Mortgage Insurance Premiums

OBBBA revives this deduction in 2026

For tax years 2007 through 2017 taxpayers could deduct as an itemized deduction the cost of premiums for mortgage insurance on a qualified personal residence. The Taxpayer Certainty and Disaster Tax Relief Act of 2019 (aka the “Extenders Act”) revived the mortgage insurance premiums deduction for 2018 through 2020. It was extended again for one year, through 2021, by Sec. 133 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020. OBBBA revives this deduction after 2025.

OBBBA did not include anything other than other than to make the premiums deductible again beginning in 2026. We are unsure if the qualification and phaseout from the old law will apply. Thus, we will have to wait for the IRS to issue regulations. What follows is the old law that related to this deduction should it prevail, but don’t count on it.

Premiums

The premiums are deducted as home mortgage interest. To be deductible:

-

The premiums must have been paid in connection with acquisition debt (note acquisition debt includes refinanced acquisition debt).

-

It must be for a qualified residence (first and second homes).

-

The cost of the insurance does not affect the $750,000 or $1,000,000 (or grandfathered debt) limitation for acquisition debt.

-

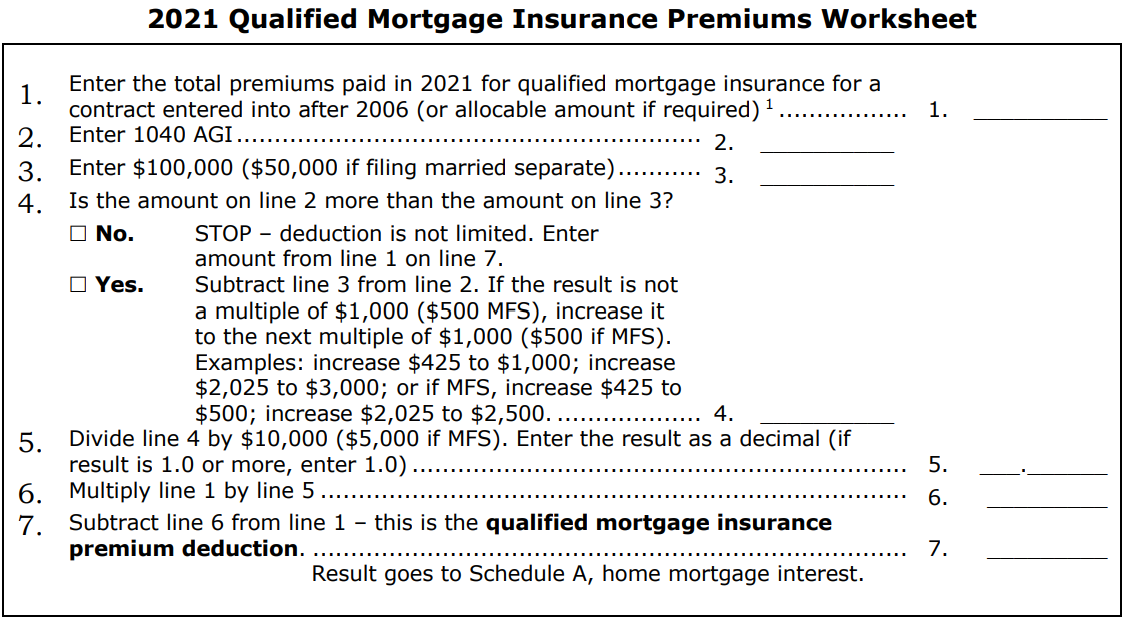

The deductible amount of the premiums phases out ratably by 10% for each $1,000 by which the taxpayer’s AGI exceeds $100,000 (10% for each $500 by which a married separate taxpayer’s AGI exceeds $50,000)., If AGI is over $109,000 ($54,500 married separate), the deduction is totally phased out. The phase-out range amounts are not inflation-adjusted.

Qualified Mortgage

Qualified Mortgage insurance means mortgage insurance provided by the:

-

Dept. of Veterans Affairs (VA),

-

Federal Housing Administration (FHA), or

-

Rural Housing Services (RHS), and

-

Private mortgage insurance, as defined by Sec. 2 of the Homeowners Protection Act of '98 (12 U.S.C. 4901), as in effect on Dec. 20, 2006.

Prepaid Premiums

Prepaid Premiums for mortgage insurance other than that provided by the VA or RHS are not fully deductible in the initial year but must be amortized over the period to which they apply. The unamortized balance is not deductible if the mortgage is paid off before the end of its term. IRS Notice 2008-15 provides a simplified allocation method to determining the portion of prepaid premiums deductible during a year. Allocate the prepaid premium ratably over the shorter of:

-

The stated term of the mortgage, or

-

84 months, beginning with the month in which the insurance was obtained.

1 For a mortgage obtained after 2006 where allocation of prepaid premiums was required (other than amounts paid to VA or RHS), allocate the premiums ratably over the shorter of the term of the mortgage or 84 months, beginning in the month in which the insurance was obtained. Example: T/P purchased a principal residence on 10/4/15 and in order to obtain his loan he paid a premium of $4,000 for private mortgage insurance; loan term is 25 years; amount deductible for 2015 = $4,000 ÷ 84 mos. x 3 mos. = $143; the annual deduction for 2016 through 2021 is $571 ($4000 ÷ 84 x 12). Only if there’s another extension will a deduction of $431 ($4,000 ÷ 84 x 9 = $429, but adjusted to $4,000 – 3,569, the previously deducted amounts) be allowed for 2022.