Paid Family & Medical Leave Credit

The Credit

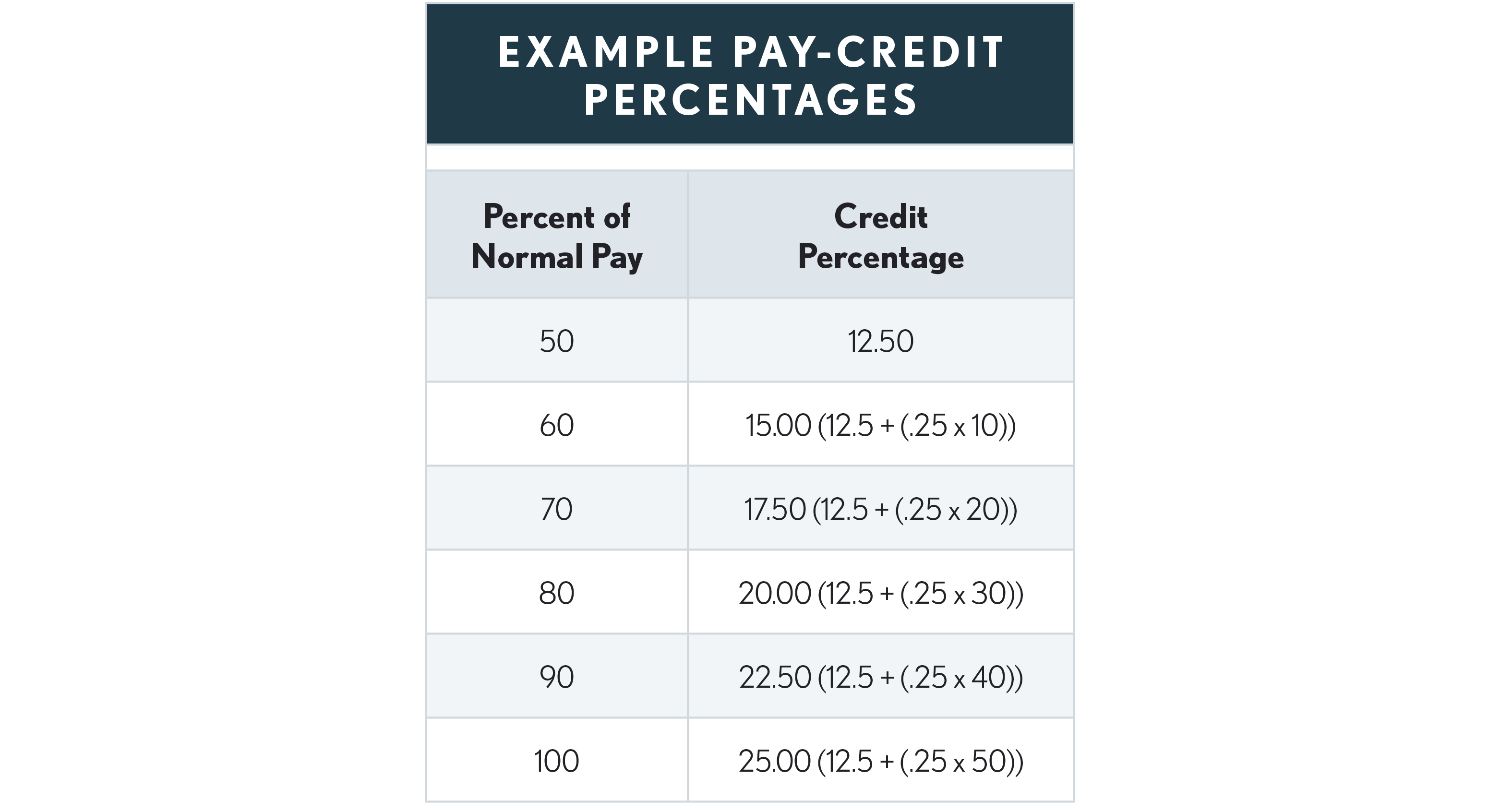

For wages paid in tax years beginning after 2017 and before 2026, a general business credit may be claimed equal to 12.5% of the amount of wages paid to a qualifying employee during any period in which the employee is on family and medical leave if the rate of payment is at least 50% of the wages normally paid to the employee, for up to a maximum of 12 weeks of leave with respect to any employee for the tax year. (Sec. 45S(b)(3)) The credit is increased by 0.25 percentage points (but not above 25%) for each percentage point by which the rate of payment exceeds 50%.

Example: ABC, Inc. has a qualifying written policy to pay an employee 70% of their normal wage while on family or medical leave. 70% is 20 percentage points above the 50% credit threshold. The credit is increased by 5 percentage points (.25 x 20) which, when added to the base credit of 12.5%, results in a credit percentage of 17.5%. Assuming the leave wages paid for the year were $15,000, the credit would be $2,625 (.175 x $15,000).

-

Leave that is paid by a state or local government or is required by state or local law is not included in the amount of paid family and medical leave provided by the employer.

Qualifying Employer

To qualify for the credit, an employer must have a written policy containing certain requirements, and all “qualifying” full-time employees must be given at least two weeks of annual paid family and medical leave (all less-than-full-time qualifying employees must be given a commensurate amount of leave on a pro rata basis).

Qualifying Employee

To be a qualifying employee, the individual must have been employed by the employer for one year or more, and, for the preceding year, had compensation not in excess of an amount equal to 60% of the “highly compensated employee” threshold. $150,000 is the “highly compensated” amount for 2023 (up from $135,000 in 2022). Thus, to be a qualifying employee in 2023 an employee must have earned no more than $81,000 (60% of $135,000) in compensation in the preceding year.

Credit or Deduction (No Double-Dipping)

The employer can't take both a credit and a deduction for amounts for which the paid family and medical leave credit is claimed. Claiming the credit is an election.

Employer Policy

The employer’s policy, at a minimum, must provide:

-

That:

-

A qualifying employee who is not a part-time employee, generally one who works 30 hours or more a week is provided no less than two weeks of annual paid family and medical leave, and

-

A qualifying employee who is a part-time employee, generally one who works less than 30 hours a week, is provided an amount of annual paid family and medical leave that is not less than an amount which bears the same ratio to the amount of annual paid family and medical leave that is provided to a qualifying employee who is not part time (works 30 or more hours a week) as:

-

The number of hours the employee is expected to work during any week, bears to

-

The number of hours an employee who is not part time is expected to work during the week.

-

-

-

The policy requires that the rate of payment under the program is not less than 50% of the wages normally paid to that employee for services performed for the employer.

Form 8994

The IRS developed Form 8994 to be used when claiming the paid family and medical leave credit. The instructions to Form 8994 provide details as to eligible employers, qualifying employees, what constitutes family and medical leave, minimum paid leave requirements, the applicable percentage, and how to compute the credit, including worksheets. Preparers are encouraged to read the instructions carefully before claiming the credit on a client’s return and to make sure the various requirements noted in the instructions for the employer’s written policy have been satisfied. Wages used to figure the COVID-19 employment credits on an employment tax return such as Form 941, Employer’s Quarterly Federal Tax Return, cannot also be used to figure a credit on Form 8994.

Families First Act and ARPA Provisions

Don’t confuse this credit with the special 2020 and 2021 sick and family leave provisions related to the Covid-19 pandemic provided under the Families First Coronavirus Response Act (FFCRA) and as extended by ARPA. The FFCRA/ARPA leave benefits are funded by the government via the employer’s ability to retain payroll taxes as reimbursement or by direct reimbursement. See Chapter 3.33 for details of the FFCRA.