Recovery Rebate Credit "Economic Impact Payments"

Federal Credit Expired After 2021

As a means of providing financial assistance to individuals during the COVID pandemic, Congress authorized Economic Impact Payments (EIPs) which are advance payments of the Recovery Rebate Credits authorized for the 2020 and 2021 tax years.

EIP #1 - The first EIP (EIP1) was authorized by the CARES Act, which was signed into law March 27, 2020. The maximum EIP1 amounts were:

-

Each eligible individual: $1,200

-

Married couple (both eligible) filing jointly: $2,400

-

Each qualifying child (as defined by IRC Sec 24(c)(under age 17 at close of year): $500

-

Reconciled on the 2020 return

EIP #2 - EIP2 was authorized by the COVID-Related Tax Relief Act of 2020, enacted Dec. 27, 2020, and provided for a second round of EIPs, with payments scheduled to begin the last week of December and a goal of all payments being made by Jan. 15, 2021. EIP2 is also an advance toward the 2020 RRC, even though payments may have been received in 2021. The maximum amount of these payments was:

-

Each eligible individual: $600

-

Married couple (both eligible) filing jointly: $1,200

-

Each qualifying child (as defined by IRC Sec 24(c)(under age 17 at close of year): $600

-

Reconciled on the 2020 return

EIP#3 - The ARPA provides a third round of EIPs, and these EIPs are an advance of the RRC for 2021. The maximum amount of these payments, which the government began to disbursed in early March, 2021, was:

-

$1,400 ($2,800 for joint filers) plus

-

$1,400 per dependent – unlike the prior payments, a dependent will qualify regardless of age.

-

Reconciled on the 2021 return

U.S. Possessions - A similar benefit would be available to residents of U.S. possessions.

Eligibility - Eligibility for EIP3 was based on information reported on the 2019 return, or 2020 return if the 2020 return had been filed and processed by the IRS. If neither a 2019 nor 2020 return had been filed by the date of determination of eligibility, other information available to the Treasury could be used to determine eligibility. If the EIP3 is based on the 2019 return but using a filed and processed 2020 return results in a greater EIP amount, the IRS made an additional payment of the difference between the amounts, provided the return was filed by the earlier of 90 days after the original due date or September 1, 2021. (IRC Sec 6428B (g)(5)(B), as added by the Act)

