Home Solar Credits

AKA: Residential Clean Energy Credit

Caution

Under OBBBA this credit’s sunset date has been moved up to December 31, 2025 and thecredit is no longer available after 2025

Overview

Residential Clean Energy Credit – Sec 25D

Includes:

-

Solar Electric

-

Solar Water Heating

-

Fuel Cell

-

Small Wind Energy Property

-

Geothermal Heat Pumps

Applies to taxpayer’s Main or Second Home (Except for Fuel Cell)

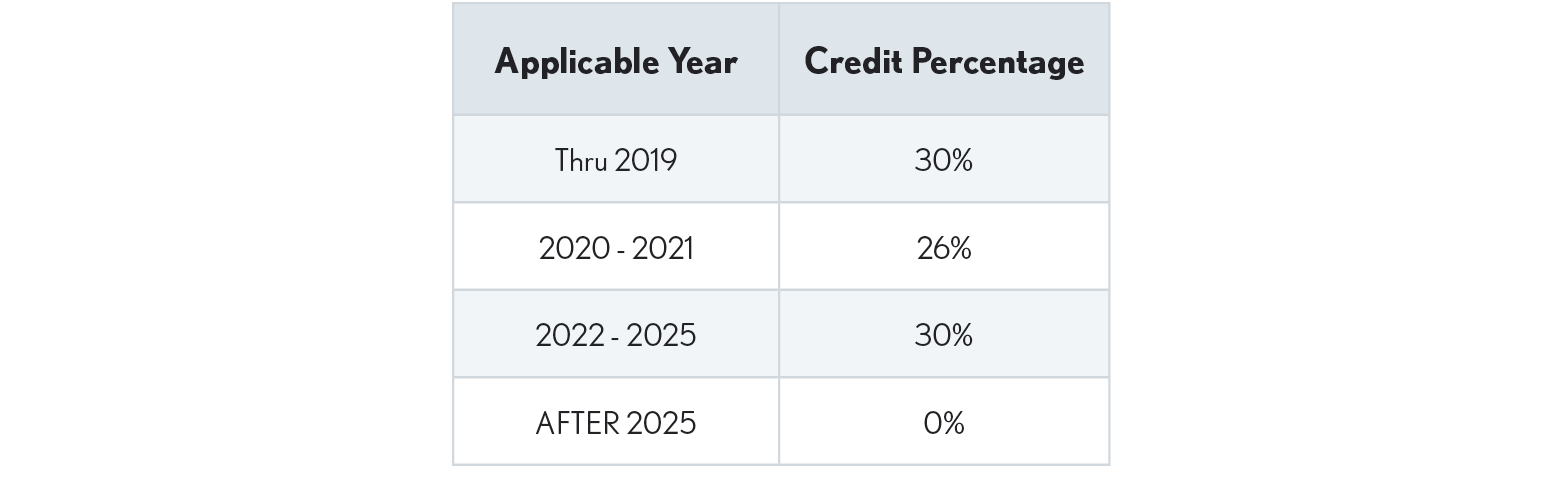

Credit Percentages (no limit on credit amount) for Qualified Solar Electric and Solar Water Heating Systems:

-

30% through 2019

-

26% for 2020 through 2021

-

30% for 2022 through 2025

-

Sunsets after 2025

Non-refundable Personal Credit – The energy credits offset AMT. Limited carryover available.

Related IRC and IRS Forms & Publications

-

Sec 25D – Residential Clean Energy Credit

-

Form 5695 – Residential Energy Credits

-

Inflation Reduction Act of 2022

Solar Credit (Sec 25D)

Originally titled the Residential Energy Efficient Property Credit, the Inflation Reduction Act of 2022 renamed Sec 25D to Residential Clean Energy Credit.

This is a personal tax credit available for the purchase of residential energy efficient property that uses solar power, to create electricity. Other types of alternative energy property eligible for the Sec 25D credit are listed below but not otherwise covered in this material.

