Credit 2023 Through 2025

General Requirements

-

Dwelling Unit – Credit is only allowed for components installed in or on a dwelling unit located in the United States and owned and used by the taxpayer as the taxpayer’s principal residence, within the meaning of IRC Sec 121 (Sec 25C(c)(1)(A))

-

Manufactured Homes – The term “dwelling unit” includes a manufactured home which conforms to Federal Manufactured Home Construction and Safety Standards (part 3280 of title 24, Code of Federal Regulations) (Sec 25C(c)(4))

-

Original Use - The original use of such component commences with the taxpayer Sec 121 (Sec 25C(c)(1)(B)), and

-

Period of Use - Such component can reasonably be expected to remain in use for at least 5 years. (Sec 25C(c)(1)(C)

Credit Limits

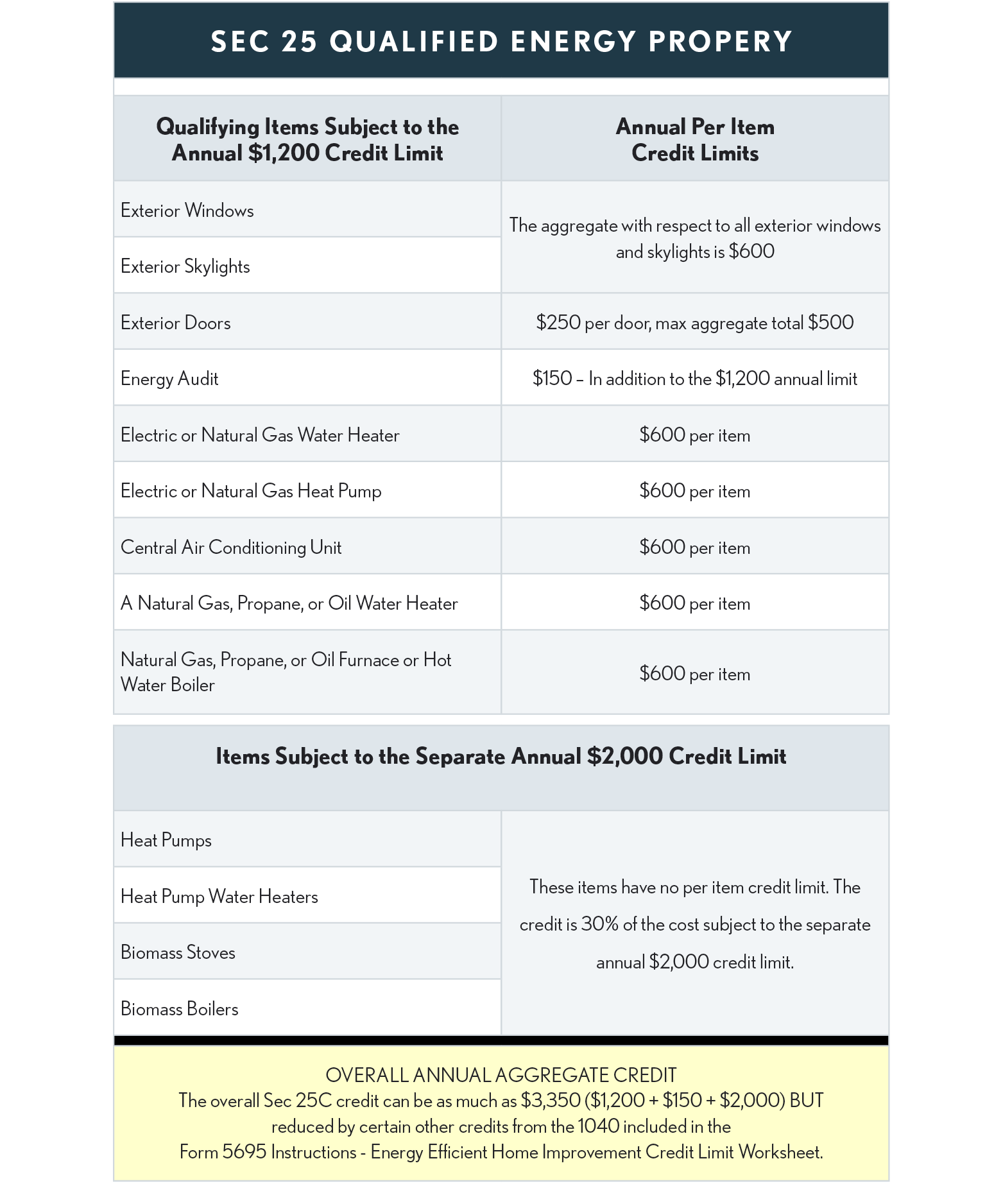

The credits, which can be confusing, are broken down into three categories and an overall maximum:

-

$150 – Home Energy Audits - Taxpayers can claim a Home Energy Audit Credit for each taxable year, up to 30% of the cost, capped at $150 per year. This means that if you have a qualifying home energy audit conducted each year, you can claim the credit each year, subject to the annual cap of $150 for the audit expenses.

