Disabled or Full-Time Student Spouse

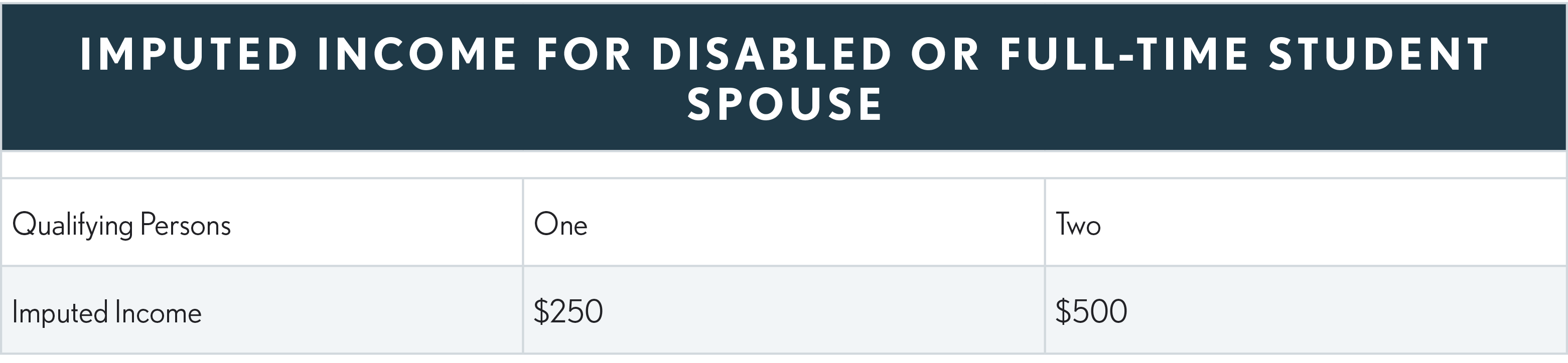

The expenses allowable in computing the credit are limited to earned income of the lower paid spouse. For a disabled or full-time student spouse there is a special “imputed earned income” allowances of $250 per month. Thus, if the spouse qualified for the full 12 months of the year the earned income limit would be $3,000 (12 x $250) if care is needed for 1 qualifying person and $6,000 (12 x $500) for the care if 2 or more qualifying persons. Any part of a month is treated as a whole month.

Example 1: Joyce is a full-time student for 10 months of 2025 and in order for her to attend college she incurs childcare expenses of $5,000 for the care of her dependent daughter. Her husband works full time and has earned income of $60,000. Joyce’s dependent care credit is based upon the income of the lower earning spouse and since Joyce does not work and is a full-time student, she uses the imputed income of $250 per month for 10 months or $2,500. Her childcare expenses were $5,000 but they are limited to $3,000 for one child. However, in her case the credit is based upon the lesser of the earned income (or imputed income) or the care expenses, which for one child are limited to $3,000. Since the imputed income of $2,500 is less than the $3,000 expense maximum, Joyce’s dependent care credit is $500 ($2,500 x .2). The .2 was determined from the table on page 9.01.02 based on the couple’s AGI.

-

Both Spouses Disabled or Full-Time Students

If both spouses were full-time students or disabled (and not working) in any given month, then only one can be considered to have the imputed income for that month. A part of a month is treated as a whole month.

Students at Online Institutions

In the case of a married taxpayer-student the cost of childcare while studying online at home is NOT a qualified expense for purposes of the deemed income rule. The statute requires that the educational organization have students in attendance at the place where its educational activities are regularly carried on.

However, an individual who takes online courses at a school that has traditional classroom instruction as well as online courses may be a student for purposes of the deemed earned income rule.