Enhancement of the Saver’s Credit - Effective After 2026

Section 103 of the SECURE 2.0 Act repeals and replaces the saver’s credit with respect to IRA and retirement plan contributions, changing it from a credit paid in cash as part of a tax refund into a federal matching contribution that must be deposited into a taxpayer’s IRA or retirement plan if the individual is at least age 18 by year end. Matching is not available to an individual who is allowed as someone else’s dependent, a full-time student or a nonresident alien. The same reduction of eligible contributions and testing period appy as under the current saver’s credit rules.

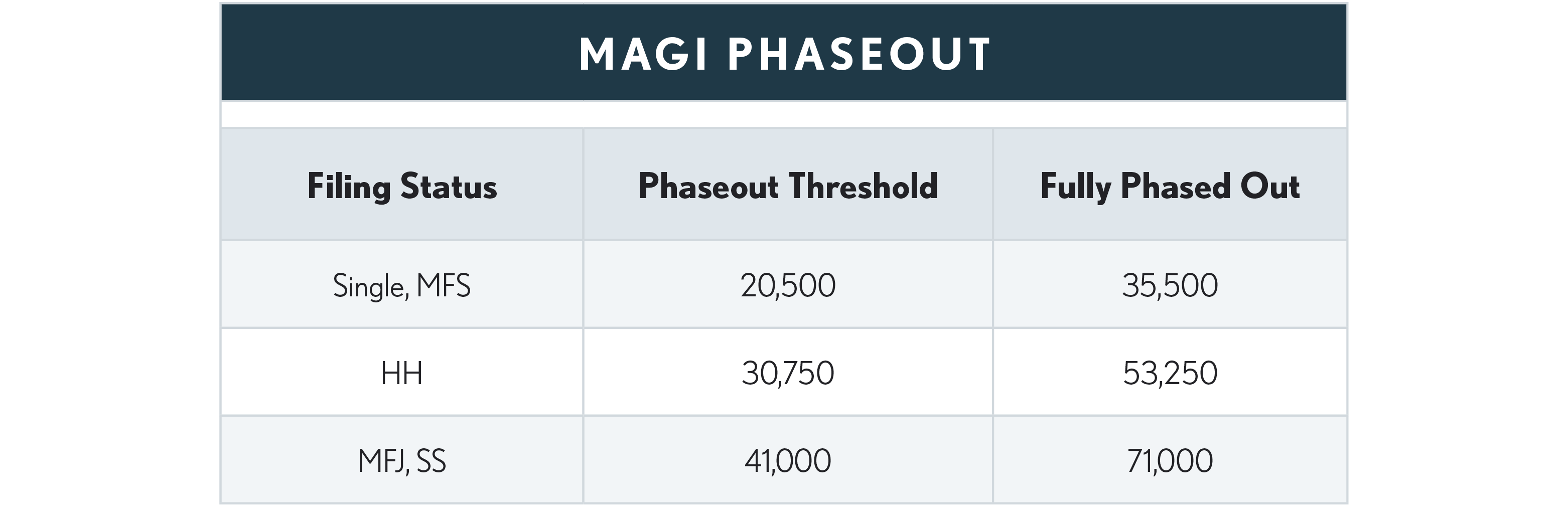

The match is 50% of IRA or retirement plan contributions up to $2,000 per individual. Minimum match is $100 and amounts less than $100 would instead be treated as a credit on the individual’s tax return. The 50% match rate is phased down based on modified AGI, as shown in the following table.

MAGI = AGI plus add back of foreign and possession (Sections 911,931 and 933) exclusions) and determined without regard to any exclusion or deduction allowed for any qualified retirement savings contribution made during the taxable year.

No doubt (hopefully) the IRS will provide more details and regulations as we near 2027.

The threshold amounts will be inflation adjusted after 2027 in $1,000 increments.

Effective Date: After December 31, 2026