Definitions in Investment Interest

Investment Interest Expense

Investment Interest Expense is all interest on debts used to carry or purchase investment property (e.g., stocks, bonds, or land held for appreciation). However, interest on loans used to buy investments which produce tax-exempt interest income is not deductible as investment interest expense. In fact, such interest is not deductible at all. In addition, interest taken into account in determining gain or loss from a passive activity is NOT investment interest.

Investment Expenses

Investment Expenses are expenses (other than interest) incurred to produce investment income and which are normally deductible as Tier 2 miscellaneous itemized deductions on Schedule A. CAUTION: Under TCJA Tier 2 miscellaneous itemized deductions are not deductible for years 2018 through 2025. Form 4952 instructions use depreciation and depletion allowed on assets that produce investment income as examples of eligible investment expenses.

Caution

The term Investment Income has a different meaning when applied to the limitations on investment interest (IRC Sec 163) than it does for the Net Investment Income Tax, the 3.8% surtax on NII discussed at Chapter 11.3 (IRC Sec 1411). IRC Sec 163(d)(4)(D) says: “Investment income and investment expenses shall not include any income or expenses taken into account under IRC Sec 469 in computing income or loss from a passive activity,” whereas Sec 1411 requires that rental income and passive trade and business income be included as investment income.

Investment Income for Purposes of the Investment Interest Expense

Includes gross income from:

-

Interest, dividends, non-qualified annuities, and royalties, whether received directly or from a passthru entity, and not derived from a trade or business;

-

Capital gains (other than derived from a trade or business) that are not elected to be taxed at the lower capital gains tax rates;,

-

Substantially non-depreciable property;

-

Equity-financed lending activities;

-

Acquisition of certain interests in a pass-through entity licensing intangible property. ,(Temp. Reg.

1.469-2T(f)(10)).

Cancellation of Debt Income

Cancellation of debt (COD) income can be investment income. In Letter Ruling 9522008, the IRS held that discharge of debt on a loan traceable to investment property is investment income, but only to the extent the debt relief income isn’t excludable from gross income.

Allocation

Whether a debt is allocable to investment property is to be determined under the interest allocation rules of Reg. 1.163-8T by tracing the use of the proceeds of the debt.

