Determining the Amount of the Deductible Income Tax

The state and local income tax that may be deducted on federal Schedule A is a combination of the amounts paid, withheld and applied from a prior year’s overpayment of state and local income taxes during the tax year. More specifically, these amounts include state and/or local:

-

Estimated tax paid - for example, the installments generally paid in April, June and September of the current year (the year for which the deductions are being itemized), plus the payment usually made in January of the current year for the prior tax year (but see “Required Allocation. . .” below for potential required offset);

-

Overpayments from a prior year’s return that are applied to the current year’s tax;

-

Tax paid in the current year with the filing of the prior year’s return (including extension payments), with an amended return, or a delinquent original return of any year (but not penalties for underpayment of estimated tax, late filing or payment, or interest paid);

-

Tax withheld on Forms W-2 (including state benefit funds contributions – see below), W-2G, 1099R, SSA-1099, 1099-INT, 1099-DIV, 1099-B, 1099-MISC, 1099-NEC;

-

Tax withheld by a partnership or S corporation and passed through to the electing partner or shareholder on the state K-1

-

Tax withheld on real estate transactions; and

-

Tax withheld and passed to a beneficiary via the state version of Schedule K-1 (fiduciary).

Indian Tribal Government

An Indian tribal government that is recognized by the Secretary of the Treasury as performing substantial government functions will be treated as a state for this purpose. Income taxes, real estate taxes and personal property taxes imposed by that Indian tribal government (or by any of its subdivisions that are treated as political subdivisions of a state) are deductible.

State Benefit Funds

An employee can deduct mandatory contributions to state benefit funds that provide protection against loss of wages. Employee contributions to private or voluntary disability plans aren’t deductible. Mandatory payments made to the following state benefit funds are deductible as state income taxes. (IRS Pub 17, 2024 edition)

-

Alaska Unemployment Compensation Fund

-

California Nonoccupational Disability Insurance (SDI) - Caution: VPDI (voluntary plan disability insurance) withheld in lieu of SDI is not deductible as a State Benefit Payment for federal itemized deduction purposes.

-

New Jersey Nonoccupational Benefit Fund

-

New Jersey Unemployment Compensation Fund

-

New York Nonoccupational Disability Benefit Fund

-

Pennsylvania Unemployment Compensation Fund

-

Rhode Island Temporary Disability Benefit Fund

-

Washington State Supplemental Workmen's Compensation Fund

Estimated Tax Must Be Reasonably Based

To be able to deduct state and local estimated tax payments, there must be a reasonable basis for making them. For example, a taxpayer knew that a state estimated tax payment she made in December would be completely refunded but made the estimated tax payment anyway. No deduction is allowed on her federal Schedule A for the December estimated payment because it was not made in good faith on a reasonable basis.

