Non-Refundable Renter's Credit

This non-refundable credit is:

-

$120 for Joint, HH and SS filers, and

-

$60 for all others.

Qualifications

To claim renter's credit, a taxpayer must meet the following conditions:

-

Be a resident of California for the entire year.,

-

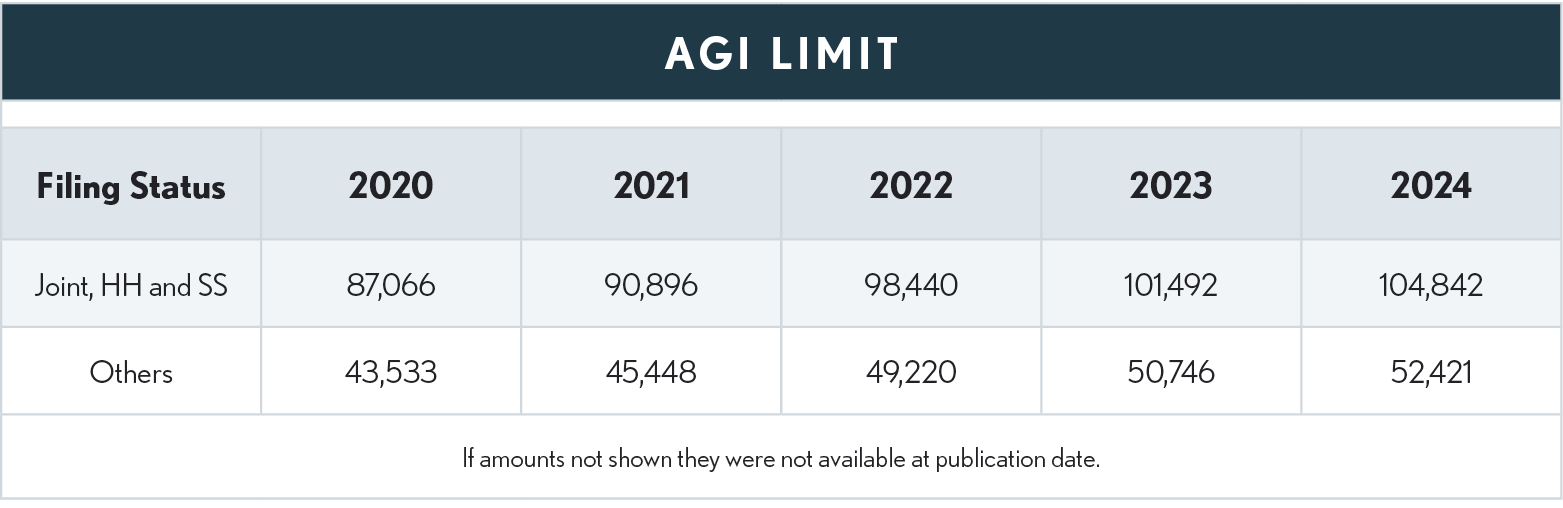

AGI must be below annual limit. Use California AGI for this test.

-

Must pay rent for at least half of the tax year on property (including a mobile home that the taxpayer owned on rented land) in CA that was the taxpayer's principal residence.

-

The rented property is not exempt from property taxes.

-

For not more than half the year, the taxpayer did not live with, or was not a minor under the care of a parent, foster parent, or legal guardian who claimed the taxpayer as a dependent.

-

Military personnel - A military person, who is not a legal resident of California, does not qualify for this credit. However, the military person's spouse may claim this credit if he or she was a California resident, did not live in military housing, and is otherwise qualified.

-

Form 540NR – Some 540NR filers may qualify if they were residents of California at least six months during the tax year.

-