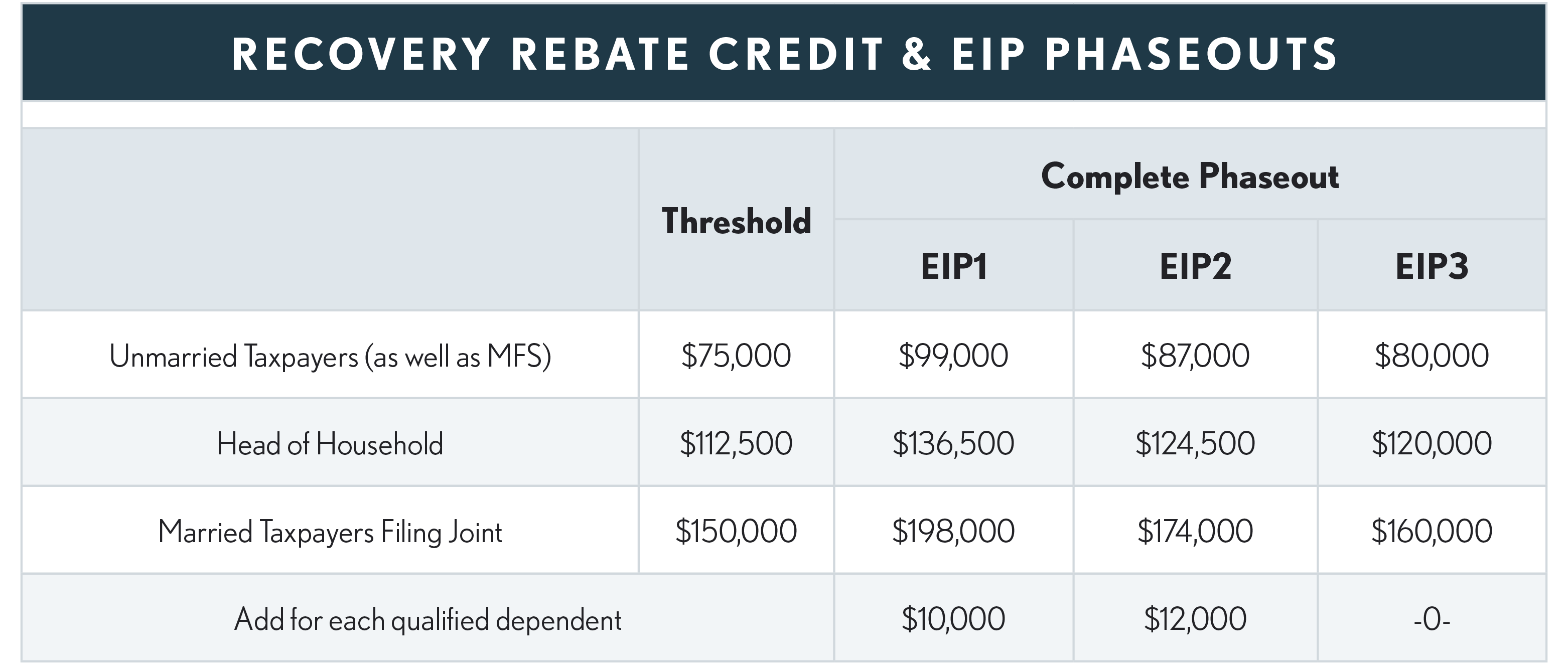

Phaseout

All three rounds of EIPs were phased out for higher income taxpayers and the higher end of the phaseout became more restrictive for each subsequent round.

Payment Reconciliation

-

2020 Tax Return – Both EIP1 and EIP2 payments were based upon the 2020 tax return. However, since the 2020 return would not be filed until 2021, the IRS used the 2019 return to determine the payment amount. If 2019 had not been filed by the time the payment was scheduled, the 2018 return was used to determine the amount of the payment., The EIP first and second round of payments are reconciled against the amount that should have been paid based upon the 2020 tax return. If the taxpayer is entitled to more than what was paid in advance, the difference becomes a refundable Recovery Rebate Credit on the 2020 tax return.

-

2021 Tax Return – EIP3 and any possible additional payments during 2021 are based upon the 2021 return. However, since the 2021 return wouldn’t be filed until 2022, the IRS used the 2020 return to determine the payment amount. If 2020 had not been filed by the time the payment was scheduled, the 2019 return was used to determine the amount of the payment. The EIP3s are reconciled against the amount that should have been paid based upon the 2021 tax return. If the taxpayer is entitled to more than what was paid in advance, the difference becomes a refundable Recovery Rebate Credit on the 2021 tax return.

Excessive Advance Payments - Taxpayers whose advance payments exceed the amount for which they are eligible for the tax year are not required to repay any difference.

Example: Shelly, a single parent files her 2019 return claiming her 15-year-old daughter Whitney as a dependent and using the Head of Household filing status. Shelly’s AGI is below $112,500, so Shelly received a first-round rebate of $1,700 ($1,200 for herself and $500 for Whitney) and a second-round rebate of $1,200 ($600 for herself and $600 for Whitney), for a total of $2,900. In 2020 Whitney goes to live with her dad, and so when Shelly files her 2020 tax return she no longer has a dependent child under age 17 and files as single. Thus, the credit computed on her 2020 return is only $1,800. However, Shelly does not have to pay back the difference.

-

Underpaid Advance Payment - If the advance payment is less than the credit determined on the 2020 (or 2021 return, if applicable) tax return, then the excess will become a refundable credit on the 2020 (or 2021, if applicable) return.

Example: Don and Shirley, whose AGI is less than $150,000, are newlyweds with no children and filed a joint return for 2019. They received rebates of $3,600 ($2,400 first round + $1,200 second round). In 2020 they have a baby and when their credit is determined on the 2020 return, it is $4,700 ($1,200 + $1,200 + $500 + (600 x 3)). Since they only received $3,600 in rebates, they were entitled to a $1,100 refundable credit on their 2020 return.

-

Eligible Taxpayer

A taxpayer eligible for the credit is anyone OTHER than:

-

a non-resident alien individual

-

a dependent, or

-

an estate or trust

Caution - Before anyone gets any bright ideas: Sec 6428(d)(2) says among those not eligible for the economic impact payment is any individual with respect to whom a deduction under section 151 is allowable to another taxpayer for a taxable year beginning in the calendar year in which the individual's taxable year begins. So, it is a facts-based issue - if the parents could qualify to claim a child as a dependent, then the child isn't eligible for the economic impact payment, even if the parents don't claim the child.

