California Differences - Deductible Taxes

California does not allow a deduction for the following taxes:

-

State Benefit Payments – SDI (or VPDI)

-

State Early Withdrawal (2.5%) Penalty

-

State Income Tax

-

Sales Tax

-

Foreign Income Taxes Paid (Foreign real property taxes are deductible.)

Foreign Property Tax

Since California has not conformed to the TCJA itemized deductions changes, foreign property tax is still deductible for California purposes.

Nonconformity with TCJA and OBBBA

California has not conformed to the $10,000 (or $40,000) limit for tax deductions imposed by the TCJA or OBBBA. Therefore, if a taxpayer’s real property and personal property taxes exceed the SALT limit, the taxpayer would be able to claim the full amount of the payments as a California itemized deduction.

CA Fire Prevention Fee

For several years, the California State Board of Equalization was required to charge an amount not to exceed $150 as a fire prevention fee (the fire fee) on each structure within a state responsibility area, i.e., an area of the state in which the financial responsibility of preventing and suppressing fires has been determined by the California Board of Forestry and Fire Protection to be primarily the responsibility of the state. This fee has not been deductible as a real property tax (IRS Chief Counsel Advice 201310029).

Effective July 1, 2017, through 2030, this fee is suspended, and as of January 1, 2031, the fee is repealed. (AB 398) These changes are part of the legislation extending the state’s cap-and-trade program. It is the intent of the Legislature that moneys derived from the cap-and-trade program auctions or sales will replace the fire prevention fee to continue the funding of the fire prevention activities.

Use Tax Liability Takes Precedence

For purchases of tangible personal property made on or after January 1, 2015, in taxable years beginning on or after January 1, 2015, enacted Assembly Bill 2758 requires payments and credits on a California personal income tax, corporation franchise or income tax, partnership, limited liability company, estate or trust tax, or information return of a taxpayer that reports California use tax on the return to be applied first to satisfy the use tax liability, with any excess amount then being applied to the outstanding taxes, penalties, and interest owed to the Franchise Tax Board (FTB). When use tax and the pass-through entity elective tax are reflected on the return and all liabilities are not paid, payments received by FTB will be applied first to the use tax. (FTB Tax News, July 1, 2022)

