Tax Deductions and AMT

Taxes deductible on Schedule A for regular tax purposes are NOT ALLOWED as a deduction against the AMT. They are subtracted on line 2a of Form 6251 (2024). If the client is being taxed by the AMT and not receiving any benefit from the deduction, the following strategies might be considered.

Defer Regular Tax-Deductible Tax Payments

Since no tax including state income, property tax, etc., claimed on Sch. A is ever deductible for AMT purposes, conventional wisdom would dictate deferring or accelerating tax payments to the subsequent or prior year if taxed by the alternative method in the current year. When deferring, care should be exercised in regard to late payment penalties and interest on underpayments for certain taxes. For example, if a taxpayer puts off paying their state tax liability until the subsequent year, will the benefit exceed the underpayment penalty? When accelerating tax payment, don’t overlook Rev Ruling 82-208 (where IRS ruled that when a taxpayer makes an estimated state tax payment with no reasonable basis for belief that he owes any additional state income taxes, a deduction will be denied for the year of the payment).

Tax Benefit Rule – State Income Tax

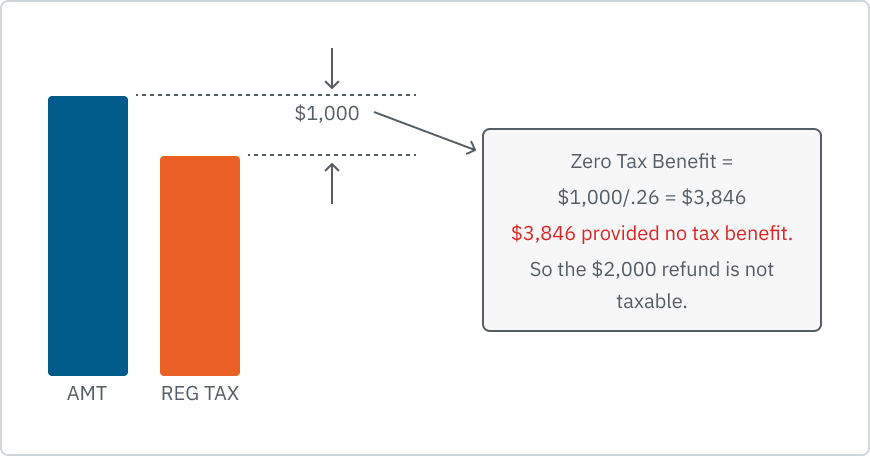

When taxed by the AMT, part or none of the state income tax paid is allowed as a deduction. Therefore, to the extent the tentative AMT exceeds the regular taxable income, the taxpayer receives no benefit for the state tax deduction.

To the extent the taxpayer receives no benefit, the state income tax refund is not taxable for regular tax purposes in the subsequent year. Tax software may not make this computation, and the state’s refund statement (Form 1099-G) absolutely does not take it into consideration. Therefore, if there is a state refund from the prior year and the taxpayer had some AMT tax, then part or all the refund is not taxable. (IRC §111(a))

Example: In the prior tax year, the taxpayer itemized, and his state income tax deduction was $5,000, his state tax refund was $2,000 and the AMT (add-on tax) was $1,000. Assuming he was in the 26% AMT bracket and his AMT tax was $1,000, he did not receive benefit from $3,846 ($1,000/.26) of the state income tax deduction. Therefore, any state tax refund up to that amount would not be taxable in the subsequent year. In this example, none of the $2,000 refund needs to be included into income the following year.

-

Be Sure to Look Back

Was the taxpayer subject to the AMT on the prior year’s return? If yes, apply the tax benefit rule and treat as taxable the amount of refund that reduced the regular tax taxable income below the alternative minimum taxable income (AMTI).

Schedule A Taxes Can Reduce AMT LTCG Tax

The LTCG 0%, 15% and 20% rates for AMT purposes are determined from the taxpayer’s regular taxable income for the year. Therefore, for 2025, to the extent a taxpayer’s taxable income is at or below $48,350 (single or MFS), $64,750 (head of household), or $96,700 (married joint) their LTCG will be taxed at 0% for both AMT and regular tax purposes. This makes the planning choices more difficult. The question being: is there more tax benefit maximizing the tax deduction or minimizing it through other strategies for taxes? Also see next item for another strategy.

Capitalize Property Taxes for Unimproved and Unproductive Real Estate

Taxpayers who are affected by the AMT or who are simply taking the standard deduction can annually elect to capitalize the taxes that they paid on unimproved and unproductive real estate. This means forgoing the deduction and adding the amount of tax paid to the real property’s cost basis (Reg Sec 1.266-1(b)(1)).

To make this election, the taxpayer must file a statement with the original return for the year of the election; this statement must specify the item(s) that the taxpayer has elected to capitalize (Reg Sec 1.266-1(c)(3)).