-

$1,200 – Qualifying Energy Property - The credit is 30% limited to an annual cap of $1,200, with specific annual caps for certain categories of improvements.

-

$2,000 – Biomass Stoves & Boilers, Heat Pumps and Heat Pump Water Heaters – there are no specific limits for categories of items. The credit is 30% of the cost but limited to an annual cap of $2,000.

-

$3,350 – Which is the aggregate overall maximum Sec 25C credit based on the 3 credit limits above BUT reduced by certain other credits from the Form 5695 Instructions - Energy Efficient Home Improvement Credit Limit Worksheet.

Basis Adjustment

The basis of the property is increased by the amount of the expenditure and reduced by the amount of the credit. (Code Sec. 25C(f)). This will generally create a different basis for federal and state purposes where the state does not provide a credit, or it differs from the federal credit amount.

Other Credit Issues

-

Non-refundable Personal Credit

-

Credit offsets AMT

-

No Carryover - Planning Tip: For example, if installing windows, spread the replacements over multiple years to maximize the credit.

-

Swimming pools - Code Sec. 25C credit doesn't have any specific prohibitions against swimming pools or hot tubs.

-

Reliance on manufacturer’s certification – A taxpayer may rely on a manufacturer’s certification that the component is eligible for the credit provided the IRS hasn’t withdrawn the certification.

-

After 2024, for an item qualifying for credit produced by a qualified manufacturer, the taxpayer must include the qualified product ID number of the item on the tax return for the tax year. (Sec. 25C(h)(1), Act Sec. 13301(g)(1)). Omission of a correct product identification number is treated as a mathematical or clerical error by the IRS.

Installation Costs

For certain items qualified for the Section 25C credit, both installation labor and materials can count towards the credit. Specifically, the credit covers:

-

Residential Energy Property - This includes items such as heat pumps, biomass stoves, and biomass boilers. For these items, the credit is 30% of the costs, including onsite preparation, assembly and original installation (labor), up to $600 for each item, provided they meet the energy efficiency requirements specified.

-

Building Envelope Components - This includes items like insulation, exterior windows and skylights, and exterior doors. However, for these components, the cost of onsite preparation, assembly and original installation (labor) is not included in the credit calculation—only the cost of the materials themselves is eligible.

Definitions

Biomass Stove or Boiler – That uses the burning of biomass fuel to heat a dwelling unit located in the United States and used as a residence by the taxpayer, or to heat water for use in such a dwelling unit and has a thermal efficiency rating of at least 75 percent (measured by the higher heating value (HHV) of the fuel).

-

Fuel Type - The stove must use biomass fuel, which includes plant-derived fuel available on a renewable or recurring basis. This can include agricultural crops, trees, wood, wood waste and residues (including wood pellets), plants, grasses, residues, and fibers.

-

Primary Purpose: The stove must be used to heat a dwelling unit or to heat water for use in the dwelling unit. The dwelling unit must be located in the United States and used as a residence by the taxpayer.

-

Certification - The manufacturer of the biomass stove must provide a certification statement that the stove meets the efficiency requirements. This certification should be retained by the taxpayer for their records but does not need to be submitted with the tax return.Installation Costs - The credit applies to both the cost of the biomass stove and the installation costs.

Oil Furnace or Hot Water Boiler

-

Placed in service after December 31, 2022, and before January 1, 2027, meets or exceeds 2021 Energy Star efficiency criteria, and is rated by the manufacturer for use with fuel blends at least 20 percent of the volume of which consists of an eligible fuel, as defined in § 25C(d)(3) (eligible fuel).

Electrical Circuits - Any improvement to, or replacement of, a panelboard, sub-panelboard, branch circuits, or feeders installed in a manner consistent with the National Electric Code, has a load capacity of not less than 200 amps, and is installed in conjunction with:

-

Any qualified energy efficiency improvements, or

-

Any qualified energy property described in § 25C(d)(2)(A) through (C) for which a § 25C credit is allowed for expenditures with respect to such property, and

-

Enables the installation and use of any qualified energy efficiency improvements or any qualified energy property described in § 25C(d)(2)(A) through (C)).

Rebates for Energy Efficient Improvements

Taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns. They will, however, need to reduce the basis of the property when they sell it by the amount of the rebate. (AN 2024-19)

The Department of Energy(DOE) home energy rebate programs funded through the Inflation Recovery Act (IRA) will be treated as a reduction in the purchase price or cost of property for eligible upgrades and projects. Accordingly, the consumer that receives an IRA rebate will not be required to report the value of the rebate as income.