Special Circumstances

Home Under Construction

A home under construction may be treated as a qualified residence for a period of up to 24 months during the construction period if the property actually becomes the taxpayer’s first or second home when completed. Thus, the construction loan interest can be treated as qualified home mortgage interest during that 24-month period and need not be capitalized. Purchasing a lot, planning and designing the home aren’t considered “construction.” Amended returns are necessary if the taxpayer fails to make the completed home his residence after the construction.

Example #11: - Deduction of Home Mortgage Interest on Home Under Construction - Will owns a vacant lot in the mountains. On 05/01/21, he got a loan to begin construction of a vacation house on the lot. On 09/01/23, construction began, and the home was completed and occupied by Will on 12/01/25. Will may choose to treat the property under construction as his second home for purposes of deducting home mortgage interest for any 24 months during the period beginning 09/01/23 and ending 12/01/25.

-

Home Destroyed

A taxpayer may be able to continue treating their home as a qualified home even after it is destroyed in a fire, storm, tornado, earthquake, or other casualty. This means the taxpayer can continue to deduct the interest subject to the normal limits for home mortgage interest. To continue treating a destroyed home as a qualified home, the taxpayer must do one of the following within a reasonable period of time after the home is destroyed:

-

Rebuild the destroyed home and move into it, or

-

Sell the land on which the home was located.

This rule applies whether the home is the main home or a second home that the taxpayer treats as a qualified home. Also, it applies whether or not the home is in a federal disaster area.

Converting a Home to a Rental

Occasionally, taxpayers will convert their existing home to a rental. The interest deduction for a rental is limited to the interest on the acquisition debt. Had the converted home been previously refinanced, the interest on any debt in excess of the acquisition debt for the property would not be deductible as rental interest. If the excess debt can be traced per the general tracing rules to a deductible use, then the excess interest would be deductible. Otherwise, the excess interest would no longer be deductible.

Timesharing Arrangements

A taxpayer can treat a home owned under a timesharing plan as a qualified home if it meets all the requirements.

Rental of Timeshare

If a taxpayer rents out the timeshare, it qualifies as a second home only if the taxpayer also uses it as a home. To qualify as a home, the taxpayer must use the home the greater of: (1) 14 days, or (2) 10% of the days rented. To determine if the taxpayer meets that requirement, count the days of use and rental of the home only during the time the taxpayer had a right to use it.

Equitable Ownership

Home mortgage interest deductions are not necessarily limited to the taxpayers whose name is on the title or mortgage. Rather, taxpayers with an “equitable ownership” in the property may be entitled to deduct the interest.

The

general rule is that only the person(s) liable for the underlying debt are

entitled to deduct the interest on that debt. However, regulations state:

“Interest paid by the taxpayer on a mortgage upon real estate of which he is

the legal or equitable owner, even though the taxpayer is not directly liable

upon the bond or note secured by such mortgage, may be deducted as interest on

his indebtedness” (Reg Sec 1.163-1(b)).

Therefore,

it is possible for a taxpayer who is not directly liable for the mortgage to be

the beneficial or equitable owner of the mortgaged property, and thus allowed a

deduction for the interest on the mortgage payments he or she makes. To be the

beneficial or equitable owner of a mortgaged property, the taxpayer must assume

the burdens and benefits of ownership, often considered by the Tax Court to be

whether the taxpayer:

-

Has a right to possess the property and enjoy its use, rents or profits;

-

Bears the property’s risk of loss;

-

Has a duty to maintain the property;

-

Has a responsibility for insuring the property;

-

Is obligated to pay the property taxes;

-

May improve the property without consent of the owner; and

-

Has the right to obtain legal title at any time by paying the balance of the purchase price.

Examples where taxpayers were equitable owners:

-

Taxpayer entered into a binding contract to purchase a residence, and took possession of the residence under an “occupancy agreement” while financing was pending. The occupancy agreement made taxpayer responsible for utility payments and for getting liability and contents insurance on the property. Following a two-month transition period, it also made taxpayer liable for repairs to plumbing, heating, cooling, electrical equipment and appliances. The purchase contract and the occupancy agreement shifted sufficient burdens and benefits of ownership to taxpayer to give him equitable title to the property. (Uslu, Saffet, TC Memo 1997-551)

-

Taxpayer's son was the legal owner of the property, but he didn't reside there. Taxpayer lived on the property and covered all expenses and taxes. When the property became rental property, taxpayer and not the son served as landlord, i.e., finding a tenant and providing all services related to the property. Taxpayer held the burden and benefit of ownership exclusively and so was the equitable owner. The son's name was used solely to procure the mortgage when taxpayer was having financial difficulties. (Njenge, Ndile G., TC Summary Opinion 2008-84*)

-

Neither title to the property nor the mortgage obligation was in the taxpayer's name, but taxpayer resided at the property, contributed a significant part of the down payment, and agreed to be responsible for all mortgage payments. (Edosada, Conrad, TC Summary Opinion 2012-17*).

Examples where taxpayers WERE NOT equitable owners:

-

Taxpayers’ sons, who lived with their parents in a residence then owned jointly by their father and uncle, didn't prove they held a beneficial interest in the property under then applicable state (CA) law, entitling them to deduct mortgage interest they paid, where they didn't: (i) contribute to the down payment; (ii) show they made any payments for the residence for the 12 preceding years the family lived there; or (iii) show any agreement entered into with their father or uncle giving them an ownership interest. (Daya, Gabriel, TC Memo 2000-360),

-

Taxpayer assumed no benefit or burden of ownership on a home legally owned by her brother. Although she made mortgage payments to help her brother, she couldn't establish that she had any right to possession or use of the property or any obligations for its maintenance. (Puentes, Lourdes, TC Memo 2013-277)

Under California law, the owner of legal title to property is presumed to be the owner of full beneficial title as well. This presumption may be rebutted only by clear and convincing proof. One way of overcoming the presumption is by showing that there exists an agreement or understanding between the parties evidencing an intent contrary to that which is reflected in the deed (Van Phan, TC Summary Opinion 2015-1*).