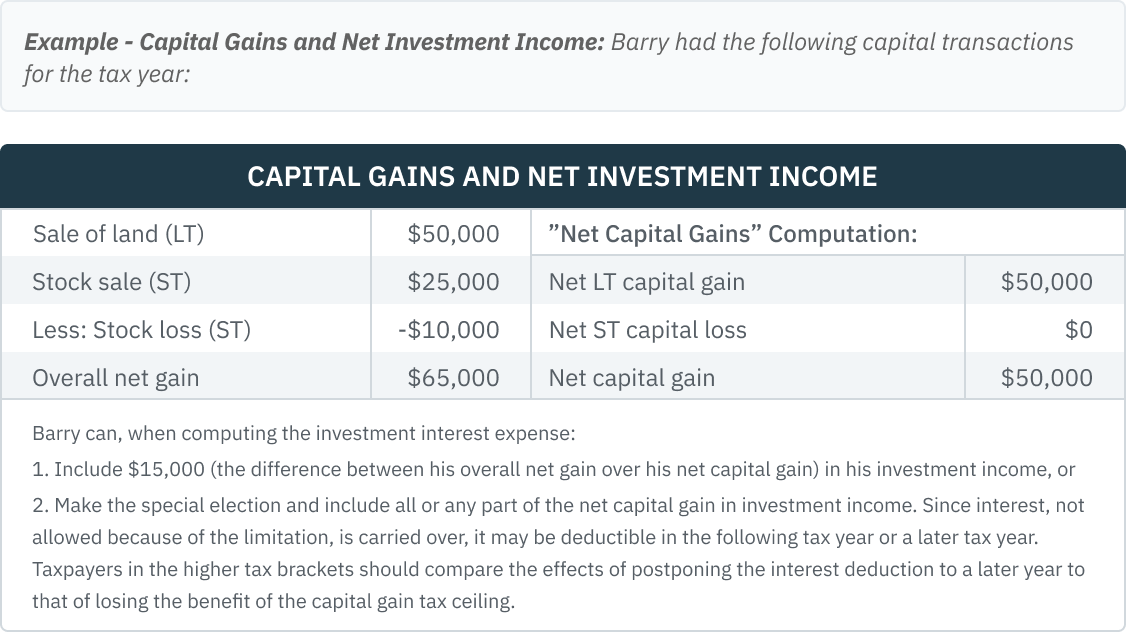

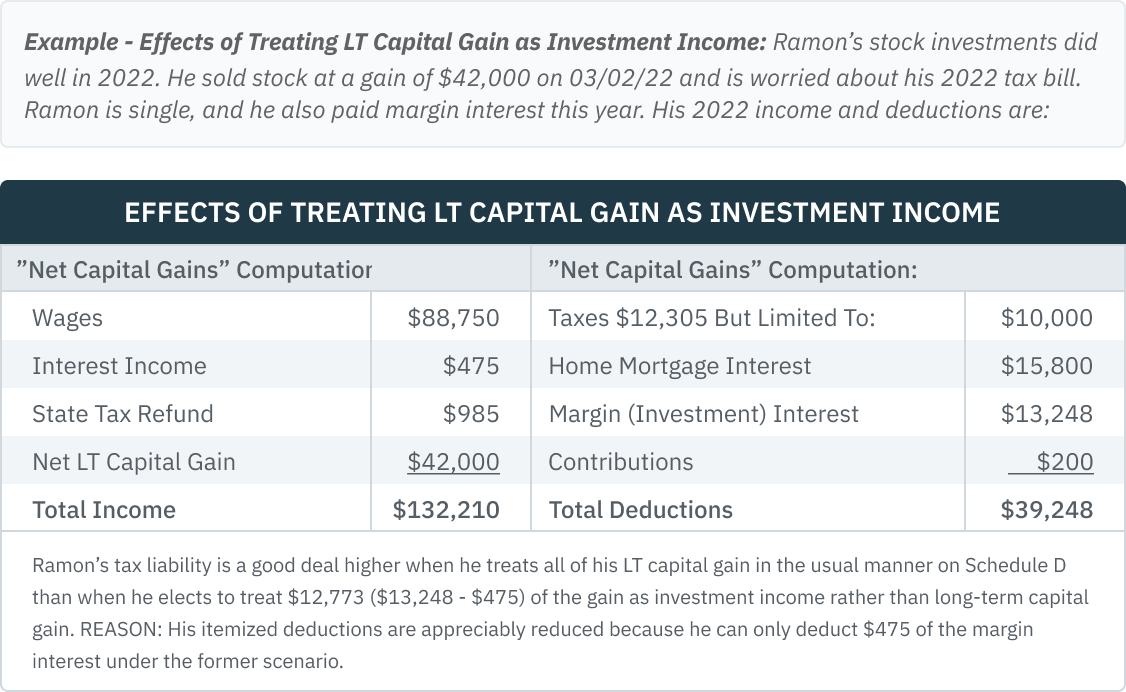

Capital Gains Election

“Net capital gain” on investment property generally can’t be included in investment income for purposes of computing net investment income for the investment interest limitations, unless a taxpayer elects to include all or any part of it as investment income. However, any net capital gain which the taxpayer includes as investment income under this election, must be excluded from the gain that qualifies for the lower tax rates on capital gains. This election will have no effect on the Net Investment Income Tax, the 3.8% surtax on NII computation discussed at chapter 12.05 (IRC Sec 1411), since all capital gains except those derived from a trade or business are included in investment income for purposes of that tax.

Net Capital Gain

“Net capital gain” is the excess of net long-term capital gain over net short-term capital losses. The rule doesn’t affect the treatment of net short-term capital gain in the calculation of net investment income since short-term capital gain gets no tax rate break.

Dividend Election

Qualified dividends (those that would be eligible for the 0%, 15% and 20% tax rates) are not included as investment income for the investment interest expense limitation calculation unless the taxpayer makes an election to treat them as investment income for this purpose. Dividends elected to be investment income are taxed at ordinary income rates and are not eligible for the 0%, 15% and 20% tax rates. This is similar to the capital gains election discussed above.

When and How to Make Election

The elections described above for treating net capital gain and qualified dividend income as investment income must be made on or before the extended due date of the return for the year the net capital gain is recognized, or the qualified dividend income is received. The election is made as part of the investment interest limitation calculation on Form 4952. (Reg § 1.163(d)-1(b)) The elections are revocable with consent of the IRS Commissioner.