Use Tax Payments

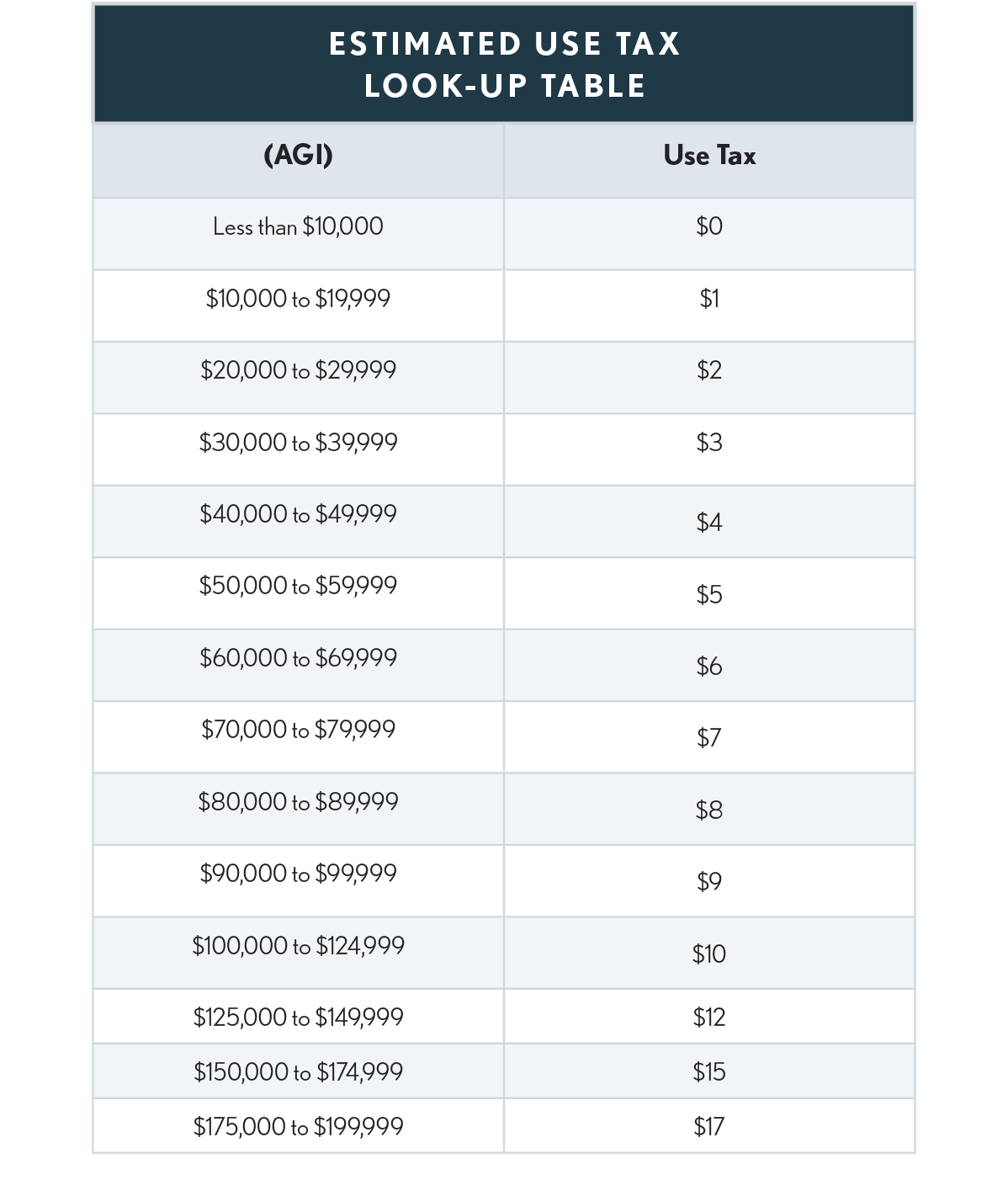

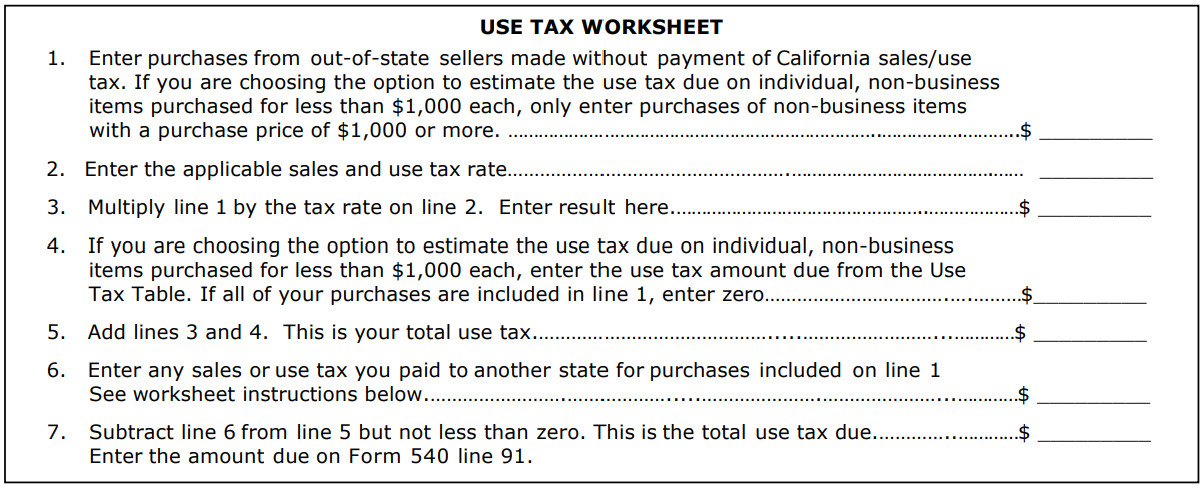

CA requires individuals who make out of state purchases, including in person, via the Internet by phone or mail order, to pay use tax on those purchases if California sales tax has not been collected by the seller of the item. Those not registered with the California Department of Tax and Fee Administration (CDTFA), formerly the Board of Equalization, can make the use tax payments on their CA income tax return. For those who have made out of state purchases and did not pay use tax, the CDTFA provides an optional use tax table, which is updated yearly and included in the Form 540 instructions (see table below).

The intent is to make it more convenient for taxpayers not registered with the BOE to comply with their use tax obligations by giving taxpayers the option to report their estimated use tax liabilities determined from a use tax table, instead of calculating and reporting their actual unpaid use tax liabilities.

Use Tax Entry Required

A.B. 1593, signed by the governor October 7, 2017, requires taxpayers to enter a number – which can be a zero – on the use tax line of personal income tax returns beginning with 2017 returns. The act also requires taxpayers who enter a zero on the use tax line to check one of two boxes to validate they either already paid their use tax obligation directly to the CDTFA or that they do not owe use tax.

Form Instructions - Report purchases of items that would have been taxable if purchased from a California retailer. For example, include purchases of clothing, but not purchases of prescription medicine.

-

Include handling charges.

-

Do not include any other state’s sales or use tax paid on the purchases.

-

Enter only purchases made during the year that correspond with the tax return you are filing.

-

If you traveled to a foreign country and carried items back to California, generally the use tax is due on the purchase price of the goods you listed on your U.S. Customs Declaration less the $800 per-person exemption. This $800 exemption does not apply to goods sent or shipped to California by mail or other common carrier.

-

If your filing status is “married/RDP filing separately,” you may elect to report one-half of the use tax due or the entire amount on your income tax return. If you elect to report one-half, your spouse/RDP may report the remaining half on his or her income tax return or on the individual use tax return available from the California Department of Tax and Fee Administration (CDTFA).