Reimbursement for Living Expenses

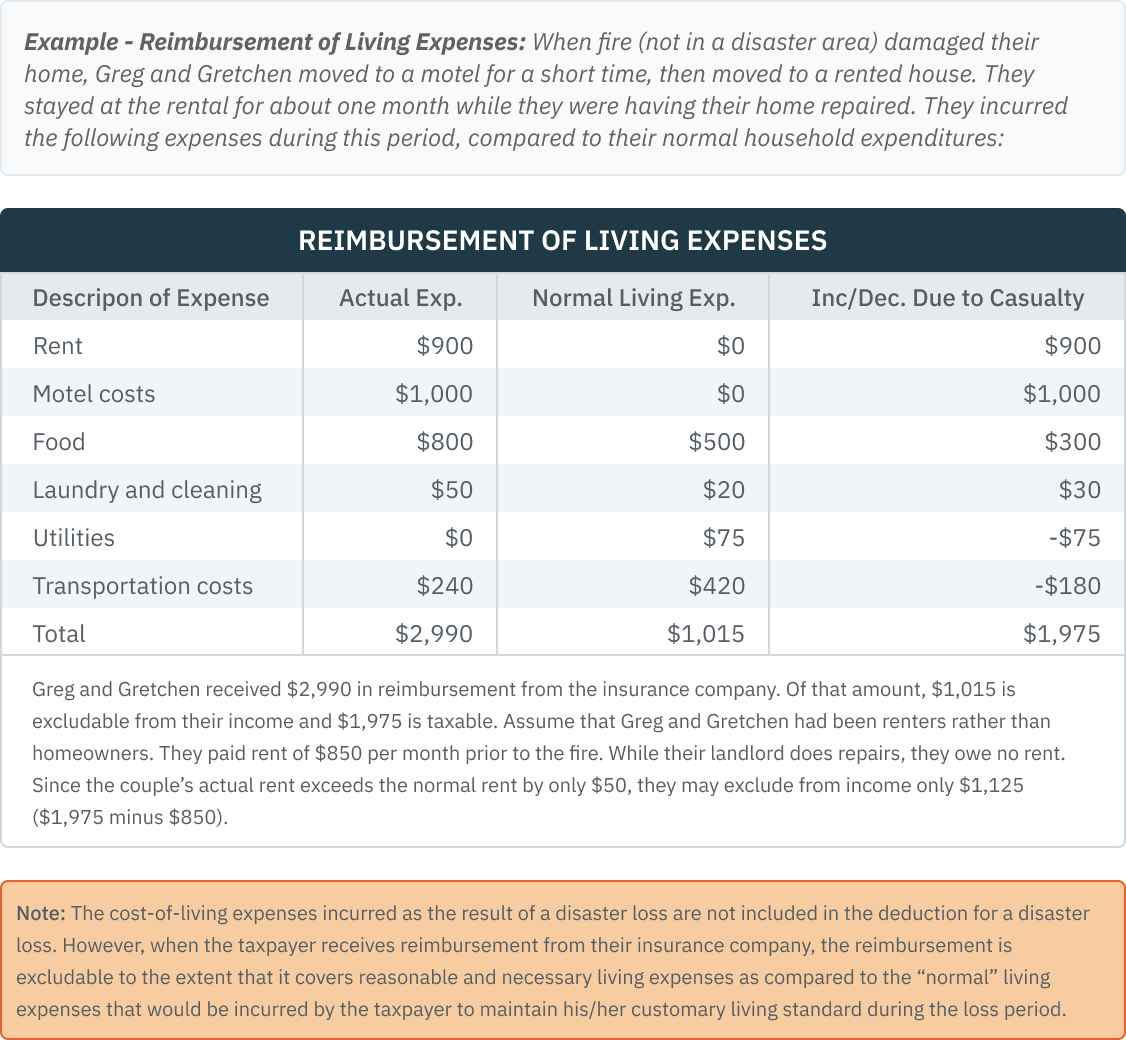

An exclusion from gross income is allowed for insurance proceeds received for the temporary increase in living expenses due to a disaster loss (or casualty loss) of a principal home. If the casualty occurs in a federally declared disaster area, none of the insurance payments are taxable. Otherwise, the exclusion amount is limited to the increased “actual”, reasonable and necessary living expenses as compared to the “normal” living expenses that would be incurred by the taxpayer to maintain his/her customary living standard during the loss period. Living expenses include temporary housing, utilities, meals, transportation and miscellaneous items like laundry, etc. For this purpose, mortgage interest is not considered a living expense.