California Differences - Child & Dependent Care Credit

The California child and dependent care credit is non-refundable and similar to the Federal credit. The credit is phased out for higher income taxpayers: The credit isn’t available for taxpayers with Federal AGI over $100,000. Only care provided in California qualifies. The California credit may apply even if no federal credit is claimed, such as when federal tax liability is zero. The credit, calculated on FTB Form 3506, is based on a credit figured using the federal child and dependent care credit rates multiplied times the following factor:

| If Federal AGI is: | Percent of Federal Credit: |

| $40,000 or less | 50% |

| Over $40,000 but not over $70,000 | 43% |

| Over $70,000 but not over $100,000 | 34% |

| Over $100,000 | 0% |

California allows a custodial parent who never married the child’s other parent, and who doesn’t qualify to claim the child as a dependent, to qualify for the child care credit. For purposes of the earned income limit when figuring this credit, "earned income" is limited to earned income (as defined under the federal credit provision) that is subject to California personal income taxation and includes compensation, other than pensions or retirement pay, received by a member of the armed forces for active services as a member of the armed forces, whether the member is domiciled in California.

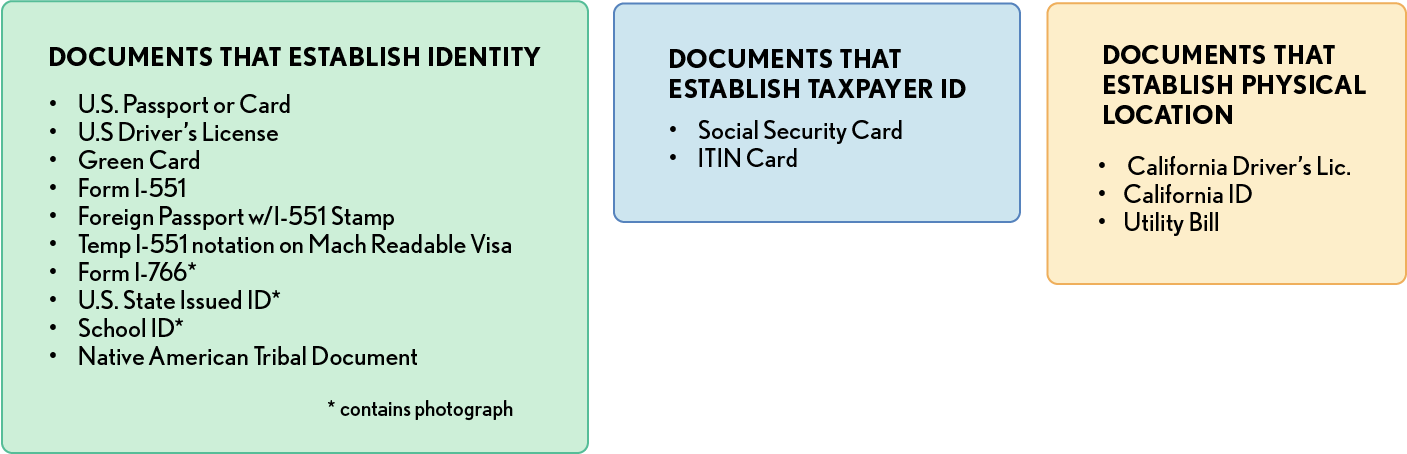

Substantiation Requirements - Taxpayers must retain adequate records to prove entitlement to claim the credit, including documents that establish (1) the identity and age of the qualifying child/dependent, (2) the identity and taxpayer identification number of the care provider, and (3) the physical location of where the care was provided. If applicable, medical records that demonstrate the physical or mental incapacity of the qualifying child/dependent must be retained. The taxpayer must also retain proof of payment for the child/dependent care expenses. These substantiation requirements apply to tax years beginning on or after January 1, 2013.

2021 Federal Increase - ARPA Conformity

CA did not conform to the increased child and dependent care credits nor the increased exclusion from gross income for employer-provided dependent care assistance for year 2021.