Additional Benefits for Certain Disaster Losses

Forced Relocation or Demolition

Taxpayers who are forced to relocate or demolish a residence (not necessarily a principal residence), which is in a disaster area, may claim a casualty for the property, regardless of whether a casualty occurred to the residence, if the:

-

Area was declared a Federal disaster area,

-

Taxpayer was ordered by state or local officials to demolish or relocate the residence,

-

Order was made no later than 120 days after the date of the President’s disaster declaration, and

-

Residence was determined to be unsafe because of (as a “proximate result of”) surrounding conditions (Sec 165(k)).

Insurance Proceeds

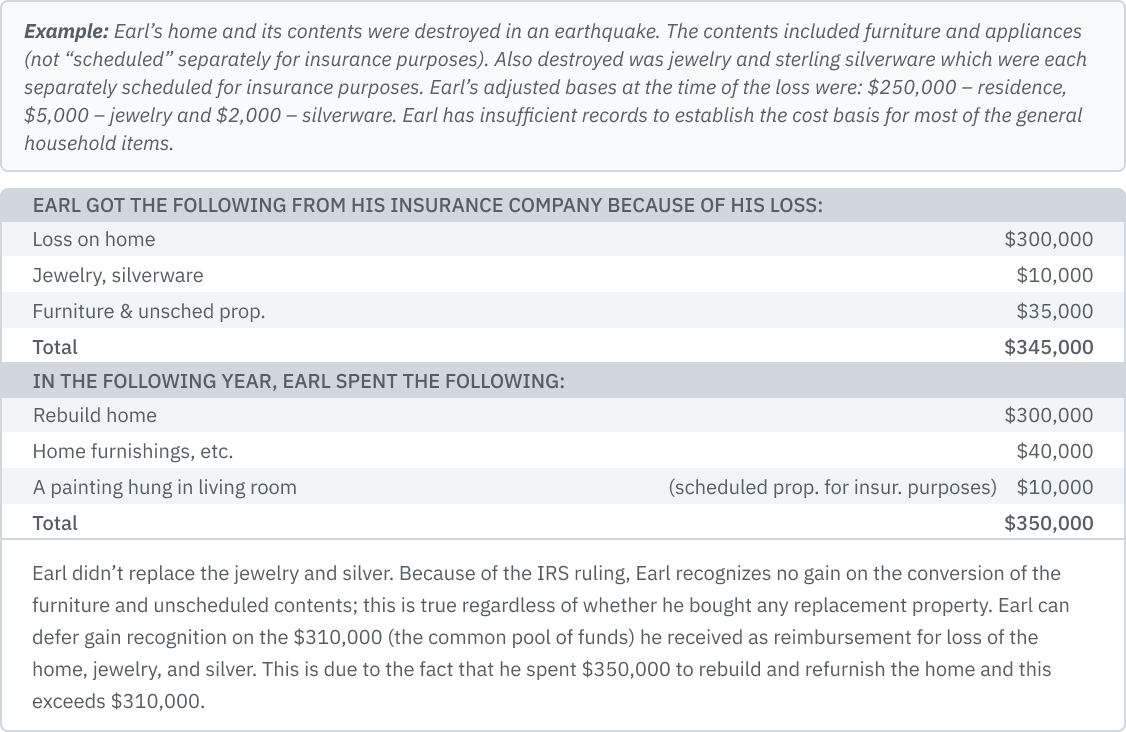

A taxpayer whose principal residence (or its contents) is damaged in a disaster can qualify for special tax treatment regarding certain insurance proceeds received as a result of the casualty. To qualify, the locale of the residence must be in a Presidential-declared disaster area. The rules stipulate that no gain is recognized on the receipt of insurance proceeds for personal property that was part of the residence’s contents, if such property was not scheduled under the insurance policy (scheduled property is property such as jewelry which is covered by a rider under the insurance policy).

Other insurance proceeds received for the residence, or its contents may be treated as a common pool of funds. If those funds are used to purchase property similar to the property lost, a taxpayer will need to recognize the gain only to the extent that the pool is more than the cost of the replacement property. The replacement period for the damaged or lost property is extended to four years after the close of the first taxable year in which any part of the gain on the involuntary conversion is realized.

These rules are extended to renters as well. Renters who receive insurance proceeds related to disaster damage to their property in a rented principal residence also qualify for the disaster loss relief.

Rev Rul 95-22, 1995-12 IRB explains when gain doesn’t have to be recognized on the receipt of insurance proceeds for the destruction of a principal home (or contents) in a disaster area. The ruling clarifies that gain recognition is avoided if the proceeds received for the residence and scheduled property are reinvested in a replacement residence and/or any kind of replacement contents, whether separately scheduled or not.

Extended Deadlines

The IRS has the authority to postpone for up to one-year certain tax deadlines of taxpayers affected by a federally declared disaster. Examples of deadlines the IRS will postpone in disaster areas are those for filing income, excise and employment tax returns; paying income, excise and employment taxes; and contributing to IRAs. See the IRS web site – www.irs.gov – for news releases and other announcements of covered disaster areas.

Interest Abatement

When the IRS extends the due date for filing and paying tax and waives related penalties (late filing and payment), for a taxpayer in a Presidential-declared disaster zone, it must also abate assessment of underpayment interest for the period of the extension.