions to a self-employed retirement plan or IRA. Although there are not many deductible business expenses in such a situation, the legal or other costs associated with drafting and executing the surrogacy contract are deductible.

A self-employment surrogacy activity would fall into the category of a specified service business for the purposes of the Sec 199A self-employed and pass-through business deduction. Thus, provided that the surrogate mother’s return (for 2023) has taxable income that does not exceed $182,100 (or $364,200 if she is married and files a joint return with her spouse), she would be eligible for the IRC Sec 199A pass-through deduction, which is equal to 20% of the net self-employment income. However, this deduction phases out at 2023 taxable incomes between $182,100 and $232,100 (or $364,200 and $464,200 if filing jointly). The income from self-employment surrogacy can be used to determine the earned income tax credit if a surrogate mother is otherwise qualified.

Unfortunately, tax novices on the Internet are creating their own interpretations of the tax code, and many of them are attempting to justify their preferences instead of describing the actual rules.

As a result, many—dare we say, most—surrogate mothers are not reporting their surrogacy income. The IRS is not catching up with them because neither the parents nor the agencies are issuing 1099-NEC forms to surrogate mothers. The parents are under no obligation to issue a 1099-NEC because, for them, the payment is not related to a business. The agency, on the other hand, is a business, so if the surrogacy fee passes through it, the agency is obligated to issue a 1099-NEC.

Tax Treatment for the Parents - Surrogate mothers’ expensesare not specifically addressed in the IRC or in other regulations. Under current tax law, the only place that a surrogate fee could be deducted is as a medical expense. However, consider the following:

-

Medical deductions are allowed only for the medical care of the taxpayer, spouse and dependents (IRC Sec 213(a)).

-

These expenses must be for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body (IRC Sec 213(a)(1)(A)).

A surrogate mother is, by definition, neither the taxpayer nor the taxpayer’s spouse, and she is typically not a dependent either. An unborn child is also not a dependent (Cassman v. United States, 31 Fed. Cl. 121 (1994)). Thus, medical expenses paid to a surrogate mother and her unborn child do not qualify for a medical deduction.

This fee also cannot be construed as a treatment for a female taxpayer’s inability to conceive.

Thus, the new parents cannot deduct the surrogacy fee or any agency fees, legal fees, and medical expenses for the surrogate mother and unborn fetus.

Surrogate Mother Expenses - As with in vitro fertilization, this issue is not specifically addressed in the Code, Regs, etc. The Code does tell us that medical expenses are only deductible for the taxpayer, spouse and dependents. The definition of a dependent for medical purposes ignores the gross income and joint return tests. Therefore, it appears that a surrogate mother’s medical expenses can only be deducted if she qualifies as a “medical dependent.” The unborn fetus is not a dependent until actually born.

The office of Chief Counsel has provided some guidance on this issue in a letter to a taxpayer:

Section 213(a) of the Internal Revenue Code allows a taxpayer to deduct the expenses paid during the taxable year, not compensated for by insurance or otherwise, for medical care of the taxpayer, the taxpayer's spouse, or the taxpayer's dependents (as defined in § 152), to the extent the expenses exceed 7.5 percent of adjusted gross income. Section 152(a) [prior to amendment by the Working Families Tax Relief Act of 2004] defines a dependent as (1) an individual listed in the section (2) for whom the taxpayer provided over half of the support for the taxable year.

A surrogate mother is, of course, neither the taxpayer nor the taxpayer's spouse, and typically is not a dependent of the taxpayer. Nor is an unborn child a dependent. Cassman v. United States, 31 Fed. Cl. 121 (1994) Thus, medical expenses paid for a surrogate mother and her unborn child would not qualify for deduction under § 213(a).

Under very limited circumstances, legal fees may be allowable as medical care expenses. In Gerstacker v. Commissioner, 414 F.2d 448 (6th Cir. 1969), legal expenses incurred to create a guardianship in order to involuntarily hospitalize a medically ill taxpayer were held to be deductible medical expenses because the medical treatment could not otherwise have occurred. However, legal expenses incurred in connection with a surrogate mother are typically not in connection with otherwise-deductible medical care expenses. Thus, the legal expenses likewise would not be deductible under § 213(a). (Associate Chief Counsel Letter #INFO 2002-0291, 12/31/02, Index 213.02-00)

Homosexual Discrimination? - The biological father was capable of producing and providing healthy sperm with or without the involvement of an egg donor or a gestational surrogate; [2]-Because the costs attributable to the identification, retention, compensation, and care of the egg donor and the surrogate weren't incurred for the purpose of affecting any function of the father's body, he could not deduct them as "medical care" expenses under Sec 213(d); [3]-The father's asserted right to IVF-and-surrogacy-assisted reproduction was not a fundamental right subject to equal rights protection; [4]-There was no evidence that the IRS's actual decision makers engaged in any intentional discrimination because the father was a homosexual, and he had not been treated differently from similarly situated heterosexual taxpayers. (Morrissey vs U.S. 871 F.3d 1260, Appeal Court, 7th Circuit, 9/25/2017)

Telephone - Included in medical expenses is the cost of special telephone equipment that lets a person who is deaf, hard of hearing or has a speech disability communicate over a regular telephone. This includes teletypewriter (TTY) and telecommunications device for the deaf (TDD) equipment and the repair of the equipment.

Television - Included in medical expenses is the cost of equipment that displays the audio part of television programs as subtitles for persons with a hearing disability. This may be the cost of an adapter that attaches to a regular set. It also may be the part of the cost of a specially equipped television that exceeds the cost of the same model regular television set.

Transplants - See “Organ Donors”

Travel - See the guide "Travel"

Tuition - A lump-sum fee that includes education, board, and medical care, but that does not distinguish which part of the fee relates to medical care, is not considered an amount paid for medical care, and therefore not deductible. However, charges for a health plan included in a lump-sum tuition fee qualify if the charges are separately stated or can easily be obtained from the school.

Weight-Loss Programs - The IRS has concluded that expenses for certain weight-loss programs may be deducted as a medical expense. To be deductible, the program must be undertaken as treatment for a specific disease or diseases (including obesity) diagnosed by a physician. The costs are not deductible by taxpayers who participate in weight-loss programs to improve their general health or appearance. Further, the cost of purchasing diet food items is not deductible. (Rev. Rul. 55-261, 1955-1 CB 307, and Rev. Rul. 79-151, 1979-1 CB 116, are distinguished)

Caution: IRS Publication 502 takes a restrictive view of this deduction. It says that “You can include in medical expenses amounts you pay to lose weight for a specific disease diagnosed by a physician (such as obesity, hypertension, or heart disease). This includes fees you pay to join a weight reduction group and attend periodic meetings. You cannot include membership dues in a gym, health club, or spa but you can include separate fees charged there for weight loss activities.”

Thus, IRS Publication 502 seems to be saying that no portion of membership dues paid to a gym, health club or spa qualifies as a deductible medical expense in any case—even if the individual joined on the advice of a physician to lose weight to combat a disease.

Wig - A taxpayercan include in medical expenses the cost of a wig purchased upon the advice of a physician for the mental health of a patient who has lost all his or her hair from disease. (IRS Publication 502)