Small Business Stock Gain

50% of the gain on certain qualified small business stock (QSBS) held over 5 years is excluded from capital gains. Note: for the following periods, and provided the stock is held over 5 years, the exclusion is:

-

75% gain exclusion for stocks issued after 2/17/2009 and through 9/27/2010.

-

100% gain exclusion for stocks issued after September 27, 2010. The 100% exclusion rate was made permanent by the PATH Act of 2015. In addition, there is no AMT preference when the exclusion percentage is 100%.

Any gain excluded under this provision is not treated as investment income. See chapter 2.7 for details on QSBS.

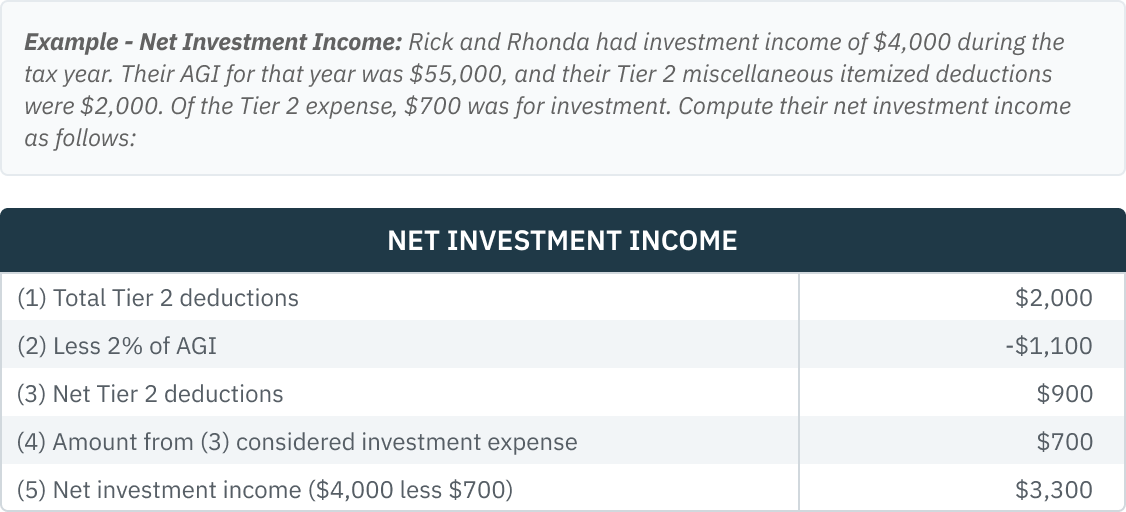

Net Investment Income (Except for years 2018 through 2025)

Net Investment Income is the excess of investment income over allowed investment expenses. To compute net investment income, use investment expenses AFTER applying the 2% floor on Schedule A. Consider Tier 2 expenses, WHICH ARE NOT INVESTMENT EXPENSES, as the first disallowed by the 2% reduction.

Net Investment Income (2018 through 2025)

Since TCJA has suspended Tier 2 itemized deductions for years 2018 through 2025, net investment income is not adjusted by investment expenses that in years other than 2018-2025 would be allowed as a tier 2 miscellaneous deduction. So, in most cases for 2018-2025 net investment income is simply the sum of investment income.

AMT Considerations

Investment interest is deductible for both regular and AMT purposes to the extent of net investment income. However, because the interest from private activity municipal bonds generally is taxable for AMT purposes, taxpayers with private activity bond income will have a higher net investment income and, therefore for AMT purposes, will be allowed to deduct more investment interest expense. This also creates two investment interest carryovers, one for regular tax and one for the AMT. Generally, most preparation software will make both carryover computations. Line 2c on Form 6251 (2021) compensates for the differences between the regular investment interest deduction and the AMT investment interest deduction.

AMT Strategy - Omit Investment Expenses

(For years other than 2018 through 2025 since investment expenses are not deductible for those years anyway)

For both the regular tax and the AMT, the deductible investment interest expense is limited to net investment income (NII). NII is taxable investment income reduced by investment expenses. Investment expenses are reported on Schedule A as investment taxes or as miscellaneous investment expenses. Both of these categories are not deductible for AMT purposes. Therefore, if the taxpayer is taxed by the AMT method, omit investment taxes and expenses from Schedule A. You may wish to double check your software’s computation to see if it makes this adjustment automatically. To be on the safe side, simply don’t deduct it. Caution: This may adversely affect the 3.8% NII Tax (see Chapter 11.3) and the state and overall tax liability.