Used Car, Boat, Plane and Other Motor Vehicle Donations

Used Vehicle Donations Severely Restricted

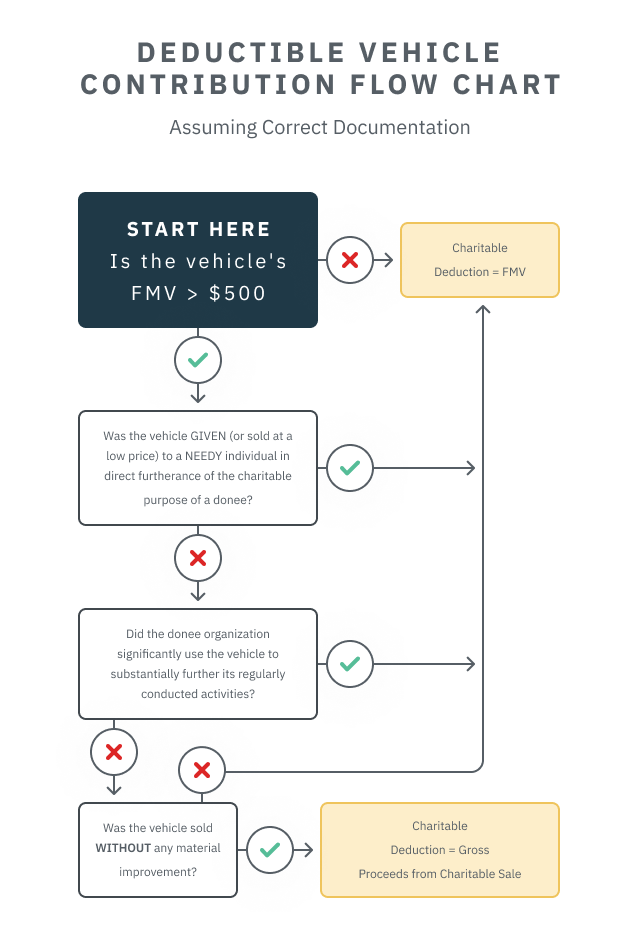

(Code Sec. 170(f)(12), as amended by 2004 Act. Sec. 884(a)) The deduction is limited for motor vehicles (as well as for boats and airplanes) contributed to charity for which the claimed value exceeds $500 by making it dependent upon the charity's use of the vehicle and imposing higher substantiation requirements.

Vehicle Sold Without Significant Intervening Use

If the charity sells the vehicle without any “significant intervening use” (actual, significant use of the vehicle to substantially further the organization's regularly conducted activities) or “material improvement” (e.g., major repairs), the donor's charitable deduction can't exceed the gross proceeds from the charity's sale.

Significant Intervening Use

This occurs only if the donee organization actually uses the vehicle to substantially further its regularly conducted activities, and the use is significant. Use includes providing transportation on a regular basis for a significant period of time or significant use directly related to instruction in vehicle repair but does not include use of the vehicle to provide training in general business skills, such as marketing and sales. Examples of qualifying significant intervening use are delivery of meals every day for a year or driving 10,000 miles during a one-year period while delivering meals. (Notice 2005-44, Sec. 7.01)

Material Improvement

This includes a major repair or improvement that improves the vehicle's condition in a way that significantly increases its value. Cleaning, minor repairs and routine maintenance aren't enough, nor are: painting, rustproofing or waxing; removal of dents and scratches; cleaning or repair of upholstery; or installation of theft deterrent devices. (Notice 2005-44, Sec. 7.02)

Exception for Autos Given (or sold at low price) to Needy Individuals

The gross proceeds limitation on a donor's auto contribution deduction doesn't apply if the charity sells it at a price significantly below FMV (or gives it away) to a needy individual. This non-statutory exception applies only if supplying a vehicle to a needy individual is in direct furtherance of the charitable purpose of a donee of relieving the poor and distressed or the underprivileged who are in need of a means of transportation. (Notice 2005-44, Sections 3.02(3) and 7.03)

FMV Defined

The gross proceeds limit doesn't apply if there is significant intervening use or material improvement of the vehicle, or if it is given (or sold at a low price) to a needy individual under the rules explained above. Here, under long-standing rules, the donor's contribution cannot exceed the vehicle's FMV. Under Notice 2005-44, Sec. 5, FMV of a vehicle may be determined by using an established used vehicle pricing guide (i.e., a “blue-book” type reference), but only if it lists a sales price for a vehicle that is the same make, model, and year, sold in the same area, in the same condition, with the same or substantially similar options or accessories, and with the same or substantially similar warranties or guarantees, as the vehicle in question. Dealer retail value can't be used.

Contemporaneous Written Acknowledgment

Additionally, a deduction for donated vehicles whose claimed value exceeds $500 is not allowed unless the taxpayer substantiates the contribution by a contemporaneous written acknowledgment from the donee. To be contemporaneous, the acknowledgment must be obtained within 30 days of either: (1) the contribution or (2) the disposition of the vehicle by the donee organization. The donor must include a copy of the acknowledgment with the tax return on which the deduction is claimed. The acknowledgment must contain:

-

The name of the donor,

-

Taxpayer identification number of the donor, and

-

The vehicle identification number (or similar number) of the vehicle.

-

If the charity (donee) sells the vehicle without performing a significant intervening use or material improvement of such vehicle, the acknowledgment must say that the vehicle was sold in an arm's length transaction between unrelated parties and state the gross proceeds from the sale and that the deductible amount may not exceed the gross proceeds.

-

Acknowledgment by the donee organization which includes whether the donee organization provided any goods or services in consideration of the vehicle, and a description and good faith estimate of the value of any such goods or services, or, if the goods or services consist solely of intangible religious benefits, a statement to that effect.

Form 1098-C

Form 1098-C incorporates all the required acknowledgment elements for the donee (charitable organization) to complete. The donor is required to attach copy B of the 1098-C to his or her federal tax return when claiming a deduction for contribution of a motor vehicle, boat or airplane.