Solar Effective Dates

-

Qualified Solar Electric and Solar Water Heating Systems –The credit was phased in years 2020 and 2021, was fully reinstated for 2023 through 2032. OBBBA terminated this credit after 2025. There is no annual dollar cap on the credit for these systems.

Definitions

-

Qualifying Solar Water Heating Property – Qualifies if used in a dwelling unit located in the U.S. that is used by the taxpayer (need not be the owner of the residence) as a main or second residence where at least half of the energy used by the property for such purpose is derived from the sun. Heating water for swimming pools or hot tubs does not qualify for the credit., The property must be certified for performance by the Solar Rating Certification Corporation or a comparable entity endorsed by the state government where the property is installed.,

-

Qualified Solar Electric Property - Is property that uses solar energy to generate electricity for use in a dwelling unit located in the U.S. and used as a main or second residence by the taxpayer (need not be the owner of the residence).

Carryover

If the credit exceeds the limitation imposed by the amount allowed for each year (Sec 26(a)), such excess shall be carried to the succeeding taxable year and added to the credit allowable under subsection (a) for such succeeding taxable year. (Code Sec. 25D(c))

The following credits are used to offset the year’s tax before the Residential Clean Energy Credit is applied:

-

Negative Form 8978 Adjustment

-

Foreign Tax Credit

-

Credit for Child or Dependent Care Expenses

-

Credit for the Elderly or the Disabled (Schedule R) Nonrefundable Education Credits, and

-

Retirement Savings Contributions Credit

Installation Costs

Expenditures for labor costs allocable to onsite preparation, assembly, or original installation of property eligible for the credit, and for piping or wiring connecting the property to the residence, are expenditures that qualify for the credit. (Code Sec. 25D(e)(1))

Roof

This is an area where there is little guidance except for the Code itself. There is no IRS publication on the subject, and the Form 5695 instructions say the same thing as Code Sec 25D. We looked for cases on the issue and could find none. Here is what Sec 25D(e) says…

25D(e) Special Rules. For purposes of this section -

-

(1) Labor costs - Expenditures for labor costs properly allocable to the onsite preparation, assembly, or original installation of the property described in subsection (d) and for piping or wiring to interconnect such property to the dwelling unit shall be taken into account for purposes of this section.

(2) Solar panels - No expenditure relating to a solar panel or other property installed as a roof (or portion thereof) shall fail to be treated as property described in paragraph (1) or (2) of subsection (d) solely because it constitutes a structural component of the structure on which it is installed.

Our research service included this…An expenditure for a solar panel or other property installed as a roof (or portion of a roof) won't fail to qualify solely because it's a structural component of the structure on which it's installed.

Thus, our interpretation is that an entire new roof would not qualify, only the portion that is a structural component of the structure on which the solar system is installed.

We believe this interpretation is bolstered by Letter Ruling 201523014 that deals with the commercial solar energy credit of Sec. 48. Here, the IRS, citing Reg 1.48-9(k), only allowed the "incremental costs" of a new roof that was designed to be reflective, limiting the amount that may be included for purposes of the credit only to amounts that exceed the cost to install a new normal roof. So, it is likely the IRS would also take a similar position for Sec. 25D, and not permit the entire cost of the new roof being installed as part of a solar energy upgrade.

The 2021 Form 5695 instructions include the following statement: “Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof's decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit.”

Ground-Mounted

IRS Notice 2013-70 (Sec. 5.02, Q&A 25) states that the Sec 25D credit may be claimed for solar panels that are not directly located on the taxpayer’s home if they are used to generate electricity for the home. Although there is no specific IRS guidance related to onsite preparation and structural components for ground-mounted solar arrays, it would appear that those costs would qualify as installation costs for the credit (IRS Letter Ruling 201536017).

Swimming Pool

Expenditures that are properly allocable to a swimming pool, hot tub, or any other energy storage medium having a function other than the function of such storage are NOT taken into account for purposes of the credit. (Code Sec. 25D(e)(3))

Basis Adjustment

The basis of the property is increased by the amount of the expenditure and reduced by the amount of the credit. (Code Sec. 1016(a)(34); Code Sec. 1016(a)(35)). This will generally create a different basis for federal and state purposes where the state does not provide a credit or it differs from the federal credit amount.

