Charitable Contribution of Non-LTCG Property

In general, the charitable contribution of property is deductible in an amount equal to the fair market value (FMV) of the property at the time of donation. See Reg Sec 1.170A-1(c)(1).

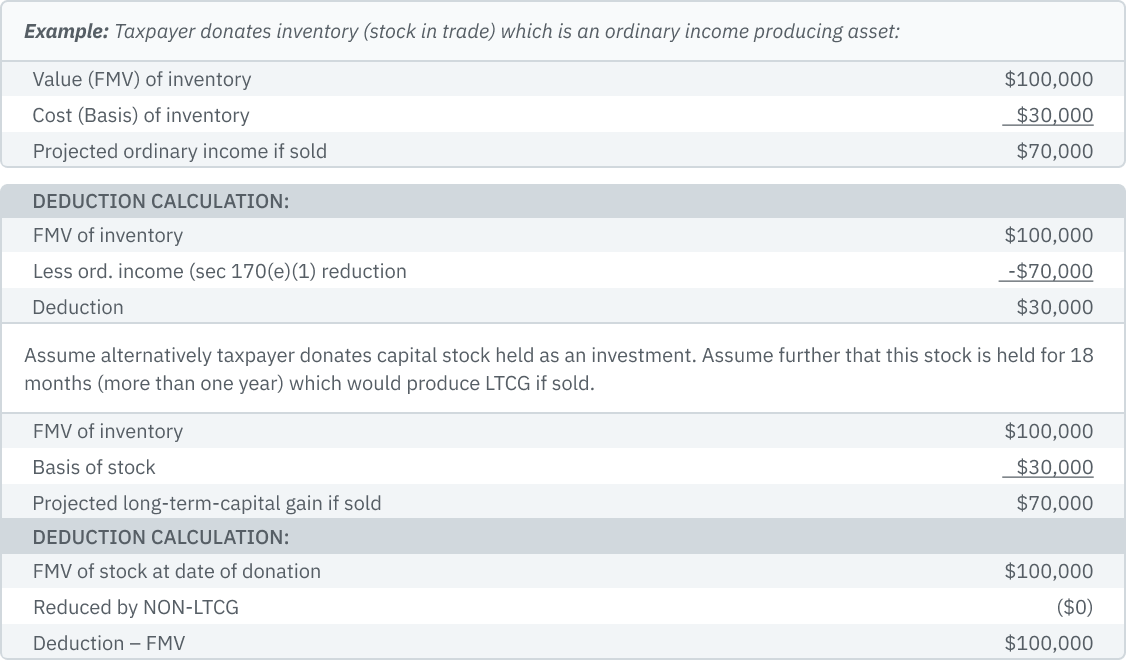

However, the contribution deduction of FMV must, under section 170(e)(1), be reduced by the amount of the projected gain from the sale of such property that would not have been LTCG. “Generally, this means reducing the fair market value of the property to its cost or other basis.” If the cost or basis is smaller than the FMV. (Reference page 12 of Pub 526)

So, when this rule applies the deduction equals the lower of FMV or basis (cost).

To repeat the above and underscore this rule, section 170(e)(1) requires a reduction of the charitable contribution deduction for any property which if sold at FMV would NOT produce a long-term capital gain (LTCG) such as property which if sold would produce ordinary income or STCG. So, this reduction is required not just for ordinary income producing property like inventory or stock in trade. It is required of ANY property that if sold would NOT produce a LTCG. (See examples below).

Intangibles

Generally are not capital assets. Most intangibles are excluded from the definition of capital asset by section 1221(3) so they cannot produce a capital gain if sold. They create ordinary income if sold at a gain. They will produce neither STCG nor LTCG no matter how long the holding period. However, this rule only applies if the intangible is held by (A) a taxpayer whose personal efforts created such property. such as a painting and the painter, (B) in the case of a letter, memorandum, or similar property, is held by a taxpayer for whom such property was prepared or produced by the author or other creator, or (C) is held by a taxpayer in whose hands the basis of such intangible is determined, in whole or part by reference to the basis of such property in the hands of a taxpayer described in subparagraph (A) or (B). Note well, a receipt of property by gift falls under this category since the basis of a property received by gift is, under section 1015, equal to the donor’s basis.

Which Intagibles are Not Capital Assets?

Intangibles that are NOT capital assets under section 1221(3) include:

-

Patents,

-

Invention, model, or design (whether or not patented)

-

Secret formula or process

-

Copyrights,

-

Literary composition like a book, poem, or short story, and

-

Letters, memoranda, and/or other similar intellectual property

So, if you donate intellectual property described above and in section 1221(3) to a qualified section 501(c)(3) organization, your deduction is effectively the smaller of FMV or the cost or other basis of this property. as stated above, this reduction only applies if the intellectual property is held by the taxpayer who created it (see (a) above) or held by a taxpayer for whom it was created (see (b) above).

For example, a literary work, held by the author or held by a taxpayer for whom the literary work was written is subject to this provision. (section 170(e)(1).

The following examples, while not comprehensive, illustrate this rule:

Example #1. Assume a painting held by the artist who created it has a FMV of $2,000 and a basis of $200 - the cost of paint and canvas. The artist donated this painting to a qualified, section 501(c)(3) charity. If the artist had sold this painting for $2,000 the gain of $1,800 would be ordinary income. Therefore, the charitable deduction would be equal to $200 ($2,000 less $1,800);

Example #2. Assume alternatively, the taxpayer in EG #1, did not create this painting but instead purchased it for $2,000 as an investment or for personal use to hang on the wall in their home. The taxpayer decides to donate it to a museum a section 501(c)(3) organization. At the time of contribution this painting had increased to $10,000. Assume further the taxpayer held this painting for over one year thus creating a potential LTCG of $8,000 ($10,000 less $2,000 basis (cost)). The charitable contribution deduction would be FMV of $10,000;

Example #3. A taxpayer donates several boxes of letters and memoranda given to the taxpayer by a well-known personality such as a celebrity or national politician. The letters and cost (basis) memoranda had a certified appraised value of $100,000. The basis to the taxpayer is, under section 1015, the donor’s basis equals the incidental costs of stationary, pens, etc. of an estimated $1,500.

The charitable contribution equals $1,500 - FMV of $100,000 reduced by the projected non-longterm capital gain of $98,500 ($100,000 less basis of $1,500);

Example. Assume the same facts as in 3 above except the creator of these letters gives them to charity. A deduction of the lower of FMV or cost would be allowed, $1,500;

Example. Assume a taxpayer purchased for $2,500 capital stock as an investment, holds it for 3 months (short term) and then gave it to a charity. The FMV of the stock at the time of gift was $4,000. If sold at the date of gift the taxpayer would realize a STCG of $1,500 ($4,000 less $2,500). The taxpayer is entitled to a charitable deduction of FMV of $4,000 less the STCG of $1,500 equals a charitable deduction of $2,500.