Caution - These cases have unique sets of circumstances and should only be relied upon in cases with the same sets of circumstances but see * below.

*Pursuant to IRC Sec 7463(b), summary opinions may not be treated as precedent for any other case.

Late Payment Charge on Mortgage Payment

A taxpayer can deduct as home mortgage interest a late payment charge if it is not for a specific service performed by the mortgage holder.

Mortgage Prepayment Penalty

If a taxpayer pays off the home mortgage early and is charged a prepayment penalty by the lender, the prepayment penalty can be deducted as home mortgage interest.

Mortgage Interest Credit

The taxpayer may be able to claim a mortgage interest credit, if the taxpayer were issued a mortgage credit certificate (MCC) by a state or local government. Figure the credit on Form 8396, “Mortgage Interest Credit.” If the taxpayer takes this credit, the mortgage interest deduction is reduced by the amount of the credit.

Minister and Military Housing Allowances

If the taxpayer is a minister or a member of the uniformed services and receives a housing allowance that is not taxable, the taxpayer can still deduct the home mortgage interest.

Mortgage Proceeds Invested in Tax-Exempt Securities

The home mortgage interest on home equity or excess mortgage debt is not deductible if the taxpayer used the proceeds of the mortgage to buy securities or certificates that produce tax-free income.

Capitalizing Mortgage Interest

Under certain circumstances taxpayers can elect to capitalize otherwise deductible mortgage interest, taxes and carrying charges on unimproved and unproductive real property in lieu of deducting these expenses. This rule does not apply to any qualified residence interest. (Code Sec. 263A(f)(2)(B))

Below Market (Gift) Loans

Occasionally when preparing tax returns, we encounter situations where there are loans between family members, or occasionally between employer and employee, with no interest being charged or the rate of interest is below market rates. IRC Sec. 7872 deals with issues related to below market loans including: creating interest income, interest payments, investment interest, gift consequences and certain exceptions to the Sec 7872 treatment. Sec 7872 covers a variety of circumstances; however this discussion deals only with its application to non-business loans between family members or between employer and employee.

Below-Market-Loan

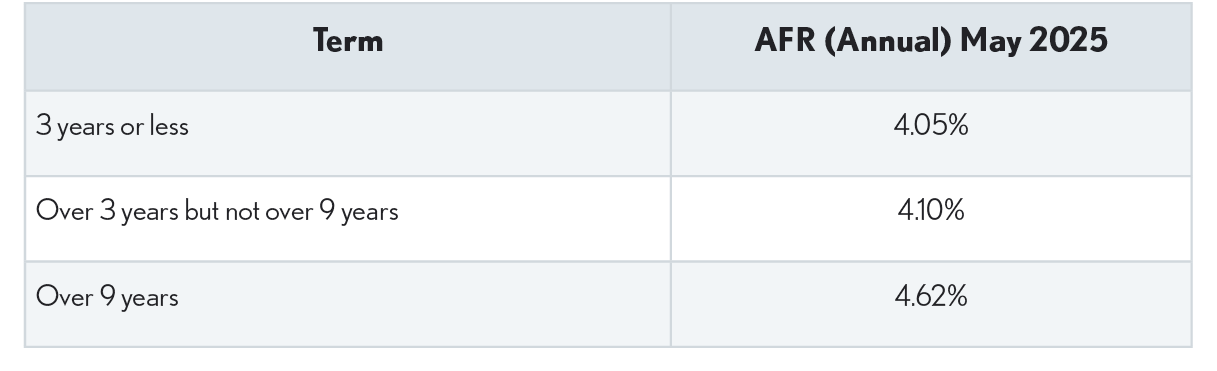

A below-market loan (Sec 7872(a)(1)) is generally a gift or demand loan where the interest rate is less than the applicable federal rate (AFR). The code defines the term “gift loan” as any below-market loan where the forgoing of interest is in the nature of a gift, while a “demand loan” is any loan which is payable in full at any time on the demand of the lender. (Secs 7872(f)(3); 7872(f)(5)) The AFR is established by the Treasury Department and posted monthly. As an example, the AFR rates for May 2025 were:

Current and historical rates can be found at https://apps.irs.gov/app/picklist/list/federalRates.html

A term loan (defined in the Code as any loan that isn’t a demand loan) can also be a "below-market" loan if the amount loaned is more than the present value of all payments due under the loan (Code Sec. 7872(e)(1)(B)).

Tax Treatment

Generally, for income tax purposes:

Borrower – Is treated as paying interest at the AFR rate in effect when the loan was made and the interest is deductible for tax purposes if it otherwise qualifies. However, where the loan amount is $100,000 or less, the amount of the forgone interest deduction cannot exceed the borrower’s net investment income for the year.

Lender – Is treated as gifting to the borrower the amount of the interest between the interest actually paid, if any, and the AFR rate. Both the interest actually paid and the forgone interest are treated as investment interest.

Exception - The below-market loan rules do not apply to gift loans directly between individuals where the loan amount is $10,000 or less. This exception does not apply to any gift loan directly attributable to the purchase or carrying of income-producing property. (Sec 7872(c)(2))

Employer and Employee - Loans between employer and employee, or independent contractor and the contracting person, are subject to the same rules except that the forgone or below market interest is treated as compensation to the employee or independent contractor. (Sec 7872(b)(1)(B))