Association or Cooperative Costs

A taxpayer who is a member of a condominium management association (Sec 25D(e)(6) for a condominium he or she owns, or a tenant-stockholder in a cooperative housing corporation (Sec 25D(e)(5), is treated as having paid his or her proportionate share of any qualifying costs of such association or corporation.

Battery

Emergency power outages imposed by utilities in high fire prone areas during periods of high winds and low humidity, as well as in other disaster areas, can be a major inconvenience, especially for those that work from home. The answer may be a solar-charged battery.

Homeowners who already have a solar installation can add a storage battery and qualify for the solar credit for the cost of the battery. Those who do not already have a solar system may want to consider the cost of installing a solar system with a battery. Although not specifically mentioned in the code or regulations before amendment by the Inflation Reduction Act of 2022, it was the subject of a letter ruling.

According to this letter ruling, a battery attached to solar panels is qualified solar electric property if it’s charged only by solar energy. A software-management tool is qualified solar electric property where the software is necessary to monitor the charging and discharging of solar energy from a battery attached to solar panels. Earlier installations of qualifying property don’t affect the availability of the solar credit for qualifying property in later years. Thus, where a qualifying solar panel system was installed in Year 1, an additional solar credit could be claimed in Year 2 for the installation of a battery that was connected to the system and was qualified solar electric property. (IRS Letter Ruling 201809003)

The Inflation Reduction Act of 2022 amended IRC Sec 25D(d) by adding and defining the term “qualified battery storage technology expenditure.” Effective for expenditures made after December 31, 2022, this term covers the cost of battery storage technology which (A) is installed in connection with a dwelling unit in the United States that is used as a residence by the taxpayer, and (B) has a capacity of not less than 3 kilowatt hours. (Act Sec 13302(b))

Caution

To qualify for the credit, the battery must be an integral component of the solar system. One that is portable and can be removed and taken with the taxpayer should the home be sold does not qualify.

Mixed-Use Property

If less than 80% of the property is used for non-business purposes, only that portion of expenditures that is used for non-business purposes is taken into account. Thus, if the business use of a dwelling unit is 20% or less, the full amount of the expenditures is eligible for the credit.

Timing and Treatment of Expenditures

Code Sec 25D(e)(8) says that the expenditures shall be treated as made when the original installation is completed, and Code Sec 25D(g), which specifies the credit rate for various years, refers to when the property is placed in service. Reg Sec 1.46-3(d)(1)(ii) say property shall be considered placed in service in the taxable year in which the property is placed in a condition or state of readiness and availability for a specifically assigned function. U.S. Court of Appeals for the Federal Circuit concludes that neither Sec 1603 of the American Recovery and Reinvestment Act of 2009, nor Treas. Reg. Sec 1.46-3(d)(1)(ii), states or implies that the property must produce an anticipated or projected amount before it may be considered ready and available for a specifically assigned function. Thus it would seem when the building inspector signs off on the building permits is when the expenditures qualify for the credit.

Multiple Installations

The credit is available for multiple installations. For instance, after the initial installation, if a taxpayer adds additional panels to increase capacity or adds batteries for storing electricity, these would be treated as original installations and the credit would apply at the credit rate applicable for the year the additional installation is completed. On the other hand, if a taxpayer had to replace damaged panels, inoperative batteries or perform other maintenance on the system, these items would not be an original system and their costs would not qualify for the credit.

Leased Installations

When a solar installation is leased, the lessor gets the credit, not the home resident.

Who Gets the Credit

The taxpayer need not own the property to qualify for the credit, as the taxpayer need only be a “resident” of the home. For the Residential Clean Energy Credit, the code does not specify that an individual has to own the home, only that it is the taxpayer’s residence.

