Taxability of State Income Tax Refund

One of the questions that the TCJA raised was how the SALT limitation would affect taxability of state income tax refunds. Would the IRS apportion the SALT limit between the types of taxes deducted? Or would it require that the taxes deducted be considered in a specific order, say first state income tax, then real estate tax, then other property tax? Or just the reverse order? Or would the taxpayer be able to choose the order? In late March 2019, in Rev. Rul. 2019-11, the IRS revealed that the taxability of refunds from 2018 returns, and future returns as long as the SALT limitation is in effect, should be based on the tax benefit rule.

Section 111(a) excludes from gross income amounts attributable to the recovery during the taxable year of any amount deducted in any prior year to the extent the amount did not reduce the amount of tax imposed by Chapter 1 of the Code. Section 111 partially codifies the tax benefit rule, which generally requires a taxpayer to include in gross income recovered amounts that the taxpayer deducted in a prior taxable year to the extent those amounts reduced the taxpayer’s tax liability in the prior year.

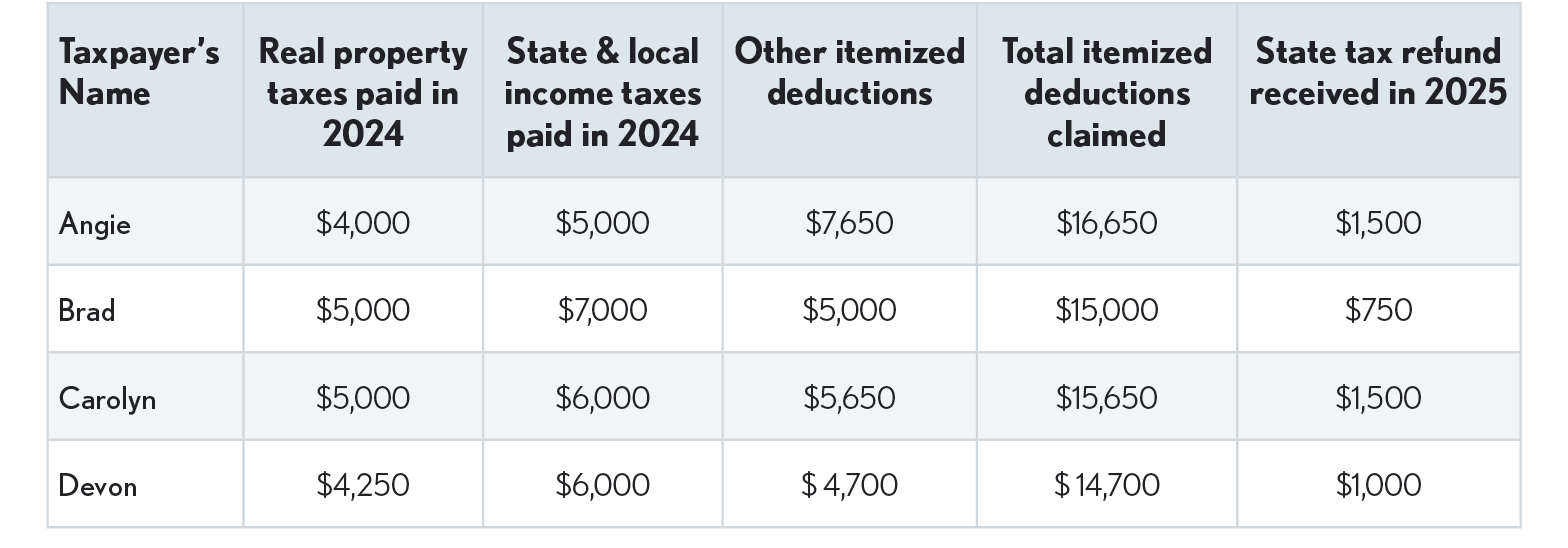

According to the IRS, a taxpayer whose state and local tax deduction was impacted by the SALT limitation needs to determine how much, if any, of their state tax refund is taxable by recalculating their prior year itemized deductions and reducing their income tax deduction by the amount of the refund. If the reduction reduces their overall itemized deductions, then the refund will be taxable. The following are examples based on those in Rev Rul 2019-11.

Example 1 – State tax refund fully taxable: Angie’s state and local tax deduction was not limited by the SALT limitation because her $9,000 total of SALTs was below the $10,000 limit. Including other allowable itemized deductions, Angie claimed a total of $16,650 in itemized deductions on her 2024 federal return. Had Angie paid only the proper amount of state income tax in 2024 ($3,500), her state and local tax deduction would have been reduced from $9,000 to $7,500 and as a result, her itemized deductions would have been reduced from $16,650 to $15,150, a difference of $1,500. Angie received a tax benefit from the overpayment of $1,500 in state income tax in 2024. Thus, she is required to include the entire $1,500 state income tax refund in her 2025 gross income.

-

Example 2 – State income tax refund not includible: Brad’s SALT deduction was limited to $10,000, so he could not deduct $2,000 of the $12,000 state and local taxes he paid. Had Brad paid only $6,250 ($7,000 – $750), the proper amount of state income tax in 2024, his SALT deduction would still have been $10,000 and his total itemized deductions would have remained $15,000. Brad received no tax benefit from the overpayment of $750 in state income tax in 2024, and therefore, he is not required to include the $750 as income on his 2025 return.

-

Example 3 – State income tax refund partially taxable: Carolyn was limited to claiming $10,000 as a SALT deduction, so she could not deduct $1,000 of the $11,000 state and local taxes she paid. Had she paid only the proper amount ($4,500) of state income tax in 2025, her SALT deduction would have been reduced from $10,000 to $9,500 and as a result, her itemized deductions would have been reduced from $15,150 to $14,650. Carolyn received a tax benefit from $500 of the overpayment of state income tax in 2024. Thus, $500 of her state income tax refund must be included in her 2025 gross income.

-

Example 4 – Standard Deduction: Devon’s state and local tax deduction was limited to $10,000, so he could not deduct $250 of the $10,250 state and local taxes paid. In 2025, Devon received a $1,000 refund of state income taxes paid in 2023. Had Devon paid only $5,000, the proper amount of state income tax in 2024, his SALT deduction would have been reduced from $10,000 to $9,250, and, as a result, his itemized deductions would have been reduced from $14,700 to $13,950, which is less than the standard deduction of $14,600 that he would have taken in 2024. The difference between Devon’s claimed itemized deductions ($13,950) and the standard deduction he could have taken $14,600) is $650. He received a tax benefit from $650 of the overpayment of state income tax in 2024. Thus, Devon is required to include $650 of his state income tax refund on his 2025 federal return.

-