-

Also note on Form 1040, page 1, for Standard Deduction, the box "someone can claim you as a dependent" - says can claim, not did claim. So, if the child were to file his or her own return and NOT mark the box, but the parents could claim the child, then the child has filed an erroneous (some might say, fraudulent) return.

Deceased Taxpayers

An issue that arose with the first-round advance payments was whether deceased taxpayers were eligible for the payments. Although the CARES Act seems to say that anyone alive in 2019 would qualify for an EIP, the IRS’s FAQs (QA5) says otherwise: “payment made to someone who died before receiving the payment should be returned to the IRS” and “For payments made to joint filers with a deceased spouse who died before receiving the payment, return the decedent’s portion of the payment.” And in QA1: “The following are also not eligible: a deceased individual or an estate or trust.”

The COVID-Related Tax Relief Act of 2020 specifies that any individual who was deceased before January 1, 2020, shall be treated as if the valid identification number of such person was not included on the return. In other words, those who passed away before 2020 aren’t eligible for an EIP or recovery rebate. (Act Sec 272(f)(2)(A))

Further, no amount of credit shall be determined with respect to any qualifying child of the taxpayer if the taxpayer was deceased before January 1, 2020, or in the case of a joint return, both taxpayers were deceased before January 1, 2020. (Act Sec 272(f)(2)(B))

The ARPA includes a provision that individuals deceased before January 1, 2021 don’t qualify for EIP3. (IRC Sec 6428B(g)(2)(B)(i))

Social Security Number (SSN)

No credit shall be allowed to an individual without an SSN, except for:

-

Adopted children - In the case of a qualifying child who is adopted, an adoption identification number (ATIN) qualifies in place of an SSN.

-

Military (Special Rule) – Where one spouse has an SSN, the other is not required to have one.

-

Mixed-status Couples – For the first round of advance payments, both spouses had to have an SSN for either spouse to qualify for a payment. Added by the COVIDTRA: Married taxpayers filing jointly, and otherwise eligible, where one spouse has a Social Security Number and one spouse does not, are eligible for a payment of $600, in addition to $600 per child under age 17 with a Social Security Number.

Non-Filers Receiving Government Benefits

Those that are receiving Social Security, SSI disability, survivor’s or Railroad Retirement or veteran’s benefits, but hadn’t filed a 2020, 2019 or 2018 return, should have automatically received an EIP for themselves. If they have qualifying dependents and they did not receive the additional payment it can only be paid if the individual files a return for the tax year.

Other Non-Filers - If taxpayers did not receive an economic impact payment, they can file a return for 2020 or 2021 as applicable and receive the refundable credit then.

A Few Words of Caution - No doubt scammers will come up with an IRS look-alike website in an attempt to steal taxpayers’ direct deposit info, which can also be used for direct withdrawals. When visiting the IRS website always make sure your clients are on IRS.gov before entering any personal or financial information. And caution them not to fall for solicitations from scammers who want to charge them a fee to help apply for the rebate payment; there are no fees required by the IRS, and in most cases, an individual’s Economic Impact Payment will come automatically from the IRS.

Keep in mind the economic impact payments are actually advance payments for a refundable credit that can be claimed on your clients’ 2020 (or 2021 for EIP3) tax returns. If they, for whatever reason, miss out on the advance payments, they will receive the payment on their 2020 (or 2021) tax return, or a possible substitute process provided by the IRS for non-filers.

Incarcerated Individuals

Although the language in the CARES Act did not state that incarcerated individuals are not eligible for the Recovery Rebate Credit and advance economic impact payments, the IRS FAQs on the subject had stated that someone incarcerated was ineligible for the EIP. The IRS was sued and on September 24, 2020, a federal district court issued a preliminary injunction, later becoming a permanent injunction, barring the IRS from denying an EIP to an incarcerated individual who otherwise qualifies to receive an EIP (Scholl v Mnuchin, DC CA 9/24/2020) The government in December 2020 withdrew its appeal.

Both the COVID Tax Relief Act, and the American Rescue Plan Act are silent on the issue of whether incarcerated individuals are eligible for the rebate credit and EIPs, but IRS FAQ B10, added February 5, 2021, states that individuals will not be denied the Recovery Rebate Credit solely because they are incarcerated.