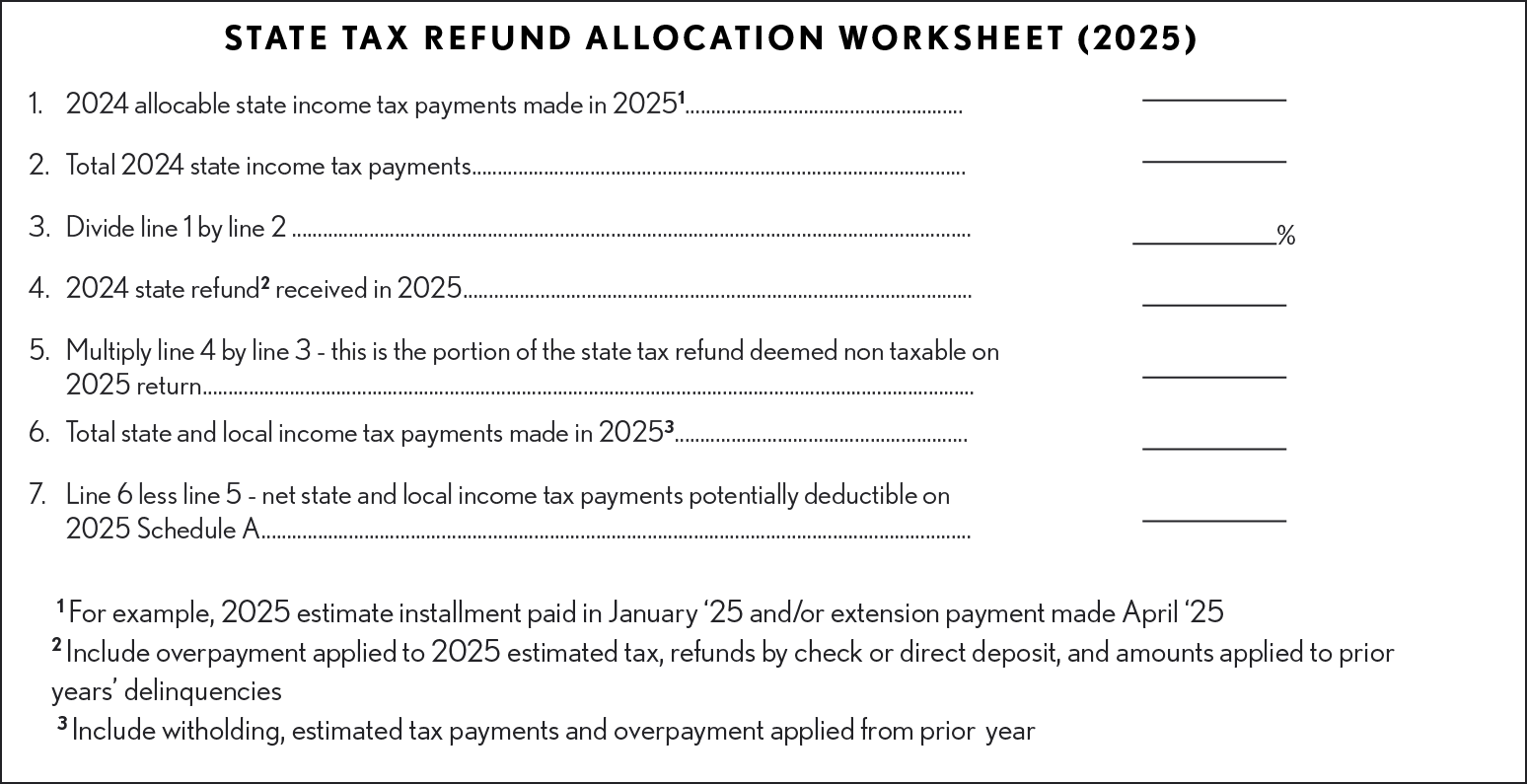

Required Allocation Reduces State Tax Deduction

When a state tax refund is received that is for amounts paid in two or more years, the refund is prorated between the years to determine the amount of the refund that may be taxable, and the amount of state tax paid in the current year that may be deductible. Typically, this situation arises when a taxpayer makes a payment in January of Year 2 for Year 1’s state estimated tax and receives a refund in Year 2 based on Year 1’s state tax return. It also comes up when an extension payment is made in Year 2 for Year 1’s state return, and subsequently a refund from Year 1’s return is received in Year 2. In both instances, a portion of the state overpayment is deemed attributable to the payment in Year 2 and isn’t taxable, but the nontaxable portion reduces the amount of the Year 2 payment when determining how much of that payment is deductible.

Example – Allocating Refund and Estimated Payments: Guy’s state estimated tax for 2024 is $6,000 and he has no income tax withholding; he made an estimated state tax payment of $1,500 on each of April 15, June 15, and September 15 in 2024 and January 15, 2025. In 2025 he received a state tax refund of $500 from his 2024 return. Guy itemized deductions on his federal returns in both years. The refund must be allocated between 2024 and 2025. Since 75% ($4,500 ÷ $6,000) of the estimated tax was paid in 2024 (and deducted on that year’s Schedule A), 75% of the refund, or $375, is potentially taxable on Guy’s 2025 return. The remaining $125 of the refund is deemed to be from the January 2025 payment, and reduces Guy’s deduction for state and local income tax on his 2025 Schedule A to $1,375 ($1,500 - $125), plus any other state and local income tax payments he made, or tax withheld in 2025.

-