IRC Sec. 25D(b)(2) - Qualified solar electric property expenditure - The term “qualified solar electric property expenditure” means an expenditure for property which uses solar energy to generate electricity for use in a dwelling unit located in the United States and used as a residence by the taxpayer.

-

Example: Son lives with his mother who owns the home. Son pays to have the solar system installed. The son gets the credit.

Newly Constructed Homes

Sec 25D credits can be taken for newly constructed homes if the costs of the residential energy efficient property can be separated from the home construction and the required certification documents are available (Sec 25D(e)(8)(B)).

Second Home

A taxpayer may claim a Sec 25D credit for other qualifying properties described in §25D that are not fuel cell properties installed in or on a dwelling unit used as a second home or a vacation home by the taxpayer.

But a taxpayer may not claim the §25D credit for expenditures for improvements made to an investment property, such as rental property, that is not also used as a residence by the taxpayer. Thus, presumably if a taxpayer has multiple second homes the credit will apply to all of them as long as they are located in the United States and used as a residence by the taxpayer.

HERO Program Financing and Deductions

The HERO program originated in Riverside County in Southern California – the purpose being to provide financing for energy related improvements to a taxpayer’s home with principal and interest payments added to the taxpayer’s property tax bill for the year. The HERO program has since spread to almost all counties in CA and even some areas outside of California.

The HERO loans – sometimes referred to as PACE (Property Assessed Clean Energy) loans – are used primarily to finance high-cost energy improvements such as home solar energy property. The complication here is that the annual loan payments are added to the home’s property tax bill leading many to believe (incorrectly) the payments are deductible as property taxes. This includes a number of real estate agents with websites making this claim.

The truth of the matter is the payments are loan payments and NOT deducible as property tax. The interest portion of the separately stated payments is deductible as home acquisition debt interest and the principal portion is not deductible at all. The principal portion, however, may add to the home’s basis to the extent not used to determine an energy related credit.

The HERO program will have provided your client with a loan amortization statement, which allows you to determine what portion of the payment is home acquisition debt interest. As an additional minor complication, the loan amortization schedule provided by the HERO program administrator is on a fiscal year, and the income tax reporting is on a calendar year, requiring you to make an adjustment. Generally, you can approximate the interest for the calendar year by adding the interest amounts for the two fiscal years including the calendar and dividing by 2.

In addition, the interest is not being reported on a 1098 so there will be mismatch with IRS’s computer.

Comment: If you are providing clients with guidance in financing their home energy improvements, be sure to make them aware of the very high interest rates associated with HERO loans, sometimes in excess of 8%. Other sources of funds should be explored first, although the HERO loan qualifications are very liberal.

-

Residential Rentals

Although a tax credit for installation of solar equipment on a residential rental isn’t allowed under Sec 25D, a credit may be available under Sec 48 – Energy Credit – as part of the general business credit of Sec 38. Property eligible for the general business credit is tangible property for which depreciation is allowed, and this would include solar equipment installed in a residential rental property. (Sec 48(a)(5)(D)) The solar system must be used to generate electricity or to heat or cool a structure, but not for heating a swimming pool. (Sec 48(a)(3)(A)(i)) While Sec 50(b)(2) generally prohibits a business credit for property used primarily to furnish lodging, this prohibition doesn’t apply to “any energy property.” (Sec. 50(b)(2)(D)) The same credit rates and phaseouts apply under Sec 48 as under Sec 25D.

Used Solar Panels

The tax code does not directly address the question of whether used solar panels qualify for the credit but does repeatedly refer to the “original installation.” A fact sheet from the Dept. of Energy (DOE) seems to have come up with a reasonable interpretation of “original installation”:

The solar PV system is new or being used for the first time. The credit can only be claimed on the “original installation” of the solar equipment.

This situation might arise when panels are purchased from someone who purchased them originally but for some reason never used them. In situations of this nature, consider how it can be proven the panels were never used in case the credit is challenged.

Link to DOE factsheet:

California Differences

California has no equivalent credits. Therefore, the basis of property on which the federal credit is claimed will be different for federal and California.