California Differences - Young Child Tax Credit

AB 91 (signed by the governor 6/27/2019) added R&TC Sec 17052.1 that, effective for years beginning on or after January 1, 2019, allows a refundable “Young Child Tax Credit.”

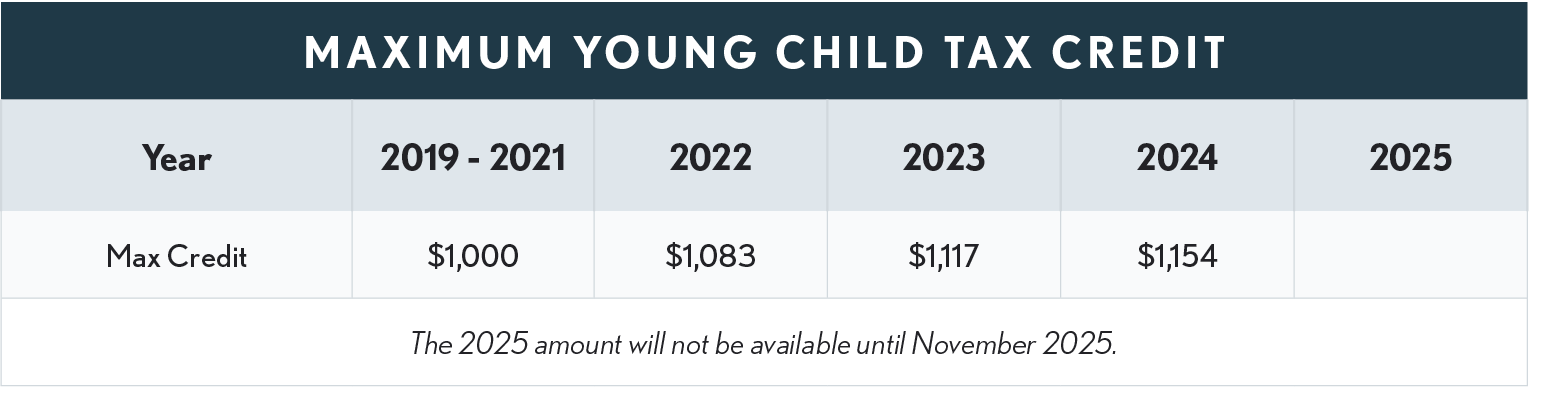

The credit is per taxpayer (i.e., per return), not per child and is equal to a fixed amount (see table below). That fixed amount is determined by multiplying the amount authorized by the legislature for the year times the annual CA EITC adjustment factor. For example, for years 2019 through 2021 the authorized amount was $1,175 and the CA EITC adjustment factor was 0.85. Thus, the maximum credit for those years was $1,000 (.85 x $1,175). The amounts shown in the table below have already been adjusted for the CA EITC adjustment factor.

Qualifications

-

Have a child under age 6.

-

2019 through 2021 - Eligible taxpayers would need earned income of $1 to $30,000. Those with zero earned income or less would not qualify for YCTC.

-

2022 Forward – Generally, a taxpayer must have earned income to be eligible for the YCTC. However, a taxpayer may qualify for YCTC with total earned income of zero dollars or less provided all the following apply:

-

Total wages, salaries, tips, and other employee compensation (whether subject to California withholding or not), if any, do not exceed $34,602 in 2024 (up from $33,497 for 2023).

-

Total net loss (defined below) does not exceed $34,602 in 2024 (up from $33,497 for 2023).

-

Otherwise meet the CalEITC and YCTC requirements.

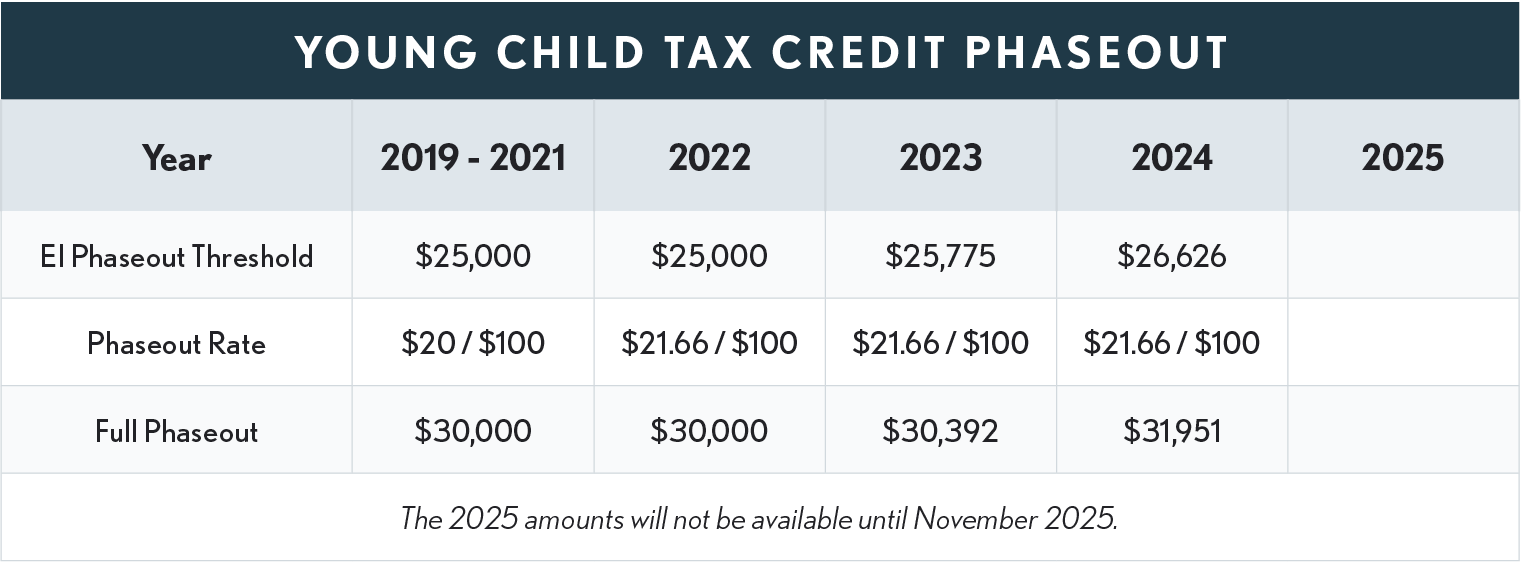

The credit phases out when the taxpayer’s earned income exceeds the threshold amounts shown in the table below. The phaseout rate is specified for each year.

Net Loss for YCTC Purposes

A net loss is generated when a taxpayer’s losses exceed their income during the tax year. This includes all current tax year losses – not just the portion of losses that can be utilized to reduce taxable income. Those with net losses could include self-employed individuals, as well as those with investment, rental, or other losses.

Credit is claimed on the CA EITC FTB Form 3514.